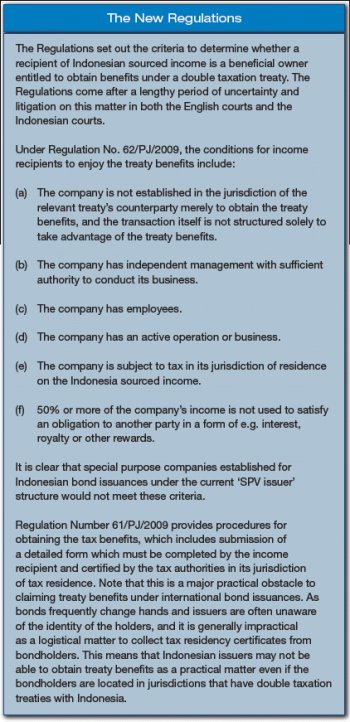

In November 2009, the Indonesian Directorate General of Taxation issued two key tax regulations (Director General of Tax Regulations Nos. 61/ PJ/2009 and 62/PJ/2009, the "Regulations"). The Regulations have wide-ranging implications for tax structuring of cross-border transactions involving Indonesia and, in particular, have prompted market participants to explore new structures for issuing Indonesian high-yield bonds. A description of the new regulations is set out in the box below.

This article is intended to review the traditional issuer structures for high-yield bonds, as well as new structures which have been proposed since the entry into force of the Regulations. This article reviews new structures that are currently under discussion in the market. As far as we are aware, none of these structures have been tested or have been the subject of formal tax rulings and we do not express any views as to the effectiveness of any of these structures.

This article does not intend to propose structures to be used to artificially reduce tax. Many holders of high-yield bonds are domiciled in jurisdictions that have double tax treaties with Indonesia. However, due to the highly tradable nature of the typical high-yield bond instrument and the difficulty of identifying the holders at any given time, it is highly impractical as an administrative matter to obtain the required documentation to claim the treaty benefits.

As, under typical Indonesian high-yield practice, issuers invariably 'gross-up' for withholding tax this means that issuers inevitably end up paying more tax than they would otherwise be required to pay. A possible justification for these structures is that many holders would be entitled to benefit from tax treaties with Indonesia that would reduce their withholding tax burden to ten percent (10%). Some of these structures do not achieve withholding tax rates that are any lower, but eliminate the heavy administrative burden involved in obtaining actual treaty benefits with individual noteholders. We believe this is consistent with international guidance on the matter - for example the guidance published by UK tax authorities Her Majesty's Revenue & Customs (HMRC) on the effect of the Indofood decision (Indofood International Finance Limited v JP Morgan Chase Bank NA, London Branch).

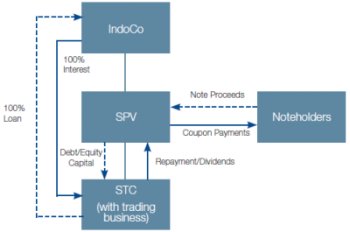

A. Traditional 'SPV Issuer' Structure

Under the traditional structure for Indonesian high-yield bond issuances, an Indonesian corporate sets up an SPV in a jurisdiction with a favourable double taxation treaty with Indonesia. The SPV issues the bond and lends the proceeds to the Indonesian company. The intent was to reduce Indonesian withholding tax on interest payments from the default rate of 20%, to the rate under the tax treaty between Indonesia and the jurisdiction of residence of the SPV - zero percent (0%) for a special purpose issuer ("SPV") established in Netherlands, or ten percent (10%) for an SPV established in Singapore.

The Regulations make it clear that an SPV issuer established under the traditional structure will not be treated as the beneficial owner of the interest income for Indonesian tax purposes. This increases the effective rate of withholding tax on the issuance to twenty percent (20%), the default rate if no tax treaty applies.

There have been a small number of Indonesian high-yield bond issuances since the coming into effect of the Regulations. Some issuers with transactions in the pipeline when the Regulations were promulgated decided not to delay their bond issuance process, and took a commercial decision to absorb the additional withholding tax.

B. 'Dual Issuer' Structure

Others, with a little more time to adjust to the impact of the Regulations, have adopted a 'Dual Issuer' structure involving an SPV with a special trading company ("STC") subsidiary along the following lines:

There are a number of possible variants on this structure depending on the following factors:

- The jurisdictions of SPV and STC - typically either Singapore for a ten percent (10%) withholding rate or Netherlands for a zero percent (0%) withholding rate.1

- The ratio of debt to equity capitalization of STC.2

- The ownership of SPV and STC, either of which may be owned by the ultimate Indonesian borrower or by a third party, such as a trust company.

- The nature and volume of business conducted by STC.

To our knowledge, none of the recent issuances adopting this 'Dual Issuer' approach have been the subject of formal tax rulings in Indonesia, and prospectuses have contained lengthy risk factors setting out the possible taxation impact if the structure is ultimately found to be ineffective by the Indonesian tax authorities.

This structure appears to generally comply with the strict letter of the Regulations, but may nevertheless be subject to challenge, e.g., on the basis that the STC does not have sufficient trading business and that the structure is therefore artificial. Obviously the higher the level of real business conducted by the STC, the more justifiable the structure will be. We understand from informal discussions with the Indonesian tax authorities that they may be inclined to accept this structure if the bond is issued through a real trading company.

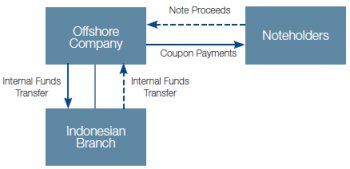

C. 'Branch Issuer' Structure

At least one issuance that has come to market since the promulgation of the Regulations employs a 'Branch Issuer' structure along the following lines:

The theory is that, as the Offshore Company is not a separate legal entity from its Indonesian branch, there is no transaction capable of being subject to taxation on internal fund transfers between branches, and that, as no withholding tax applies in the jurisdiction of the Offshore Company, interest on the Notes can be paid free of any withholding tax.

If the theory is valid, the converse also seems theoretically possible - i.e., an Indonesian company establishes a branch in a jurisdiction without withholding tax, and issues debt through that branch. This type of structure has been used for subordinated debt issuances by Indonesian banks in the past, but we are not aware of it having been tested in a non-banking context.

As far as we are aware there has been no formal tax ruling on either form of the 'Branch Issuer' structure. Risks include (i) the Indonesian authorities treating the onshore and offshore branches as separate legal entities for tax purposes, (ii) the Indonesian authorities treating the offshore branch as an Indonesian entity for tax purposes, (iii) the Indonesian tax authorities decreeing that interest paid by an Indonesian branch of an offshore company is Indonesian source income subject to the twenty percent (20%) withholding tax, and (iv) the application of branch taxes in addition to Indonesian corporate tax with respect to the profits of such an Indonesian branch.

It is worthwhile to note that the only 'Branch Issuer' transaction that has come to market this year benefits from a specific tax concession in its operating agreement with Indonesian state owned enterprises. This may be a unique driver behind the tax structuring of this particular issuance.

D. Structures Involving Banks

An alternative means of reducing the borrowing costs of an Indonesian issuer by taking advantage of Indonesia's tax treaty network may involve loans from relationship banks in favourable tax treaty jurisdictions that may in turn reduce their exposure to their Indonesian borrowers, e.g., by funding the loans, in part or in whole, through participation notes or certain types of derivative transactions.

There are a number of variants on this type of structure using instruments such as credit linked notes, credit derivatives, total return swaps, as well as structures involving separate issuance vehicles incorporated offshore and owned by trust companies.

While issuers outside of Indonesia have used 'Bank' structures, we are not aware of any Indonesian deals that have come to market using this type of structure. The main obstacles are regulatory capital and risk management implications for the financial institution itself, although it should be possible in theory to develop a structure that is workable for financial institutions wishing to provide these services.

E. Alternative Financing Structures

We think it likely that the increased cost of high-yield bonds resulting from the higher withholding tax under the Regulations may cause Indonesian issuers to consider further alternative financing structures.

Convertible Bonds

For Indonesian public companies, convertible bonds may be an interesting alternative source of financing.

A new regulation issued by the Indonesian capital markets supervisory board (Bapepam-LK) late last year (Bapepam-LK Regulation IX.D.4 (the "Rights Issue Regulation")) entitles Indonesian public listed companies to issue up to 10% of their paid-up capital within a period of two (2) years without conducting a rights issue or subjecting the recipient of the shares to any lock-up periods. The Rights Issue Regulation makes convertible financing far more attractive than under the previous rules which made issuances without a rights issue very much more difficult and subjected certain recipients to a lengthy lock-up period (assuming that the rights issue is done by way of a public offer).

A convertible bond typically attracts a low commercial interest rate, and equity settlement of the conversion typically does not attract withholding tax. Accordingly, a convertible bond may be a highly tax efficient alternative form of financing to a high-yield bond if a significant portion of the economic return can be structured into the equity settlement on conversion. Of course, the returns do include an element of equity risk and reward, which means that the instruments may appeal to a different investor base.

There has been a significant uptick in convertible bond financings in Indonesia so far this year. This suggests that there may be a keen investor base for this form of financing , even if many of the convertible bonds currently in the market attract too high a fixed coupon to obtain significant withholding tax.

Securitisations / Receivable Backed Financing Structures

Once popular in the mid 1990s, securitisations have attracted little interest in Indonesia since the financial crisis in the late 1990s, save for the 2005 Indocoal financing. However, market conditions may be right for a resurgence of the Indonesian securitisation market. Two 'proof of concept' domestic mortgage backed securitisations were brought to market in 2009, attracting a favourable rating from Moody's Investor Service, Inc. While the new Regulations make cross-border securitisation of interest-bearing receivables (such as mortgages and auto-loans) difficult to structure, we believe there may be structures whereby a domestic securitisation could be offered to both offshore and onshore investors in separate offerings.

Offshore securitisations of non-interest bearing receivables do not suffer from the same withholding tax problems as all payments of receivables are made offshore. This is potentially a highly tax efficient method of raising offshore financing. In addition, where the receivables are backed by strong offshore credit providers, the issuance could potentially breach the 'sovereign ceiling' and attract an investment grade rating, leading to extremely favourable financing costs.

Unfortunately, these types of transactions are invariably complex and need careful structuring to ensure that the arrangements do not have withholding tax and/or VAT implications. Accordingly, while all of these obstacles are capable of being overcome, this type of deal is only likely to be brought to market by strong issuers, with very large financing needs and strong obligor credits.

F. Summary

Indonesia's domestic economy is currently proving to be very robust, and there is no shortage of demand for offshore financing. With bank lending still lower than historical levels and a relatively small domestic financing market, the high-yield market is likely to make a strong showing in Indonesia this year. In part due to the Regulations, alternative financing structures, particularly structures using convertible bonds and securitisations, are likely to start to play a larger role in Indonesian financing this year.

Footnotes

1. Indonesia recently signed a new double tax treaty with Hong Kong. The treaty provides for a ten percent (10%) withholding rate on interest, as well as a low withholding rate of five percent (5%) on royalties and dividend payments on substantial shareholdings. Once this new treaty is ratified and comes into effect, Hong Kong may become an alternative jurisdiction worth considering for Indonesia related transactions.

2. This ratio depends on the local tax treatment in the jurisdictions of SPV and STC. If SPV and STC are incorporated in Netherlands, it may be preferable to capitalize STC entirely by way of equity and treat SPV and STC as a 'fiscal unity' for Netherlands corporate tax purposes. This enables coupon payments on the notes to be offset against interest payments on the loan for the purposes of calculating Netherlands corporate tax. In Singapore, the analysis is different and it may be preferable to capitalize STC with a blend of 50% debt and 50% equity. As Singapore corporate tax is currently 17%, there should be sufficient tax credits available from the 10% withholding tax paid in Indonesia to reduce to zero the Singapore corporate tax on the 50% coupon declared as profit in Singapore.

O'Melveny & Myers LLP routinely provides advice to clients on complex transactions in which these issues may arise, including finance, mergers and acquisitions, and licensing arrangements. If you have any questions about the operation of the applicable statutory provisions or the case law interpreting these provisions, please contact any of the attorneys listed on this alert.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.