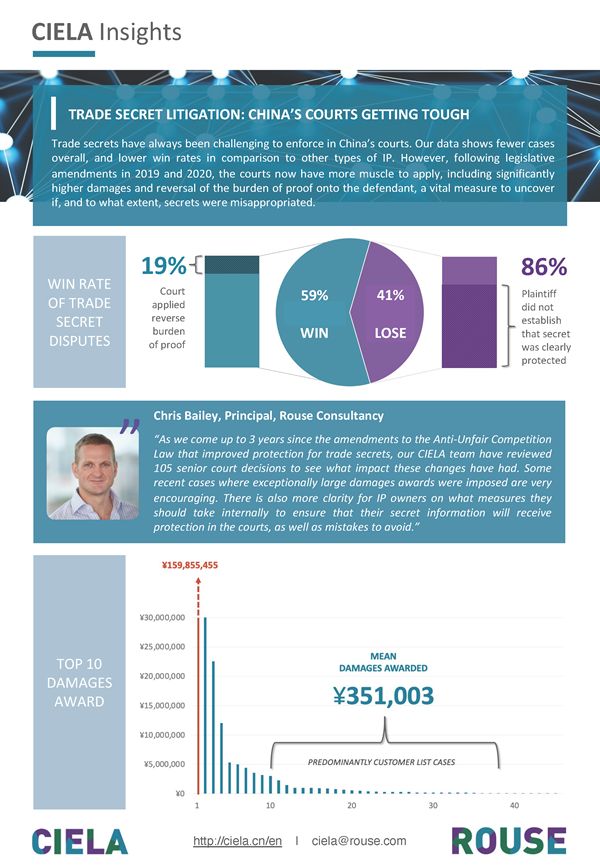

The Danish holding company regime, the investment company regime and the limited territoriality taxation applicable to Danish resident companies offer tax planning opportunities for multinationals and other cross-border investors.

New Danish Holding Company Regime

The Danish holding company regime is changing significantly with effect from the income year 2010.

As from the income year 2010 dividends and capital gains realized by a Danish holding company on "subsidiary shares" and "group shares" will generally be exempt from taxation.

Subsidiary shares are defined as shareholdings of at least 10 percent in another company (the "Subsidiary"), provided that the Subsidiary is a foreign company the dividends of which are tax exempt or subject to reduced taxation according to the EU parent/subsidiary directive or a tax treaty between Denmark and the jurisdiction where the Subsidiary is a tax resident.

Group shares are defined as shares in a Danish or foreign company (the "Group Company") held by a Danish company, where the Danish company and the Group Company are subject to Danish national joint taxation or could elect to be subject to Danish international joint taxation (generally, this requires that the Danish company directly or indirectly controls more than 50 percent of the votes of the Group Company).

The concepts of subsidiary shares and group shares are illustrated below:

If DK HoldCo holds at least 10 percent of the shares in OpCo and OpCo is resident in a jurisdiction covered by the EU parent/subsidiary directive or a jurisdiction that has entered into a tax treaty with Denmark providing for exemption or reduction of withholding tax on dividends, DK HoldCo's shares in OpCo will be subsidiary shares, and dividends and gains on the shares in OpCo will therefore be exempt from taxation at DK HoldCo level. If DK HoldCo holds more than 50% of the votes in OpCo, DK HoldCo's shares will be group shares, and dividends and gains on the shares in OpCo will therefore be exempt from taxation at DK HoldCo level irrespective of where OpCo is a tax resident. It should be noted that the Danish CFC regime may apply if more than 50% of OpCo's income is financial income.

If DK HoldCo is owned by a foreign parent company, funds at DK HoldCo level may be repatriated to the parent by way of dividends. Such dividends will be exempt from Danish withholding tax, provided that the parent company holds at least 10 percent of the shares in DK HoldCo, is the beneficial owner of the dividends, and is resident in a jurisdiction covered by the EU parent/subsidiary directive or a jurisdiction that has entered into a tax treaty with Denmark providing for exemption or reduction of withholding tax on dividends.

Specifically with respect to the beneficial owner-requirement it should be noted that the Danish tax authorities recently have started aggressively looking into whether a foreign company receiving payments in the form of dividends, etc., from sources in Denmark meets this requirement. However, there is not yet any guidance on how the beneficial owner test will be applied by the Danish tax authorities - and ultimately - the Danish courts.

Danish Investment Companies

Danish companies that qualify as investment companies for Danish tax purposes are only taxed on income in the form of dividends received from other Danish companies. All other income – Danish or foreign sourced – is tax exempt.

Broadly speaking, a Danish company will qualify as an investment company if:

- the company qualifies as an undertaking for collective investment in transferable securities within the meaning of the UCITS Directive (85/611/EEC); or

- the company's business consists in investing in securities, etc. and, at the request of the shareholders, shares in the company shall be redeemed by means of company funds at a price not materially below book value; or

- the company's business consists in investing in securities and the company has more than 7 shareholders.

The tax definition of an investment company does not require that the company invests in a diversified portfolio of assets or that shares in the company are offered to the public.

Investment Companies - International Tax Planning Opportunities

As mentioned, the only income taxable at the level of Danish investment companies is dividends received from other Danish companies. Accordingly, a Danish investment company will not be taxed on dividends from non-Danish companies, capital gains on shares, interest and capital gains on bonds or financial contracts, etc.

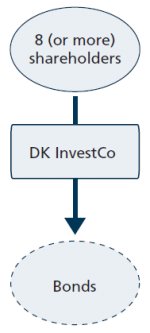

The Danish investment company is therefore a very interesting vehicle for use in international structures as illustrated below:

At least 8 non-Danish individuals and/or companies invest in bonds through a Danish company (DK InvestCo). Assuming that DK InvestCo does not own any other assets than these bonds, DK InvestCo will be considered an investment company for Danish tax purposes and income from the bonds will therefore be tax exempt at DK InvestCo level.

Limited Territoriality Taxation

Historically, Danish tax law has been based on a global income principle, implying that all Danish tax residents, including Danish companies, have been taxed on their worldwide income.

However, in the spring of 2005 a limited territoriality principle for Danish tax resident companies was introduced to the effect that under Danish internal tax law Danish companies are no longer taxed on income and gains deriving from permanent establishments ("branches") and real property situated outside Denmark, provided that

- the source state has not in a double tax treaty or other international agreement waived the right to tax income and gains deriving from such branch or real property,

- the branch would not have been subject to the Danish CFC regime, had it been a company, and

- the Danish company has not opted for Danish international joint taxation.

Broadly speaking, the Danish CFC regime applies if (i) the financial income of the branch constitutes more than half of the branch's total income, and (ii) the branch's financial assets constitutes more than 10 pct. of the total assets of the branch.

Danish international joint taxation only applies if specifically opted for by the Danish company or group Assuming that the Danish CFC regime does not apply, income and gains deriving from branches and real property situated outside Denmark and owned by a Danish resident company will therefore in practice be exempt from Danish taxation, unless the source state in a double tax treaty of other international agreement has waived the taxing rights.

Tax-Exempt Investments

The Danish limited territoriality principle applies irrespective of whether or not income and gains deriving from the foreign branch or real property is taxed in any other state. Consequently, if no tax is levied by the state where the branch or real property is situated and the source state has not waived the taxing rights in a double tax treaty or other international agreement, income and gains deriving from a Danish tax resident company's foreign branch or real property will effectively be fully tax-exempt.

Normally, income and gains from a branch or real property owned by a Danish company will be taxed in the state where the branch or real property is situated (the state of source). However, in some cases no or only low tax is levied in the state of source - e.g. because the state of source does not under its internal rules tax foreign companies on the relevant income items, applies a different interpretation of the applicable double tax treaty or simply because the foreign state is a zero or low-tax jurisdiction.

In such scenarios income and gains from foreign branches or real property investments may be fully tax-exempt if a Danish company is used as investment vehicle.

The interesting combination of the limited territoriality principle and the exemption from Danish withholding tax for dividends paid to parent companies resident within the EU/EEA or in a Danish treaty partner is illustrated in the example below.

Example

A corporate investor resident within the EU has decided to invest in a branch or in real property in state X. State X does not tax foreign companies on income derived in state X.

However, since the state of residence of the investor taxes pursuant a global income principle, the investor will in the state of residence be taxed on income and gains deriving from state X.

The investor therefore incorporates a Danish tax resident company ("DanishCo") and DanishCo makes the investment in state X.

Due to the limited territorially principle no Danish tax is levied on income and gains deriving from state X and since no tax is levied in state X either, profits may flow from state X to DanishCo within any taxation.

Furthermore, since the investor is resident within the EU and holds 100% of the shares in DanishCo, profits may be transferred to the investor without any Danish withholding tax by way of distributions of dividends.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.