Switzerland has been and is regarded as an attractive and competitive location for setting up a holding company, especially in the case of the acquisition of a company or the formation of a group of companies. This article not only outlines the tax advantages and consequences of incorporating a holding company in Switzerland, but also provides an overview of selective and up-to-date corporate aspects to be aware of when considering Switzerland as a possible location, taking into consideration recent changes in the law, for example as regards consolidated financial statements.

Introduction – legal framework

Under Swiss corporate law, a Swiss holding company is a company whose main purpose is the holding of participations in other companies. Apart from a few isolated statutory provisions, Swiss corporate law does not provide for a specific legal framework for a Swiss holding company as a company or for the group of companies held by a Swiss holding company. It rather considers that (i) a Swiss holding company must take one of the general legal forms of company available under Swiss law; and (ii) each group company held by a Swiss holding company is legally independent from each other.

In contrast to Swiss corporate law, Swiss tax law has developed a specific legal concept for Swiss holding companies, the so-called "holding status". The holding status is defined in the cantonal tax legislations and is granted upon satisfaction of certain conditions.

Corporate law aspects

Swiss holding companies are generally constituted either as joint stock corporations ("Aktiengesellschaft"/ "société anonyme") or as limited liability companies ("Gesellschaft mit beschränkter Haftung"/"société à responsabilité limitée").

Past experience has demonstrated that Swiss holding companies holding substantial participations usually take the form of the joint stock corporation. The main reason is that the limited liability company has certain disadvantages, such as the lack of confidentiality (the shareholders must be registered in a public register), and is in principle not used or intended as the legal form for capital-market transactions (e.g. IPO). This notwithstanding, for particular reasons (e.g. for foreign (in particular US) tax purposes), shareholders may find it more favourable to opt for the form of the limited liability company. This article will exclusively focus on the aspects of Swiss holding companies in the form of the joint stock corporation.

The company name may in principle be chosen freely. There are however certain restrictions to this, in particular the following: (i) the content of the company name must be true, not misleading and not contrary to public interest; (ii) the company name must be clearly distinguishable from existing company names; and (iii) the company name must include information on the legal form (the joint stock corporation will usually add "Ltd" ("AG"/"SA") at the end of the company name).

The minimum nominal value of the share capital of a Swiss holding company incorporated as a joint stock corporation amounts to SFr100,000 (about €83,000). It can be divided into bearer shares or registered shares. The minimum nominal value of a share is SFr0.01.

Incorporation of a Swiss holding company as a joint stock corporation

The Swiss holding company (in the form of the joint stock corporation) is established at the meeting of the founders, which is held in the presence of a notary public. At such a meeting, the founders adopt the articles of association of the company and designate the members of the board of directors and the auditors, if any.

The minutes of the founders' meeting and the articles of association are filed with the competent commercial register for registration.

In addition to articles of association, the joint stock corporation usually adopts organisational by-laws, which set out in further details the internal corporate structure and the rights and obligations of the board of directors and the managers (e.g. duties, signing power, meetings and remuneration). Swiss law requires organisational by-laws only if the board of directors delegates its management powers. The organisational by-laws are not filed with the commercial register.

Prior to the founders' meeting, the founders must make a contribution at least equal to the nominal value of the share capital of the joint stock corporation. If the value of the contribution exceeds the nominal value of the share capital, the surplus is booked into the legal general reserve (share premium).

The contribution will generally take one of the following forms:

- Contribution in cash: The founders deposit funds in cash in a special account with a bank in Switzerland. The paid-up amount is released upon the registration of the company in the commercial register.

- Contribution in kind: Instead of a contribution in cash, the founders can transfer assets (e.g. participations in other companies) to the Swiss holding company (constituted as a joint stock corporation) (so-called "contribution in kind"). As opposed to the straightforward contribution in cash, the contribution in kind proceeding is cumbersome on the following grounds: (i) the joint stock corporation (in foundation) and the founders must conclude a contribution-in-kind-agreement, which must describe the assets to be transferred; (ii) the founders must report on the nature and condition of the assets to be transferred; (iii) a licensed auditor must confirm that the report is complete and correct; (iv) certain information must be registered and is thereby available to the public, such as the object and valuation of the assets to be transferred, the name of the contributor(s) and the shares issued to such contributor(s).

- Acquisition of assets: A foundation by acquisition of assets occurs when the joint stock corporation has agreed or intends to acquire after its incorporation assets (e.g. participations in other companies, real estate) from the founders or persons closely affiliated to them. Typically, the following occurs: (i) the founders contribute 100% of the share capital in cash (i.e. by contribution in cash); and (ii) the joint stock corporation uses the cash to acquire assets from the founders or persons closely affiliated to them, as it was previously agreed or intended. As for the contribution-in-kind proceedings, a founders' report and an auditor's report are required; they become public upon the registration of the Swiss holding company as a joint stock corporation in the commercial register. The agreement governing the acquisition of assets is generally not available upon the incorporation of the company; however, if it is already concluded, it will also have to be filed with the commercial register. The founders may be tempted to not comply with this cumbersome proceeding. This may however have detrimental consequences since case law and the leading scholars consider that the acquisition of assets is null and void if the founders do not comply with the statutory provisions applicable to the incorporation of a company by acquisition of assets. The violation of the proceeding may also have criminal consequences (falsification of documents).

- Combinations: There are other ways of contributing the share capital of a Swiss holding company in the form of a joint stock corporation than the ones mentioned above. Especially in restructuring transactions, past practice has been to combine elements of the contribution in kind, acquisition of assets, loan and contribution "à fondsperdu" (i.e. without consideration for the transferred assets), for instance as follows: (i) by combining the contribution in kind and a loan granted by the founders (e.g. the founders transfer to the joint stock corporation 100% of the shares they hold in a subsidiary, 60% against all the shares in the joint stock corporation, the remaining 40% being purchased by the joint stock corporation by means of a loan granted by the founders); or (ii) by combining the contribution in kind and a contribution "à-fonds-perdu" (e.g. assuming that the founders hold all the shares in three subsidiaries, they may decide to transfer to the joint stock corporation all the shares in one of the subsidiaries as a contribution in kind (in exchange for all the shares in the joint stock corporation) and to transfer to the joint stock corporation, without consideration, their participations in the remaining two subsidiaries).

Corporate bodies

The shareholders' meeting

The shareholders' meeting is the supreme body of the holding company constituted as a joint stock corporation. The shareholders' meeting has in particular the following powers: (i) to amend the articles of association; (ii) to appoint and remove the members of the board of directors and the auditors; (iii) to approve the financial statements (including the consolidated financial statements); and (iv) to resolve on the allocation of the profits, in particular the declaration of dividends.

Unless provided by law or the articles of association, the shareholders' meeting passes its resolutions by an absolute majority of the voting rights represented at such meeting. Swiss law stipulates in particular that certain important resolutions (e.g. the amendment of the purpose or the relocation of the registered seat of the company) require at least two-thirds of the voting rights represented and an absolute majority of the nominal value of shares represented.

The company must hold an ordinary shareholders' meeting each year within six months of the close of the business year. Extraordinary shareholders' meetings must be called whenever the need arises or when the law so requires (e.g. law requires that the board of directors calls a shareholders' meeting when half of the share capital and the legal reserves are no longer covered by the assets).

The board of directors

The board of directors is entrusted with the management of the company. It is composed of one or more members, one of which being the chairman. At least one member of the board of directors (with individual signing power) or two members of the board of directors (with joint signing power by two) must be authorised to represent the company. The members do not have to be Swiss citizens or Swiss residents. Swiss law however requires that at least one board member or one manager (with single signatory power) or two board members or managers (with joint signing power by two) with domicile in Switzerland be authorised to represent the company.

The board of directors may delegate most of its powers to some of its members or to managers. The delegated powers must be set forth in organisational by-laws. However, certain important duties and powers must by law in any case remain with the board of directors (so-called non-transferable duties and powers), such as the ultimate management of the company, the appointment, removal and supervision of the managers and the notification of the court in the event of overindebtedness. The delegation of the management powers narrows the scope of liability of the board of directors to the damages which result from inadequate instruction, choice or supervision of the delegated person(s).

The question is often raised whether the board of directors or the managers can manage the entire group of companies. As indicated above, a Swiss holding company, which needs to take one of the legal forms available in Switzerland, is a legal entity legally independent from its subsidiaries. Each of the holding company and its subsidiaries has a board of directors, which has non-transferable duties and powers and must safeguard the interests of the company to which it is elected.

Consequently, from a Swiss corporate law perspective, the management of the group cannot be entirely delegated to the board of directors or the management board of the holding company. However, certain legal scholars have developed ways to overcome this issue. They consider in particular that the subsidiaries can delegate to the holding company the management duties and powers that are required to steer the group under unified management. This delegation of duties and powers, as well as the management structure, must be clearly set forth in the organisational by-laws of the holding company and its subsidiaries.

The auditor

In addition to their standalone financial statements, companies controlling one or more legal entities must draw up, and submit to the auditor for an ordinary audit, consolidated financial statements, unless one of the following conditions is satisfied:

- the holding company does not exceed together with the group companies two of the following thresholds in two consecutive business years: (i) balance sheet of SFr20m; (ii) revenue of SFr40m; (iii) annual average of 250 fulltime employment positions; or

- it is controlled by a company that has drawn up consolidated financial statements which are subject to an ordinary audit.

This notwithstanding, consolidated financial statements are to be prepared if (i) shareholders representing at least 20% of the share capital so require; or (ii) this is necessary for a reliable assessment of the financial position.

Dividend declaration and distribution

The holding company (in the form of the joint stock corporation) may validly pay out a dividend only if the following conditions are satisfied:

- the dividend is declared based on (audited) financial statements that have been formally approved by the shareholders at the shareholders' meeting;

- the dividend is paid (i) out of the balance sheet profit and/or the freely available reserves; and (ii) after allocation to the general legal reserves according to law and the articles of association.

Tax advantages and consequences

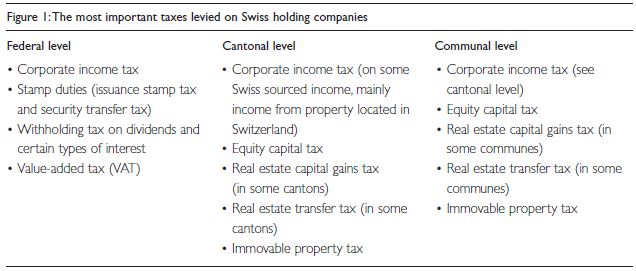

Certain Swiss taxes are levied on the federal, cantonal and communal levels (Switzerland is composed of 26 cantons, and each canton has a number of communes). Figure 1 shows the most important taxes levied on Swiss holding companies on the three levels.

Corporate income tax

Federal level

At the federal level, the corporate income tax rate is 8.5% (flat tax rate). In Switzerland, all taxes due by corporate taxpayers are tax deductible. Therefore, the effective federal corporate income tax rate is 7.8%. The federal corporate income tax of the Swiss holding company is calculated on its total worldwide income, subject to certain exceptions (e.g. real estate property located abroad).

The federal tax system does not provide for a federal corporate income tax exemption for Swiss holding companies. However, Swiss holding companies only pay federal corporate income tax on the income that does not qualify for "participation relief ". Income arising from dividends and capital gains may qualify for "participation relief ". Swiss holding companies benefit from the "participation relief " if the Swiss holding company (i) owns at least 10% of the participation of the entity distributing the dividends; or (ii) holds participations of the distributing entity which have a fair market value of at least SFr1m; they also benefit from the "participation relief " on capital gains if they (i) sell at least 10% of the share capital of the company; and (ii) at the time of the sale, they have held the 10% participation for at least one year. Very often the "participation relief " reduces federal corporate income tax burden to nil. However, in case of high debt financing and/or substantial management expenses a remaining marginal federal corporate income tax may become due.

Cantonal and communal level

At the cantonal and communal level, if the Swiss holding company qualifies for the holding status, it is exempt from cantonal and communal corporate income tax. The exemption applies irrespective of whether the income is generated abroad or in Switzerland. Note however that income from real estate located in Switzerland does not benefit from the exemption. The following requirements must be satisfied to receive the holding status:

- the main purpose of the Swiss holding company as set out in its articles of association must be the long-term holding and management of participations;

- at least 2/3 of either the assets (balance sheet) or the income (P&L) must be composed of, or derived from, long-term participations;

- the Swiss holding company may not be actively engaged in any commercial activity in Switzerland.

The last condition means that the Swiss holding company may not have any commercial or industrial activities (such as manufacturing, trading and services activities) in Switzerland. However, activities such as management and administration of the company itself and the participations it holds, as well as the management of the company's working capital, are permitted. A Swiss holding company can also provide support functions for the entire group (e.g. centralised management and reporting, market studies, legal and tax advice, human resources).

Equity capital tax

An equity capital tax is levied on the cantonal and communal levels only. The tax base is in principle the aggregate of the nominal share capital, the reserves, the retained earnings and certain hidden reserves. The cantonal and communal tax rates depend on the canton and commune where the Swiss holding company is located. Some of the cantons do only know a flat rate on the cantonal level. For instance, in Zurich city and Zoug city, the cantonal and communal tax rates amount to 0.0344% and 0.0030% respectively.

Federal withholding tax

Dividends

Dividend distributions of Swiss holding companies are subject to a 35% federal withholding tax, possibly reduced to nil or a specific remaining withholding tax rate according to an applicable treaty or the taxation of savings directive. Repayment of share capital and reserves derived from qualifying contributions made by direct shareholders (e.g. capital surplus, contributions) may be repaid without being subject to the federal withholding tax. According to the taxation of savings agreement between Switzerland and the European Union, no withholding tax shall be levied on cross-border dividends from a company resident in Switzerland to a recipient company in the European Union if the participation is held for more than two years and if the participation equals more than 25% of the share capital of the distributing company.

Royalties and interest

Subject to certain exceptions (e.g. if the financing instrument qualifies as a bond), no federal withholding tax is levied on royalties and interest payments. If the royalties or interests are not paid at arm's length, the authorities will, however, qualify part of the payment as a constructive dividend and federal withholding tax of 35% may be triggered.

Swiss value-added tax

A Swiss value-added tax ("VAT") is levied on (i) the supply of goods or services for consideration in Switzerland; (ii) the receipt of services for consideration from enterprises with domicile outside of Switzerland; and (iii) the import of goods. The VAT is calculated on the basis of the consideration or price paid for the supply of goods or services at a standard rate of 8%. Certain goods and services are taxed at a more favourable rate (goods for personal consumption (books, newspapers), supply of accommodation, medical treatment, education).

Stamp duties

Issuance stamp tax

An issuance stamp tax is levied upon the incorporation of a Swiss holding company if the founders' contribution exceeds SFr1,000,000. This tax amounts to 1% of the fair market value of the founders' contributions.

In case of a reorganisation (mergers, quasi-merger, spin-offs or transformations), it may be possible to apply for an issuance stamp tax exemption or relief. No issuance stamp tax is due in the event of the relocation of the registered seat to Switzerland, the contribution of participations of at least 50% to a Swiss resident company (quasi-merger) or the set-up of a Swiss branch by a foreign company.

Security transfer tax

A security transfer tax is due on the consideration paid for the transfer of certain securities (in particular shares in companies, debentures and participations in collective investment schemes), if one of the involved parties qualifies as a securities dealer. The tax rate amounts to 0.15% on Swiss securities and to 0.3% on foreign securities. Banks and bank-like financial institutions as defined by Swiss banking law as well as investment fund managers qualify as Swiss securities dealers. The term also includes individuals, companies, partnerships and branches of foreign companies whose essential activities consist in trading or acting as intermediaries in deals involving taxable securities. Swiss companies which are not predominantly in the securities trading business qualify also as securities dealers if they own taxable securities of a book value in excess of SFr10m. Swiss holding companies often meet that test.

International double tax treaties

Double taxation may result from the overlapping of two different tax jurisdictions. Consequently, the taxpayer is simultaneously submitted to similar taxes on the same income in two different countries. In order to avoid international double taxation, Switzerland has concluded comprehensive favourable double tax treaties with more than 80 different countries.

Swiss tax rulings system

Whilst the Swiss tax rulings procedure is not explicitly mentioned in the Swiss tax regulations, it is common practice to seek tax authorities' written approval prior to entering into a transaction (e.g. a restructuring). Rulings are available for almost every aspect of taxation. They are in principle valid as long as the facts set out in the ruling request remain true and correct and there is no change in law.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.