Treaty Taxation

Puerto Rico is a territory of the United States that is not empowered to enter into tax treaties with other countries. The tax treaties of the United States generally do not include Puerto Rico taxes

Income Tax

1.1.1.Income Tax Rate.

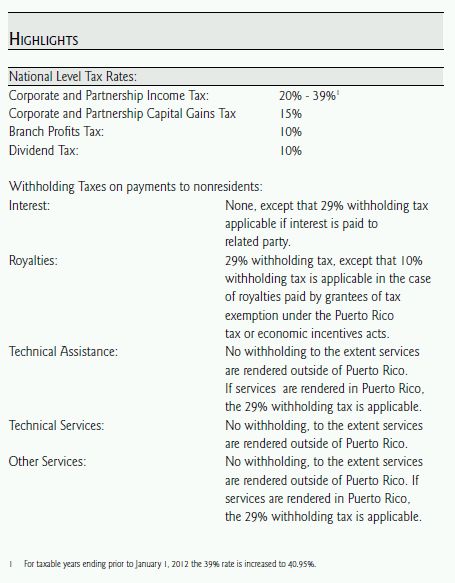

The corporate income tax is the higher of a regular tax ranging between 20% and 39% of net income and an alternative minimum tax of 22 % of "alternative minimum net income". For taxable years ending prior to January 1, 2012 the 39% rate is increased to 40.95%.

1.1.2.Net Income and Alternative Minimum Net Income.

In general, net income is the excess of "gross income" over the sum of "deductions" and a credit for dividends received ranging between 85% and 100% of the dividend. "Gross income" embraces all revenues, other than those specifically excluded by-law, and "deductions" are basically all ordinary and necessary expenses incurred to generate the gross income.

Alternative minimum net income is the net income, as defined above, adjusted to reflect essentially the economic net income of the corporation or partnership.

1.1.3.Depreciation.

A reasonable amount may be deducted from gross income for exhaustion, wear and tear and normal obsolescence of property used in the corporation's or partnership's trade or business or held for the production of income. Generally, depreciation is allowable only for tangible or intangible property that has a limited useful life of more than one year. However, the cost of acquiring goodwill may be depreciated during a 15 year period.

The straight line method (i.e., cost or other basis of property less estimated salvage value divided by estimated useful life) or any other recognized trade practice, may be used to compute the depreciation deduction.

Generally, assets may also be depreciated under the accelerated cost recovery method. Under this method assets may be depreciated during period ranging from 5 to 35 years. Assets that qualify as 5 year or 10 year property may be depreciated using a 200% declining balance method, and assets that qualify as 15, 20, 30 or 35 year property may be depreciated using a 150% declining balance method.

1.1.4.Transfer Pricing.

Puerto Rico transfer pricing rules are based on the rules of section 4 82 of the United States Internal Revenue Code of 1986, as amended (the "US-Code"). In general, the Puerto Rico Treasury Department may adjust the transfer price for goods or services among related parties (i.e, parties that, directly or indirectly, control, are controlled by or are under common control with the other pay by way of stock ownership, contractual provisions or otherwise), if it is not fixed on an arm's length basis (e.g., the price that an unrelated party would charge in similar circumstances).

1.1.5 Tax Losses Carryforward /Carryback.

Net operating losses may be carried forward until exhausted to the succeeding seven (7) taxable years. No carryback of net operating losses is allowed.

Generally, the net operating loss may only be used by the corporation or partnership that incurred the loss. A corporation that acquires all or substantially all of the assets of the corporation or partnership that incurred the losses in certain corporate reorganizations may also use the net operating losses, but only against the net income derived by the business activities of the transferor that incurred the losses.

Lastly, the use of the net operating losses is restricted to the income of the business activities that incurred the losses when there is a change in the stock ownership of the corporation or partnership of at least 50% of the value of the issued and outstanding shares of stock or partnership interest, respectively.

1.1.6 Corporate Reorganizations.

No gain or loss is recognized upon the transfer of assets, shares of stock or partnership interests in certain reorganizations. Generally, the following transactions qualify as non-recognition reorganizations in which no gain or loss is recognized:

(a) statutory mergers or consolidations of corporations under the laws of Puerto Rico;

(b) acquisition of at least 80% of issued and outstanding shares of stock or partnership interests of a corporation or partnership, respectively, or substantially all of its assets, in exchange for voting stock or partnership interests of the acquiror (or its parent company);

(c) transfer by a corporation or partnership of all or a portion of its assets to a corporation or partnership, if immediately after the transfer the transferor or its shareholders or partners, or a combination of both are, in control of the transferee;

(d) reincorporations; and

(e) recapitalizations.

1.2 Payment and Filing Date.

Corporations and partnerships must file their income tax returns on or before the 15 th day of the fourth month after the close of the taxable year. Estimated tax payments must be made quarterly and any amount due must be paid with the filing of the income tax return.

1.3 Dividends and Branch Profits.

Dividends and partnership profits distributed by corporations or partnerships organized in Puerto Rico to their nonresident shareholders or partners, are generally subject to a 10% withholding tax.

Dividends and partnership profits distributed by corporations or partnerships organized outside of Puerto Rico to their nonresident shareholders or partners, are subject to either to a 10% withholding tax or a 10% branch profits tax, to the extent that the dividend or partnership profits are from sources within Puerto Rico.

1.4 Cross-border Payments.

1.4.1. Dividends or Partnership Profits.

A 10% withholding tax is generally withheld from distributions of dividends or partnership profits from sources within Puerto Rico.

1.4.1.2. Royalties:

Royalty payments are subject to a 29% withholding tax. However, royalties paid by corporations or partnerships that are grantees of tax exemption under the Puerto Rico tax incentives acts are generally subject to a 10% withholding tax rate.

1.4.1.3. Services:

Payments for services rendered outside of Puerto Rico are not subject to withholding tax. If the services are rendered in Puerto Rico, the 29% withholding tax is applicable.

1.4.1.4. Interest:

Interest payments are not subject to withholding taxes. However, if the interest is paid to a related person (as defined in the Puerto Rico Internal Revenue Code of 1986, as amended) the interest payments are subject to a 29% withholding tax.

2. Sales and Use Tax:

A 7% sales and use tax is generally applicable to the sale, use, storage and consumption of tangible personal property, taxable services, rights of admission and combined transactions (collectively, the "Taxable Items").

Unprepared food ingredients, certain motor vehicles, gasoline, crude oil and products derived from oil; medicines that can be acquired with medical prescription; certain articles used in the treatment or prevention of sickness or illness; machinery and equipment and raw materials for use in the manufacturing process; money and securities and certain public utilities, are among the articles exempted from the sales and use tax. Resellers of taxable items and real estate transactions are also exempt from the sales and use tax.

Among the services exempt from the sales and use tax are certain designated professional services, education and health services, insurance services, internet and service charges by financial institutions, and services provided by the government of Puerto Rico.

Any and all persons (individuals or entities) engaged in the sale, use or storage of Taxable Items must register in the Registry of Merchants of the Puerto Rico Treasury Department. Failure to register results in penalties of up to $10,000. Manufactures and resellers of Taxable Items must obtain a Certificate of Exemption from the Puerto Rico Treasury Department in order to claim their respective exemptions.

3. Other Taxes:

3.1.1. Real and Personal Property Taxes.

Generally, real and personal property taxes are assessed annually upon the real property located in Puerto Rico and the personal property used in a trade or business in Puerto Rico.

Real property taxes are imposed upon the appraised value of the real property pursuant to certain guidelines established for the appraisal of real property conducted in Puerto Rico in the late 1950's. As a result, the appraised value for real property tax purposes is generally significantly lower than the prevailing market value of the real property.

Personal property taxes are assessed upon the market value of the personal property. Book value is used as the basis for the assessment, unless it does not reflect the market value of the personal property.

Real property and personal property tax rates fluctuate depending on the municipality where the property is located. Generally, the real property tax rate ranges between 8% and 8.33% and the personal property tax rate ranges between 6% and 6.33%.

Generally, real and personal property taxes are assessed as of January 1st of each year. However, the personal property tax upon inventory is assessed based on the annual average of inventory of the preceding year.

3.1.2. Excise Taxes.

Vehicles, petroleum products, jewellery and other articles imported to, or manufactured in, Puerto Rico are subject to excise taxes. In the case of articles imported to Puerto Rico, the taxpayer is the consignee. In the case of locally manufactured articles, the taxpayer is the manufacturer. The excise tax rate varies depending on the type of product.

3.1.3. Municipal Taxes.

(a) Municipal License Taxes. The Municipal License Tax Act, as amended (the "MLTA"), empowers each municipality of Puerto Rico to impose a municipal license tax upon the "volume of business" of generally all persons engaged in business within its territorial limits.

The MLTA defines "volume of business" as essentially the gross income from sources within and without Puerto Rico attributable to the operations conducted in the municipality, including without limitation, interest and dividend income.

Interest from obligations of the government of Puerto Rico or the United States is among the items exempt from the municipal license tax.

The tax rate is a maximum of 0.5%. However, financial businesses are subject to a maximum tax rate of 1.5%.

(b) Municipal Construction Tax. Most municipalities have enacted municipal ordinances imposing a tax on the value of any construction within their territorial limits. The rates vary depending on the municipality where the construction is located.

4. Custom Duties.

Articles imported to Puerto Rico from foreign countries are subject to the custom duties imposed by the United States upon articles imported into the United States.

5. Tax Incentive s Programs.

5.1.1. E conomic Incentives Act for the Development of Puerto Rico (the "EID").

Manufacturing, assembly, certain designated products, certain services rendered within Puerto Rico to nonresidents and certain recycling activities qualify for tax incentives under the EID. The tax incentives include a 4% maximum income tax rate, full exemption on dividends or distributions of profits, 90% property tax exemption, 60% municipal license tax exemption and full municipal construction tax exemption. Special tax credits and deductions are also available. The period of exemption is 15 years.

5.2.1. Tourism Development Act of 1993.

Generally, hotels, condo-hotels, inns, and other tourist facilities qualify for 90% income, property and municipal license tax exemptions and full exemption from excise on certain products. Special tax credits are also available to investors in tourism projects. The period of exemption is 10 years and may be extended for 10 additional years.

5.2.3. Agricultural Tax Incentives Act of 1995.

Farming, animal breeding, agro-industrial operations and other agriculture related operations are eligible for 90% income tax exemption and full exemption from property, excise and municipal taxes under the Agricultural Tax Incentives Act of 1995, as amended. Special tax credits are available for certain investments in eligible agricultural operations.

5.2.4. Hospitals.

Hospitals, clinics, convalescent homes and certain contractors of any of the foregoing, qualify for 50% income tax exemption, and full property, municipal license and excise tax exemption on equipment, machinery and devices designed for medical diagnosis and treatment of human diseases. The period of exemption is 10 years.

5.2.5. Air Carriers.

The real and personal property of air carriers is eligible for property tax exemption. The exemption is also applicable to the planes and equipment leased to air carriers. The period of exemption is 10 years and may be extended for 10 additional years if certain conditions are met.

5.2.6. Investments in Solid Waste Treatment and Disposal Facilities.

Special tax credits are available for investments in solid waste treatment and disposal facilities.

5.2.7. Film Industry.

Certain eligible film infrastructure projects may enjoy a reduced 7% income tax rate, 90% property tax exemption and full exemption from municipal and excise taxes under the Film Industry Development Act. The period of exemption is 10 years. Special tax credits are also available to investors and lessors of property to eligible film entities.

5.2.8. International Banking Center Regulatory Act.

Companies engaged in banking, lending, currency transactions, underwriting, distribution and trading of securities, insurance or other financing transactions with person located outside of Puerto Rico, may qualify for income, property and municipal license exemption under the International Banking Center Regulatory Act. Dividends, partnership profits, interest and finance charges paid to nonresidents of Puerto Rico also qualify for income tax exemption.

5.2.9. Other Exemptions.

Other tax exemptions are available to venture capital funds, maritime freight transportation, the construction or improvement of real property in certain designated areas and certain historical zones, and businesses established in certain areas

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.