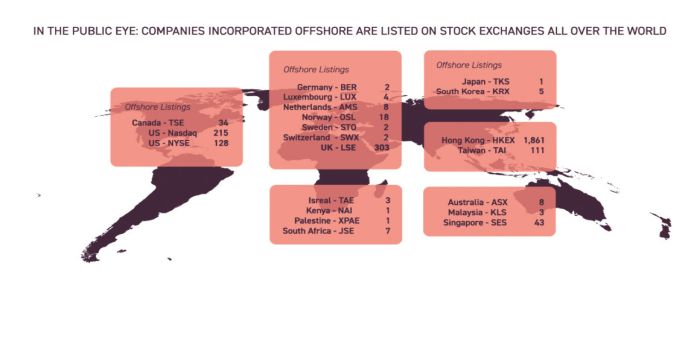

Did you know that there are over 300 offshore companies listed on the London Stock Exchange? Or that there are more Cayman companies listed on the Hong Kong Stock Exchange than there are Hong Kong companies?

Analysis of companies incorporated across the offshore region – Bermuda, Cayman, British Virgin Islands, Jersey, Guernsey, Isle of Man and Mauritius – points to the continued popularity of offshore incorporated companies whose shares are listed on over 20 stock exchanges around the world. These range from BVI incorporated mining companies on the Toronto Stock Exchange to Cayman incorporated manufacturing companies on the Taiwan Stock Exchange.

These offshore jurisdictions are welcomed by regulators and are acceptable to underwriters, rating agencies and both institutional and private investors.

The following is a list of some of the potential advantages in using an offshore incorporated listing vehicle (incorporated in Bermuda, Cayman, British Virgin Islands, Jersey, Guernsey, Isle of Man or Mauritius):

- Each of the offshore jurisdictions listed above are well regulated and have strong service infrastructures.

- Each of the offshore jurisdictions:

- operates within a progressive and responsive legislative, business and regulatory environment, providing for innovative legal solutions on capital markets transactions; and

- benefits from a flexible corporate regime which permits common public company transactions including take-privates and mergers.

- The listed company's constitutional documents can be tailored to the target market's requirements, limiting any such changes to those specifically imposed by the market.

- Where listing on one of the main US exchanges, offshore entities may be able to take advantage of "foreign private issuer" status, which provides certain advantages, including: (i) reduced reporting requirements; (ii) reduced disclosure requirements; (iii) certain exemptions from US proxy rules; (iv) ability to apply accounting standards other than US GAAP; (v) flexibility in choice of reporting currency; and (vi) ability to apply certain "home country" standards in respect of corporate governance practices, publication of interim and annual reports, and the composition, election and classification of directors.

- An offshore incorporated issuer listed on the London Stock Exchange (whether on the Main Market or on AIM) is not automatically subject to the United Kingdom Takeover Code and the jurisdiction of the Panel on Takeovers and Mergers of the United Kingdom. An offshore incorporated issuer has the discretion to include provisions in its articles of association providing shareholders with some or all of the protections they would have under the Takeover Code.

While offshore companies can be found on all major exchanges, the principal jurisdictions are London, New York and Hong Kong.

The London Stock Exchange and its Alternative Investment Market for smaller growing companies have always been an international hotspot, with almost 60 countries featuring on it. Crown Dependency companies feature heavily with more companies listed on the exchange than the rest of Europe and Russia combined.

In the US, Bermuda, BVI and Cayman companies frequently show up on the NYSE and Nasdaq. From cutting-edge e-commerce to heavy-engineering transportation, an enormous range of companies have gone public following incorporation offshore and the recent surge of interest in Special Purpose Acquisition Companies (SPACs) has added to the mix. These 'blank cheque' investment companies are often incorporated in Cayman or BVI before their listing in the US.

An intriguing feature of the Hong Kong main market and its related Growth Enterprise Market (GEM) is that over three quarters of listed entities are incorporated offshore. Over 1,800 Cayman and Bermuda companies are currently listed in Hong Kong, of which Appleby has brought 375 to market. The relative simplicity of Bermuda and Cayman Islands company law makes for an attractive route to market, combined with the reassurance of expert offshore legal advice being available in Hong Kong itself.

Some companies are waiting for geopolitical uncertainties to pass, and IPOs worldwide are down on 2018 levels. High profile erosion of value in some recently listed technology companies has also underlined the difficulty in correctly pricing unique new enterprises, but nevertheless, IPOs continue to offer an attractive route for many companies to raise money and an important source of liquidity for private equity sellers looking for an exit.

In 2019, 180 offshore companies successfully completed IPOs, and with numerous others announcing their intention to list in the future we expect further offshore additions to international exchanges in 2020.

Appleby's global Corporate team is one of the largest and most renowned offshore, advising a wide range of companies on every aspect of corporate and commercial law. The team has extensive expertise in supporting offshore companies with IPOs, introductions, placements and listings of both equity and debt securities on the Hong Kong, United States, London and many other internationally recognised stock exchanges. The highly experienced team are committed to providing the highest possible level of service, together with the pragmatic and insightful advice required to navigate increasingly heightened listing and regulatory requirements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.