How can ESG create value in a given investment?

From the very beginning of the ESG movement, about fifteen years ago, asset managers have asked themselves if and how ESG can create value. In our view, trillion-dollar questions are always worthy of our attention, particularly if answering them may help to save the planet.

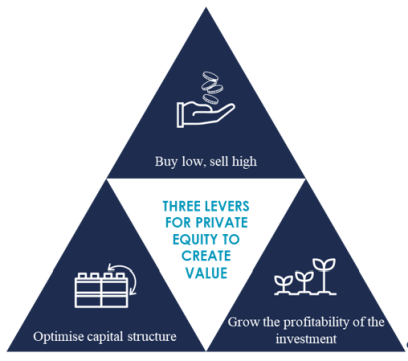

In order to show whether improvements in ESG can drive value, we will concentrate on the three key levers which investors (Private Equity investors specifically) typically operate in order to add value:

FIGURE 1: PRIVATE EQUITY VALUE CREATION LEVERS

Source: MJ Hudson Spring

Understanding how each of these levers can be influenced by ESG will help us better understand where, and how we might expect to deliver increased value.

Buying low, selling high, and optimising capital structure

Private equity investors only have three value levers; they can buy low and sell high, they can optimise capital structure, or they can grow the profitability of the investment.

There are numerous instances where failures in ESG have led to significant reductions in a company's value. From recent history we can take the example of BP and the Deepwater Horizon oil spill in the Gulf of Mexico. On April 20th, 2010, a blowout one mile underwater resulted in the sinking of the Deepwater Horizon exploration rig and a catastrophic oil leak. Before the leak was plugged nearly 3 months later, it had spilt over 3 million barrels of oil into the Gulf of Mexico. The impact of this environmental disaster on BP's share price? Just before the accident, market capitalisation was ~$180 billion with a share price of 641.80 GBX; by the beginning of July, less than four months later, it was trading at 322.00 GBX (before stabilising around 450 GBX). This is, however, an extreme case, and there are plenty of examples that demonstrate that companies with poor ESG track records can perform well.

On the other side of the equation, early signs are that a strong ESG track record probably helps to achieve a higher selling price. ESG is not, of course, the only influencer. Macro-economic factors and the cyclical nature of certain industries or sectors can have a great effect on the price that an investor can achieve when it comes to sell.

ESG elements can also influence the cost of financing. Green financing for particular investments can reduce the cost of debt by 50 bps and many banks are trying to extend this to ESG investing, too, with lower discounts. An interesting case in point is Eurazeo, which contracted the first ever sustainability-linked loan for private equity. The interest rate is in this case linked to two levels of sustainability key performance indicators: carbon neutrality indicators and sustainability governance measures throughout the investment cycle.

Growing a company's profitability is key

Fundamental value creation, however, takes place at the company level. Over the last ten years, we have assembled many examples of ESG value creation. Typically, the most successful private equity firms follow a few principles:

- Look for growth. Always

- Improve continuously

- Beware of marginalisation

- Link to existing strategy and structure

Below, we will look at how these four principles could leverage ESG to potentially deliver even greater value for investors.

Look for growth. Always.

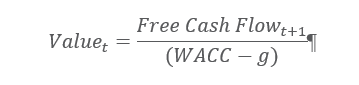

The underlying value that an investment creates over its lifetime, is approximated by:

Where the wacc is the weighted average cost of capital and g is the growth rate.

Although the factors are not independent, PE investors know that the main differentiating factor in this formula is the g. Nothing beats growth. This can both be top line growth, as well as profitability growth, but the latter is not possible in perpetuity without the former. So, the top line really counts. In the negative sense, this is even more true; it is extremely difficult to create value in a declining market.

Therefore, any investor who wants to let ESG coincide with financial value, will have to start with the growth potential of its sector or industry, as this is typically the limiting factor on the growth of any given company (exceptions are where a company pivots and changes industry). It seems safe to assume that investors already have a perspective on market growth, but ESG considerations may give them a different view. If the growth of an industry is not aligned with the public good, it makes sense to think twice about entering that market, even if only for financial reasons. The public concern could be translated into changing customer demand, legislation, or competitive behaviour.

Assessing the license to grow is not always straightforward, but the extremes are pretty clear. A lignite power plant in Germany has no future, whereas free online math tools for children (such as from the Kahn Academy) from a public perspective almost have unlimited growth potential. The general question the investor should be asking, is "what would this industry look like from the perspective of a citizen?" More concretely, does public opinion require this industry to transition, and if so, is the technology to do so mature, or is it still experimental?

It is obvious that selecting the right industry can be a great value driver: look at Tesla, or Beyond Meat - but finding a growth path from an existing position is also often possible, as witnessed by Heineken moving into non-alcoholic beer (0.0), or Centrica embracing renewables.

Improve continuously

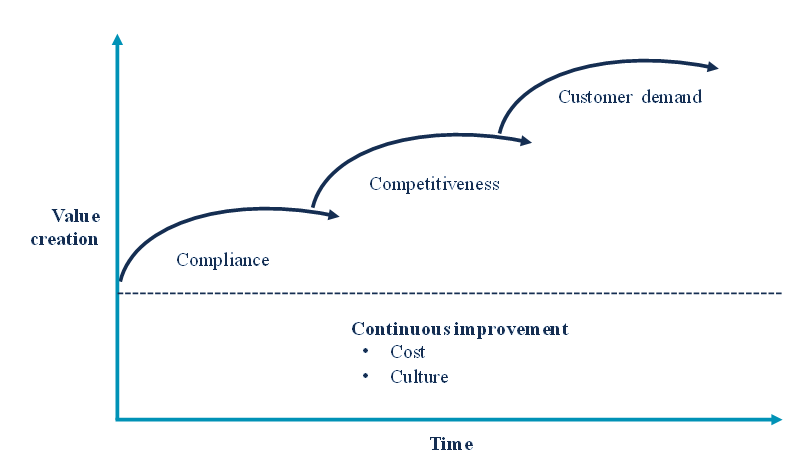

Value creation categories linked to ESG are no different from the categories investors and entrepreneurs already work with, but the sustainability lens may afford a different view and focus. This does not always require big moves. Constant monitoring and a continuous improvement cycle over time could add up to real value generation.

FIGURE 2: VALUE CREATION LINKED TO ESG

Source: MJ Hudson Spring

Compliance. Much of the energy transition has been and will be stimulated and enforced by new legislation. The same applies to matters such as diversity, data security, and anti-slavery efforts.

Competitiveness. Monitoring competitors and benchmarking against them often highlights where and when to follow. For instance, in government tenders across Europe, carbon neutrality is increasingly valued. Technically, this is low hanging fruit, as it just requires some analysis and proper procurement. We see the value of certain sustainability labels, such as Cradle-to-Cradle, B Corp, Rainforest Alliance, or MSC increasing.

Customer demand. In some cases, it is evident that there is unmet demand in the market. Mostly, this does not require a complete repositioning or huge development process, just the addition of a product or product line. Several meat processors have successfully entered the meat replacement market, for instance Tyson's pea-based chicken nugget and Vion's recently launched ME-AT start-up for high-end meat alternatives.

Cost. Efficiency gains are often still possible. Lowering scrap rates or 'quality cost', defined as costs associated with poor quality as scrap or rework, seems possible in many materials intensive mid-market companies in Europe. Also, energy savings (often required by law) are very often possible.

Culture. Obviously, culture can be a big value driver. Examples of these cultural value drivers include HR, safety, and wellbeing. Labour markets are tense and taking care of your employees often pays off in lower staff turnover.

From a timing perspective, it is compliance that is always first, directly followed by competitiveness. Practically, we provide our clients with a menu of ideas:

FIGURE 3: Example solutions in our solutions repository

Source: MJ Hudson Spring

Beware of marginalisation

One of the great challenges of the sustainability transition is that granular analysis, combined with marginal thinking, may lead to paralysis. What we mean by this is that the value associated with a small step forward is typically very low, suggesting it is not worthwhile.

Yet, larger steps can generate substantial value, but only if a transition investment leads to a recognisable differentiation (or qualification, for that matter) which itself can lead to a substantial benefit. Now that there are full electric vehicles with a 400-mile range, it is incredibly difficult to claim that hybrid technology is something a customer should be prepared to pay for. Also, food that is not 'organic' will not be recognised by most consumers as sustainable. In other words, positioning should be black or white, not grey.

But beware! The good old 'business case' requirement for any new investment can be a trap. It can lead to marginal thinking (what is the payback period of a new energy-saving machine?) instead of strategic thinking (will we break out from our industry if we can make fully recyclable products?). Often, the strategic option is also cheaper and much simpler in the long run. A total cradle-to-cradle turnaround can be a lot cheaper than annual LCA monitoring and incremental changes.

Link to existing structures and strategies

Many PE firms publish ESG reports these days. Nice, shiny documents, sometimes even with the jolly colours of the SDGs but not so many of them are capable of reporting real, tangible progress when it comes to ESG factors.

A reason is that sustainability measures often do not achieve the desired returns. The IRR of an investment in solar panels, for example, is much lower than the fund's IRR target, even including subsidies. Hence, a fund manager will not be incentivised to deploy it. A solution we see occurring at our clients, is the creation of a separate fund with dedicated capital for ESG investments at portfolio companies, provided at attractive terms. Take Bregal's Sustainable Development Fund as example. Separating capital flows in such a way can accelerate ESG initiatives without jeopardising the fund's returns.

Another reason is that many overlook the importance of truly integrating ESG in business by embedding it into the equity story (and capex plans) from the beginning. Real value and progress will materialise over time when opportunities are made concrete. Action plans and targets to monitor and improve will help in doing so. Responsibilities and oversight at board level will help to ensure strong sustainability commitments and results.

Now, to wrap up the trillion-dollar question. Sustainability champions can generate exceptional returns, and we have seen that. To unlock the alpha of ESG, fund managers should start by finding growth opportunities that are aligned with the public good. They should assist portfolio companies in taking a high-level approach towards finding continuous internal improvements and market opportunities. Beware of marginal thinking, look for recognisable differentiation and evaluate your strategic options. But, to get this value engine started, it is key that fund managers start embedding ESG in their companies' equity story from beginning. If all this is done successfully, returns might just go Beyond Meat.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.