This edition of the Bermuda Public Companies Update summarises significant transactions involving Bermuda public companies in the first half of 2020. This has been a period of unprecedented disruption due to the Covid-19 pandemic. Despite a very difficult and uncertain economic climate, Bermuda listed companies collectively managed to raise more capital in H1 2020 than H1 2019. This is a testament to the strength and resilience of the listed Bermuda corporates, which has been supported by investor confidence in Bermuda as a jurisdiction. Conyers is consistently recognised as the leading Bermuda law firm advising Bermuda public company issuers and underwriters.

Global market update

Global capital markets activity in H1 2020 was heavily impacted by the Covid-19 pandemic and associated economic slowdown. IPO activity declined across all regions, compared with H1 2019. In the Americas, both IPO deal volume (81 deals) and proceeds (US$24.5 billion) fell by 30% compared with YTD 2019. After a very slow April and May, the market saw a strong rebound in June as lockdowns eased. Nearly a third of the IPOs in H1 2020 occurred in June. Technology, industrials and health care were the dominant sectors.

Global mergers & acquisitions (M&A) activity was similarly impacted. All regions witnessed a decline in deal volume and value except for Asia-Pacific, and South and Central America, which witnessed growth in deal value. Overall, according to data from Refinitiv, Q1 2020 was the worst first quarter for M&A since 2016, down 13% from a year ago. Parties to pending M&A transactions have been considering their options. While some have moved forward with planned mergers or acquisitions, others have put plans on hold or terminated agreements.

Bermuda companies update

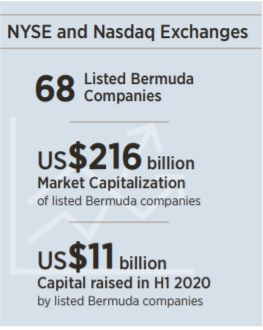

Some US$11 billion in capital was raised in the first half of 2020 by Bermuda companies listed on the NYSE and Nasdaq. Despite the disruptions caused by Covid-19, this is up from US$8.2 billion for the same period in 2019. The increase was primarily driven by the insurance sector, as we discuss in our feature article on page 3. Other significant market activity included sizeable notes offerings by Nabors Industries Ltd, Norwegian Cruise Line Holdings Ltd, Axalta Coating Systems Ltd and GeoPark Limited.

There was one Bermuda company IPO on a US exchange in the period – GAN Limited, a gambling software provider, began trading on Nasdaq on 5 May 2020 under the ticker symbol GAN. The company was previously listed on the AIM market operated by the London Stock Exchange, but delisted as of 6 May 2020.

Blue Capital Reinsurance Holdings Ltd delisted from the NYSE at the end of March.

M&A activity was significantly down from 2019 levels in terms of volume of transactions. Among the most significant, Helen of Troy acquired Drybar Products LLC for approximately US$255 million and International General Insurance Holdings acquired Tiberius Acquisition Corporation in a US$120 million reverse merger transaction. The new entity, IGI Holdings, listed on Nasdaq in March.

We hope this update on Bermuda public companies market activities will be of interest to our legal colleagues, clients and Bermuda market followers

Highlighted Transactions

NYSE

- Triton International Limited (NYSE:TRTN) completed a US$150 million offering of Series D Cumulative Redeemable Perpetual Preference Shares. (January)

- SFL Corporation Ltd. (NYSE:SFL) completed a NOK600 million (US$62 million) offering of senior unsecured bonds due January 2025. The bonds are listed on the Oslo Stock Exchange. (January)

- GeoPark Limited (NYSE:GPRK) completed a US$350 million offering of senior notes due 2027. (January)

- RenaissanceRe Holdings Ltd. (NYSE:RNR) completed an offering of common shares by Tokio Marine & Nichido Fire Insurance Co., Ltd. (January)

- Nabors Industries Ltd. completed offerings of US$600 million of 7.25% senior guaranteed notes due 2026 and US$400 million 7.50% senior guaranteed notes due 2028. (NYSE:NBR) (January)

- Brookfield Business Partners L.P. (NYSE:BBU) together with certain of its affiliates and institutional partners made an offer to acquire the remaining 26.8% stake in Teekay Offshore Partners L.P. from Noster Capital, LLP and others for approximately US$120 million. (January)

- Brookfield Business Partners L.P. (NYSE:BBU) made an offer to acquire a 26% stake in IndoStar Capital Finance Limited for INR10.9 billion (approx. US$14 million). (January)

- TransAtlantic Petroleum Ltd. (AMEX:TAT) sold Petrogas Petrol Gaz ve Petrokemya Urunleri Insaat Sanayive Ticaret A.S. to Reform Ham Petrol Dogal Gaz Arama Uretim Sanayi ve Ticaret A.S. for US$1.5 million. (February)

- Athene Holding Ltd. (NYSE:ATH) completed a US$500 million issuance of 6.150% senior unsecured notes due 2030. (April)

- A consortium including N. Malone Mitchell III, CEO of TransAtlantic Petroleum, Longfellow Energy LP, Dalea Partners LP, Dalea Management LLC and others made an offer to acquire TransAtlantic Petroleum Ltd. (AMEX:TAT) for US$6.85 million. (April)

- IHS Markit Ltd. (NYSE:INFO) acquired Catena Technologies Pte Ltd. (May)

- Argo Group International Holdings, Ltd. (NYSE:ARGO) sold Trident Insurance Services, LLC to Paragon Insurance Holdings, LLC for US$43 million. (May)

- Borr Drilling Limited (NYSE:BORR) completed a US$30 million equity offering. (May)

- Essent Group Ltd. (NYSE:ESNT) completed a US$382.4 million offering of common shares. (May)

- Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) completed a US$400 million private placement of exchangeable senior notes due 2026. (May)

- Athene Holding Ltd. (NYSE:ATH) completed a US$600 million offering of depositary shares that were listed on the NYSE under the ticker symbol "ATHPrC." (June)

- Axalta Coating Systems Ltd. (NYSE:AXTA) completed a US$500 million offering of senior unsecured notes due June 2027. (June)

- The Bank of N.T. Butterfield & Son Limited (NYSE:NTB) completed a US$100 million offering of fixed to floating rate subordinated notes due 2030. (June)

- RenaissanceRe Holdings Ltd. (NYSE:RNR) completed a US$250 million offering of depositary shares. (June)

- RenaissanceRe Holdings Ltd. (NYSE:RNR) completed an offering of common shares and a concurrent private placement, for total aggregate proceeds of approximately US$1.12 billion. State Farm Mutual Automobile Insurance Company purchased 451,807 common shares from the Company in the concurrent private placement. (June)

- Credicorp Ltd. (NYSE:BAP) completed a US$500 million offering of 2.75% senior unsecured notes due 2025. (June)

- GasLog Ltd. (NYSE:GLOG) completed a private placement of common shares for gross proceeds of US$36 million. (June)

- Athene Holding Ltd. (NYSE:ATH) acquired an 11.1% stake in Jackson National Life Insurance Company. (June) Nasdaq

Nasdaq

- Helen of Troy Limited (NasdaqGS:HELE) completed its acquisition of Drybar Products LLC for approximately US$255 million. (January)

- Arch Capital Group Ltd. (NasdaqGS:ACGL) entered into an agreement to acquire a 29.5% stake in COFACE SA from Natixis S.A. for approximately €480 million (approx. US$544 million). (February)

- Axovant Gene Therapies Ltd. (NasdaqGS : AXGT) completed a US$65 million offering of common shares. Roivant Sciences Ltd, the company's major shareholder, purchased US$20 million of the shares. (February)

- Brookfield Property Partners L.P. (NasdaqGS:BPY) was part of a consortium with Simon Property Group and Authentic Brands Group that signed a stalking horse agreement to acquire all assets of Forever 21 Inc. for US$81.1 million. (February)

- International General Insurance Holdings Limited (NasdaqCM:IGIC) acquired Tiberius Acquisition Corporation in a reverse merger transaction worth US$120 million. The new entity, IGI Holdings, listed on Nasdaq. (March)

- GAN Limited (NasdaqCM:GAN) completed its initial public offering on 5 May 2020 for gross proceeds of US$54 million. The ordinary shares of GAN plc that previously traded on the AIM market in London were delisted as of 6 May 2020. (May)

- Sirius International Insurance Group, Ltd. (NasdaqGS:SG) participated with other investors in a US$100 million equity round of funding for Pie Carrier Holdings by private placement and in a US$45 million round of funding for Pie Insurance Holdings Inc. (May)

- Kiniksa Pharmaceuticals, Ltd. (NasdaqGS:KNSA) completed a US$43.8 million offering of its Class A common shares. (May)

- Kiniksa Pharmaceuticals, Ltd. (NasdaqGS:KNSA) completed a private placement of class A1 shares for gross proceeds of US$29.2 million. (May)

- Arch Capital Group Ltd. (Nasdaq: ACGL) completed an offering of US$1 billion aggregate principal amount of 3.635% senior notes due 2050. (June)

Bermuda re/insurers raise billions in new capital in H1 2020

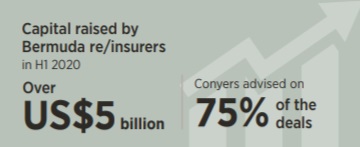

Bermuda insurers and reinsurers have raised billions through public offerings in the first half of 2020, as the sector prepares to face the claims impact of the pandemic and to take advantage of a pricing upswing.

While the full extent of insurance and reinsurance losses due to Covid-19 remains unclear, the industry is expected to be badly hit, particularly by business interruption claims. Lloyd's has projected global pandemic-related claims of up to US$107 billion. At the same time, volatile financial markets could put their investment portfolios at risk. On the positive side, reinsurance pricing has risen due to the crisis. Increased capital capacity will not only prepare insurers to meet claims, but will allow them to take advantage of the rise in prices by writing more business.

RenaissanceRe Holdings Ltd. (NYSE:RNR) and Arch Capital Group Ltd. (NASDAQ: ACGL) both completed US$1 billion offerings in June. Renaissance Re raised about US$1.12 billion in a sale of 6,325,000 new common shares that included US$75 million sold to US insurer State Farm. Arch Capital Group completed a US$1 billion offering of 30-year senior notes.

Athene Holding Ltd. (NYSE:ATH) also raised approximately US$1 billion via two offerings: US$500 million in investment grade notes in March and US$600 million in a fixed rate preferred stock IPO in June.

Essent Group Ltd. (NYSE:ESNT) raised US$382 million in an offering of 12,000,000 common shares in May.

Two Bermuda companies that are listed on the London Stock Exchange, with large operations in the Lloyd's of London market, have also raised hundreds of millions of dollars recently. Lancashire Holdings Limited (LSE:LRE) successfully completed the placing of 39,568,089 new common shares in June, raising gross proceeds of approximately US$340 million. Hiscox Ltd. (LSE:HSX) completed the placement of new ordinary shares in May, raising around US$461 million. Both said they were raising funds so that they could respond to future opportunities and rate improvements

Privately-owned Fidelis Insurance Holdings Limited completed an offering in June of US$300 million of senior notes due 2030, with a fixed-rate coupon of 4.875%. This followed announcements that the company had secured US$800 million in committed equity funding since February, primarily from existing investors. The notes issuance brings the aggregate capital raised by Fidelis in the last six months to over US$1 billion.

Conyers advised on all the US-listed company deals and the Fidelis deal.

Originally published 24 July, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.