When a founder wants to sell his or her company, there is often a discrepancy between the seller's price expectations and the buyer's willingness to pay. This article describes three mechanisms that use options, warrants and swaps to build a bridge between buyer and seller

1. Earn out – Use of options, warrants and swaps

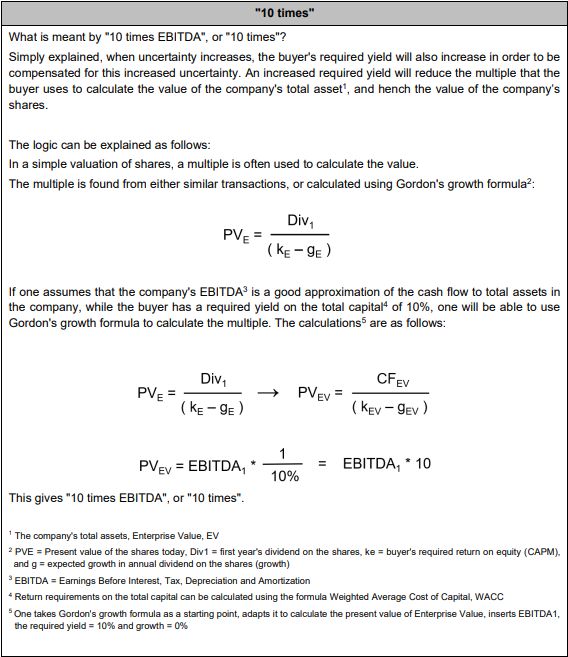

We are now experiencing a time of interest rate increases and sky-high inflation, and that fear prevails on the world's stock exchanges. This uncertainty also affects the transaction market, for example when a founder wants to sell his or her company. The founder has high price expectations based on historical multiples. At the same time, the buyer is probably not willing to pay the same as before, due to the increasing cost of capital (See explanation in the table). How can one then build a bridge between the seller's price expectations and the buyer's willingness to pay?

A mechanism that is often used to solve such a deadlock is a so-called earn out model. The core of this model is that the parties agree on a cash amount (base amount) that is paid for the shares upon completion of the agreement (closing), but where the seller can be paid an additional consideration (additional amount) after, for example, three years if certain financial key figures are met. In this way, the risk for the subsequent value development of the company has been distributed between buyer and seller.

The subject of this article are three alternatives to a classic earn out model, and that is seller credit, reinvestment and the use of intangible assets.

2. Seller credit

What is often the cause of a dead-lock when it comes to negotiations on the purchase price is that the buyer does not have the financial ability to pay more, for example where the buyer's bank has set a limit on what the buyer can borrow to finance the purchase of the company.

A solution in such cases could be for the seller to grant the buyer a seller's credit with deferred payment.

With such a seller's credit, there are no conditions that must be met for the seller to receive the additional amount, but often this seller's credit will be after (be subordinated to) the buyer's other acquisition financing and there is therefore a risk that the seller will not be paid if the business in the company is performing bad. In this way, a sellers' credit is similar to a classic earn out. If it is difficult for the seller to obtain security for the seller's credit in the form of a pledge or guarantee, a solution may be for the seller to take out credit insurance (Credit Default Swap) with an insurance company, thereby securing payment of the seller's credit. Another solution is for the seller to agree a call option with the buyer, so that the seller can take back shares corresponding to the unpaid seller credit. A third alternative is for the company to issue independent subscription rights (warrants) to the seller which the seller can use to subscribe for shares in the company, where the seller can use the claim linked to the seller's credit as a in-kind share deposit.

3. Reinvestment

Another alternative to a classic earn out is for the seller to reinvest part of the purchase price and become a co-owner in the buyer company. For the buyer, it may be important that the founder (and key employees) both own and work in the company after the purchase. Such reinvestment can take place by reinvesting between 5% - 25% of the purchase price at the sale either through a separate holding company or a jointly owned management holding company (pooling vehicle). In the same way as under a classic earn out, such a reinvestment will give the seller an incentive to make an extra effort after the sale.

What the seller must be aware of is which shares one becomes the owner of, and which rights and obligations come with the shares. Usually, the reinvestment is structured so that the seller becomes a co-owner in a pooling vehicle which in turn owns shares in one of the acquiring companies (TopCo). In a pooling vehicle, the buyer will often own one A share and decide everything, and the seller will own B shares with the possibility of future dividends / gains when certain financial conditions are met (waterfall). The disadvantage is that it can be difficult to get the money out of such a structure, as it is common for a shareholder agreement to determine how the price of the shares is to be calculated, and when and to whom the shares can be sold. The seller must therefore assess whether the value of shares in TopCo corresponds to the value of the cash the seller would otherwise receive under a classic earn out.

An alternative to a reinvestment is for the seller to keep some of the shares in the founding company, but where the buyer has a call option on the remaining shares. It can be agreed that this call option on the remaining shares can only be exercised when certain criteria are met. Such a call option can be combined with the buyer also having a put option where the buyer can sell the shares back to the seller at a specific price (strike price). This combination of options can provide incentives for the seller similar to a classic earn out.

4. Intangible assets

A third way to bridge the gap between the buyer's price expectations and the seller's willingness to pay is to enter into an agreement between the seller and the company on the use of intangible assets. This can be done by, for example, demerging a patent to be owned by the seller, where the demerged company receives license income from the company that has been sold to the buyer.

After the seller has received license income corresponding to the additional amount, the patent can be lifted out of the patent company and into the company using an option contract on the patent (real option) at a pre-agreed price (strike price).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.