This edition of the Bermuda Public Companies Update summarises significant transactions involving Bermuda companies on the New York Stock Exchange and Nasdaq in the second half of 2020.

Global market update

2020 was characterised by the Covid-19 pandemic and yet, despite its continuing impact, global capital markets surged to all-time highs in the second half of the year. Growth in the tech sector led the way to a record US$1.1 trillion of activity for the year, while the retail and consumer sectors suffered the biggest losses. Predictably, global debt markets were busy as well. During the first nine months of 2020, issuances passed a record US$8 trillion.

M&A activity came roaring back from the lows of March. There were US$496 billion in mega transactions (over US$5 billion) recorded in Q3 – double the value recorded in Q2 – according to Refinitiv. In fact, eight of the 10 biggest deals in terms of value were announced in the second half of the year, including S&P Global Inc.'s US$44 billion proposed acquisition of Bermuda company IHS Markit Ltd.

Bermuda companies update

The most significant event in a busy half year for Bermuda public companies was the announcement of IHS Markit Ltd.'s merger agreement with S&P Global Inc., which we discuss in more detail on page 2.

Other activity included a number of take-privates and share/notes offerings, as the impact of Covid-19 sent many companies to the markets to raise funds. Over US$16.5 billion was raised by Bermuda companies on the NYSE and Nasdaq in a variety of transactions. Sizeable equity and bond offerings included:

- Norwegian Cruise Line Holdings Limited offered US$250 million of ordinary shares in July with a follow-on equity offering worth US$832 million in November.

- Athene Holding Limited raised nearly US$493 million with a bond offering.

- Triton International Limited completed a US$409.5 secondary offering of common shares.

- Liberty Latin America completed a US$350 million offering of Class C common shares.

The total number of Bermuda companies listed on the major US exchanges dropped slightly, as a result of several take-privates, including:

- Central European Media Enterprises Ltd.'s US$2.1 billion take-private by way of merger with TV Bermuda Ltd.

- Hudson Limited's US$311 million take private by way of merger with Dufry Holdco Ltd. to become a wholly owned subsidiary of Dufry

- TransAtlantic Petroleum Limited's take private by way of merger with TAT Holdco LLC

Other M&A activity included the announced merger of Sirius International Insurance Group Limited (NasdaqGS:SG) with Third Point Reinsurance Limited (NYSE:TPRE). The transaction is expected to complete in Q1 2021, creating a Bermuda-based company called SiriusPoint Limited.

There was one Bermuda company IPO in the period – IBEX Limited, a provider of outsourced customer service products and services, raised US$90.48 million in its IPO on the Nasdaq Global Market in August, trading under the ticker IBEX.

IHS Markit Ltd. – A Bermuda Company Success Story

On 29 November, 2020 IHS Markit Ltd. (NYSE: INFO) and S&P Global Inc. (NYSE: SPGI) entered into an agreement to merge in an all-stock transaction which was the biggest M&A deal announced in 2020.

IHS Markit, which tracks financial market data, is the largest listed Bermuda company by some margin. Worth about US$39.5 billion, the group has 14,900 employees and generated almost US$4.3 billion in revenue for the 2020 financial year. Its story is one of impressive growth that demonstrates the benefits of Bermuda as an ideal jurisdiction from which to take a company public and then foster its development.

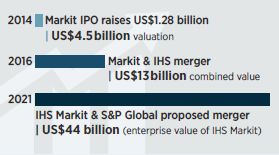

- Markit was founded in 2003 and a new top-level holding company was incorporated in Bermuda in 2014 in connection with its initial public offering on Nasdaq in June 2014. The IPO raised US$1.28 billion.

- In 2016, Markit merged with IHS Inc. to create IHS Markit in a deal with a combined equity value of US$13 billion.

- Over the next four years, the group continued to expand, acquiring Macroeconomic Advisers and automotiveMastermind in 2017, Ipreo and DeriveXperts in 2018 and Novation Analytics in 2019.

- On 30 November 2020, IHS Markit and S&P Global announced they had entered into a definitive merger agreement to combine in an all-stock transaction which values IHS Markit at an enterprise value of US$44 billion, including US$4.8 billion of net debt.

The proposed IHS Markit/ S&P Global merger was unanimously approved by the boards of directors of both companies and is expected to close some time this year, subject to shareholder approval of both companies and regulatory and anti-trust approvals.

Since 2014 Conyers has advised IHS Markit on the Bermuda law aspects of its IPO, secondary offerings, debt offerings, credit facilities, accelerated share repurchases, corporate governance and its mergers with IHS and now with S&P Global.

Highlighted Transactions

NYSE

- Argo Group International Holdings, Ltd. (NYSE:ARGO) completed a US$150 million offering of depositary shares. (July)

- Aspen Insurance Holdings Limited (NYSE:AHL) completed the sale of its surety operations to Amynta Agency Inc. for an undisclosed sum. (July)

- Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) completed a US$250 million offering of ordinary shares. (July)

- Brookfield Infrastructure Partners L.P. (NYSE:BIP) along with its co-issuers, Brookfield Infrastructure Corporation (NYSE: BIPC) and Brookfield Asset Management Inc. (NYSE: BAM), completed a US$205.83 million secondary offering of Class A exchangeable subordinate voting shares. (July)

- Third Point Reinsurance Ltd. (NYSE:TPRE) entered into a definitive agreement to acquire Sirius International Insurance Group, Ltd. (NasdaqGS:SG) for US$788 million. (August)

- Brookfield Infrastructure Partners L.P. (NYSE:BIP) completed a US$200 million issuance of inaugural "green" Class A preferred limited partnership units. (September)

- Borr Drilling Limited (NYSE:BORR) completed a US$27.5 million offering of depositary receipts. (September)

- Nordic American Tankers Limited (NYSE:NAT) entered into a market issuance sales agreement with B. Riley Securities, Inc. to sell US$60 million worth of common shares. (October)

- Brookfield Business Partners L.P. (NYSE:BBU) entered into an arrangement agreement to acquire the remaining 43.3% stake in Genworth MI Canada Inc. for CAD 1.6 billion (US$1.2 billion). (October)

- Triton International Limited (NYSE:TRTN) completed a US$409.54 million secondary offering of common shares. (October)

- Athene Holding Ltd. (NYSE:ATH) completed a US$492.68 million offering of 3.5% senior unsecured notes. (October)

- Frontline Ltd. (NYSE:FRO), Golden Ocean Group Limited (NasdaqGS:GOGL) and others sold SeaTeam Management Pte. Ltd. to OSM Maritime Group AS. (October)

- Borr Drilling Limited (NYSE:BORR) completed a US$5.3 million equity offering. (November)

- Athene Holding Ltd. (NYSE:ATH) entered into an agreement to acquire substantially all of the assets of Donlen Corporation for approximately US$880 million. (November)

- S&P Global Inc. entered into a definitive merger agreement to acquire IHS Markit Ltd. (NYSE:INFO). (November)

- Argo Group International Holdings, Ltd. (NYSE:ARGO) completed the sale of Ariel Re Bda Limited to J.C. Flowers & Co. and Pelican Ventures for US$30 million. (November)

- Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) completed a US$832 million equity offering. (November)

- Bunge Limited (NYSE:BG) sold its margarine and mayonnaise assets in Brazil to Seara Alimentos S.A. for BRL 700 million (approximately US$136 million). (November)

- Brookfield Business Partners L.P. (NYSE:BBU) and its institutional partners agreed to acquire a majority stake in Everise Holdings. (December)

- Argo Group International Holdings, Ltd. (NYSE:ARGO) agreed to sell its Italian operations to Perfuturo Capital AG, a subsidiary of Philantra Holding AG. (December)

Nasdaq

- Kiniksa Pharmaceuticals, Ltd. (NasdaqGS:KNSA) completed its offering of Class A common shares and concurrent private placement for a total of US$155 million. (July)

- Liberty Latin America Ltd. (NasdaqGS:LILA) announced an agreement to acquire Telefónica de Costa Rica TC, S.A. for US$500 million. (July)

- IBEX Limited (NasdaqGM:IBEX) raised US$90.48 million in an IPO and began tr ading on the Nasdaq Global Market. (August)

- Liberty Latin America Ltd. (NasdaqGS:LILA) completed a US$350 million offering of Class C common shares. (September)

- Pangaea Logistics Solutions, Ltd. (NasdaqCM:PANL) acquired an additional 33.3% equity stake in Nordic Bulk Holding Company Ltd. for US$22.5 million. (September)

- VEON Ltd. (NasdaqGS:VEON) agreed to acquire the remaining 15% stake in Pakistan Mobile Communications Ltd., bringing its ownership to 100%. (September)

- Marvell Technology Group Ltd. (NasdaqGS:MRVL) entered into a definitive agreement to acquire Inphi Corporation for US$8.8 billion. (October)

- Arch Capital Group Ltd. (NasdaqGS:ACGL), Warburg Pincus LLC and Kelso & Company, L.P. entered into a definitive agreement to acquire the remaining 87% stake in Watford Holdings Ltd. (NasdaqGS:WTRE) from Enstar Group Limited (NasdaqGS:ESGR) and others for approximately US$700 million. (November)

- Sumitovant Biopharma Ltd. entered into a definitive merger agreement to acquire the remaining 27.6% stake in Urovant Sciences Ltd. (NasdaqGS:UROV) for approximately US$210 million. (November)

- GAN Limited (NasdaqCM:GAN) entered into a share exchange agreement to acquire Vincent Group p.l.c. for approximately €150 million (US$176.7 million). (November)

- Auris Medical Holding Ltd. (NasdaqCM:EARS) completed a US$8 million equity offering. (December)

- GAN Limited (NasdaqCM:GAN) completed a US$96.7 million secondary offering of common shares. (December)

- Golar LNG Limited (NasdaqGS:GLNG) completed a US$96.25 million equity offering. (December)

- Brookfield Property Partners L.P. (NasdaqGS:BPY) and Simon Property Group, Inc. acquired all of the retail and operating assets of J. C. Penney Company, Inc. for US$1.2 billion. (December)

SPACs on the Rise

Special Purpose Acquisition Companies (SPACs) have risen to new heights in the past year as an alternative to traditional IPOs. More than US$80 billion worth of SPAC IPOs were recorded in 2020, up from US$13 billion in 2019. July saw a record-setting US$4 billion SPAC IPO by Pershing Square Capital Management's Bill Ackman.

Amidst all the market disruption caused by Covid-19, investors and businesses alike were drawn to the relative safety of these so called "blank-check companies," which offer significant amounts of ready capital, a clear timeframe and confidence in experienced management teams.

SPACs are unique in that they are incorporated with no underlying business. They raise capital through an IPO for a yet-unknown acquisition target. The capital is typically placed in trust and deployed once the target is identified, usually through a merger acquisition in the following one to three years. Given the inherent risk associated with investing in a company with no operations of its own, a number of investor protections are provided for in the structure.

Bermuda is the ideal place in which to domicile a SPAC. It offers tax neutrality, stability, and a regulatory regime that is based largely on English common law. Bermuda has both flexibility and agility when it comes to the establishment, structuring and operation of SPACs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.