If you are interested in entering the Guatemalan market, you will need to get to grips with financial regulatory compliance in Guatemala.

Failure to comply with financial regulations can result in legal issues or financial penalties that could adversely affect your business and diminish your company's standing in the eyes of local authorities.

Table of Contents

- Legal entity Compliance – Guatemala a growing prospect for investors

- Entity regulatory compliance in Guatemala key responsibilities

- Common Questions on Entity Legal Compliance in Guatemala

- Biz Latin Hub Can Assist You With Financial Regulatory Compliance in Guatemala

Financial regulatory compliance fits in with what is more broadly referred to as corporate compliance, which is often offered by a third party provider under the name of corporate secretarial services.

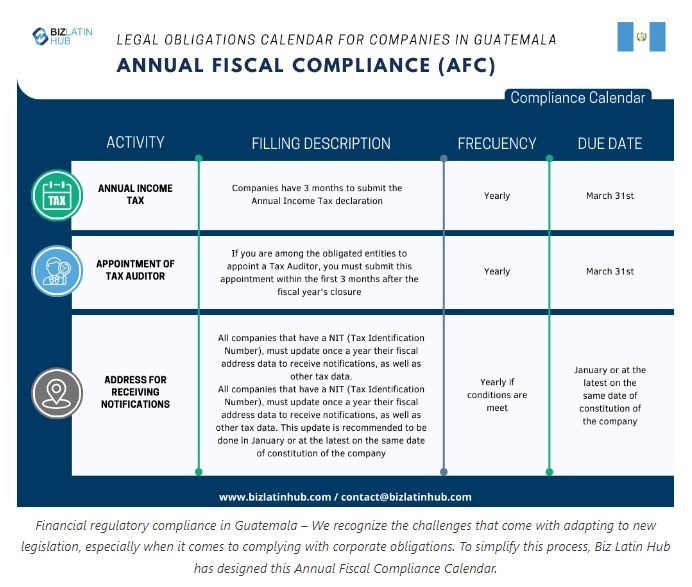

Financial regulatory compliance in Guatemala – We recognize the challenges that come with adapting to new legislation, especially when it comes to complying with corporate obligations. To simplify this process, Biz Latin Hub has designed this Annual Fiscal Compliance Calendar.

For anyone interested in starting a business in Guatemala, the following guide on financial regulatory compliance in Guatemala will be of interest.

Legal entity Compliance – Guatemala a growing prospect for investors

With Mexico and Belize on its northern border and El Salvador and Honduras to the south, Guatemala has a strategic location as the gateway between North and Central America.

Any goods traveling over land between Central and North America have to pass through the country, and with a landmass spanning the width of the Central American isthmus, Guatemala also has high-volume ports serving both the Pacific Ocean and the Caribbean Sea.

Guatemala is the largest economy in Central America, in terms of GDP. In 2019, GDP reached $76.71 billion (all figures in USD). The services sector is the largest contributor, accounting for approximately 63% of that figure.

Guatemala also has a sizable manufacturing sector, responsible for around 22% of GDP, and the country's agricultural sector contributes 10% — more than double that of neighbors Mexico and El Salvador, reflecting the ongoing importance of agriculture to the economy.

Major export products include bananas, coffee, and garments, and Guatemala also has significant hydrocarbon and mineral deposits. The country is also home to a number of sectors that are growing, including the tech sector, pharmaceuticals, medical devices, and electronic devices, which are expected to contribute significantly to post-pandemic economic recovery.

Guatemala has faced challenges with high levels of crime and insecurity, but there's some positive news! In recent years, the country has made significant progress in improving the situation. Impressively, the intentional homicide rate was cut in half between 2009 and 2019.

That radical improvement led to a concomitant rise in interest among investors, with foreign direct investment (FDI) almost doubling during the same period to reach $966.8 million in 2019.

It is in the context of this rapidly growing and evolving market that investors must navigate financial regulatory compliance in Guatemala.

Entity regulatory compliance in Guatemala: key responsibilities

While financial regulatory compliance in Guatemala can vary based on the type of company you have, the following aspects of corporate compliance are generally applicable to all.

Holding an annual general meeting (AGM) of

shareholders

The general assembly of shareholders is the highest corporate body

of any company and is attended by the shareholders registered in

the 'minutes book of the general shareholders,' or by their

representatives or agents. Its operation and powers are regulated

under corporate law in Guatemala, as well as the company's

bylaws. Under the terms of legal regulatory compliance in

Guatemala, an AGM must be staged at least once per financial year,

and for most companies, it must be held within four months of the

close of the financial year on December 31.

Filing and payment of value-added tax

(VAT)

VAT must be filed on a monthly basis, by both companies and

individuals. The current rate of VAT in Guatemala is 12% on the

value of most goods and services, and companies charging VAT must

report the total amount of VAT they have charged each month.

Withholding tax

Withholding tax must be paid on a monthly basis.

Additional salary bonuses

Many employees are eligible for two annual bonuses, each equal to

one full month of pay. The first one is due in July, while the

second must be distributed in two parts. The first half is paid out

in the first half of December, while the second half is paid in

January. However, many companies pay the second bonus in its

entirety in December.

Statutory contributions

As part of financial regulatory compliance in Guatemala, companies

are obliged to pay all health, pension, occupational risk, and

unemployment contributions to the relevant government agencies

within 20 days of the salary payment to which they correspond.

Transfer Pricing Studies (TPS).

In Guatemala, transfer pricing studies must be conducted in compliance with the country's tax regulations and international standards. The Guatemalan tax authorities require multinational companies with related-party transactions to follow the arm's length principle, which means that the prices charged in intercompany transactions should be consistent with what unrelated entities would charge each other for similar transactions.

Note that a company is not obliged to enroll in the national social security program if it has two or fewer employees, in which case this provision would not apply.

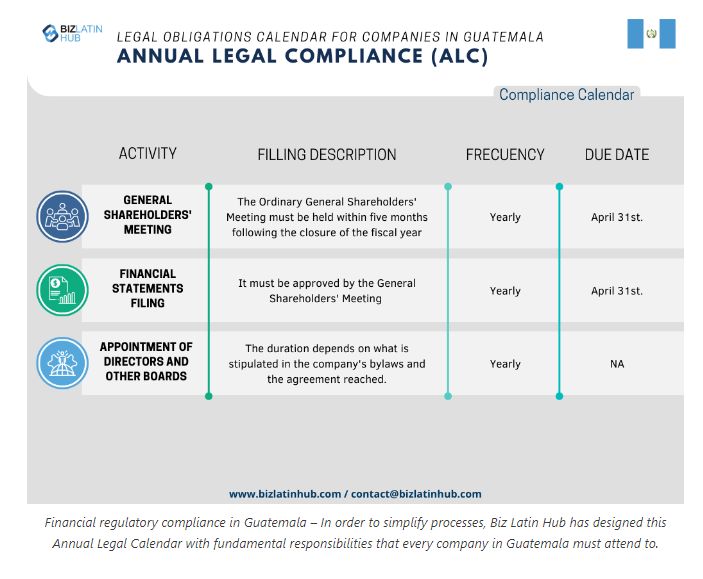

Financial regulatory compliance in Guatemala – In order to simplify processes, Biz Latin Hub has designed this Annual Legal Calendar with fundamental responsibilities that every company in Guatemala must attend to.

Common Questions on Entity Legal Compliance in Guatemala

Based on our extensive experience these are the common questions and doubts of our clients on entity legal compliance in Guatemala:

The following are the most common statutory appointments for

Guatemalan legal entities:

– An appointedLegal Representativewho will

be personally liable, both legally and financially, for the good

operation and standing of the company. This should be a local

national or a foreigner with a registered and active tax ID (NIT)

in the Superintendency of Tax Administration (SAT).

– ACertified Local Accountant

(CPA)registered with the authorities on behalf of the

company.

Yes, a registered office address or local fiscal address is required for all entities in Guatemala for the receipt of legal correspondence and governmental visits.

All companies that have a NIT (Tax Identification Number) must update once a year their fiscal address data to receive notifications, as well as other tax data. This update is recommended to be done in January or at the latest on the same date of constitution of the company.

If you are among the obligated entities to appoint a Tax Auditor, you must submit this appointment within the first 3 months after the fiscal year's closure. The deadline for this in Guatemala is March 31st.

The Ordinary General Shareholders Meeting must be held within five months following the closure of the fiscal year. The deadline for this in Guatemala is April 31st.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.