The disclosure of shareholdings in accordance with art. 120 et seqq. of the Financial Market Infrastructure Act (FMIA) and its implementing ordinances (in particular art. 10 et seqq. FMIO-FINMA) is a key element of Swiss capital market and stock exchange law. The market should receive a timely overview of any (changes in) holdings of the relevant investors (or groups thereof) (starting from 3% of the voting rights) in issuers of shares listed in Switzerland. The relevant information is published on the website of the SIX Exchange Regulation (SER) or Bern Stock Exchange (BX).

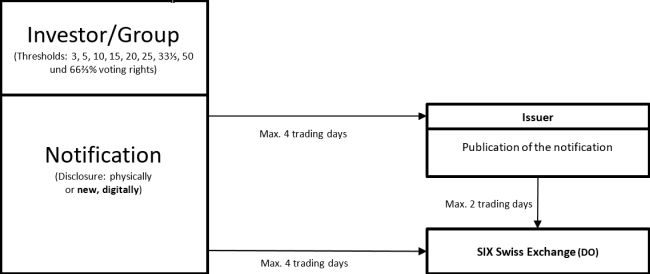

Various details of the required content of any individual or group reporting obligations, particularly in light of sometimes complex transaction structures, are not always clear and must be examined in detail on a case-by-case basis. The relatively short deadline of (generally) four trading days from the date on which the reporting obligation arises has in the past proven to pose a challenge. The investor must submit the notification to both the disclosure office (DO) of the stock exchange and the issuer in good time. The SIX Swiss Exchange (SIX) provides different reporting forms for this purpose depending on the reporting entity; the same applies to the BX. The issuer must publish the notification within two further trading days.

In practice, this often leads to omissions, delays or – sometimes even, although marginal – errors, which regularly result in corresponding investigations by the DO and the Swiss Financial Market Supervisory Authority FINMA and even the opening of administrative criminal proceedings before the Federal Department of Finance (FDF), which is responsible for such matters.

The requirement that the notifying party or an authorized representative physically sign the disclosure form has already been removed, albeit only at SIX, and SIX is now taking the next welcome steps towards digitalization, standardization and simplification. Until now, only the issuers themselves were able to digitally register and publish disclosure notifications (as well as management transactions) on the SIX issuer platform. From 4 March 2024, SER will now also provide investors with a fully digitalized way of fulfilling their reporting obligation: the new "OLSdigital" platform. This will make it possible not only for issuers but also for investors to digitally record disclosure notifications directly online and send them simultaneously to the relevant issuer and the DO of SIX. Physical disclosure forms will be no longer required at all. Investors will therefore be able to make use of either the physical or digital disclosure options. Art. 18 of the SER Directive on Electronic Reporting and Publication Platforms (DERP) will be amended accordingly. SER will also make an instruction manual on OLSdigital available. Issuers are well advised to deal with the possibility of migration to this digital reporting and publication process promptly because the previous reporting platform will be discontinued – for disclosures, but not (for the time being) for management transactions – with the introduction of OLSdigital.

Your VISCHER team will be happy to answer any questions you may have.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.