The Bank of Thailand currently administers and publishes two reference rates:

- the Thai Baht Interest Rate Fixing ("THBFIX"), which uses USD LIBOR as a component, and is more widely used as a reference rate for (a) derivatives, notes and loans, and (b) market-to-market valuations; and

- the Bangkok Interbank Offered Rate ("BIBOR"), which is a forward looking interest rate benchmark reflecting the Thai Baht local market that was introduced in 2005 but, due to a lack of underlying liquidity, is not often preferred.

The demise of LIBOR in 2021 will affect the THBFIX reference rate but not BIBOR, which will continue to be published by the Bank of Thailand.

In October 2019, the Bank of Thailand took the first steps to address the impact of the cessation of THBFIX and, together with the Thai Bankers Association and Association of International Banks, established the Steering Committee on Commercial Bank's Preparedness on LIBOR Discontinuation (the "LIBOR Committee"), which is charged with providing guidance to commercial banks on various issues relating to the cessation of THBFIX and setting the direction for the use alternative reference rates.

In April 2020, the LIBOR Committee and the Bank of Thailand announced that the country would discontinue the use of THBFIX and the adopt the Thai Overnight Repurchase Rate ("THOR") as the alternative benchmark rate. However, it was not until August 2020, that Thailand's largest commercial bank, Kasikornbank, and CIMB Bank Thailand issued the first inter-bank swap referencing THOR, and in October 2020, Siam Commercial Bank conducted the first swap with a Thai corporation.

To expedite the transition to THOR, on 17 November 2020, the Bank of Thailand and the LIBOR Committee issued Transition Milestones for financial institutions to move away from THBFIX. The proposed timetable recommends that:

- from 1 April 2021, all financial institutions be able to offer interbank derivative products referencing THOR, especially interest rate swaps and THOR/SOFR cross currency swaps;

- from 1 July 2021, all financial institutions stop offering new loans and debt securities that reference THBFIX; and

- all financial institutions complete all necessary processes and modifications to amend existing THBFIX or LIBOR loans to include fallback reference rates from 1 July 2021.

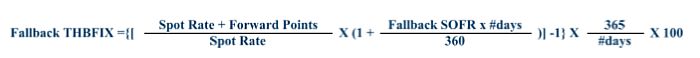

For legacy contracts, however, the Bank of Thailand intends to publish a modified version of THBFIX (referred to as "Fallback THBFIX") until end-2024, which will be calculated using SOFR plus a spread (referred to as "Fallback SOFR"). It will replace USD LIBOR in the original calculation formula for THBFIX, in line with the practice recommended by the International Swaps and Derivatives Association, and will be calculated as follows:

For new contracts, and unlike THBFIX, THOR will reflect the local Thai Baht currency and will not be based on the USD. Therefore, in the short term at least, the lack of market liquidity may affect the speed of adoption of THOR. Going forward the use of THOR, particularly in respect of cross border activities, will be depend on how readily counterparty country systems can accommodate the local Baht reference rates.

Originally Published by Mayer Brown, November 2020

Visit us at www.mayerbrown.com

Mayer Brown is a global legal services organization comprising legal practices that are separate entities (the Mayer Brown Practices). The Mayer Brown Practices are: Mayer Brown LLP, a limited liability partnership established in the United States; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales; Mayer Brown JSM, a Hong Kong partnership, and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein. Please also read the JSM legal publications Disclaimer.