"Change is the only constant" (Heraclitus):

Few areas of the global economy bear out this ancient wisdom like the retail sector in 2023. After two decades of digitization, capped by the seismic supply chain shocks of the pandemic, retailers have become veterans of disruption to the way they do business. Ongoing economic uncertainties and the accelerating pace of technological innovation and uptake mean there is every reason to expect the disruptions to continue across consumer product categories, from grocery to specialty goods.

For retailers worldwide, the key imperative is to engage consumers everywhere they want to shop, while delivering the higher levels of value and service they now demand. In China, additional disruptive factors make the race even hotter and more complex. Businesses are under intense competitive pressure to master the omnichannel model of selling, advanced by China's e-commerce giants and now progressing to a level of sophistication not seen elsewhere. The rewards for business transformation are great, but the hurdles are high. A data-driven, tech-assisted approach is helping the most agile businesses navigate changing times.

Disruptive demographics: China's "no-size-fits-all" consumer mix

Marketers know that no region's shopping population is a homogeneous whole, but monolithic notions of "the average consumer" are particularly inadequate in China. Rapid demographic changes are creating cohorts with sharply differentiated tastes and values. While the ageing population is much discussed as a societal phenomenon, the retail sector is only beginning to grapple with the implications for sales and marketing strategy.

The over-60s are China's fastest growing generational group, and the wave of baby boomers retiring in the 2020s is creating a silver economy that retailers ignore at their peril. These "New Seniors" are digitally enabled, but less novelty-hungry than their children and grandchildren. At the same time, brands used to courting the youth market need to continue to do so: Gen Z (born 1996-2010) has been dubbed "the moonlight clan", in reference to its tendency to spend its monthly salary in a single lunar cycle. That kind of spending power cannot be ignored, and China's first generation of digital natives expects constant novelty and inspirational brand engagement.

Weighing "edgy" brand identity against customer lifetime value, and continuing to appeal to shoppers as they age, is a necessary calculus for retailers striving to gain market share. Fashion finds itself in a particular dilemma: women in their 60s and 70s have more disposable income than ever before, but collections still cater to youth. Algorithms determining homepage content priorities contribute to the problem: an older visitor who is shown a brand's most sensational designs may be deterred before they reach items intended to appeal to them.

A demographic problem may have an algorithmic solution: smarter segmentation. One example is Jingdong's JD.com app has a dedicated interface for seniors, serving up relevant product categories. The first marketing priority for brands must be to build a granular picture of their target audience. Technology is a key enabler, with the ability to customize content, but retailers also need to align their other channels as well.

Disruptive digitization and the Omnichannel shift

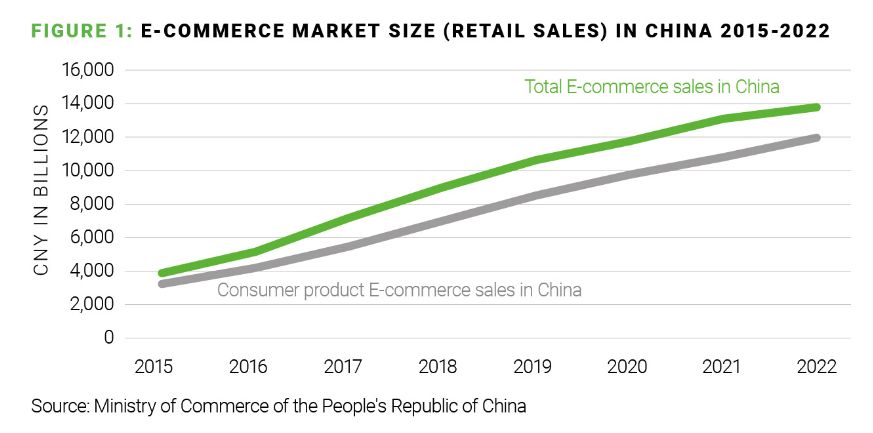

While demographic complexity is driving the "what, and to whom" of retail strategy towards greater segmentation, the "how" is now defined by the opposite goal: seamless integration. For the past decade, China's leading e-commerce platforms have led the retail sector in a race to sell to everyone, everywhere, all at once. The high penetration rate of smartphones and uptake of mobile payment systems have seen e-commerce sales grow rapidly year on year, further accelerating during the pandemic. The rise of social commerce has contributed to an explosion in the number of customer "touchpoints", and retailers need an end-to-end digital strategy that extends from self-owned platforms to WeChat to Douyin (TikTok).

And the omnichannel battleground is much bigger than digital dominance. Alibaba defined the new rules of consumer engagement with its "New Retail" unveiling in 2016, and rival Jingdong (JD.com) countered with "Unbounded Retail" two years later. In simplest terms, China's largest e-commerce platforms planned to leverage their logistics prowess to expand online-to-offline (O2O), with brick-and-mortar stores. But their vision now extends beyond a footprint in physical retail, to complete ecosystems that encompass all related business functions, from sellers to manufacturers. JD.com once billed itself as "China's leading technology-driven e-commerce company"; tellingly, the description was updated in 2021 to: "a leading supply chain-based technology and service provider."

Entering an omnichannel landscape dominated by tech-backed players is daunting for many traditional retailers. AlixPartners' annual Disruption Index (ADI) canvasses business leaders on the levels of upheaval their companies are facing; in 2023, 86% of retail executives reported that their business model needed to change within the next year - thirteen points higher than the average across other industries. Strategic prioritization is essential for firms without the benefit of an e-commerce giant's economies of scale.

Physical retail has proven to be a powerful catalyst for online sales, with the leading e-tailers concentrating their O2O efforts in the grocery market. Alibaba's Freshippo/Hema Xiansheng brand opened its first store in Shanghai in 2016, has since grown to 350 outlets nationwide, and aims to operate in 200 Chinese cities of one million-plus inhabitants by 2030. For Freshippo and its JD.com counterpart, SEVEN FRESH, the mission is more sophisticated than simple O2O conversion, or prompting online customers to buy offline. The in-store experience is a journey of ultra-convenience, discovery and engagement.

Freshippo's stated target customer is aged 25-35: young adults with their grocery-buying lives ahead of them, and an appetite for new products and shopping modalities. Digital advances many customers are now accustomed to - scanning QR codes in the aisles for product information, or paying via Alibaba's Alipay app - are ceding the spotlight to new-tech flourishes. An augmented reality app feature leads Freshippo customers on gamified adventures through the store to discover new product lines, while cross-promoting the latest studio blockbuster.

Physical outlets not only help to engage online customers - they make it cheaper to serve them. The operational advantages are simple: offline stores double as fulfilment centres. Freshippo's flagship service is 30-minute delivery within a 3km radius, enabled by store staff who are part-time stock pickers, and the cost efficiencies created by integrating online and offline warehousing and distribution under one roof.

Competing in an Omnichannel 2.0 world

The omnichannel transition is still a work in progress for many businesses. Building out front-end digital capacity has been the squeaky wheel, demanding attention in order to engage and retain customers. Online channels, self-owned platforms, omnichannel loyalty schemes and digital marketing are now the norm, and a second phase of omnichannel transformation is in progress. For businesses transitioning from legacy systems, the secret to competitive advantage lies in tackling integration issues, increasing back-end operational efficiency and smart use of big data to improve decision-making. There are major gains to be made in the following areas:

Diving into the data lake:Data analytics have never been more sophisticated or more critical. The proliferation of customer touchpoints gives retailers access to unprecedented real-time consumption data: it's now possible to map the customer journey from online browsing to physical pathway through a store, to purchase online or off. The retailer that understands consumer behaviour can refine online/offline store experience and layout, predict demand, streamline inventory, and determine pricing, promotions, and new product development.

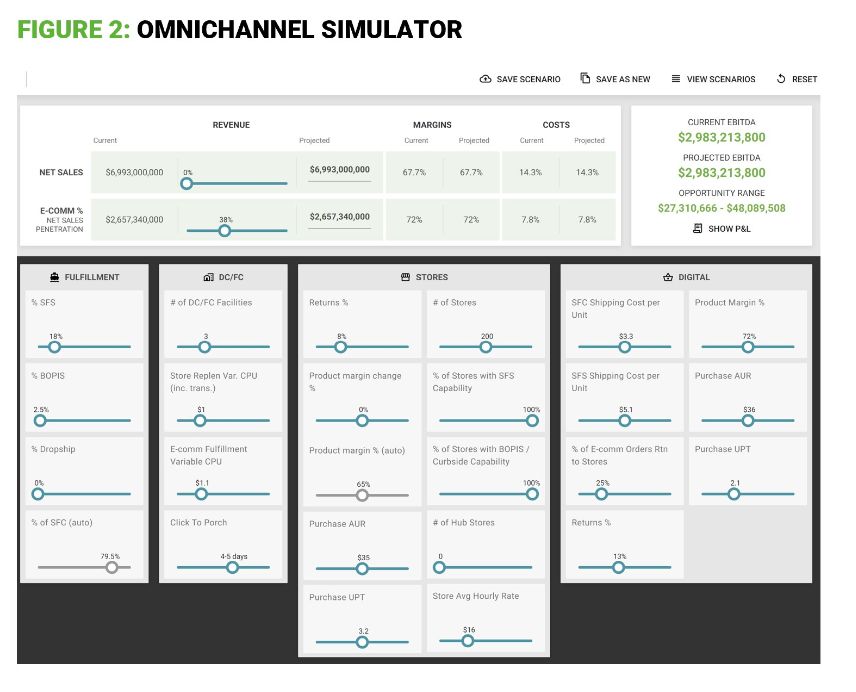

Understanding the value of omnichannel capabilities:AlixPartners' Omnichannel Simulator helps clients project what specific channels would mean for their bottom line. Every business's priorities are unique, and the best online-to-offline pathway might be more like a revolving door: for example, luxury brands, whose physical business in China has stayed notably resilient, are now exploring new digital channels in line with consumer expectations of a shopping journey that begins, and sometimes ends, online. Physical boutiques are reimagined as immersive experiences or innovation labs which build customers' emotional connection with the brand. The old model of closely-guarded online sales is loosening, with leading brands opening up to third- party platforms. Bulgari, Givenchy, Louis Vuitton and Berluti have all formed partnerships with JD.com. Nevertheless, luxury's new O2O agility may not be indicative of a sector-wide shift. The 2023 ADI survey found that 84% of offline retailers do not understand the true economic value of an online store. In-depth bespoke analysis is needed to understand omnichannel's potential.

Transparency from farm to shelf:E-commerce firms have led the way in deploying blockchain technology as a customer engagement tool. QR codes on some fresh produce do not simply link to a product page in the app, but provide details about grower, origins and transport: complete information to interest and reassure increasingly quality-conscious shoppers.

Thriving amidst retail new normal

Facing transformative opportunities and stiff competition, it is unsurprising that retailers report both optimism and anxiety. In a recent AlixPartners Consumer Products Survey, two thirds of executives said they were confident that their business transformation plans would be executed properly - but 71% of interviewees for the 2023 Disruption Index admitted to concerns that their business models were not adapting fast enough.

With Chinese consumers showing not just a growing appetite for consumption, but a differentiated one, the first priority for any retailer considering its omnichannel future must be to evaluate its current omnichannel effectiveness. The second is to identify strategic capabilities, investing in areas that offer major gains. The third is to apply an equally strategic approach to application of emerging technologies. The Consumer Products Survey found that 60% of firms plan to prioritize investment in Artificial Intelligence and the Internet of Things. The best choices for ROI may not be those next-gen technologies that attract most media attention and hype.

The rewards are clear: Omnichannel customers spend an average 30% more annually than single-channel consumers. To thrive in retail's turbulent new normal, the most resilient businesses will drive changes that are right for them, rather than allow themselves to be buffeted by disruptions - which are here to stay.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.