What is Common Reporting Standard?

Common Reporting Standard (CRS) is a global reporting standard developed by the Organisation for Economic Co-operation and Development (OECD) to facilitate the automatic exchange of financial information for tax purposes between countries that have adopted the standard (Participating Jurisdictions1). To date over 90 jurisdictions have committed to the regime, 60 of which, including the Cayman Islands, have formally adopted the CRS by signing the Multilateral Competent Authority Agreement.

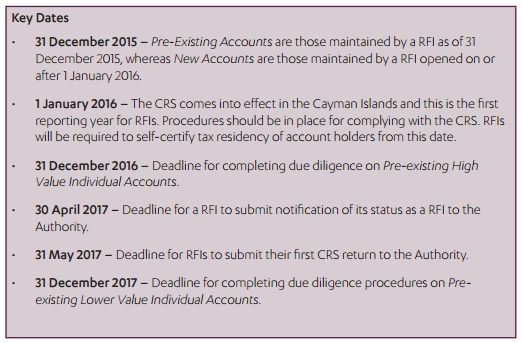

On 16 October 2015, the Cayman Islands introduced The Tax Information Authority (International Tax Compliance) (Common Reporting Standard) Regulations, 2015 (the Regulations) to implement the CRS.

Who will be affected by CRS?

The reporting obligations under the CRS apply to all Reporting Financial Institutions (RFIs). Such obligations are very similar to the existing requirements under the US Foreign Account Tax Compliance Act (US FATCA) and under the 2010 arrangement between the United Kingdom and Northern Ireland and the Cayman Islands for the avoidance of double taxation and the prevention of fiscal evasion (UK FATCA).

CRS will not apply to Non-Reporting Financial Institutions, including but not limited to governmental entities, international organisations or central banks (except where such entities are involved in certain commercial activities); pension funds for governmental entities; qualified credit card issuers; exempt collective investment vehicles; or trusts whose trustee is a RFI.

What is a RFI?

A RFI is defined as a Financial Institution that is not excluded as a Non-Reporting Financial Institution. A Financial Institution is defined in the Regulations as a Custodial Institution, a Depository Institution, an Investment Entity, or a Specified Insurance Company, as is the case under FATCA.

An Investment Entity is defined in the Regulations as any entity that primarily engages in activities or operations including but not limited to trading in money market instruments, transferable securities, individual and collective portfolio management, investing, administering, or managing financial assets or money on behalf of other persons. We expect that the majority of Cayman Islands investment funds will be classified as the Investment Entities for purposes of the CRS.

What are a RFI's obligations under the CRS?

RFIs will have to conduct due diligence, as prescribed in the Regulations, on their customers primarily for the purpose of identifying individuals or entities (Reportable Persons) with assets and income in another Participating Jurisdiction, so that the information can be reported to the tax authorities in those other Participating Jurisdictions.

The RFIs will report to the Cayman Islands Tax Information Authority (the Authority) annually on the information obtained during the due diligence process.

What information does a RFI need to report?

Each RFI will have to report the following information in respect of each Reportable Account:

- the name, address, the jurisdiction(s) of residence, tax information number(s) (TIN) and date and place of birth (in the case of an individual) of each Reportable Person that is an account holder(s) of the account;

- the account number (or functional equivalent in the absence of an account number);

- the name and identifying number (if any) of the RFI; and

- the account balance or value as of the end of the relevant calendar year or other appropriate reporting period.

RFIs will have to retain for six years records of any information obtained and reported on for the purposes of complying with the Regulations.

How does a RFI comply with its obligations under CRS?

RFIs will have to establish policies and maintain procedures designed to identify Reportable Accounts. Those policies and procedures must:

- identify each jurisdiction in which an account holder (or a controlling person) is resident for income tax or corporation tax purposes;

- apply the due diligence procedures as set out in the CRS; and

- ensure that any information obtained in accordance with the Regulations or a record of the steps taken in respect of a financial account is kept for six years.

RFIs must also notify the Authority of their status as a RFI under the Regulations. This notification must include the following information:

- the name of the RFI;

- the classification category of the RFI; and

- the full name, address, designation and contact details of the individual authorised by the RFI to be the RFI's principal point of contact for the purposes of complying with the Regulations and the CRS.

Notifications must be submitted to the Authority electronically and any change in the information submitted by a RFI must be notified to the Authority immediately.

A RFI must submit annually (by way of return) the information prescribed under the CRS for each reporting year, beginning with its first reporting year. The annual return must be filed electronically in the form and manner to be specified by the Authority. A RFI that fails to comply with the Authority's filing requirements will be treated as not having complied with the requirements under the Regulations. It is expected that penalties will be introduced for non-compliance with the Regulations.

Further Guidance

The OECD has issued extensive guidance on the CRS, including Commentaries on the CRS and an Implementation Handbook2.

Further parts of the Regulations, specifically addressing compliance and self-certification forms, are expected to be issued in December 2015. It is also anticipated that the Authority will issue guidance on complying with the CRS.

Footnote

1.http://www.oecd.org/tax/automatic-exchange/ ; http://www.oecd.org/tax/exchange-of-tax-information/implementation-handbook-standard-for-automatic-exchange-of-financial-account-information-in-tax-matters.htm ; http://www.oecd.org/ctp/exchange-of-tax-information/standard-for-automatic-exchange-of-financial-information-in-tax-matters.htm ; http://www.oecd.org/tax/automatic-exchange/common-reporting-standard/common-reporting-standard-and-related-commentaries/#d.en.345314

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.