Finance parties in a transaction frequently use structured vehicles using a borrower orphan as an instrument to secure their position. This is due to the nature of an orphan trust and the independence of its directors which provides an extra degree of comfort when making decisions on enforcing their transaction security. In this article, we discuss the dynamic of orphan structures and how new developments in the industry, in particular the development of the Global Aircraft Trading System ("GATS"), may further enhance the security offered by orphan structures

Orphans and Special Purpose Companies

It is industry practice for each new aircraft finance transaction to incorporate a new company (or special purpose company, or SPC) to hold title to a financed aircraft. There are variations on this theme including multiple aircraft being held in one SPC, or multiple SPCs holding one or more aircraft each, but each SPC solely holding only aircraft and related assets, such as the downstream leases, which are financed and secured in connection with the specific transaction. The use of an SPC provides credit enhancement in a number of ways, but in particular, as the SPC can only incur obligations and liabilities to the finance parties, the risk of third-party creditors unconnected to the finance transaction petitioning the SPC for insolvency and having any recourse to the assets of the SPC are remote.

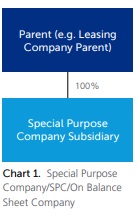

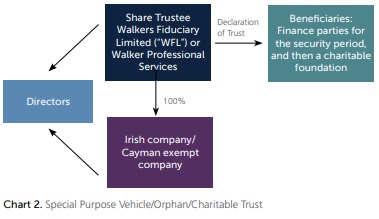

SPCs are usually wholly-owned subsidiaries of a larger group, such as an aircraft leasing company (and may be referred to as on-balance sheet SPCs or simply SPCs hereinafter), or may instead be set up as orphans. The use of the term "orphan" has been coined to differentiate the ownership structure to that of an SPC. The issued shares in an orphan are held by a professional services company which acts as share trustee. Shortly following incorporation of the orphan, the share trustee will unilaterally declare a trust over the orphan's nominal issued share capital for general charitable purposes. In most transactions, the shares will be held under a discretionary trust for the benefit of "obligees" of the orphan, or specifically the finance parties, until the secured obligations under the financing are discharged. As this trust is discretionary, the share trustee is not obliged to exercise its trust powers for the benefit of the finance parties as beneficiaries and the finance parties cannot issue directions to the share trustee and do not have direct control of the orphan as beneficiaries of the trust. However, the finance parties are able to request the share trustee to exercise its rights in a particular manner as shareholder of the orphan in an enforcement scenario. For example, the finance parties could request the share trustee to pass a shareholder resolution to direct the orphan to take action to repossess an aircraft. On the face of it, this may provide limited comfort to the finance parties due to its discretionary nature, but given the fiduciary duties of the nominated directors of the orphan, combined with the powers of a discretionary trust, in practice, financiers are well protected.

The directors of an orphan are independent professional directors who are often employees of a professional services company and are often appointed by the share trustee. On occasion, some structures have different requirements, such as Asset-Backed Securitisations (ABS) where the directors will be a combination of independent directors and directors appointed by the servicer or E noteholders. This is a key difference between orphans and SPCs, where the directors may be employees of the parent leasing company, or professional services employees appointed under a service agreement entered into with the parent company. Orphan directors are subject to the same fiduciary duties as directors of any other company. In respect of an orphan incorporated in:

- The Cayman Islands, these duties are not codified in the Cayman Islands Companies Act. However, English case law is highly persuasive in the Cayman Islands and the courts have adopted English common law principles related to directors' duties. These duties include a duty to act in what the directors bona fide consider to be the best interests of the company; and

- Ireland, the Companies Act 2014 introduced the codification of the duties of directors which are to be interpreted and applied in the same way as common law rules or equitable principles around director's duties. The 2014 Act confirms the long-standing position at common law that directors stand in a fiduciary relationship to their company and accordingly owe duties to their company. One of the principal fiduciary duties owed by a director is to act in good faith in what the director believes to be in the interests of the company.

The security package taken by the finance parties in a transaction with an orphan is likely to be materially the same as that in a transaction structured with an SPC and will consist of security over the assets (principally a security assignment over the downstream lease and a mortgage over the aircraft) and security over the shares of the orphan/SPC granted by the share trustee or parent company (as applicable).

Sending an SOS

In a distressed transaction structured with an SPC, where the finance parties have taken the decision to enforce, they will consider what is the best course of action, whether to enforce the mortgage and security assignment for direct control of the assets, or whether to enforce the share security and obtain control of the assets indirectly by obtaining control of the SPC.

For orphan transactions, the covenant package in the finance documents often provides a number of levers for the finance parties to manage a default at the lessee level. Should this be insufficient, the next step for the finance parties would be to decide whether to enforce their security, including the share charge. A share charge given in respect of an orphan would normally contain a suite of efficient self-help remedies usually provided pursuant to the share security, including pre-signed director resignation letters and share transfer forms which the financed parties have authority to date in an enforcement, which can be used to fast track enforcement. However, with an orphan, the finance parties may not need to progress to the security enforcement stage in a distressed scenario where they otherwise would with an SPC. Indeed, it is uncommon for finance parties to enforce security in an orphan transaction. This is because the sole creditors of the orphan are the finance parties and any action desired by the finance parties to be taken by the orphan to maximise proceeds to apply to the debt would highly likely be aligned with the best interests of the orphan Practically, any request made by the finance parties to the orphan directors in a distressed scenario is considered in a board meeting of the orphan directors and, if considered to be in the best interests of the orphan, the orphan directors will independently resolve to take such action. This process would not only apply to direct requests made to the orphan directors by the finance parties, but also to the share trustee in the finance parties' capacity as beneficiaries of the discretionary trust (subject to the share trustee passing a resolution).

GATS and Orphans

GATS further enhances the standard security package in an aircraft finance transaction. As well as the asset security (the security assignment and mortgage) and the share security, the interposing of a GATS trust means that finance parties are provided with security over the SPC's or orphan's beneficial interest in the GATS trust property (typically the aircraft) and its rights under the GATS trust instrument with the GATS trustee, as trustee. In a GATS transaction using an orphan, there are two trust arrangements, the first between the GATS trustee and the orphan, as well as the trust declared by the share trustee for charitable purposes over the orphan's shares. GATS has been developed primarily to maximise efficiencies in the trading and financing of aircraft. With the notable exception of aircraft ABS, orphans are most commonly used in finance lease transactions, whereby the sale of the aircraft occurs at the end of the finance lease term or on early voluntary termination when title to the aircraft is transferred to the lessee, and there is unlikely to any be trading during the tenor of the finance lease. The use of a GATS trust in a finance lease transaction, however, brings notable benefits to financiers. First, it provides an extra layer of security and therefore an additional enforcement option. Second, the GATS electronic platform imposes a technological block on any trading of the beneficial interest in the GATS trust until the security over the GATS trust has been released as further protection for financiers, Third, enforcement over the security in a GATS trust is arguably more efficient and straightforward than enforcement over share security or over security in a non-GATS trust as security can be enforced electronically through the GATS platform (to the extent such action is not prohibited by applicable laws, such as bankruptcy moratoria). Last, the risk of the GATS trust being infected with liabilities is lower than an SPC, because a trust is a collection of assets and (in most common-law jurisdictions) is not treated as a separate legal entity. As the use of GATS trusts becomes more commonplace, it is conceivable that in financings to operating lessors using finance lease structures (including those also using orphan trust structures), an additional GATS trust may be deployed as the lessee under the finance lease, such that title can drop into the lessee GATS trust (also acting as lessor under the operating lease with the airline) at the end of the tenor of the financing in order to facilitate onward trading of the aircraft.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.