1. INTRODUCTION

The Cayman Islands Companies Act (the "Act") imposes continuing obligations on all types of companies. Those companies which carry on business as trust companies, banks, company managers, insurance companies, insurance managers, mutual fund administrators and most mutual funds are subject to additional regulation governing those activities, details of which are available on request.

2. CORPORATE RECORDS

The Act prescribes certain documents and records that a company must maintain.

2.1. Register of Members

Every company must keep a Register of Members containing the names and addresses of the members of the company, the number and category of shares held by each member, the amount paid or agreed to be paid on the shares, whether each category of shares carries voting rights under the articles of association and, if so, whether such voting rights are conditional, the date on which each person became a member and the date on which each member ceases to be a member.

A company in default of complying with the requirement to maintain a Register of Members shall incur a penalty of CI$5,000 / US$6,098. Any director or manager of the company who knowingly and wilfully authorises or permits such default shall also incur a CI$5,000 / US$6,098 penalty.

An exempted company may, but is not required to, maintain one or more branch registers of such category or categories of members as the exempted company may determine. A branch register is deemed to be part of the exempted company's register of members and, as such, must be kept in the same manner in which a principal register is required to be kept. In addition, a copy of each branch register must be kept with the principal register.

An exempted company in default of the requirement to maintain a copy of the branch register or the requirement to make changes to the branch register will be liable to pay a CI$5,000 / US$6,098 penalty. Any director or manager of the company who knowingly and wilfully authorises or permits such default shall also incur the CI$5,000 / US$6,098 penalty.

A company must make available, at its registered office, the Register of Members and any branch register as may be required by service of an order or notice by the Tax Information Authority. A failure to comply with an order or notice of the Tax Information Authority without reasonable excuse will result in a penalty of CI$500 / US$610 and a further penalty of CI$100 / US$122 for every day during which the non-compliance continues.

2.2. Register of Directors and Officers

Every company must keep a Register of Directors and Officers containing the names and addresses of its directors, including alternate directors, and officers. A copy of the Register of Directors and Officers must be sent to the Registrar within sixty (60) days of the first appointment of any director or officer of the company.

Notification of any change to the Register of Directors and Officers must be sent to the Registrar within thirty (30) days of the change taking place.

A company in default of complying with the above requirements shall incur a penalty of CI$500 / US$610. In addition, if the Registrar is satisfied that a breach has been knowingly and wilfully authorized or permitted, a company shall incur a CI$1,000 / US$1,220 penalty and every director and officer shall incur a penalty of CI$1,000 / US$1,220 as well as a further penalty of CI$100 / US$122 for every day during which the default continues.

The Registrar will make available the names of the current directors and, if applicable, alternate directors for inspection by any person upon payment of a fee of CI$50/US$61.

2.3. Register or Mortgages and Charges

Every limited company must keep a Register of Mortgages and Charges at its registered office. The Register of Mortgages and Charges must include a short description of the property mortgaged or charged, the amount of the charge created and the names of the mortgagees or persons entitled to such charge.

Any director, manager or other office of the company who knowingly and wilfully authorizes or permits the omission of such entry, shall incur a penalty of CI$100 / US$122.

The Register of Mortgages and Charges must be open to inspection by any creditor or member of the company at all reasonable times. If such inspection is refused, any officer of the company refusing the same, and every director and manager of the company authorising or knowingly and wilfully permitting such refusal shall incur a penalty of CI$4 / US$5 for every day during which such refusal continues and a Judge sitting in chambers may compel an immediate inspection of the register.

A collection of the various documents and records, generally referred to as the "Minute Book", will normally contain, in addition to the registers noted above, the following items:

- Certificate of Incorporation;

- Memorandum and Articles of Association;

- Minutes of all directors' and members' meetings (including written resolutions, if any) and any documents tables and/or approved at these meetings;

- Annual Return;

- Copies of share certificates;

- Financial statements; and

- The tax undertaking (if ordered for an exempted company).

2.4. Beneficial Ownership Register

Certain companies, limited liability companies and limited liability partnerships are required to maintain beneficial ownership registers at their registered offices and for the information contained therein to be provided to the Cayman competent authority for beneficial ownership, the General Registry. Regulated insurance companies are exempted from the requirement to keep a beneficial ownership register by virtue of being licensed under the Insurance Act. However, a regulated insurance company must provide its corporate services provider ("CSP") with written confirmation of the exemption with prescribed information together with instructions to file the written confirmation with the competent authority. The insurance company is required to notify its CSP within one month of becoming aware of any changes to the written confirmation. Although insurance companies are exempted from the primary obligations of the beneficial ownership regime, penalties may still apply under the Monetary Authority (Administrative Fines) (Amendment) Regulations, 2020 (the "Fines Regulations") if an insurance company fails to provide such written confirmation and instructions, or if they incorrectly report that they are an exempted entity.

3. ECONOMIC SUBSTANCE

The International Tax Co-Operation (Economic Substance) Act (2021 Revision) (as amended) (the "ES Act") applies to a defined class of relevant entities including exempted companies and exempted partnerships, foreign companies and foreign partnerships registered in Cayman, limited liability companies, general partnerships (other than local partnerships) and limited liability partnerships that are required, subject to what is said below, to maintain economic substance in the Cayman Islands unless they are (i) tax resident outside the Cayman Islands; (ii) an investment fund (including entities through which any such fund invests or operates); or (iii) a not-for-profit company.

The ES Act requires that all Cayman Islands entities notify the Cayman Tax Information Authority ("TIA") of, amongst things, whether or not it is carrying on a "relevant activity" (as defined in the ES Act and as discussed further below) and, if so, whether or not it is a "relevant entity". The notification to the TIA is by way of an Annual Economic Substance Notification which must be filed prior to an entity filing its Annual Return with the General Registry's Corporate Administration Portal.

A relevant entity is subject to the ES Act from the date on which it commences a relevant activity unless the entity is partnership (exempted, general or foreign) that was in existence prior to 30 June 2021 in which case it was required to comply with the ES Act by 1 January 2022. Non-compliance with the ES Act will result in significant financial penalties and continued non-compliance may result in an application by the TIA to the Grand Court for an order that the entity is defunct.

3.1. Relevant Activities

Relevant entities will be required to meet the economic substance test in respect of their relevant activities in the Cayman Islands. The categories of relevant activities include the following which are further defined in the ES Act:

- Banking business;

- Distribution and service centre business;

- Financing and leasing business;

- Fund management business;

- Headquarters business;

- Holding company business;

- Insurance business;

- Intellectual property business; and

- Shipping business.

3.2. Economic Substance Requirements

For relevant entities carrying on relevant activities, the ES Act requires that they:

- conduct core income generating activities ("CIGAs") (see further below) in relation to the relevant activity;

- be directed and managed appropriately in the Cayman Islands related to the relevant activity; and

- with regard to the level of relevant income from the relevant

activity carried out in the Cayman Islands, have an adequate:

- amount of operating expenditure incurred in the Cayman Islands;

- physical presence (including maintaining a place of business or plant, property and equipment) in the Cayman Islands; and

- number of full-time employees or other personnel with appropriate qualifications in the Cayman Islands

Each relevant entity, whether or not carrying on a relevant activity will be required to file an annual notification with the TIA in respect of their status under the ES Act.

3.3. Core Income Generating Activities

CIGAs are defined in the ES Act to mean activities that are of central importance to a relevant entity in terms of generating income and that are being carried out in the Cayman Islands including, in relation to insurance business, (i) predicting or calculating risk or oversight of prediction or calculation of risk; (ii) insuring or re-insuring against risk; and (iii) preparing reports or returns, or both, to investors or the Cayman Islands Monetary Authority, or both. Reinsurance business is also in-scope for the ES Act. CIGAs may be outsourced provided that the relevant entity is able to monitor and control the carrying out of the CIGA. The TIA will only accept the relevant entity's claim to have satisfied the ES Test by means of domestic outsourcing if the information is verified by the service provider. Such verification must be made within thirty days of the relevant entity providing the same information to the TIA.

Service providers undertaking outsourcing functions are required to register with the Cayman Islands Department of Information Tax Co-operation ("DITC") so that the DITC can independently verify the engagement and nature of the services provided.

4. BOOKS OF ACCOUNT

All companies must keep proper books of account. They need not be kept at the Registered Office. The books of account must be such as are necessary to give a fair and true view of the state of the company's affairs and explain its transactions. Accounts need not be audited unless the company conducts a regulated activity (bank, trust company, insurance company, corporate manager, mutual fund administrator or regulated mutual fund).

5. NAME

The name of the company must be displayed outside the company's Registered Office and every other place of business maintained by it. An exempted company may have a dual foreign name in nonRoman script.

6. CHANGES IN DIRECTORS OR OFFICERS

The Articles of Association of a company will generally contain provisions relating to the removal, resignation and appointment of directors. Typically, members' resolutions are required to appoint or remove directors and officers. Copies of any such resolutions should be added to the Minute Book, the Register of Directors and Officers updated and a filing made with the Registrar.

7. SHARE TRANSACTIONS

New shares are usually issued by resolution of the directors. The Articles of Association typically contain restrictions on, and procedural requirements relating to, the issue of new shares. A copy of the minutes of the meeting at which the resolution is passed should be added to the Minute Book.

If existing shares are transferred, a share transfer form must be signed and a copy placed in the Minute Book. The old share certificates should be returned to the Registered Office for cancellation. Save in the case of a public company, the directors will normally be required to pass a resolution approving a share transfer and the issue of a new share certificate.

Companies with shares listed on appointed stock exchanges may provide, either in the Articles of Association or by special resolution of the members, for paperless transfers.

8. FILING REQUIREMENTS

On the occurrence of certain events a notice is required to be sent to the Registrar. There are statutory time constraints for such notifications to be filed. These are indicated in brackets below.

- Change in directors or officers (30 days);

- Increase in the authorised capital of the company (30 days);

- Change to the name of the company (15 days);

- Alteration of the Memorandum or Articles of Association (15 days);

- Change of location of the Registered Office (30 days); and

- Any special resolution passed by the members (15 days).

9. SEAL

A company may, but is not required to, have a common seal. If it has one it would usually be kept at its Registered Office. If there will be documents to be sealed outside Cayman the company's common seal may be sent overseas. The seal must bear the name of the company and may also contain the company's foreign dual or translated name.

10. COMPANY MEETINGS

Generally, meetings may be called by the board of directors or by requisition of a certain proportion of members. The Articles of Association will set out the procedure for the calling of general meetings.

Members may be represented at meetings by proxy. Forms of proxy should be delivered to (and will usually be organised by) the Registered Office of the company.

Notice of all meetings of members, directors or of any committee of the directors should be given to all those entitled to attend and vote at the meetings. The Articles of Association will set out the period of notice required.

An exempted company is not obliged to hold an annual general meeting.

11. ANNUAL REQUIREMENTS

An annual return must be submitted to the Cayman Government in January of every year together with the prescribed fee. A current listing of the annual government fees is available upon request.

12. INSURANCE ACT AND THE CAYMAN ISLANDS MONETARY AUTHORITY (CIMA)

The nature of the regulation under the Insurance Act is a combination of self-regulation, filings of statutory financial statements and certifications as to compliance with the applicable statutory requirements, together with review and investigation by CIMA in specified circumstances.

CIMA has wide powers to examine the affairs of insurance companies, with full access to business and other records of these companies and power to call on the insurance manager to provide any information or explanation.

12.1. Minimum Capital Requirements

In respect of a class A insurer that is an external insurer, "available capital" means total assets located in the Cayman Islands less total liabilities and any other applicable deductions relating to the Cayman Islands risks. The minimum capital requirement is the greater of one million dollars or policy liabilities. The "prescribed capital requirement" for an external class A insurer is 150% of the minimum capital requirement.

In respect of a class A insurer that is a local insurer, "available capital" means capital and surplus made up of issued share capital; additional paid in capital, including share premiums; retained earnings; investment reserves; currency translation reserves and other equity reserves. The available capital requirement must exceed the minimum capital requirement which is: the greater of KYD300,000 or the square root of the sum of the square of: (i) capital required for subsidiaries; (ii) capital for assets; (iii) margin for policy liabilities; (iv) margin for catastrophes; and (v) margin for foreign exchange risk. The "prescribed capital requirement" for a local class A insurer is 125% of the minimum capital requirement.

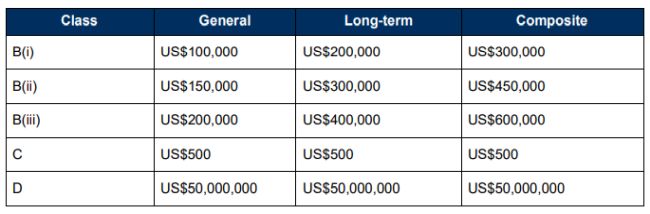

Minimum capital requirements for class B, C and D insurers means the minimum capital that an insurer must maintain in order to operate. The minimum capital requirements are as follows:

Prescribed capital requirements are the total risk based capital that a class B, C or D insurer must maintain in order to operate in a safe and sound manner.

The prescribed capital requirements for class B(i) and class C insurers are equal to the minimum capital requirements. In respect of class B(ii), B(iii) and D insurers, the prescribed capital requirements are a function of premiums and/or reserves. Specific guidelines and calculations relating to prescribed capital requirements are available upon request.

12.2. Enhanced Capital Requirements

Notwithstanding the minimum capital requirements, CIMA may set an enhanced prescribed capital requirement in respect of any insurer. CIMA may also, for class B, C and D insurers, exclude from the calculations assets that it deems inappropriate.

12.3. Capital Reporting Requirements

At the end of each quarter, every insurer must calculate and record the minimum capital requirement and prescribed capital requirement and, if required, the enhanced prescribed capital requirement.

The calculation for external class A insurers relates to the assets and liabilities arising out of the insurer's Cayman Islands' risk whereas the calculation for local class A insurers relates to worldwide assets and liabilities.

Any insurer which fails to meet the minimum capital requirement must notify CIMA within 30 business days of the end of each quarter where it fails to do so. CIMA may require such insurer to submit a remedial action plan or provide additional information or it may direct the insurer to take any action it deems appropriate.

12.4. Solvency Margins

Class B, C and D insurers are required to keep solvency equal to or in excess of the total prescribed capital requirement. Where the capital of an insurer falls below the prescribed capital requirement but is greater than the minimum capital requirement, such insurer must present a remedial action plan to CIMA. Where the capital of an insurer falls below the minimum capital requirement, CIMA may consider regulatory action.

12.5. Capital and Solvency Returns

Every class B, C and D insurer must keep a copy of its capital and solvency return at its principal office for a period of five years beginning with its filing date and must produce such copies to CIMA if directed to do so.

12.6. Financial Statements and Auditors

Every licensed insurer is required to prepare financial statements in accordance with generally accepted accounting principles. Auditors approved by CIMA must be appointed.

An insurer carrying on long term business must, in addition to preparing GAAP financial statements, prepare annually an actuarial valuation of its assets and liabilities, certified by an approved actuary, so as to enable CIMA to be satisfied as to its solvency. CIMA issued Rules and a Statement of Guidance in relation to Actuarial Valuations in December 2019. This Guidance sets out CIMA's minimum expectations and requirements on the preparation, structure, content and submission of actuarial valuation reports.

If an auditor suspects that an insurer is:

- unable or likely to become unable to meet its obligations as they fall due;

- carrying on or attempting to carry on business or winding up its business voluntarily in a manner that is prejudicial to its policyholders or creditors;

- carrying on or attempting to carry on business without keeping any or sufficient account records to allow its accounts to be properly audited;

- carrying on or attempting to carry on business in a fraudulent or criminal manner;

- carrying on or attempting to carry on business otherwise than in compliance with the laws of the Cayman Islands or a condition of its licence,

the auditor must immediately give CIMA written notice of such suspicion.

Class A and class D insurers must publish their audited financial statements no later than the date they are submitted to CIMA. Class B(iii) and class B(iv) insurers must make their audited financial statements available, on request, to insured persons, third party beneficiaries and any other persons that may be prescribed.

12.7. Principal Office

The Insurance Act requires every insurer to maintain full and proper business records at a designated principal office in the Cayman Islands.

In the case of an insurer which has not established its own staffed office in the Cayman Islands, it is usual for the insurance manager to provide the principal office and to maintain the business records. The Insurance Act allows the alternative of appointing an approved principal representative for this purpose but this is not a common practice since it is now obligatory to have an insurance manager (see below).

12.8. Insurance Manager

The Insurance Act requires that every class B or class C insurer which does not have its own staffed office in the Cayman Islands to appoint an insurance manager resident in the Cayman Islands. The insurance manager must maintain, at its place of business or at another location approved by CIMA, full and proper records of the business activities of the insurer sufficient to: (i) explain the transactions of the insurer; (ii) disclose with reasonable accuracy the state of affairs of the insurer; and (iii) enable the insurer to prepare annual financial statements.

Insurance managers must themselves meet the requirements of and be licensed under the Insurance Act, with the inherent responsibilities attendant thereunder.

12.9. Annual Licence Fee

All licensees under the Insurance Act are required to pay an annual licence fee to CIMA on or before 15 January of each year.

13. SEGREGATED PORTFOLIO AND PORTFOLIO INSURANCE COMPANIES

13.1. Segregated Portfolio Companies (SPCs)

The Insurance Act requires that every class B insurer that is established as an SPC maintain, in respect of each segregated portfolio, the prescribed margin of solvency and an actuarial valuation of its assets and liabilities certified by a CIMA approved actuary (unless this requirement is waived by CIMA) with each valuation to be prepared using the same financial year end.

Where a Portfolio Insurance Company's ("PIC") (see further at 13.2 below) controlling insurer is a class B(iii) or class B(iv) insurer, the PIC must make its audited financial statements available, on request, to insured persons, third party beneficiaries and any other persons that may be prescribed.

Every PIC is required to prepare financial statements in accordance with generally accepted accounting principles. A PIC that conducts long term business must, in addition to preparing GAAP financial statements, prepare annually an actuarial valuation of its assets and liabilities, certified by an approved actuary, so as to enable CIMA to be satisfied as to its solvency. The controlling insurer, each of its segregated portfolios and each portfolio insurance company it controls must all have the same financial year end.

A controlling insurer may only control one PIC on behalf of any relevant segregated portfolio.

The directors, managers and officers of a PIC may be, but need not be, the same persons as the directors, officers and managers of the PIC's controlling insurer or the same persons as the directors, officers and managers of another PIC which is controlled by the controlling insurer. A PIC must appoint the same insurance manager, however, as its controlling insurer. It must also have the same registered office as its controlling insurer.

Subject to the memorandum and articles of association of a PIC, or any restrictions or limitations imposed by CIMA, there are no restrictions or limitations upon a PIC entering into any contract, transaction or arrangement with any person including its controlling insurer acting on behalf of any of its segregated portfolios; its controlling insurer acting otherwise than on behalf of any of its segregated portfolios or any other portfolio insurance company. A PIC may not hold shares in its controlling insurer.

13.2. Portfolio Insurance Companies (PICs)

An exempted company that is controlled by an insurer other than a class A insurer, that is established as an SPC, may be registered as a PIC. If registered, a PIC may carry on insurance business without obtaining a licence.

Every PIC is required to have at least two directors, to carry on insurance business only in accordance with the information given in its business plan, unless otherwise approved by CIMA; to maintain prescribed margins of solvency and capital requirements; to maintain adequate arrangements for the management of risks and to maintain an effective system of government approved by CIMA.

14. ANTI-MONEY LAUNDERING AND PROCEEDS OF CRIME LEGISLATION

The Proceeds of Crime Act (2020 Revision), the Anti-Money Laundering Regulations (2020 Revision) and the Guidance Notes on the Prevention and Detection of Money Laundering in the Cayman Islands (together the "Anti-Money Laundering Legislation") constitute Cayman's anti-money laundering regime. The regulations have specific provisions which apply to relevant businesses including banks, trust companies and licensed insurers. In addition to creating offences relating to money laundering (or the giving of assistance in such activities), the Anti-Money Laundering Legislation confers expansive information gathering powers upon the authorities and there are also provisions empowering the Court to make client information, seizure and/or confiscation orders.

Regulated institutions have a duty of vigilance, meaning they must (i) verify their clients' identity and bona fides, (ii) monitor, recognise and report suspicious transactions, (iii) maintain certain records for the time period prescribed and (iv) train employees and staff so as to recognise possible unlawful activities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.