This article considers the range of vehicles available in the Cayman Islands for alternative investment fund ("AIF") structures designed for financial institutions, pension funds, sovereign wealth funds, family offices and (U)HNWs (as opposed to retail investors), as well as the legal and regulatory considerations that may influence the structure of an AIF. A summary of the key similarities and differences between the regulation of closed-ended and open-ended AIFs in the Cayman Islands is also considered.

Cayman Islands AIF Vehicles

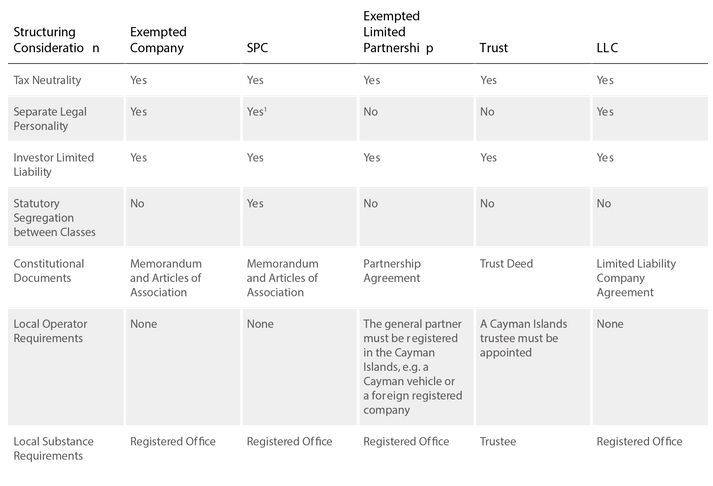

There are five types of vehicles that are commonly used in the Cayman Islands for AIF structures: exempted companies, segregated portfolio companies ("SPC"), exempted limited partnerships, trusts and limited liability companies ("LLC"). The appropriate vehicle, or combination of vehicles, for an AIF structure will be driven by a number of considerations, including the target investor base and strategy, as well as the ability to replicate the terms of investment across multiple vehicles in the structure (which may be domiciled in different jurisdictions). It will also be important to ensure that, as far as possible, the fund structure does not impose an additional layer of tax between the investor(s) and the target investment(s).

When it comes to choosing a Cayman Islands AIF vehicle, the principal considerations are set out in the table below:

Registration with CIMA and Regulatory Structuring Considerations

Once the appropriate form of AIF vehicle has been determined, the liquidity rights will define the appropriate path to registering the AIF, if required, with the Cayman Islands Monetary Authority ("CIMA"). Generally, closed-ended AIFs (i.e. those issuing non-redeemable equity interests or "Private Funds") are required to register with CIMA in accordance with the Private Funds Act, and open-ended AIFs (i.e. those issuing redeemable equity interests or "Mutual Funds") are required to register with CIMA in accordance with the Mutual Funds Act. However, there are some exceptions, which may also be relevant to the structuring of an AIF, as follows:

- Single Investor Vehicles. By definition, all Private Funds and Mutual Funds require pooling of investor capital. In addition, "investor" is defined in the law: under the Private Funds Act, the definition excludes the operators, the promoter and all proprietary investors; and, under the Mutual Funds Act, the definition of "investor" excludes the operators and the promoter.

- Non-fund (closed-ended) Arrangements. The Private Funds Act includes a substantial list of 'non-fund arrangements' which are excluded from the definition of "private funds" and therefore fall outside of the scope of the Private Funds Act altogether. This list includes: officer, manager or employee incentive, participation or compensation schemes; separately managed accounts; holding vehicles; joint venture vehicles; structured finance vehicles; preferred equity financing vehicles; sovereign wealth funds; and single family offices. The Mutual Funds Act does not contain an equivalent list.

Regulation of AIFs

While there are two distinct registration regimes, CIMA regulates Private Funds and Mutual Funds in materially the same way. In addition, the associated rules and regulation of AIF business in the Cayman Islands generally also treats Private Funds and Mutual Funds in a like manner. For example:

- There are no pre-approval requirements by CIMA and the

registration process is a straightforward online filing of the

prescribed details with CIMA for both Private Funds and Mutual

Funds. Provided the application is complete (and the relevant

CIMA registration fee is paid), the date of registration with CIMA

will be the date the application is made, and AIFs may carry on

business from such date.

- The CIMA registration fees are substantially the same for both

Private Funds and Mutual Funds.

- There are no statutory investment restrictions.

- There are no limits on the number of investors.

- CIMA generally requires two natural persons to (ultimately)

operate the governing body of the AIF according to its

'four-eyes' principle, e.g. on the board of directors or

the board of directors of the general partner, as the case may

be. However, there are otherwise no local requirements

regarding the composition of the board or other governing

body. Typically, non-Cayman Islands legal, tax and commercial

considerations will influence the constitution of the board.

- Both Private Funds and Mutual Funds are required to have their

accounts issued or undertaken by an auditor approved by CIMA, which

in practice will generally be the Cayman Islands branch of the

AIF's (onshore) auditor. Aside from the audit (and the

registered office), there is flexibility from a Cayman Islands

legal perspective regarding the appointment of service providers

required as a commercial matter.

- All Cayman Islands AIFs, including entities through which an

AIF directly or indirectly invests or operates (such as general

partner entities) are not subject to any substance requirements in

the Cayman Islands (save for the basic requirements set out in the

table above).

- The rules relating to anti-money laundering requirements, FATCA

and the Common Reporting Standard apply equally to both Private

Funds and Mutual Funds, as do the rules regarding data

protection.

- CIMA's 'conduct of business' rules that apply to Private Funds and Mutual Funds, e.g. regarding the calculation of NAV and disclosure are, for practical purposes, similar (and aligned with market practice).

There are, however, some differences between the regulation of Private Funds and Mutual Funds, which need to be borne in mind in the structuring and launch process. These are as follows:

- Disclosure. Unlike Mutual Funds, Private Funds

are not required to file an offering document with CIMA (a summary

of terms is sufficient). However, where a Mutual Fund is not

widely placed, there is scope for registering a Mutual Fund as a

"Limited Investor Fund", which removes

the requirement to file an offering document with CIMA. For a

Mutual Fund to register as a Limited Investor Fund with CIMA, the

AIF must be held by not more than 15 investors, the majority of

whom are capable of appointing or removing the operator, i.e. the

trustee, general partner, directors or managers (depending on the

structure of the relevant vehicle) of the AIF.

- Minimum Investment Threshold. There is no

minimum investment amount for a Private Fund or a Limited Investor

Fund. However, the minimum initial equity interest

purchasable by a prospective investor in a typical Mutual Fund is

US$100,000 or equivalent.

- Operator Registration with CIMA. Operators of

Mutual Funds (including Limited Investor Funds) that are companies,

i.e. directors of exempted companies and SPCs, and managers of

LLCs, must be appropriately registered with CIMA and in 'good

standing' in accordance with the Directors Registration and

Licensing Act. This requirement does not currently apply to

operators of Mutual Funds that are not companies or to operators of

Private Funds.

- Timing of Registration with CIMA. Both Private Funds and Mutual Funds (including Limited Investor Funds) are not permitted to carry on, or attempt to carry on, private or mutual fund business, respectively, unless an application has been submitted for registration with CIMA. A Mutual Fund must submit such application by the date it carries on, or attempts to carry on, mutual fund business, and a Private Fund must submit its application within 21 days of accepting capital commitments, and by the date capital contributions are received, from investors for the purposes of investments.

Conclusion

There are a range of vehicles available in the Cayman Islands that are able to accommodate most types of institutional, sophisticated and professional investors (depending on their specific requirements), strategies and broader structuring considerations. Once the appropriate form of AIF vehicle has been determined, the liquidity rights of the AIF will define the appropriate path to registering with CIMA either as a Private Fund (if the AIF is closed-ended) or as a Mutual Fund (if the AIF is open-ended). However, there are certain exceptions to the general rule that such AIFs are required to register with CIMA, which may be relevant to the structuring of the AIF.

In the event the AIF is required to register with CIMA, it is of note that the regulatory regimes in the Cayman Islands applicable to closed-ended and open-ended structures are now largely aligned. Some differences may, however, need to be borne in mind in the structuring and launch process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.