As part of its commitment to meeting international standards, the Cayman Islands has introduced a number of new legislative measures and regulatory changes in recent years. Cayman Islands entities will need to take certain actions and make certain annual filings by specified deadlines as year-end approaches to ensure they remain compliant with their regulatory obligations.

These filings include the annual economic substance notification and first return required under the International Tax Co-operation (Economic Substance) Law (2020 Revision) (as amended by relevant regulations, the "ESL") and the FATCA and CRS notifications and reports to be filed with the Department for International Tax Cooperation ("DITC") via the new DITC Portal. Further detail on these filing requirements, together with the applicable deadlines, are outlined below, along with a summary of the Cayman Islands Monetary Authority's ("CIMA") recently expanded powers to impose administrative fines for breaches of prescribed provisions of laws, regulations and rules issued by CIMA.

Economic Substance Notification

Cayman Islands entities (including Cayman Islands investment funds) with separate legal personality ("Eligible Entities") are required to file an annual economic substance notification ("ES Notification"). The filing of the ES Notification is a prerequisite to the filing of each Eligible Entity's annual return with the Registrar (due annually in January), and failure to make the filing may result in the entity ceasing to be in good standing and consequently, the imposition of penalties from 31 March 2021 onwards.

Eligible Entities in existence in 2019 will have already completed an ES Notification in respect of 2019 (a "Prior Notification"). However, on 13 July 2020, the DITC issued version 3.0 of the Guidance on Economic Substance for Geographically Mobile Activities (the "Guidance"), which included, for the first time, sector specific guidance with respect to each category of "relevant activity" that attracts economic substance requirements. As a result, Eligible Entities that have made a Prior Notification will need to consider whether the revised Guidance (and / or any change to the activities carried out by such Eligible Entity since the Prior Notification) may result in a change in their classification under the ESL. For Eligible Entities formed during 2020, it will be necessary to determine such Eligible Entity's classification under the ESL (having regard to the Guidance) in order to make the ES Notification.

Economic Substance Return

Each Eligible Entity that has indicated on its ES Notification that it is a relevant entity carrying on one of the categories of 'relevant activity' that attracts economic substance requirements under the ESL is required to report certain information on an annual basis to the DITC ("ES Return"). The first ES Return under the ESL is due no later than 12 months after the last day of a relevant entity's financial year commencing on or after January 2019.

The term 'relevant entity' does not include 'investment funds' under the ESL and as such, Cayman Islands investment funds are not required to submit an ES Return. However, Cayman Islands fund managers registered under the Securities Investment Business Law (2020 Revision) (a "Registered Person") and conducting 'fund management business' are required to submit an ES Return annually. Fund managers that registered as Registered Persons during the course of 2020 will only be required to file their first ES Return in respect of their 2020 financial year, which will become due in 2021. Other entities in fund structures, such as entities carrying on 'holding company business' may need to submit an ES Return in respect of their 2019 financial year.

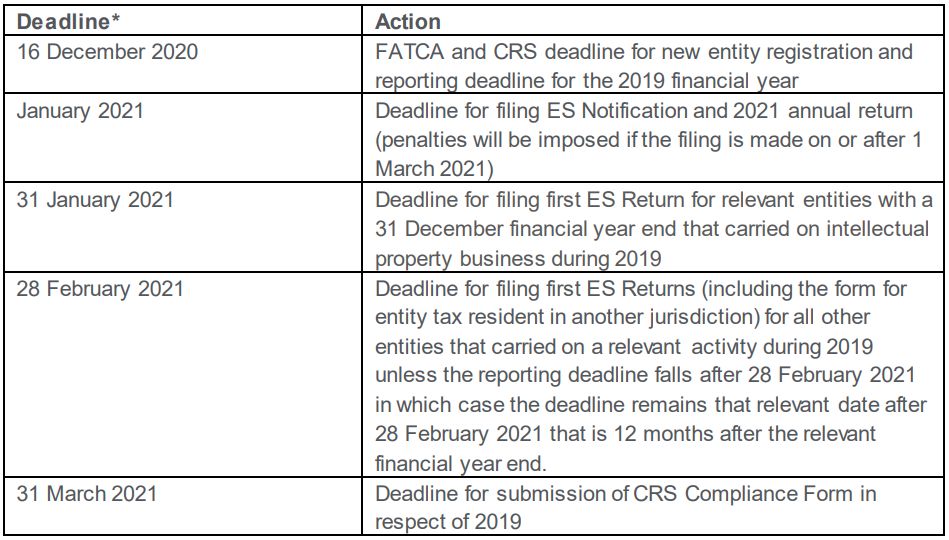

On 12 November 2020, the DITC issued an industry advisory confirming that functionality for economic substance reporting would be made available via the DITC Portal and issued sample ES Returns, including a separate sample ES Return for pure equity holding companies and a sample form for entities tax resident in another jurisdiction. The DITC has also extended the reporting deadlines for ES Returns (in respect of the 2019 reporting year only) as summarised in the table below.

FATCA and CRS Filings

The DITC Portal is now open for FATCA and CRS filings. Due to the delay in opening the DITC Portal, the DITC has further extended the FATCA and CRS reporting deadline for the 2019 financial year to 16 December 2020, meaning all investment funds must ensure their FATCA and CRS reporting is submitted via the DITC Portal by this date. The annual reporting deadline for both FATCA and CRS for future years will be 31 July (changed from 31 May).

The deadline for new entity registration has also been extended to 16 December 2020. This means that all newly launched investment funds that have not previously registered with the DITC must ensure they register via the DITC Portal before 16 December 2020.

The DITC has also introduced a new form (the "CRS Compliance Form") (which is in addition to the existing CRS reporting requirements) applicable to all reporting financial institutions ("RFIs") (including investment funds). The CRS Compliance Form seeks extensive information in respect of RFIs, including their regulatory status, financial account data, service providers and anti-money laundering processes and will need to be submitted annually via the DITC Portal by 15 September of each year. However, the first reporting deadline (in respect of the 2019 reporting period) has been extended to 31 March 2021.

On 6 November 2020, the DITC also issued updated CRS guidance notes, which contain important updates including the introduction of various new offences, including offences for the misclassification of an entity or knowingly or willfully supplying false or misleading information to the DITC.

Administrative Fines Regime

With year-end approaching and various regulatory and filing deadlines on the horizon (including the annual filings with CIMA), it is timely to remember that CIMA now has extended powers under the Monetary Authority (Administrative Fines) Regulations (as amended) (the "AFR") to impose administrative fines for breaches committed by entities or individuals of prescribed provisions of laws, regulations and certain rules issued by CIMA.

Breaches are categorised under the AFR as being 'minor', 'serious' or 'very serious' and there is a sliding scale of fines from a non-discretionary fixed fine of CI$5,000 for minor breaches and up to CI$100,000 for individuals and up to CI$1 million for entities for very serious breaches. As an example, failure of a regulated mutual fund to pay the prescribed annual fee for registration on or before 15 January of each year now constitutes a minor breach under the AFR (in additional to the usual penalties for late payment). In addition, failure to pay any penalties in respect of late payment of annual fees itself also constitutes a separate minor breach.

Given the potential to incur substantial fines, all operators of Cayman Islands regulated investment funds and their service providers should ensure that they are fully aware of and understand their regulatory obligations and maintain appropriate systems, procedures and controls to meet these requirements.

Summary of Key Dates

This article was first published in HFM Week in December 2020.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.