The International Tax Co-operation (Economic Substance) Law (the ES Law) was introduced in the Cayman Islands on 1 January 2019 in response to OECD's Base Erosion and Profit Shifting framework and related EU initiatives in relation to what are known as 'Geographically Mobile Activities'.

Overview

The ES Law is supplemented by the Guidance Notes issued by the Cayman Islands Tax Information Authority (the TIA) on Economic Substance for Geographically Mobile Activities (the ES Guidance).

Under the ES Law any relevant entity which carries on a relevant activity and receives relevant income in a financial period must satisfy the economic substance test in relation to that activity (ES Test) and make an annual filing with the TIA.

Aside from the basic filing requirements, a relevant entity which does not carry on any relevant activity is not required to satisfy the ES Test.

When is the ES Law applicable?

Relevant entities that existed before 1 January 2019 and that were carrying on relevant activities on that date must comply with the ES Test from 1 July 2019.

Relevant entities established after 1 January 2019 must comply with the requirements from the date on which they start carrying on the relevant activity. From January 2020, all entities registered or formed in the

Cayman Islands will be required to include a statement in the annual return that is filed by their registered office service provider with the Registrar as to whether or not they are carrying on a relevant activity.

What is a relevant entity?

Under the ES Law all Cayman Islands companies incorporated under the Companies Law or the Limited Liability Companies Law, all limited liability partnerships registered under the Limited Liability Partnerships Law, and all overseas companies which are registered in the Cayman Islands under the Companies Law are relevant entities except those entities which are:

- an investment fund;

- tax resident outside the Cayman Islands; or

- a domestic company.

Both 'investment fund' and 'domestic company' are clearly defined in the ES Law. The term 'investment fund' includes all funds registered with CIMA under the Mutual Funds Law, for example.

For tax residence, an entity must be subject to "corporate tax on all of its income from a relevant activity by virtue of its tax residence, domicile or any other criteria of a similar nature in that other jurisdiction" in order for the TIA to consider it as being tax resident outside the Cayman Islands. For any entity that is claiming tax residence outside of the Cayman Islands, satisfactory evidence of this will be required.

What is relevant income?

Relevant income is "all of an entity's gross income from its relevant activities and recorded in its books and records under applicable accounting standards". Any income that is not generated from relevant activities is not to be considered when determining adequate substance in the Cayman Islands.

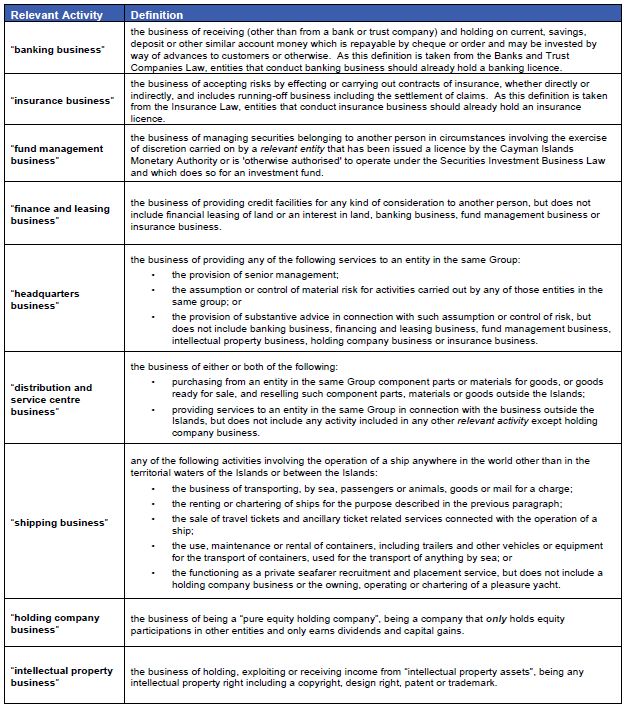

What is a relevant activity?

The ES Law specifies nine categories of relevant activity.

What is the ES Test?

There are three different ES Tests depending on the nature of the relevant activity.

The Holding Company Business Test

A relevant entity that carries on holding company business meets the ES Test if:

- it complies with its statutory obligations under the Companies Law; and

- it has adequate human resources and adequate premises in the Cayman Islands for holding and managing equity participations.

Where a relevant entity that is a pure equity holding company is passively holding equity participations in other entities it may engage its registered office provider to satisfy this reduced substance test in the Cayman Islands.

The General Test

An entity conducting a relevant activity (other than holding company business or high risk intellectual property business) meets the ES Test if the relevant entity:

- conducts Cayman Islands core income generating activities (CIGA) in relation to that relevant activity;

- is directed and managed in an appropriate manner in the Cayman Islands in relation to that relevant activity;

- having regard to the level of relevant income derived from the relevant activity carried out in the Cayman Islands, has an adequate amount of operating expenditure, physical presence and number of full-time employees or other personnel with appropriate qualifications, in the Cayman Islands.

Identifying the activities to address the above will be a matter of fact and will need to be assessed on a case by case basis for each relevant entity.

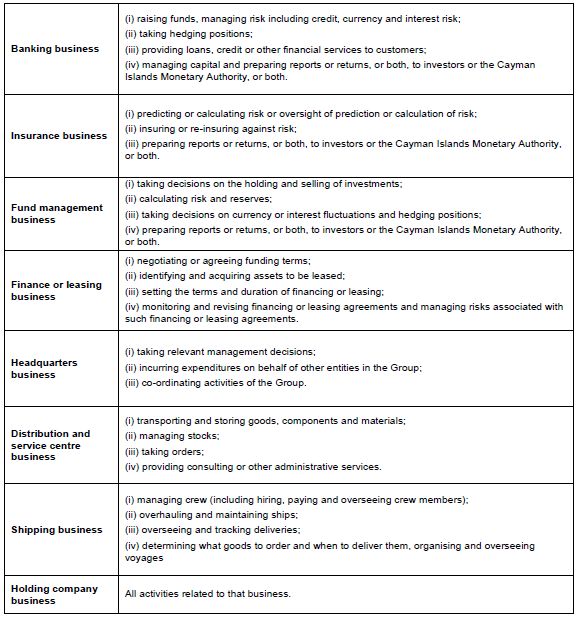

The ES Law sets out a non-exhaustive list of Cayman Islands CIGA for each relevant activity which are set out in the Schedule to this Guide.

Only the Cayman Islands CIGA of a relevant entity must be conducted in the Cayman Islands, its other activities may be conducted anywhere in the world.

In order for a relevant entity to be able to show that it is directed and managed in an appropriate manner, not all board meetings of a relevant activity must be held in the Cayman Islands but such meetings must be held at 'adequate' frequencies having regard to the nature of the relevant activity and the level of decision making required. For a meeting to be treated as being held in the Cayman Islands there must be a quorum of directors physically present in the Cayman Islands. Minutes of such meetings must be recorded and kept in the Cayman Islands.

In relation to determining what is adequate in terms of expenditure, premises or employees, the TIA makes it clear in the ES Guidance that they will employ a principles-based approach and specifically will want to ensure that those individuals who in fact do conduct the Cayman Islands CIGA for the relevant activity, do so in the Cayman Islands and not elsewhere and by extension that will dictate expenditure and premises. The ES Guidance sets out a number of factors that will be taken into consideration by the TIA in this regard.

Outsourcing

A relevant entity may outsource some or all of its Cayman Islands CIGA to an entity in the Cayman Islands provided that it has adequate supervision of the outsourced activities, they are performed in the Cayman Islands and the third party service provider has adequate resources to fulfil the outsourced activities. Outsourcing cannot be done to circumvent compliance with the ES Test.

The High Risk Intellectual Property Business Test

As income derived from intellectual property assets are considered to be at higher risk of profit shifting from higher to lower (or zero) tax jurisdictions, a more rigorous requirement applies to certain entities which carry on intellectual property business. Please contact us to discuss these requirements.

It can be noted that the TIA regards the term "intellectual property asset" as only including intellectual property assets that generate separately identifiable income for a business from any income generated from any tangible asset in which the right subsists. That is, the term does not apply to a business which owns intellectual property merely as an adjunct to its business.

What happens if an entity does not comply with the ES Law?

Enforcement action may be taken and financial penalties imposed for breaches of the ES Law. Broadly, a failure by any person (which potentially includes directors or partners) to provide information or the provision of inaccurate or misleading information to the TIA or a failure of an entity to comply with the ES Test, will constitute a breach of the ES Law. As well as potential fines, the ultimate consequence of failure to comply with the ES Law could result in the relevant entity being struck off for non-compliance and directors/managers being fined.

What are the reporting obligations?

A relevant entity must notify the TIA annually of the following:

- whether or not it is carrying on any relevant activity;

- the date of the end of its financial year; and

- if the relevant entity is carrying on a relevant activity, whether or not all or any part of the relevant entity's gross income in relation to the relevant activity is subject to tax in a jurisdiction outside of the Cayman Islands and if so, provide appropriate evidence to support that tax residence as may be required by the TIA.

A relevant entity that is carrying on a relevant activity and which receives relevant income must also file a report with the TIA that contains certain prescribed information to allow the TIA to determine if the Company is satisfying the economic substance test. Such report must be filed no later than twelve months after the last day of the end of each financial year of the relevant entity.

What are the next steps?

All companies or limited liability partnerships that are incorporated or registered in the Cayman Islands should determine:

- whether the entity is a relevant entity;

- whether it is conducting a relevant activity; and

- what steps (if any) it needs to take in order to meet the ES Test and related reporting requirements.

In order to determine if an entity is a relevant entity, or if you believe that a relevant entity is conducting a relevant activity please reach out to your usual Harneys contact for further information about how Harneys can assist the relevant entity to confirm such classification and to satisfy the ES Test.

SCHEDULE

CAYMAN ISLANDS CORE INCOME GENERATING ACTIVITIES

The CIGA examples given in the ES Law for each relevant activity are detailed below. It should be noted that these are not exhaustive lists and there is no requirement for a relevant entity to conduct all CIGA for the relevant activity if it does not do so as part of its business.

Originally published 14 May 2019

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.