Denmark has recently entered into several information exchange agreements with low-tax countries ("tax havens"). This may have severe adverse tax implications for foreign companies with Danish branches and Danish transparent entities such as limited partnerships with non-resident partners.

Tax classification of certain branches and transparent entities

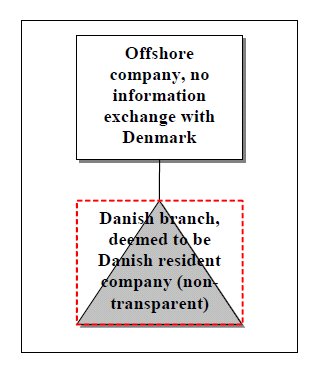

In June 2008 a new anti-avoidance rule, "Section 2C" of the Danish Corporation Tax Act, was introduced. Section 2C entails that branches and limited partnerships, etc., which are otherwise considered for Danish tax purposes to be tax transparent, in certain circumstances are reclassified as non-transparent entities and deemed resident "companies" for Danish tax purposes.

Section 2C applies to transparent entities and branches of non-Danish entities if (i) direct owners that are resident in one or several foreign jurisdictions hold more than 50% of the capital or the voting rights of the entity or branch and (ii) the entity or branch is by such jurisdiction(s) considered to be a separate taxable entity or there is no exchange of information between such jurisdiction(s) and Denmark.

The intention of Section 2C was to prevent non-resident companies from using Danish transparent entities and branches to avoid taxation by setting up, for instance, a Danish limited partnership having no permanent establishment in Denmark and being qualified under the applicable foreign tax law as a separate taxable entity (a "reverse hybrid").

However, also transparent entities constituting Danish permanent establishments are caught by Section 2C, notwithstanding that income from such permanent establishments is already subject to Danish taxation.

Consequences of information exchange agreements

If the qualification of a branch or transparent entity under Section 2C as a "company" ceases, this will trigger Danish taxation of capital gains on assets and liabilities held by the branch or transparent entity, and withholding taxes of 28% of deemed liquidation proceeds without deductions for acquisition costs will be payable.

The Section 2C qualification may cease if, inter alia, an information exchange agreement between Denmark and the relevant foreign jurisdiction is entered into.

The Danish Minister for Taxation recently introduced a bill to implement in Danish law new information exchange agreements between Denmark and Aruba, Bermuda, Cayman Islands, the British Virgin Islands and the Netherlands Antilles.

Accordingly, these agreements are expected to enter into force shortly – and this may have severe adverse tax implications for Danish branches and transparent entities at present qualified as companies under Section 2C. Such entities will be deemed to have made a taxable disposal of their assets and liabilities at market value (a deemed liquidation) and a taxable distribution of the proceeds - both without any changes to the substance of the entities having actually occurred!

Further information exchange agreements between Denmark and other low-tax jurisdictions are expected to enter into force in the near future.

Mitigation - restructuring

The harsh taxation resulting from the entry into force of the new information exchange agreements seems to be the result of incomplete legislation when first introducing Section 2C.

However, Section 2C is not likely to be amended, and instead structures hit by the introduction of information exchange agreements or other changes to the basis for Section 2C requalification should be adjusted to mitigate the adverse tax effects.

In many instances there are measures available to restructure around the exposure, but immediate action is required.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.