Introduction & Market Update

Over the past year, Alberta's energy industry has continued to be the central focus for the Province with an emphasis on innovation and diversification. In 2020, Canada faced the largest public health crisis in a century, the worst global economic crisis since the 1930s and a crippling collapse in energy prices. In response to the downturn, the Government of Alberta released a Recovery Plan in June 2020. The Province committed to diversifying Alberta's energy industry through a number of strategies and regulations which include: (i) Alberta's Natural Gas Vision and Strategy which lays out a plan for the Province to become a global supplier of clean, responsibly sourced natural gas, which includes the supply of hydrogen; (ii) a new mineral strategy to optimize Alberta's resource potential, including lithium; and (iii) the introduction of Bill 36, the Geothermal Resource Development Act, to establish a regulatory scheme for the development of geothermal resources.

Alberta's generation mix is expected to undergo a major shift as federal and provincial policies drive the retirement of all coal-fired generation by 2030. The Alberta Electric System Operator ("AESO") forecasts that coal will be replaced with a mix of natural gas generation and renewable energy. Alberta's merchant power market presents a unique opportunity for innovation and investment in clean energy in the Province through its many features, including the carbon market, power purchase agreements and government incentives targeted at moving toward a greener and diversified economy.

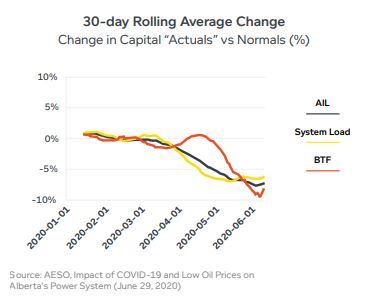

Throughout 2020, the ongoing effects of COVID-19 and low oil prices caused significant disruption to Alberta's electricity industry and the economy more broadly. The AESO indicates that load at behind-the-fence ("BTF") industrial sites, which are primarily oil and gas related facilities, began to decline due to persistently low oil prices, and in August, Alberta Internal Load ("AIL") hit its lowest levels at 950 MW, 10% below weather adjusted normal. According to the Market Surveillance Administrator ("MSA"), 2020 had the highest amount of supply surplus of any year in the last 20 years. Q3 2020 observed 1,865 minutes of supply surplus; the previous high was 231 minutes in Q3 2012.

Key Developments in 2020

ALBERTA'S ENERGY STORAGE ROADMAP

With respect to energy storage, Alberta is a flurry of activity. Alberta's first transmission connected energy storage project was completed in September 2020, and there are 10 additional energy storage projects within Alberta's connection queue.

In August 2019, the AESO released its Energy Storage Roadmap setting out a plan to facilitate the integration of energy storage technologies into the AESO's Authoritative Documents and the AESO's grid and electricity market. Highlights of the regulatory initiatives undertaken in 2020 to implement energy storage into Alberta's grid are discussed in detail in our storage article at page 69 of this publication.

DISTRIBUTION SYSTEM INQUIRY

The Alberta Utilities Commission ("AUC") launched the Distribution System Inquiry ("DSI") in December 2018 to provide a forum for Alberta's electricity industry to consider a regulatory response to mounting economic and technological pressures affecting Alberta's electric distribution systems. The inquiry was comprised of three modules, collectively focused on understanding three key questions:

- How will new technologies affect the grid and existing electric distribution facility owners and how quickly?

- How will incumbent electric distribution utilities be expected to respond to alternative approaches to providing electrical services, and which of these services should be subject to regulation?

- How should electric distribution facility rate structures be modified to incentivize efficient and cost-effective use of the grid?

The AUC identified certain emerging trends and innovations in Module One, which concluded on November 15, 2019.

" Notably, the AUC found that there was greater customer choice and control over electricity consumption, and Alberta's electricity market had become more competitive. "

Modules Two and Three both concluded on July 15, 2020. Module Two examined the interplay between the trends identified in Module One and certain forces affecting existing distribution utilities: changing consumer preferences, service prices, taxes, subsidies and government incentives aimed at consumer behavior. The resulting discussion included which distribution utility services ought to be regulated, the related implications for the monopoly franchise and the obligations to serve, and to what extent (if any) new entrants should be regulated by the AUC.

Module Three examined the ability of current rate designs to encourage investment in distribution systems and deter uneconomic bypass of regulated facilities.

The considerations included:

- What information from regulated utilities should be made available to new entrants for the purposes of interconnection, physical co-location of facilities, and unbundling of or equal access to facilities?

- Should information from new entrants be made available to other market participants, and if yes, on what terms?

- What process should the AUC follow to consider regulatory changes meant to deal with the issues identified by the DSI?

The DSI was conducted by way of a series of information requests and written submissions. The final DSI report, which has yet to be published, is expected to set out a regulatory framework intending to facilitate efficient outcomes in Alberta's utilities market.

ISO TARIFF - DISTRIBUTED CONNECTED GENERATION ("DCG") CREDITS

DCG reduces strain on the system by displacing power that would otherwise have to be imported by distribution facility owners ("DFOs") from the transmission system. DCG reduces congestion, lowers line losses and enhances system reliability by having generation located closer to consumers.

Several DFOs' tariffs give a transmission-based credit to large-scale DCG providers for the electrical energy they supply to the distribution system.

The credits are calculated by determining the difference between the AESO system access service charges to a DFO with a distributed generator in operation and the charges that would have been incurred had the distributed generator not been in operation. The idea is to encourage DCG by providing a credit for the reduced amount of electricity a DFO draws from the power pool when a distributed generator interconnects with its wires.

The future of DCG credits has been uncertain since the AUC's 2018 ISO Tariff Decision issued on September 22, 2019. In this proceeding, the AUC noted evidence of a cross-subsidy resulting from DFOs being required to provide credits to DCG providers but not receiving any corresponding benefit. DFOs recover the cost of DCG credits by passing transmission costs on to load customers, meaning that, in effect, load customers are forced to subsidize the cost of DCG.

The DSI more recently contemplated the following key submissions regarding DCG credits:

In early March 2021, the AUC is set to hear AUC Proceeding 26090 which will consider whether DCG credits shall continue to be implemented in a distribution utility's tariff. Currently, through their respective utility tariffs, each of FortisAlberta Inc., ATCO Electric Ltd. and ENMAX Power Corporation offer DCG credits. The AUC intends to decide this matter for all distribution tariffs and the AUC currently anticipates its determination in this proceeding will affect each of ATCO Electric, ENMAX and FortisAlberta as well as their customers, and the owners and operators of DCG units that receive benefit from DCG credit mechanisms.

DCG credits do not operate in a vacuum - they are intertwined with a number of other tariff, transmission and distribution system planning issues. It is within the context of these broader policy considerations that the fate of DCG credits will be determined. The future of DCG credits will likely be borne through the result of regulatory and distribution tariff proceedings, such as AUC Proceeding 26090, and the industry and market participants can likely expect the final DSI report to provide a regulatory framework which is intended to achieve competitive market outcomes.

CHANGES TO ADJUSTED METERING PRACTICE AND SUBSTATION FRACTION METHODOLOGY

Following the AUC's Decision 25848-D01-2020 (the "Decision") in late December 2020 varying Decision 2294-D02-2019, lenders and project developers within Alberta can expect impacts to connection costs for DCG projects. The Decision approved the AESO proposed adjusted metering practice and use of the substation fraction methodology to allocate the costs of interconnection facilities that may have joint use as part of the 2018 independent system operator ("ISO") tariff.

Highlights of the material findings and outcomes include:

- The AUC approved the AESO's proposed substation fraction methodology of one ("SSF=1") at all DFO contracted substations on a prospective basis which will attribute all connection costs to Rate Demand Transmission Service ("Rate DTS") contracts and none to Rate Supply Transmission Service ("Rate STS") contracts.

- The AUC confirmed that incremental costs which result from the connection of the DCG to the distribution or transmission system or alteration of connection facilities should flow through to DCGs. In order to adequately and accurately allocate incremental connection costs of the transmission system to DCGs that caused those costs, in all future customer contribution decisions ("CCDs"), the AESO was directed to clearly identify the DCG incremental transmission connection costs.

- Past CCD recalculations may have allocated costs to a DCG which did not reflect the actual incremental costs associated with their connection to DFO-contracted substations. In response, the AESO is directed to (i) reallocate such additional costs from the Rate STS to the Rate DTS, and (ii) recalculate CCDs using the SSF=1 methodology, in each case retroactively back to December 1, 2015, and inform the DFOs of those recalculations. The DFOs are directed to file a report with the AUC by March 31, 2021, with the details of the resolution of any such disputes with such DCGs. In future CCDs, the AESO will be responsible for clearly identifying, to the extent possible, the DCG incremental transmission connection costs.

- A new adjusted metering practice changing the point of totalization from the high side of a substation to the feeder level and impacting DCG credits and Rate STS contract capacities was approved by the AUC. The AUC determined this adjusted metering practice proposed by the AESO should be implemented without grandfathering and directed the AESO to submit revised tariff language as part of its compliance filing and implementation details in its next phase 2 tariff application.

- The AUC acknowledged that the adjusted metering practice will affect the availability of metering information currently used for the calculation of DCG credits. However, the AUC determined the issue with respect to the continuation of DCG credits is a distribution tariff matter and will be dealt with in AUC Proceeding 26090. AUC Proceeding 26090 will consider whether DCG credits should continue to be included in a DFO's tariff. AUC Proceeding 26090 is currently expected to be heard by the AUC during the second week of March 2021.

Noteworthy, and what will likely be carried forward to future decisions considering cost allocations, is the AUC's confirmation of the principle (established in AUC Proceeding 25101) that following energization, costs should not be allocated to a DCG if the DCG has not directly caused those costs. In other words, costs should be borne by the party benefitting from the connection project.The full effects and impacts of the Decision will be understood in the coming months.

The AESO's required compliance filing to effect the Decision was filed on January 11, 2021. DFOs must file reports by March 31, 2021, setting out the details of all resolutions and outstanding disputes pertaining to DCG flow-through matters.

SELF-SUPPLY AND EXPORT

In fall 2019, on behalf of the Alberta Department of Energy, the AUC issued Bulletin 2019-16 launching consultation on the issue of power plant self-supply and export. In the first round, the AUC sought stakeholder input on the following options for addressing the selfsupply and export issue in the future:

Option 1: Status quo

Option 2: Limited self-supply and export

Option 3: Unlimited self-supply and export

In the second round of engagement, the AUC asked stakeholders to provide comments on the market and tariff implications of unlimited power plant self-supply and export.

On June 5, 2020 the AUC provided the Department of Energy with a discussion paper which summarized the views of market participants on how best to address the issue of power plant self-supply and export going forward.

The feedback received by the AUC was that most stakeholders do not oppose unlimited self-supply and export and generally agree that accommodating unlimited self-supply and export while preserving a fair, efficient and openly competitive market requires appropriate, tariff-based incentives. However, stakeholders disagreed on whether existing transmission and distribution tariffs provide the correct incentives to accommodate unlimited self-supply and export. A majority of stakeholders recognized that these issues will be more fully canvassed in the AUC's DSI and the upcoming AESO tariff proceeding.

The discussion paper recommends that regardless of which option the Province decides to implement, the statutory scheme should be amended to clarify the circumstances in which self-supply and export is expressly permitted to ensure regulatory certainty for stakeholders. Before the AUC can effectively address the tariff issue, the Department of Energy must decide, from a policy perspective, whether it wishes to allow self-supplying generators that do not otherwise qualify as an industrial system designation ("ISD") to self-supply and export.

Until the Department of Energy provides further direction, uncertainty remains for co-generation and industrial systems across the Province. It is anticipated that relief in the form of statutory amendments or new AUC rules may be on the horizon in 2021.

Click here to continue reading . . .

Originally published March 03, 2021

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.