Dans la publication Oil and Gas Review Report de cette année, le Groupe de l'énergie de la Commission des valeurs mobilières de l'Alberta souligne les contraintes et les nouvelles exigences de déclarations imposées aux émetteurs assujettis. L'absence de financement sur le marché dispensé et la modification de la déclaration des coûts d'abandon et de remise en état sont au cSur des préoccupations.

Ce billet est disponible en anglais seulement.

In this year's Oil and Gas Review Report, the Alberta Securities Commission Energy Group highlights constraints facing reporting issuers and novel reporting concerns – the lack of exempt-market financing and altered abandonment and reclamation cost reporting being primary focuses.

- The Alberta Securities Commission (the "ASC") released its annual Oil and Gas Review Report for 2020 (the "2020 Review") on November 30, 2020.

- An Information Session regarding the 2020 Review will be held on January 12, 2021 for interested reporting issuers ("RI's")

- The 2020 Review highlights:

- Clarifications regarding the reporting of Abandonment and Reclamation Costs;

- Incorrect or inadequate disclosure of production by product type, location of measurement and production rates; and

- Once again, incorrect of inadequate annual reserve reconciliations.

- The 2020 Review also highlights the continued difficulties facing RI's in accessing public financing, the collapse of exempt market offerings by RIs and near complete capital flight from non-RI's.

Highlights of the Review

Juniors pain continues, tempered by new listings

A further net 7 RI's were delisted in 2020, reducing the total to 137 from 130 in 2019 (3 new RI's were listed, while 10 were delisted). The total decline since the high point of 302 RI's in 2012 now sits at almost 57%. The 10 RI's that ceased reporting consisted of eight juniors, being companies producing less than 10,000 BOE/day (supplemented by two new RI's), and two intermediates, being companies producing between 10,000 and 100,000 BOE/day (supplemented by one new RI). It would also appear that two intermediate issuers have now qualified as senior issuers, being companies producing greater than 100,000 COE/day, the largest number in the category since at least 2014.

Unfortunately, despite these positive signs, the frailty of the junior issuer market is real and the implications of its inherent challenges may simply be forestalled by government assistance resulting from the ongoing COVID-19 pandemic. Additionally, the ASC notes that a number of unrecorded receivership and bankruptcy processes remain underway, which remain unresolved as of the date of publishing. Together, these factors may lead to an elevated loss of RI's through 2021, particularly given the number of cease trade orders and the prominence of insolvencies in the sector in previous years.

Consolidations down, receivership and cease-trade orders dominant

Cease-trade orders remained the leading reason of delisting for juniors (six), while two intermediates and two juniors were acquired by either other RI's or private corporations. The continued increase of cease trade orders remains a significant concern, while consolidation activity remains depressed, despite some major oil patch announcements (eg. Husky/Cenovus; Whitecap/TORC).

Continuing the trend from 2019, no RI's were delisted due to a change in industry or acquisition by company engaged in a different industry indicating that, as signaled in last year's analysis, the pathway from oil and gas to cannabis remains closed.

Exempt Market Offerings Collapse – Public Financing Remains Steady

The newest trend reported by the ASC in the 2020 Report is the massive reduction in exempt market offerings by RI's, trailing even 2019's minimal exempt market raise.

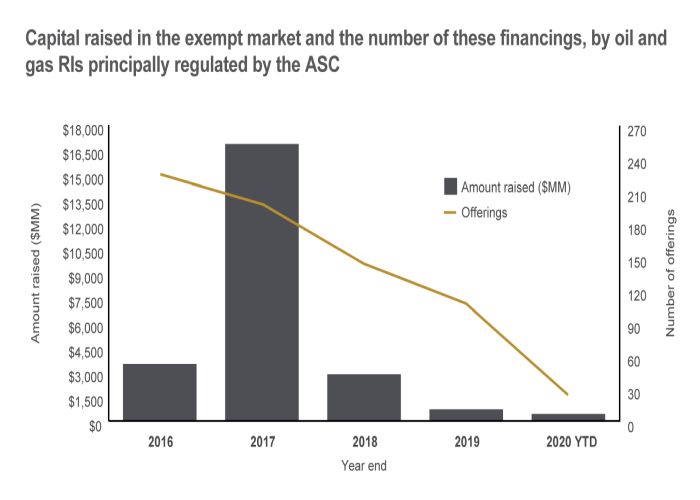

As the 2020 Review indicates in the chart below, exempt market offerings have dropped from ~120 to ~30 in the course of one year, following a raise of less than $1.5 billion in 2019. Whether this decline is in response to the COVID-19 pandemic, or a symptom of larger structural concerns remains to be seen moving into 2021. By comparison, prospectus offerings remained relatively stable following the 2018 collapse in public offerings, with a decrease from ~7 to ~5 offerings which raised approximately $1.0 billion more funds (for a total of ~$3 billion). Notably, public financing continues to be dominated entirely by seniors and entirely by debt issuances, a trend which has remained stable since 2017. Public equity markets in oil & gas remain firmly closed.

As with 2019, the ASC has recognized the same four difficulties facing RI's in the current market:

- Protracted development schedules for oil and gas reserves;

- Delays and cancellations of transportation and other infrastructure development;

- Reduced investor interest; and

- Scarce investment capital.

Areas of concern for the ASC

Reconciliations of summed gross proved plus probable reserves have generally remained stable in 2020, with juniors experiencing greater net increases, while intermediates experiencing increased net decreases. Extensions and improved recovery remained a major source of improvement, following the capital programs of many companies, while Senior RI's also saw a number of acquisitions and intermediates saw significant negative technical revisions. All three categories of RI's also observed a decrease to production and a decrease in respect of economic factors. Discoveries also remained minimal, reflecting structural adaptations by the industry to Alberta's changing market conditions.

The ASC additionally raised the following concerns, which appear to generally be more technical than in previous years:

- Over and inaccurate reporting in relation to abandonment and reclamation costs in the statement of reserves data, attributed to October 2019 amendments to the COGE Handbook not mirrored by corresponding changes to National Instrument 51-101;

- Incorrect disclosures of production in news releases and investors presentations, largely owing to a lack of specificity as to product type and first point of sale measurements; and

- Ongoing technical issues in reserve reconciliation methodology, reflecting concerns raised in previous years.

Focus area: Abandonment and Reclamation Cost Reporting

Regarding the reporting of abandonment and reclamation costs ("ARC") in RI's statements of reserve data, the ASC notes that, despite amendments to the COGE Handbook in October 2019, a number of costs which have been included should not be qualified as ARC, as defined in National Instrument 51-101, which is not superseded by the COGE Handbook. Additionally the ASC notes that an RI's statement of reserves data and other information in combination with tis financial statements should provide a comprehensive picture of an RI's oil and gas restorations and decommissioning costs and liabilities. Rather than duplicating costs, the ASC recommends that commentary be added to RI's in their disclosure regarding these differing sources required to achieve a complete picture of ARC liabilities.

Looking Ahead

The 2020 Review reflects an industry which may have stopped its free-fall but has not yet clearly rounded the corner on recovery. With government assistance potentially propping up a number of companies, oil and gas prices subject to COVID-19 and other world events and increasing regulatory constraints signaled in the general Canadian landscape, recovery in 2021 remains uncertain.

As we stressed last year, while it may be tempting to look for comfort from the relative deceleration in the reduction in the number of RI's from the massive losses of 2015 and 2016 and the relative stabilization in the number of junior and intermediate issuers, the lack of a healthy M&A market and the complete inability of junior and intermediate issuers to access capital, paired with the other headwinds facing the oil and gas industry suggest that any stability may be fleeting. With few options to exit and no access to capital to develop or in some cases maintain, many issuers are left with no other option but to play a waiting game.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.