Parts 1 and 2 of this Series reviewed what is meant by control for purposes of the Income Tax Act (Canada) (the "Act") and reviewed some of the key tax implications of control under the Act. Part 2 of the Series also considered the tools required to determine de jure control ("DJC") with an emphasis on the impact of unanimous shareholdrs agreements ("USAs") on DJC. In this the third and final instalment of the Series, we'll consider the tools required to determine de facto control ("DFC ") with an emphasis on the impact of ordinary shareholders agreements on DFC. In addition, we'll also review the income tax impacts of paragraph 251(5)(b) on the exit provisions that are commonly found in many shareholders agreements.

Tools To Determine DFC

The nature of items that can impact DFC is extremely broad since the determination is, as clarified by new subsection 256(5.11), required to take into account all relevant factors. The terms of shareholders agreements, including those agreements that are not USAs, can often play a significant factor when making DFC determinations.

Although the tax implications of DJC are broader than those of DFC, the tax implications of DFC are still extremely far-reaching. Moreover, due to the fact-based nature of DFC determinations, the ability for the terms of shareholders agreements, regardless of whether or not the agreements are USAs, to impact DFC is far more insidious.

Shareholders Agreements and DFC

Some of the terms in a typical shareholders agreement that can contribute to a determination of DFC include:

- nominee or representation arrangements;

- casting vote;

- quorum requirements; and

- veto or other consent requirements for certain resolutions.

Two cases, Multiview Inc. v. the Queen ("Multiview") and The Lenester Sales v. The Queen ("Lenester"), both of which involved a review of the impact of ordinary shareholders agreements on DFC, are discussed below to illustrate how, if at all, the terms of shareholders agreements can impact DFC.

In both cases the issue was whether a person who directly or indirectly controlled less than a majority of votes might enjoy DFC of the respective underlying corporation as a result of the terms in each respective shareholders agreement.

Multiview

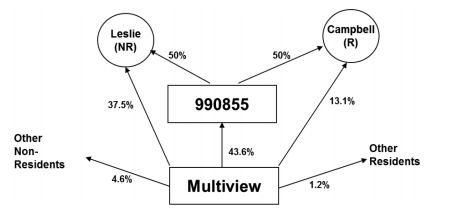

The share structure in Multiview is graphically reproduced below.

In Multiview, the question was whether Multiview Inc. was a CCPC because it was controlled directly or indirectly in any manner whatever by Leslie, a non-resident. Leslie was a direct 37.5% shareholder of Multiview Inc.. but he was also a 50% shareholder of 990855 Ontario Inc. ("855"), a holding company that owned a 44% block of Multiview Inc. If Leslie could have been considered to have DFC over 855, then together with his direct shareholdings in Multiview Inc. he would have also been considered to have DFC over Multiview Inc.

Lenester

The share structure in Lenester is graphically reproduced below.

In Lenester, the issue was whether Giant Tiger Stores Limited ("Giant Tiger"), the 49.9% shareholder of Lenester Sales Ltd. ("Lenester Sales.") had DFC of Lenester Sales. If Giant Tiger had DFC over Lenester Sales then the two corporations would have been associated and Lenester Sales would have lost its small business deduction.

In both of these cases the respective shareholders agreements governing Multiview Inc. and Lenester Sales, respectively, provided for equal representation on the board of directors of each respective corporation and did not provide any shareholder with a casting vote.

Thankfully, because the Courts have consistently held that where a shareholders agreement results in a deadlocked board of directors DFC cannot exist, in both of these cases, the respective shareholders agreements were not found to impact DFC.

Once again, while the terms of shareholders agreements may inadvertently create negative tax issues, it is worth keeping in mind that purposeful planning by careful advisors could be employed to arrange for DFC or avoid DFC in appropriate circumstances.

Footnotes

1 Michael Goldberg, tax partner, Minden Gross LLP, MERITAS law firms worldwide, and founder of "Tax Talk with Michael Goldberg", a quarterly conference call about current, relevant, and real life tax situations for professional advisors who serve high net worth clients.

2 Unless otherwise noted, defined terms in this article have the meaning designated in the first instalment of the Series.

3 See Part 1 of the Series for a review of the tax implications of DJC and DFC.

4 97 DTC 1489 (TCC).

5 2004 DTC 6461 (FCA).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.