On November 21, 2018, the Department of Finance released a mini-budget, which provides for accelerated deductions for Canadian Development Expenses (CDE), Canadian Oil and Gas Property Expenses (COGPE), and Undepreciated Capital Costs (UCC), which are effective in respect of expenses incurred after November 20, 2018.

It is expected that the accelerated deductions will be applicable to a large majority of the expenses incurred by exploration and production companies (and to service companies to a lesser extent), starting today. The enhanced CDE deductions will also be available to flow-through share subscribers, for any flow-through share subscriptions entered into starting November 21, 2018.

Canadian Development Expenses

The accelerated deduction for CDE is an additional 15% in the year the expenses are incurred, increasing the total first year deduction to 45%1

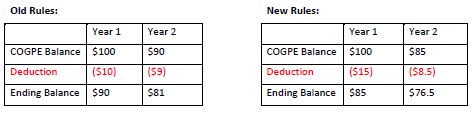

Canadian Oil and Gas Property Expenses

The accelerated deduction for COGPE is an additional 5% in the year the expenses are incurred, increasing the total first year deduction to 15%.2 After the first year, COGPE can be deducted at the general rate of 10% on a declining balance basis.

Undepreciated Capital Costs

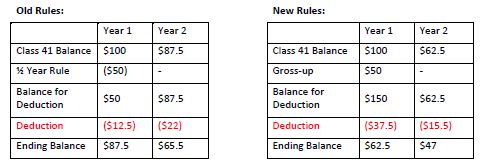

It is expected that most tangible property acquired by businesses will be eligible for the accelerated UCC. The accelerated deduction is calculated by grossing-up the actual expense amount by an additional 50% and taking the normal deduction rate off the grossed-up amount. This has the opposite effect of the old rule, where companies were required to reduce their first year UCC deduction by ½.

Numerical Example (assuming that $100 has been spent to acquire property in Class 41, i.e. 25% CCA rate)3:

Footnotes

1 This rate applies to taxation that end before 2024, and thereafter the accelerated rate will be reduced to 7.5%

2 This rate applies to taxation that end before 2024, and thereafter the accelerated rate will be reduced to 2.5%

3 And the taxpayer has no other balance in its Class 41 pool

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.