Cassels Brock developed this Lessons Learned series based on our experience with priority disputes between secured creditors and the realization that many secured parties make fundamental errors of law that cause them to lose priority in their collateral. Each lesson in the series will outline a basic mistake and the lesson to be learned...

Lesson Six: Getting Sub-Leasing Right - Common and Costly Errors can be Avoided

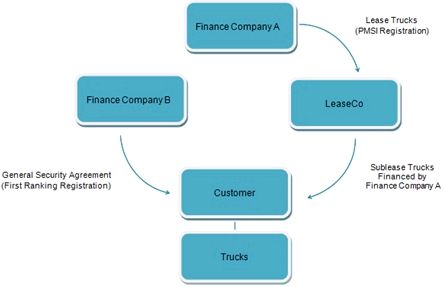

Below is an example that we have seen on more than one occasion.

Finance Company A finances trucks for LeaseCo who then leases these trucks to a third party Customer. Finance Company A makes all applicable registrations under the Personal Property Security Act (the PPSA) to ensure its first priority position in the trucks as against LeaseCo. The Customer has a bank operating line with Finance Company B and has entered into a general security agreement in favour of Finance Company B who duly registered and has a first priority security interest as against Customer under applicable PPSA rules. LeaseCo either did not register against Customer or did not ensure it had a first priority position in respect of the leased trucks. Customer then becomes insolvent. Who has the priority claim to the leased trucks: LeaseCo, Finance Company A or Finance Company B?

Often, LeaseCo or Finance Company A is of the understanding that they would have a prior claim to the trucks as Finance Company A registered under the PPSA against LeaseCo. That, however, would not be the result unless LeaseCo or Finance Company A undertook all proper registrations against the Customer and achieved priority over Finance Company B and any other prior secured creditors of the Customer. In Lesson Four of this series, we discussed that all leases of a term of more than one year should be registered under the PPSA. If Finance Company A only registered against LeaseCo and LeaseCo did not register the sub-lease against the Customer, then Finance Company B would have a better claim to the trucks under its general security agreement than either Finance Company A or LeaseCo.

The trucks in the hands of the Customer would be an asset of the Customer which would form the general collateral secured by Finance Company B's general security agreement. Notwithstanding that Finance Company A had a perfected security interest in the trucks as against LeaseCo, it would lose its security interest in the trucks in the hand of the Customer if the Customer becomes bankrupt.

How can Finance Company A protect itself from losing its priority security interest? There are a variety of options:

1. Ensure that LeaseCo registers all leases of greater than one year against its Customers and monitor that LeaseCo has done this.

While this seems like a simple solution, it is surprising how often that finance companies allow for sub-leasing without putting strict parameters of how and under what circumstances that it can be undertaken. The following is suggested:

- Ensure all sub-leases that LeaseCo enters into with Customers are registered. The only exception would be if the lease is for less than a term of one year and cannot be extended;

- Ensure that the sub-lease term is not longer than the term of the underlying financing agreement with Finance Company A;

- Finance Company A should take an assignment of the security interest in the sub-lease together with all proceeds. This may be more complicated if LeaseCo has many secured parties;

- Finance Company A should remember that the trucks are inventory in the hands of LeaseCo and not equipment and follow applicable rules to ensure it has a first ranking security interest in inventory as opposed to equipment.

2. Finance Company A registers a security interest against the Customer.

If Finance Company A takes an assignment of a security interest in the lease between LeaseCo and the Customer as set out in Section 1(c) above, then Finance Company A can claim to be a secured creditor of the Customer. If applicable waivers of interest are obtained from prior secured creditors, being in our example Finance Company B, then Finance Company A will have a prior claim to the trucks ahead of Finance Company B. The real issue is whether LeaseCo would want Finance Company A to register financing statements against LeaseCo's Customers including the Customer in our example. Typically, the answer will be 'no' for good business reasons but Finance Company A should resist this answer unless they can ensure that LeaseCo has registered against the Customer and there are mechanisms to ensure LeaseCo maintains that registration.

3. Do nothing and hope that the lease is seen as a 'true' lease and LeaseCo is the 'Owner' of the Trucks

This is not an option. For the purposes of security interests and the requirement to register under the PPSA, ownership and true leases are not relevant. (See Lesson Four and Lesson Five in this series.) Doing nothing will result in losses to financiers in an insolvency scenario. In recent cases, we have seen these losses being in excess of $1 million which could have been avoided through proper PPSA registrations.

Lesson Learned – Make sure that in a sub-lease situation that the sub-lease is properly registered under applicable Personal Property Security Act.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.