On July 17, 2020, the Canadian government proposed changes to the Canada Emergency Wage Subsidy ("CEWS") program, which would make the program more accessible to businesses and extend the program until the end of the year. These proposed changes have been provided to opposition parties and are scheduled for debate in Parliament in the coming week. The changes, if ultimately approved, will not take effect until they receive Royal Assent but are indicative of the anticipated expansion of the CEWS program.

The proposed changes to the CEWS program would:

- extend the CEWS program until December 19, 2020

- remove the threshold of 30% decrease in revenue currently required to receive CEWS benefits (thereby making the program accessible to businesses that have experienced or will experience losses less than 30%)

- create a two-part benefit comprised of base subsidies and top-up subsidies

- vary base subsidies for eligible businesses according to how much revenue they lost

- provide a gradually decreasing base subsidy for eligible businesses

- provide a top-up wage subsidy (up to 25%) for eligible businesses that have experienced at least a 50% decrease in revenue, and

- expand the definition of "eligible entity" to receive CEWS benefits to include trusts, in addition to corporations and individuals.

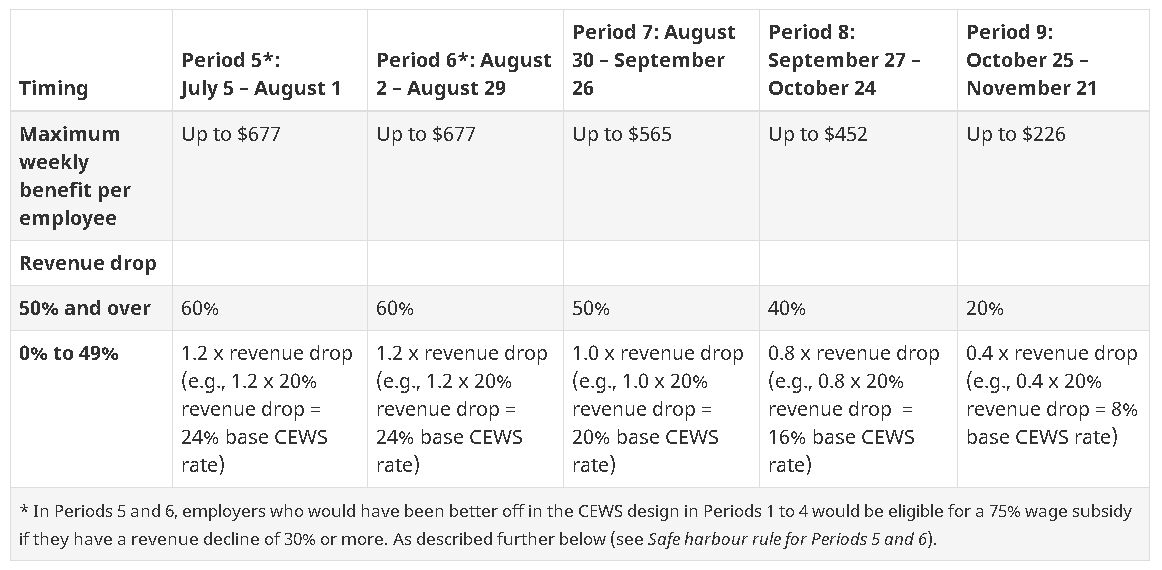

The Canadian government has released the following chart, which provides employers with guidance on expected CEWS base subsidies (some eligible employers may also be entitled to top-up subsidies in addition to the amounts in the following chart):

Source: www.canada.ca/

The transition to gradually decreasing base subsidies follows a fairly complicated formula, which may require the assistance of legal or financial advisors. It should be noted, however, that employers that have already made business decisions for July and August based on the previous CEWS rules will not receive a lower subsidy rate and can expect to transition to the new proposed subsidy rates in September.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.