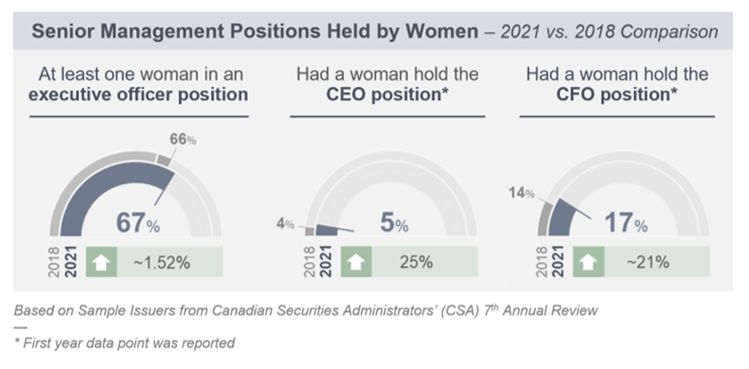

Data from the Canadian Securities Administrators' (CSA) seventh annual review of disclosure regarding women on boards and in executive officer positions shows that while 67% of issuers had at least one woman in an executive officer position, only 5% of issuers had a woman chief executive officer (CEO).

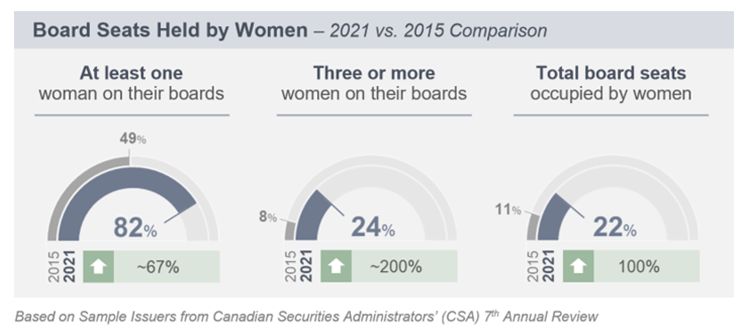

- Between 2015 and 2021, the percentage of board seats occupied by women doubled to 22%. Little growth has been made with respect to the percent of board chairs that are women (6% in 2021 and 2020, 5% in 2019).

- The number of women in executive rolls lags behind the increasing number of women directors. Only 5% of issuers have a woman CEO and 17% have a woman chief financial officer (CFO).

- There has been a significant increase in issuers adopting targets for the representation of women on their board (32% in 2021 compared to 26% in 2020 and 7% in 2015). However, very few issuers (6%) have adopted targets for representation in executive officer positions.

The CSA Review

In CSA Multilateral Staff Notice 58-313 Review of Disclosure Regarding Women on Boards and in Executive Officer Positions Year 7 Report (November 4, 2021) (the Review), the CSA have once again published data with respect key trends in board and executive gender diversity. The Review looked at information circulars and annual information forms filed before July 31, 2021 by a sample of 599 issuers (the Sample Issuers) with year ends between December 31, 2020 and March 31, 2021. More specifically, the CSA reviewed issuers' disclosure that was responsive to the requirements of Form 58-101F1 Corporate Governance Disclosure.

Progress for Boards, Status Quo for Management

The trends reported by the CSA are generally positive when looking at board composition, with more women holding board seats than was the case seven years ago:

- 82% of Sample Issuers have at least one woman on their boards as compared to 49% in 2015.

- 24% of Sample Issuers have three or more women on their boards as compared to 8% in 2015.

- 22% of total board seats with Sample Issuers are occupied by women as compared to 11% in 2015.

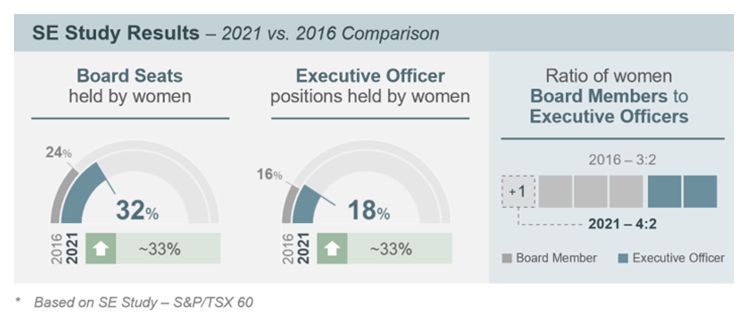

As with prior years, Stikeman Elliott has done its own analysis of the S&P/TSX 60 Constituents in 2021 (the Stikeman Data), which shows that as of July 2021, all of the issuers in the S&P/TSX 60 had at least one woman on their board, as compared to 2016 (Stikeman Elliott's first year tracking this information) when three constituents had no women on their boards.

Despite the increase in representation of women on public company boards in Canada, we have not seen similar growth in executive positions. 6% of Sample Issuers had a chair of the board that was a woman (as compared to 5% in 2019, the first year this data point was reported). Similarly, the increase of women in senior management positions has been slow:

- 67% of Sample Issuers have at least one woman in an executive officer position, an increase of 7% from 60% in 2015 (or 1% from 66% in 2018).

- Only 5% of Sample Issuers had a woman CEO as compared to 4% in 2018 (being the first year this data point was reported).

- 17% of Sample Issuers had a woman CFO, a 3% increase from 14% in 2018 (being the first year this data point was reported).

The Stikeman Data shows similar results. Approximately 32% of the board seats in the S&P/TSX 60 were held by women (approximately 24% in 2016), whereas approximately 18% of executive officers are women (approximately 16% in 2016). On average, S&P/TSX 60 Constituents will have four women board members and two women executive officers. This is again another important statistic given that executive level or C-suite experience continues to be a major pre-requisite for board candidates. Lack of growth in this pipeline would therefore have a related effect on continued growth in female representation on boards.

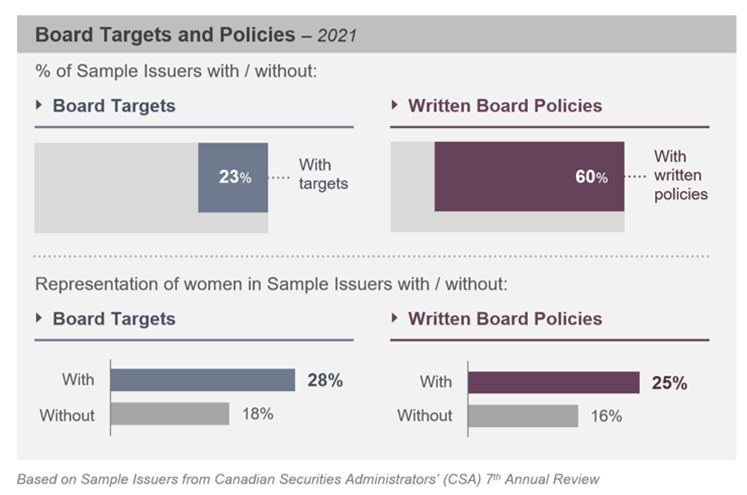

Notably, the Review found a correlation between issuers adopting board refreshment and/or renewal measures and the proportion of board seats held by women. Where Sample Issuers had adopted targets with respect to the representation of women on their boards (32%), a greater proportion of the board (28%) was comprised of women as compared to issuers without board targets (18%). Similarly, Sample Issuers with written policies related to the representation of women on their board (60%), had a greater proportion of women on their boards (25%) than Sample Issuers without written policies (16%). Issuer looking to increase representation might therefore look to a mix of tools designed to encourage refreshment and renewal as a way to create more room for diverse board members. This could include a blended approach to terms limits, requiring a mix or balance of tenures, as well as specific policies and processes at the pipeline level.

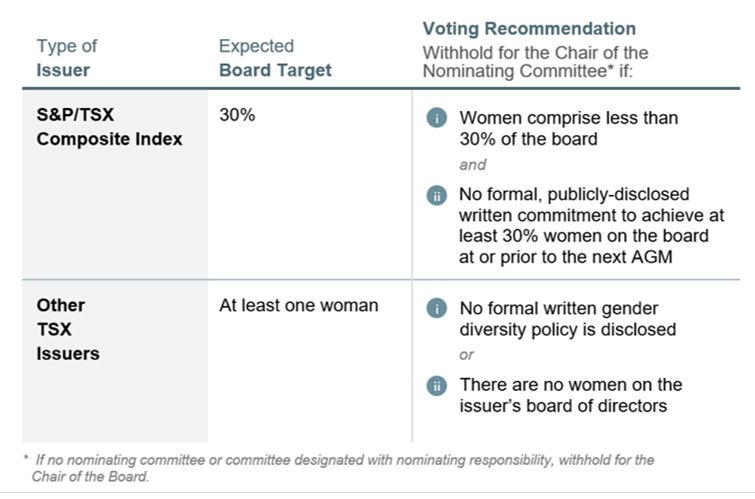

Highlighting the importance of issuers adopting targets and written diversity policies, are proxy voting guidelines adopted by Institutional Shareholder Services (ISS) and other institutional investors. In ISS' Americas Proxy Voting Guidelines Updates for 2022, ISS has updated its gender diversity policy and will make the following voting recommendations effective February 2022:

ISS will also evaluate (on a case-by-case basis) whether withhold recommendations would be warranted for additional directors where the issuer fails to meet the applicable ISS policy over two years or more. Notably, for the 2022 proxy season, ISS now expects that issuers adopt measurable goals and/or targets at or prior to their next AGM. Previously, the adoption of such measures was expected within a reasonable period of time. ISS' proxy voting guidelines do not set out any expectations with respect to targets for executive officers. However, ISS' ESG Governance QualityScore methodology does evaluate the number of executive officers who are women.

Glass Lewis has also recently published its updated Policy Guidelines for 2022 which provide for an expanded policy on board gender diversity. Beginning in 2022, for TSX-listed issuers, Glass Lewis will generally recommend voting against the chair of an issuer's nominating committee where the board has fewer than two gender diverse directors. Glass Lewis will recommend voting against the entire nominating committee where ethe board has no gender diverse directors. For meetings held after January 1, 2023, Glass Lewis will move from a fixed number approach to percentage-based approach, recommending votes against the chair of the nominating committee if the board is not at least 30% gender diverse. Glass Lewis defines "gender diverse directors" as women and directors that identify with a gender other than male or female.

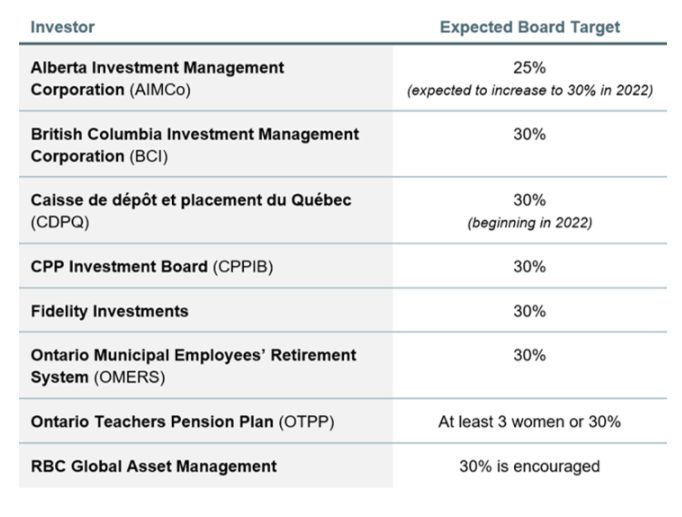

Other institutional investors have also published their expectations with respect to targets for women on boards:

What Might Account for the Disparity?

As noted above, there is a strong correlation between issuers who have adopted targets with respect to women on boards and the actual number of women who hold board seats. This correlation may account for why we have generally seen less growth in the number of women in executive roles. There has been a significant increase in Sample Issuers adopting targets for the representation of women on their board (from 7% in 2015 to 32% in 2021). However, at 6% a significantly lower percentage of Sample Issuers have adopted targets for the representation of women in executive officer positions (2% in 2015).

The types of organizations that women have historically worked for may also impact the proportion of women we have seen taking on executive rolls. Data published by Statistics Canada on May 18, 2021 shows that women rise through organizations and executive ranks in different industries and via different pipelines than their male counterparts. For example, approximately five in 10 women executives work in management occupations, compared to almost seven in 10 men. In particular, this reflects a gap in senior management in construction, transportation, production and utilities, industries which make up a large proportion of public issuers. Women executives were also found to be twice as likely to work in social sciences, education, government service and religion, industries that do not tend to find their way to the public markets. Statistics Canada's research also showed the women officers were two times less likely than men to hold top decision making roles, like president or chairperson, but were much more likely to serve as corporate secretaries.

Another factor that might influence the trends with respect to women executive officers is that the size of an executive team is often larger than the size of a board of directors, and so while the number of women in each group may be similar (as an absolute number), proportionately women comprise a smaller part of the executive team.

Best Practices for Diversity Disclosure

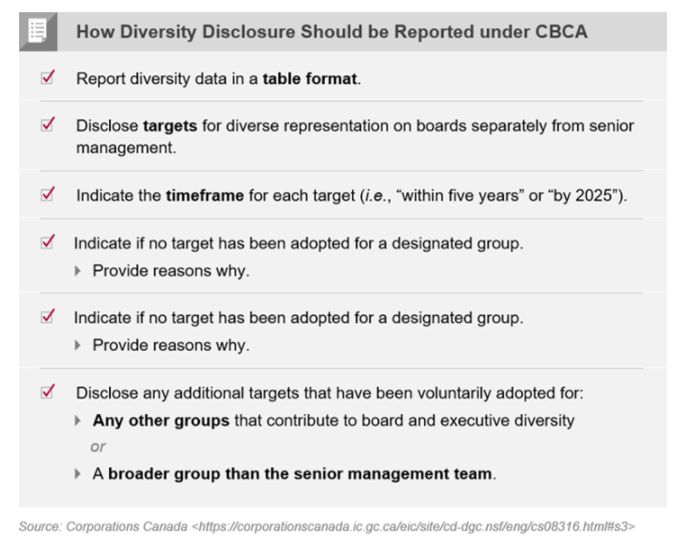

While the Notice focused on gender diversity data, the CSA have also included recommendations as to how this information is best reported. The CSA recommends that issuers provide disclosure in a consistent manner to assist investors in identifying and evaluating the information. More specifically, the CSA provide examples of how diversity data can be disclosed in tabular formats. This aligns with guidance published by Corporations Canada as to how diversity disclosure under the Canada Business Corporations Act (CBCA) should be reported. CBCA issuers are encouraged to:

For further information, please see CSA Multilateral Staff Notice 58-313 Review of Disclosure Regarding Women on Boards and in Executive Officer Positions Year 7 Report (November 4, 2021). For some of our recent discussion of board and executive diversity, please see:

- Are More Women in Canadian Boardrooms? Sixth Annual CSA Review Now Supplemented by First Ever Reporting Under CBCA Amendments (April 20, 2021)

- Glass Lewis 2021 Voting Policies Focus on ESG, Gender Diversity and Board Refreshment (December 14, 2020)

- ISS 2021 Benchmark Voting Policies Updated: ISS Backs Target of 30% Women Starting in 2022 (November 13, 2020)

- Preparing for Proxy Season: Board Composition (February 20, 2020)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.