Key Findings

- U.S. investors show strong and sustained interest

- Canadian government-backed funds lead domestic investment

- Non-dilutive funding emerges as a dominant force

- Majority of investments are in pre-seed-early stage companies

- Technology leads all sectors by far

The Canadian Venture Capital Association (CVCA) released its annual look at the state of venture capital (VC) funding in Canada in their 2023 Market Overview. The report provides a deep analysis of the country's market and insights on the latest VC trends and strategic shifts.

So now that the numbers are in, what's hot and what's not in Canadian VC funding? Where is the money coming from and where is it going? And what should companies and investors be thinking about as they look ahead?

Geography

In 2023, $6.9 billion dollars was invested into Canadian companies across 660 deals. Ontario led the provinces for venture capital investments representing 48 percent of all dollars invested into Canada in 2023 with $3.3 billion across 275 deals. The majority of investments were into Toronto-based companies, accumulating $2.1 billion across 196 deals.

Canada has a sizeable stream of foreign venture capital investments. In 2023, United States-based investors led foreign investment activity, participating in 32 percent of all deals. United States involvement in Canada remains significantly above the pre-pandemic level of 24 percent seen in 2020, demonstrating a sustained and strong interest from American investors.

As can be seen below, the United States, Europe and Asia bring in sizeable venture capital funding.

The United States brought in the most foreign venture funding with $2.071 billion across 70 deals. Additionally, not included as a venture capital firm, U.S.-based Nvidia Corporation participated in two of the largest funding rounds in 2023, totaling $405 million, which resulted in a total of $2.476 billion dollars invested by the United States into Canada as documented by the CVCA.

European investor engagement has remained steady at 8 percent since 2021. Asian investments have shown a consistent upward trend, with record high participation of 5 percent in 2023.

Who are the Most Active Firms and Funds?

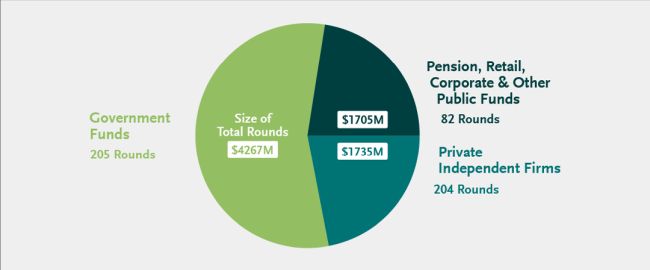

In addition to the considerable foreign funding, both private and government funds in Canada provide substantial funding to emerging companies.

As depicted in the graph below, government funds lead the investments with $4.267 billion dollars across 205 deals, followed closely by private firms and other methods of funding in Canada with $3.44 billion across 286 deals.

Non-Dilutive Financing Asserts Itself

Non-dilutive financing emerged as a dominant avenue of funding in Canada in 2023. Amidst high interest rates, SR&ED backed financing emerged as the main non-dilutive financing method representing 90 percent of all deals in 2023. Venture debt comprised the remaining 10 percent. The year saw a total of 482 deals in non-dilutive financing, demonstrating a strong preference for such funding options. There was $526 million invested across 482 deals with $139 million invested in 163 deals in Ontario.

| Most Active Firms in Non-Dilutive Financing Rounds | No. of Rounds | Size of Total Rounds (CND$ MIL) |

| Venture Debt | 35 | 227 |

| SR&ED | 430 | 93 |

Pre-Seed to Early Stage Companies

Pre-seed to early stage companies accounted for 84 percent of all investments in 2023.

Pre-seed investment activity had a record high year since 2019 with 128 deals and a total of $135 million in investment. The seed stage was the most active in 2023 in terms of volume of transactions of all deals and remained consistent as it matched the record level hit in 2022 with a total of $834 million invested across 244 deals. Quarter over quarter, deal value saw a 3 percent increase and deal count rose by 8 percent. The average deal size in seed stage companies reached a record high of $3.42 million in 2023. Early stage companies saw investments across 42 deals which accounted for 30 percent of all transactions and 38 percent of total deal value in Q4.

Sector Breakdown

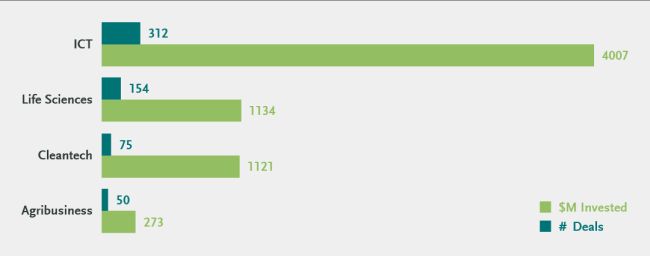

Information, communications and technology (ICT) was the hottest sector by far in 2023, attracting nearly half of all deals and 58 percent of total funding. The $4 billion in investment activity was down from just over $6.5 billion in 2022.

Internet software and services was the leading segment in ICT with $2 billion invested on 193 deals. Non-internet/mobile software saw $607 million of investment on 64 deals. Mobile and telecommunications had a busier 2023 after two years of limited dealmaking. eCommerce had its slowest year since 2019.

Image height: 256 px

Image height: 256 px

In the life sciences sector, therapeutic drugs and biologics punched above its weight with $413 million in 17 deals, for an average deal value of $24.3 million. Health and wellness continued to register only a sliver of investment in life sciences and saw a third year of decline.

Cleantech had a record 75 deals in 2023, although overall investment was slightly down from the previous year. Advanced materials has grown its share of cleantech investment every year since 2019, the only segment in the sector to do so. The share of investment in energy efficiency over the past three years is a fraction of what it was from 2018-20.

Agribusiness once again had the lowest amount of investment and the fewest deals by sector. Activity was slightly up from 2022. Advanced agriculture attracted the most funding with $83 million on 16 deals.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.