On its face, record-breaking M&A levels in Canada in 2021 appear to be setting the stage for an eventful year in dealmaking in 2022. However, deal activity is only part of the story of 2021 for dealmakers in Canada.

With continued economic volatility, and with Canadian businesses

and industries being rapidly transformed by a number of

developments (including technology and ESG factors, to name a few),

M&A in 2022, much like the year before, will be shaped by a

diverse range of drivers.

Canadian domestic deal activity

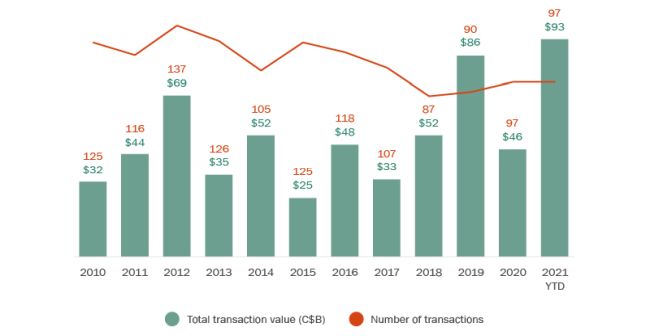

2021 was a blockbuster year for public M&A activity in Canada, with aggregate deal values reaching a 10-year high of C$93 billion (Figure 1). Transaction activity was driven by large-value transactions as a number of Canadian businesses undertook strategic transactions that underscored the confidence of boards and CEOs in this active deal environment. Sizeable Canadian transactions included Rogers Communications Inc.'s proposed C$26 billion agreement to acquire Shaw Communications Inc.1 and Brookfield Infrastructure Partners' recently completed strategic acquisition of Inter Pipeline (valued at approximately C$14 billion).

Figure 1: Canadian public M&A market

Source: Bloomberg. Based on transactions involving acquisitions of Canadian public targets announced during Jan 1, 2010 - Dec 7, 2021. Excludes terminated and withdrawn transactions.

Meanwhile, deal activity in the mid-market segment (for

transactions valued between C$100 million and C$500 million) grew

significantly by 18% (Figure 2). Transactions valued up to C$500

million accounted for 75% of overall Canadian public M&A deal

activity, in line with historical levels where mid-market deal

activity has traditionally accounted for the majority of Canadian

public M&A transactions.

More spin-offs and divestitures

While much M&A activity has stemmed from companies' active pursuit of growth strategies, we expect to see, amid high valuations, market volatility and focus on strategic optimization, more businesses undertaking spinoff transactions and divestitures in 2022 as a way to return value to shareholders and refocus their strategic direction. For example, H&R REIT recently announced a strategic repositioning plan to transform from a diversified REIT into a simplified, growth-orientated REIT. As part of its plan, it will spin-out its properties under Primaris the Canadian retail division of H&R REIT, and, together with Healthcare of Ontario Pension Plan (HOOPP), create a new stand-alone, publicly traded REIT focused on owning and managing enclosed shopping centres in Canada2. In another example, George Weston Limited recently announced that it had signed a definitive agreement to sell its Weston Foods fresh and frozen bakery businesses to affiliated entities of FGF Brands Inc. (FGF) for aggregate cash consideration of C$1.2 billion3.

As valuations remain high and market volatility creates potential challenges to price deals, it may become more challenging for some boards to pursue M&A transactions.

In what some are calling a bellwether move, GE recently announced its plans to spin off its healthcare, renewable energy and power companies to create three public companies4. GE Chairman and CEO H. Lawrence Culp, Jr. explained that, "By creating three industry-leading, global public companies, each can benefit from greater focus, tailored capital allocation, and strategic flexibility to drive long-term growth and value for customers, investors, and employees".

Many spinoff and divestiture transactions follow investor demands that companies consider optimizing their business portfolios by separating, for example, high-growth businesses from low-growth businesses or moving similar sets of assets into distinct publicly traded entities with the expectation that they will each benefit from more focused management and investor interest as a stand-alone company.

Download >> Canadian M&A Outlook For 2022

Footnotes

- Torys is representing Rogers Control Trust on this transaction.

- Torys is acting as counsel to HOOPPon this transaction.

- Torys is acting as counsel to George WestonLimited on this transaction.

- See GE press release.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.