The Canadian Competition Bureau (the "Bureau") released some informative statistics summarizing the number and characteristics of merger reviews started and concluded by the Bureau's Mergers Directorate in its 2019-2020 fiscal year (ending March 31, 2020). In past years, similar information was presented by the Bureau at the Mergers Roundtable hosted by the Canadian Bar Association's Mergers Committee and the Mergers Directorate, which did not happen this year due to COVID-19.

Non-Notifiable Mergers

About a year ago, the Bureau expanded the role of its Merger Notification Unit, now referred to as the Merger Intelligence and Notification Unit, to include a broader focus on active intelligence gathering on non-notifiable merger transactions that may raise competition concerns. These efforts have borne fruit, with the Bureau identifying and reviewing a number of non-notifiable transactions where the parties would not have otherwise engaged with the Bureau prior to closing. In one instance, the Bureau became aware of a non-notifiable transaction, Evonik Industries AG's acquisition of PeroxyChem Holding Company LLC, and entered into a consent agreement with the merging parties which required the divestiture of assets in British Columbia to remedy competition concerns.

Number of Annual filings and reviews

There has been a slight increase in merger filings and reviews over the past year, although not outside the normal range for the past 10 years. Set out below is a chart outlining the total number of merger filings by year for the past 10 years.

image: Competition Bureau Canada

It is possible that the increase in merger filings is related, at least in part, to the Bureau's September news release indicating its intention to engage in intelligence gathering activities to identify potentially problematic non-notifiable transactions.

Complexity Designations

There was a decrease this year in the number of merger reviews which were designated as 'complex'. Complex mergers involve proposed transactions between competitors, or between customers and suppliers, where there are indications that the transaction may, or is likely to, create, maintain, or enhance market power. Complex mergers require a more in-depth review than is necessary for non-complex mergers. This year only 25% (57) of mergers were designated as 'complex' while 75% (168) were designated as 'non-complex'. That is 10 less 'complex' merger designations than last year.

Timing of Reviews

Pursuant to the Bureau's Service Standards, a non-complex merger should be reviewed in 14 days and a complex merger should be reviewed in 45 days (except where a supplementary information request is issued, in which case the review time is longer). Good news for merging parties, the Bureau met its service standards in 97% of its merger reviews (93% of complex mergers; 98% of non-complex mergers). The average length of a non-complex merger review was 11 days and the average length of a complex merger review was 36 days, a noticeable improvement from last year. There was also a decrease in the number of supplementary information requests this year, which may suggest a corresponding decrease in what could be considered especially 'complex' mergers.

Industry Data

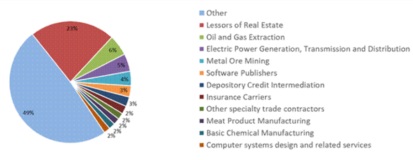

image: Competition Bureau Canada

Below is a breakdown of the industries in which mergers were reviewed by the Bureau during the 2019-2020 fiscal year. As shown below, the most frequently reviewed sector that is identifiable was Lessors of Real Estate. This sector includes entities primarily engaged in renting and leasing real estate properties. Half of the industries in which mergers were reviewed during the past year were identified as being in the 'other' category, which makes it difficult to draw meaningful conclusions about the industry data.

Merger Review Outcomes

Merger reviews can result in several outcomes, described as follows, ordered from best to worst: (i) issuance of an advance ruling certificate ("ARC"), (ii) issuance of a no action letter ("NAL"), (iii) silence from the Bureau, (iv) negotiated remedies (usually divestitures) often formalized in a consent agreement (a form of settlement agreement) or (v) a prohibition of the entire transaction (very rare).

An ARC is the highest assurance that parties to a proposed transaction can secure from the Commissioner under Competition Act (the "Act"). An ARC exempts the transaction from pre-merger notification and precludes the Commissioner from applying to the Competition Tribunal (the "Tribunal") for a remedial order under section 92 of the Act on the basis of the same or substantially the same information, provided the transaction is completed within one year. When not persuaded to issue an ARC, the Commissioner may issue a NAL, whereby the Commissioner confirms that he does not, at the time, intend to seek a remedial order under the Act. As a practical matter, a NAL is effective assurance on which parties to a proposed transaction can rely on to close their transaction.

Below is a chart outlining the Bureau's merger review outcomes for its past four fiscal years:

| Merger Review Outcomes | ||||

| 2019-2020 | 2018-2019 | 2017-2018 | 2016-2017 | |

| ARCs Issued in non-complex concluded reviews | 103 | 91 | 89 | 115 |

| Percentage of non-complex concluded reviews in which the Bureau issued ARCs | 61.3% | 64.1% | 55.3% | 68.0% |

| NALs issued in non-complex concluded reviews | 64 | 49 | 72 | 54 |

| Percentage of non-complex concluded reviews in which the Bureau issued NALs | 38.1% | 34.5% | 44.7% | 32% |

| Reviews Concluded with Issues | 5 | 5 | 7 | 9 |

| Consent Agreements | 3 | 6 | 7 | 17 |

The Bureau issued more ARCs and NALs this year than it did the year before. This is not surprising given the increase in the number of non-complex transactions and the decrease in the number of complex transactions. However, the percentage of non-complex reviews which concluded with the Bureau issuing an ARC actually decreased while the number of NALs increased slightly. This indicates the Bureau may be taking a more cautious approach to the comfort it is willing to offer parties prior to closing.There has been a significant decrease in the number of consent agreements that the Bureau has entered into over the past four years. Consistent with that trend, the number of consent agreements entered into this year amounts to half the number entered into the year before.

Takeaways

In light of the Bureau's new emphasis on intelligence gathering, it will be critically important for merging parties to assess potential competition law risks even where a transaction is not subject to mandatory notification under the Act.It is important to remember that this data covers the fiscal year ending March 2020 and does not capture the new COVID-19 reality. It is possible that merger reviews may take longer moving forward and that the categorization of transactions as complex may increase. Engaging competition counsel early is the best way to ensure that deadlines are met.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.