On March 18, 2020, the Canadian Securities Administrators ("CSA") advised issuers and other capital market participants of its response to the recent COVID-19 development. The purpose of this article is to highlight some of the key points discussed.

What You Need to Know

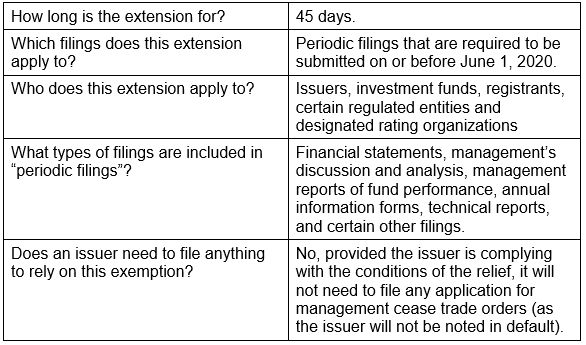

1. Periodic filings required to be submitted on or before June 1, 2020 will be granted a 45-day extension by the CSA

The extension, including the conditions enabling issuers and other market participants to rely on the extension, remain subject to the blanket relief to be issued by the CSA.

2. All comment periods for CSA proposals have been extended by 45days.

3. The CSA supports virtual meetings as a means for social distancing.

The regulator is aware that some issuers are considering virtual securityholder meetings as a means of social distancing. The CSA will remain supportive of measures that issuers take to mitigate the risk of transmitting COVID-19. Additional guidance on how to make changes to annual meetings will also be published by the regulators.

4. Investment Industry Regulatory Organization of Canada (IIROC) has confirmed volatility controls are functioning as expected in temporarily pausing declines while still allowing orderly price discovery to continue.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.