Article Summary

A debt recovery law firm will provide legal advice and legal assistance on all aspects of debt recovery law, including:

Initial Assessment and Demand Letter – The process begins with an initial assessment of the debt situation. This involves understanding the nature of the debt, the amount owed, and the debtor's details. Following this, a formal letter of demand is sent to the debtor, outlining the debt, and requesting payment. This letter often serves as a final warning before legal action is taken and may include a deadline for payment.

Commencing Legal Proceedings – If the debtor fails to respond or pay the debt as per the demand letter, legal proceedings can be initiated. This involves filing a claim in the appropriate court. The choice of court depends on the amount of the debt, as different courts have different monetary jurisdictions.

Filing and Serving a Claim and Statement of Claim – After commencing legal proceedings, a claim and statement of claim are filed and then served to the debtor. These documents outline the details of the debt, the basis of the claim, and the relief sought.

Obtaining Judgment – If the debtor does not respond to the claim or if the court finds in favour of the creditor, a judgment is obtained. This judgment is a formal decision by the court that the debtor owes the debt to the creditor. This is either summary judgment or default judgment.

Enforcement of Judgment – Once a judgment is obtained, various enforcement actions can be taken to recover the debt. This may include through the Courts by issuing an enforcement warrant to seize and sell the debtor's assets; or insolvency with bankruptcy against an individual debtor; or issuing a statutory demand and then initiating liquidation insolvency proceedings if the debtor is a corporation.

Bankruptcy or Liquidation Proceedings – If the debtor is unable to pay the debt, bankruptcy (for individuals) or liquidation (for companies) insolvency proceedings may be initiated. This involves the sale of the insolvent debtor's assets to pay off the debt.

Post-Recovery Actions – After the debt is recovered, there may be additional steps to finalise the matter, such as notifying credit reporting agencies or concluding any legal proceedings.

This article will explain in more detail.

Are you a creditor who is looking for an effective to get your debts collected from clients, but doesn't know if you should use a debt recovery law firm?

If so, it may be time for you to try debt recovery from a debt recovery law firm to see how they differ over in-house debt collection or using debt collection agency.

In today's business climate, having a consistent flow of cash from your business debts being paid by your debtors is vital to your business's health. When your debtors fail to make their payments, this can clog up your finances and lead to issues in your business, some of which can be very damaging!

But what can I do about my clients not paying their business debts? You can work with a debt recovery law firm to collect those debts!

A debt recovery law firm are collection agency lawyers that specialise in collecting debt through Courts or the Queensland Civil and Administrative Tribunal (QCAT).

They differ from regular debt collection agencies due to their specialisation in the law. This can be beneficial to your business in several significant ways.

In this article, our debt recovery lawyers explain several great ways that hiring a debt recovery law firm can help your business will be discussed so that you can understand how they can benefit you!

Debt Recovery Law Firm Knowledge

The first way that hiring a debt recovery law firm can benefit your business is due to their extensive knowledge of debt collection laws and how to navigate them.

Debt recovery and law interconnect very closely. You see, collecting business debts, as we're sure you're aware, involves managing a lot of money and personal details of your clients which, aside from being stressful for you, can be life-altering for your debtors.

If not managed correctly, the well-being and safety of your debtors can be put on the line. Due to these high stakes, the law places various regulations about what can and cannot be done by debt collectors and creditors when recovering debt.

As professionals in the law and professionals in the debt recovery industry, debt recovery law firms will have a complex and in-depth understanding of these laws and how they apply so that they can be upheld to the utmost extent.

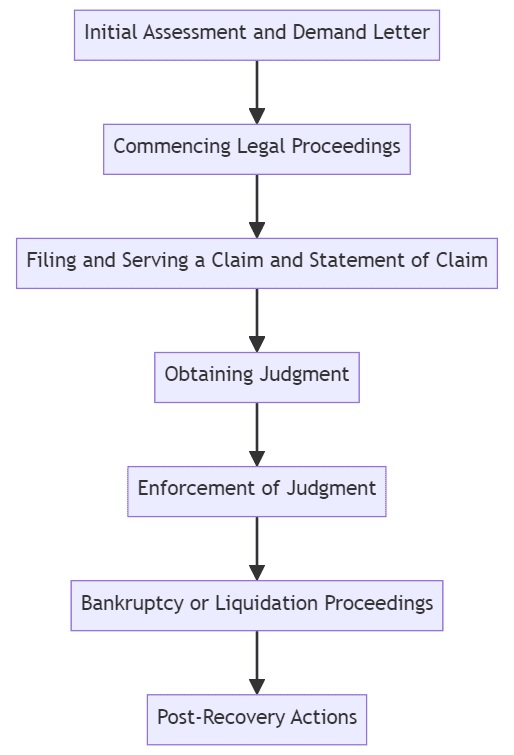

What are the Stages of Debt Recovery?

The stages of business debt recovery typically involve a series of steps and services designed to recover debts in a legal and efficient manner. These stages are:

- Initial Assessment and Demand Letter – The process begins with an initial assessment of the debt situation. This involves understanding the nature of the debt, the amount owed, and the debtor's details. Following this, a formal letter of demand is sent to the debtor, outlining the debt, and requesting payment. This letter often serves as a final warning before legal action is taken and may include a deadline for payment.

- Commencing Legal Proceedings – If the debtor fails to respond or pay the debt as per the demand letter, legal proceedings can be initiated. This involves filing a claim in the appropriate court. The choice of court depends on the amount of the debt, as different courts have different monetary jurisdictions.

- Filing and Serving a Claim and Statement of Claim – After commencing legal proceedings, a claim and statement of claim are filed and then served to the debtor. These documents outline the details of the debt, the basis of the claim, and the relief sought.

- Obtaining Judgment – If the debtor does not respond to the claim or if the court finds in favour of the creditor, a judgment is obtained. This judgment is a formal decision by the court that the debtor owes the debt to the creditor. This is either summary judgment or default judgment.

- Enforcement of Judgment – Once a judgment is obtained, various enforcement actions can be taken to recover the debt. This may include through the Courts by issuing an enforcement warrant to seize and sell the debtor's assets; or insolvency with bankruptcy against an individual debtor; or issuing a statutory demand and then initiating liquidation insolvency proceedings if the debtor is a corporation.

- Bankruptcy or Liquidation Proceedings – If the debtor is unable to pay the debt, bankruptcy (for individuals) or liquidation (for companies) insolvency proceedings may be initiated. This involves the sale of the insolvent debtor's assets to pay off the debt.

- Post-Recovery Actions – After the debt is recovered, there may be additional steps to finalise the matter, such as notifying credit reporting agencies or concluding any legal proceedings.

We have a detailed article here – https://stonegatelegal.com.au/legal-proceedings-for-debt-recovery/

The Strength of a Debt Recovery Law Firm

Another great way that hiring a small business debt recovery law firm can benefit your business is through the strength of a debt recovery & litigation lawyer in convincing a debtor to pay.

A lawyer is very professional and to the party that the debt is being collected from, an almost authoritative appearance.

This means that, upon becoming aware that a debt recovery law firm is acting for you, your debtor will become aware that you are serious about collecting this debt and will take legal action against them if necessary.

Lawyers are also further equipped with the negotiation and communication skills necessary to help get your debtor to make a payment.

If you choose to send a letter of demand to your client, the appearance of a commercial litigation lawyer's letterhead will provide the letter with that extra element of convincing that you are serious about this debt and will not give up on recovering it.

Other strengths of using a business debt recovery law firm include:

- Increased Perception of Seriousness – The involvement of a law firm in debt recovery signals a serious intent to recover debts, which can motivate debtors to prioritise repayment to avoid legal consequences (such as seizure of property).

- Legal Action Awareness – Debtors become more aware of the potential for legal action, including legal action, which can lead to more prompt payment to avoid such escalations.

- Precedent Setting – When a company consistently uses a law firm for debt recovery, it sets a precedent. This knowledge can deter future clients or customers from delaying payments, as they are aware of the potential legal follow-up.

- Psychological Impact – The mere presence of a legal entity in the debt recovery process can have a significant psychological impact on debtors, leading them to take debt repayment more seriously to avoid the stress and complexity of dealing with legal proceedings & the seizure of property or insolvency.

- Reputation Consideration – Businesses and individuals are often concerned about their reputation. The possibility of legal proceedings initiated by a law firm can encourage them to settle business debts to avoid public legal disputes.

Quality Business & Debt Recovery Legal Advice

Another great way that hiring a debt recovery law firm can benefit your business is with their quality legal advice for all your law-related needs.

Debtors who don't want to pay will often try to avoid paying by any means necessary, especially if they do not have the funds or are otherwise unable to make payments. This may mean that they raise a dispute or some type of legal action against you in hopes of having the debt dismissed or, at the minimum, put off for longer.

This can be quite stressful and confusing for the average creditor, especially if they have not encountered a dispute of this sort or a dispute at all in the past.

A business debt recovery law firm can provide quality legal advice about how to manage these types of disputes and any others that you might be dealing with. This way, all of your debt-related disputes can be managed with the utmost professionalism and knowledge.

Case Study

We were engaged by a mid-sized company who faced a significant challenge when one of their long-term clients defaulted on a significant payment. This debt was critical for our client's cash flow and operational expenses.

The debtor not only failed to make the payment but also raised a dispute. They claimed that the parts supplied were substandard and did not meet the contract specifications (which was denied by our client).

It was challenging because our client lacked the expertise to handle such legal disputes. The situation was stressful and confusing, especially since they had never faced such a dispute before. After Stonegate Legal were engaged, we provided a legal assessment, and providing strategic advice to get the best outcome.

Through skilled negotiation and the presentation of compelling evidence, the dispute was resolved. The debtor agreed to pay the outstanding amount in a structured payment plan and our client received the owed amount in full over an agreed period, avoiding a costly and time-consuming legal battle.

Debt Recovery Law Firms can be Flexible

Another great way that hiring a debt recovery law firm can benefit your business is by being flexible in their work to fit your needs.

Everyone comes into the debt collection process looking for something slightly different. Of course, everyone wants their debts to be collected; that is a given. However, there are several other variables, like how it will be collected and how this should be managed, that will vary.

Debt collection agency lawyers can be extremely flexible in meeting each of their clients' needs correctly so that everyone walks away happy!

No more making your needs fit around your debt collector; find a small to medium business debt recovery law firm that will fit your needs!

The flexibility of debt recovery law firms can also include:

- Adjustable Service Levels – They can offer different levels of service, from basic advisory roles to full representation in court, based on the client's needs and budget.

- Client-Specific Payment Plans – Law firms can negotiate payment plans that are suitable for both the creditor and debtor, considering the financial situation and preferences of the client.

- Diverse Industry Knowledge – These firms often have experience across various industries, allowing them to tailor their debt collection & recovery services to the unique challenges and regulations of each sector.

- Flexible Communication Methods – They can adapt to the preferred communication methods of clients, whether it's through regular meetings, email updates, or digital platforms.

- Responsive to Changing Situations – Debt recovery law firms are adept at adjusting their strategies in response to new developments or information in a debt recovery case (COVID-19 for example).

- Tailored Collection Strategies – Debt recovery law firms can develop customised collection strategies that align with the specific circumstances and preferences of each client.

- Varied Legal Approaches – A business debt recovery law firm can employ a range of legal approaches, from gentle reminders to formal legal proceedings, depending on the client's approach to debt recovery.

Debt Recovery Law Firm – Professional Approach

Another great way that hiring a debt recovery law firm can benefit your business is by taking a professional approach to collecting your debt.

As business collection agency lawyers, we understand that managing overdue payments can be a tricky part of running a business. It's not just about getting back what you're owed; it's also about maintaining your reputation and staying within the bounds of the law.

That's where a debt recovery law firm, like ours, comes into play, offering a professional and balanced approach to this delicate issue.

However, when you hire a debt collection law firm, you can better expect professional behaviour and rule-following. You can expect a law firm to negotiate on your behalf in a manner that is both stern and to the point, but professional and friendly also.

Choosing a debt recovery law firm means choosing a partner who values professionalism, respects legal boundaries, and understands the importance of maintaining good business relationships. It's about getting back what you're owed in a way that's fair, respectful, and, most importantly, effective.

Debt Lawyers may Allow you to Improve Your Business

Another great way that hiring a debt recovery law firm can benefit your business is by giving you the time to improve your business without the pressure of collecting debt sitting on your shoulders.

Your business and its management and growth should be your priority, but collecting business debts can take up too much of your time to even consider this kind of stuff!

By hiring a debt recovery law firm for your business debts, you can refocus your attention on your business and develop it. The firm will take over much of the debt collection process (still allowing for your input, of course) so that you can take your mind off of debt collection and do something else with all of that saved time.

By outsourcing your debt collection services or your accounts receivables, it can free you up to concentrate on business development, customer relations, employee development, financial management, innovation and research, marketing and sales, networking and partnerships, operational efficiency, quality control, and/or strategic planning.

Every business owner seems to need more hours in a day; you can claim yours by hiring a recovery firm.

Debt Recovery Law Firm – Respectability

Another great way that hiring a debt recovery law firm can benefit your business is by making your business seem more professional and respectable. By investing in a recovery firm, you will appear to be a more professional person yourself!

As we have discussed, a debt collection law firm will collect your business debts with the utmost knowledge and professionalism with fixed fee and economical debt recovery services.

Due to their disconnect from the debt, whereas it may be a bit more personal for you, they will remain calm and level-headed. This can make you appear to be taking the steps of a professional business owner who cares about their clients!

This way, your debtors will see that you are putting in the effort for them and ensuring that their debt is dealt with effectively.

Why Engage a Debt Recovery Lawyer Early?

If you have a debt dispute or if you have a continuing and increasing number of debts, then it is important to engage a debt collection law firm early, because of the following benefits debt collection services can bring (inter alia):

- Cash flow improvements

- Continuity for legal action

- Expertise & proficiency

- No commissions

- Professional appearance

- Risk management

- Save your money

- Timesaving

We will explain these in a little more detail below.

Cash Flow Improvements

Another great reason why you should engage a debt collection lawyer & commercial lawyer early when a debt is difficult to collect is to improve the cash flow in your business.

The term 'cash flow' describes the amount of money coming in and out of your business in income and expenses respectively.

It is important that your cash flow is positive, meaning that there is more money coming in than going out, in order to maintain your business's financial health.

By hiring collection agency lawyers early, you streamline the collection process and provide a boost to your cash flow!

Continuity for Legal Action

Another great reason why you should engage a debt collection solicitor early when a debt is difficult to collect is to allow continuity if legal action and commercial litigation is necessary.

When you hire a debt collection lawyer early, you ensure that they have an advanced understanding of your debt and its proceedings if the matter comes to commercial litigation & legal action.

This is because a debt collection lawyer will generally pursue many other collection methods before taking action in court, so they will have plenty of time to become acquainted with your debtor and the matter in general.

Expertise & Proficiency

Another great reason why you should engage a debt collection lawyer early when a debt is difficult to collect is to access their expertise.

Commercial litigation lawyers are professionals in the field of debt recovery with the law. This means that you can access this professionalism and expertise and apply their skill in your business!

You can learn from their actions and apply the methods that they use with your debtors in the future for better collection down the road!

No Commission

Another great reason why you should engage a debt collection lawyer early when a debt is difficult to collect is that they prioritise facts over commissions.

When you engage a lawyer, you are putting your debt in the hands of someone who is not making their commission based on how much of the debt is collected.

This means that your legal collection agency lawyers will focus on the facts of the debt and how to realistically recover it, rather than brashly attempting to collect as much money as quickly as possible.

This can lead to improved customer relations and a move thought-out, effective process of collecting your debt that deems better results for everyone involved!

Professional Appearance

Another great reason why you should engage a business debt collection lawyer early when a debt is difficult to collect is for a professional appearance for your business. It is always great to look presentable and professional as a business.

Who better to do this for you than a professional debt collection law firm or commercial litigation lawyer?

By hiring a debt collection lawyer early, you show your debtors that you both mean business with the debt and intend to deal with it professionally.

Tensions can rise between creditors and debtors when the debtor is not making payments consistently; don't give them the chance and avoid arguments with clients!

Debt Recovery Law Firm – Risk Management

Another great reason why you should engage a business debt collection lawyer early when a debt is difficult to collect is to manage legal risk in your business.

As legal professionals, legal collection agency lawyers will have an advanced understanding of the laws and guidelines associated with collecting debt.

This can prevent the accidental violation of laws, which can be highly damaging to your business and you personally in some circumstances.

Save Your Money

The first reason why you should engage a small business debt collection lawyer early when a debt is difficult to collect is to save yourself some money.

When you are dealing with problem debts, money is not something that you want to be spending a lot of.

Many creditors avoid taking action with debt recovery lawyers because of the cost of their recovery services. However, contrary to popular belief, hiring a commercial litigation lawyer can actually save you money in the collection process.

By hiring a collections lawyer, you are investing in a highly effective service that will likely collect your debt in a fraction of the time that it would take you to do it yourself. This can save you money on all of the failed collection efforts and money spent dealing with clients as the matter continues.

Debt Recovery Law Firm – Timesaving

Another great reason why you should engage a debt collection lawyer early when a debt is difficult to collect is to save time with the collection process.

Time is something that creditors never seem to have enough of. When it comes to collecting a debt, chances are you would like the money back in a timely manner, especially when you are having issues with the client.

By hiring a debt collection lawyer early in the process, you ensure the debt is in the hands of someone who is experienced and can get the recovery the fastest it can be recovered!

Debt Recovery Law Firm FAQ Questions

Welcome to our comprehensive FAQ section on Debt Recovery in Australia.

Here, we aim to provide clear and concise answers to some of the most common questions regarding the process of recovering debts, the role of debt collection solicitors, and the legal implications involved.

Whether you're a business owner, creditor, or an individual facing debt recovery actions, this section is designed to offer valuable insights and guidance to help you navigate the complexities of debt recovery in Australia.

What do debt recovery lawyers do?

In Australia, debt recovery lawyers assist creditors in retrieving unpaid debts by using their legal expertise to navigate the country's specific business debt collection laws and regulations. They engage in negotiations with debtors, prepare and handle legal documents, and can represent creditors in court proceedings. Their role is crucial in ensuring that the debt recovery process is conducted in compliance with Australian legal standards, and they often provide strategic advice to maximize the chances of successful debt recovery.

Can you ignore a debt recovery law firm?

Ignoring debt recovery lawyers in Australia is generally not advisable. If they are contacting you, it indicates that a creditor is taking serious steps towards recovering a debt. Ignoring them can lead to legal actions, including court proceedings, which might result in judgments against you, potentially leading to wage garnishments or asset seizures. It's better to engage and communicate to explore possible resolutions or payment plans.

What happens after 6 years of not paying debt?

In Australia, if a debt is not acknowledged or paid for over six years, it may become statute-barred under the Limitation of Actions Act. This means the creditor may lose the legal right to enforce the debt through the court system. However, this does not erase the debt; it simply limits the legal remedies available to the creditor. It's important to note that this period can vary depending on the type of debt and the state or territory.

What happens if I don't pay a debt recovery law firm?

If you don't pay a debt in Australia, the debt recovery process can escalate. Initially, you may receive reminders and demands for payment. If these are ignored, the creditor may engage a debt recovery lawyer or legal collection agency, and the matter could proceed to court. If a court judgment is issued against you, it could lead to wage garnishment, property liens, or seizure of assets. It's important to address debt issues proactively to avoid these consequences.

How long does debt recovery last?

The duration of the debt recovery process in Australia varies depending on several factors, including the complexity of the case, the debtor's response, and the specific recovery methods used. Generally, the process can take anywhere from a few weeks to several years, especially if legal proceedings are involved. The statute of limitations for recovering debts also plays a role, typically being six (6) years for most debts, and for judgments the limitation is twelve (12) years.

How do you initiate legal action to recover a debt?

To initiate legal action to recover a debt in Australia, the creditor typically starts by sending a formal letter of demand to the debtor, outlining the owed amount and demanding payment. If this is unsuccessful, the next step is to file a claim in the appropriate court. This involves preparing and submitting legal documents, after which the court will serve these documents to the debtor. The debtor then has an opportunity to respond, potentially leading to a court hearing.

What are the stages of debt recovery?

The stages of debt recovery in Australia typically include: 1) Initial contact and reminders to the debtor; 2) Formal demand for payment; 3) Engagement of a debt recovery service or lawyer if the debt remains unpaid; 4) Legal action, involving filing a claim in court; 5) Court judgment, if the debtor fails to respond or pay; and 6) Enforcement of the judgment, potentially involving seizing assets or garnishing wages.

What is the difference between debt collection and debt recovery?

In Australia, debt collection generally refers to the process of pursuing payments of debts owed by individuals or businesses, often conducted by debt collectors or collection agencies. Debt recovery, on the other hand, often involves legal action and is usually undertaken by debt collection solicitors or legal professionals. It typically comes into play for more complex or larger debt cases, or when initial collection efforts have failed.

How do I recover a debt from an individual in Australia?

To recover a debt from an individual in Australia, start by sending a clear and concise letter of demand, stating the amount owed and the deadline for payment. If this doesn't work, you may consider using a business debt collection agency or consulting a debt recovery lawyer for legal options. It's important to keep records of all communications and transactions, and to ensure that all actions comply with Australian debt collection laws.

How can I be successful in debt recovery?

Success in debt recovery in Australia often involves clear communication, understanding legal rights and obligations, and maintaining accurate records of all transactions and interactions with the debtor. Utilising a professional approach, whether through a debt collection agency or a debt recovery lawyer, can also be effective. It's important to act promptly and consistently, and to be open to negotiation and reasonable payment arrangements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.