Why owners should treat themselves as creditors of their own business.

As insolvency practitioners, we see a lot of SME businesses in our line of work. There are currently approximately 2.3 million SMEs in Australia, SMEs are comprised of 2.259m small business (being a business with 19 or fewer employees) and 50,000 medium enterprises (being a business between 20 and 199 fewer employees). There are less than 4,000 large businesses in Australia. The SME sector represents the biggest employer in the Australian economy and only about half of those businesses are incorporated as companies limited by shares. Last year, while nearly 350,000 businesses were founded, in the same time period, approximately 275,000 were at the end of their business lifecycle. Around 75% do not survive more than three years and these numbers have been similar for the last decade. This means that while insolvency is common in this sector, only 50% of business owners are protected by their company structure.

At the time that SME businesses are started, often there is a requirement for the owner or owners to put up a significant amount of their own money to be able to start the business, buy plant and equipment and/or to enter into a lease. Frequently, that money will come from personal savings, a personal loan or redrawing on a mortgage loan over a property such as their primary residence.

Given most SME business owners have no protection from their business's structure, it is highly advisable that owners' register the investments they make in their businesses on the Personal Property Securities Register (PPSR). This records the investment as a formal, documented loan and provides owners with the confidence to continue to make investments in their business when required, with comfort that if the company fails, they will recover some or all of their funds.

While we know that many accountants and other professional advisers advocate this course of action to their SME-owner clients, the evidence from past administrations suggests that this advice isn't being acted upon. There are likely to be several reasons for this, including that:

- people opening new businesses are not seeking advice before starting a business;

- the advice does not extend beyond noting the loan in the journal;

- the advice suggests that the loan and security is documented but does not extend to registering a security interest on the PPSR; or

- the advice is not followed because getting a legal specialist to prepare documents and register the interest on the PPSR is too expensive.

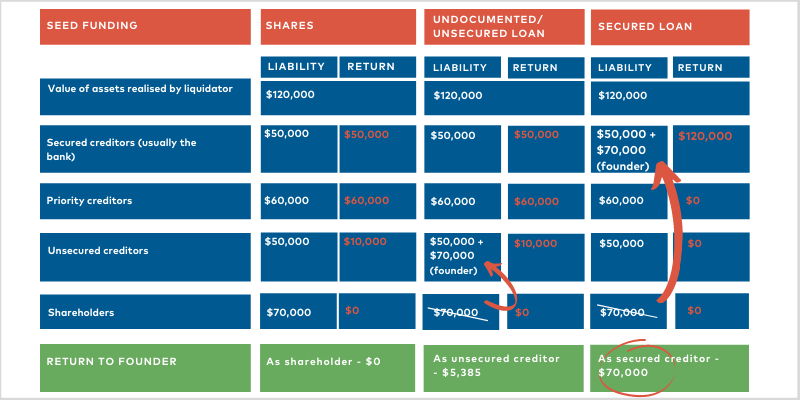

None of these are commercially justifiable reasons as there is a significant difference as to what an owner would recover on the realisations of assets by a liquidator should the loan be unsecured or unregistered versus a secured loan registered on the PPSR. This is due to the priority set out in section 556(1) of the Corporations Act 2001. The following table highlights those differences in a scenario that is typical in the liquidation of an SME:

This demonstrates that in the scenario above, with a registered secured loan, an owner would recover all of their unpaid investment. It is interesting to note that there is not a great deal of difference between not having a loan at all and having a loan without a registration on the PPSR. The money that can be recovered by the owner can then be used by them to continue to pay household bills or even to start another business.

Furthermore, beyond increasing the owner/s chance of recovering their investment, registering a loan on the PPSR could allow their current company to survive and prosper again as it puts them in a far better position to propose a viable deed of company arrangement (DOCA). In our last newsletter, we set out how a DOCA can be used to deal with the debt that has built up during the Covid-19 period click here. This is because the biggest obstacle to an owner proposing a commercially-viable and acceptable DOCA is the amount of money that is necessary to deliver enough to creditors and to keep the company going during the administration period until the DOCA is put in place. As a secured creditor, the owner is in a far stronger position. They can affect the direction of the administration which could include the acceptance of the DOCA. This happens by virtue of the fact that the secure creditor will retain the secured assets if the DOCA it proposes is not accepted. The secured creditor can also use the amount that it is owed to allow unsecured creditors to receive payment in circumstances where they would otherwise receive nothing (or very little) in liquidation by deferring its payment by the company.

The power owners have in the administration proceedings as a secured creditor allows owners to seek advice early and to plan for a smooth and quick process to rehabilitate the company and to begin to thrive again. This will likely also significantly reduce the cost of the Voluntary Administration and DOCA process and allow the owner to maintain the continuity of trading the business throughout. The position as secured creditor also allows the owner greater bargaining power to work together with the bank or private financiers and to deal with things like guarantees given to supply creditors, interactions that can otherwise derail the process.

Big thanks to Matthew Kelly and the team at Krodok (Krodok.com.au) for their insights and assistance in drafting this article.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.