The Federal Government's JobKeeper Payment Scheme, which was announced in March 2020, is one of the most significant business stimulus packages offered by the Government in response to the COVID-19 pandemic. The scheme aims to keep Australians employed, in their pre-pandemic role with their employer.

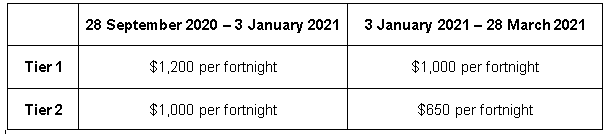

The original JobKeeper Payment Scheme saw eligible employers receive fortnightly 'JobKeeper Payments' of $1,500 per eligible employee. However, from 28 September 2020, payments will decrease and employer eligibility restrictions will tighten. Further changes will also come into effect on 4 January 2021.

New Payment Rates

A new tiered approach will determine an employee's JobKeeper Payment rate, generally based on their average hours worked.

Tier 1 rates apply to employees who worked 80 hours or more (including paid leave or paid public holidays) over the 4-week pay period preceding either 1 May 2020 or 1 July 2020. Tier 2 rates apply to those who worked less than 80 hours.

As per the original JobKeeper eligibility requirements, employees will be eligible if they:

- Are currently employed by an eligible employer (this includes those who have been stood down or re-hired);

- Were employed by the employer on 1 July 2020;

- Are full-time, part-time, or a casual employee who had been employed on a regular basis for longer than 12 months as at 1 July 2020;

- Are 18 years old, or at least 16 years old if independent;

- Are an Australian citizen, the holder of a permanent visa, a Protected Special Category Visa Holder, a non-protected Special Category Visa Holder who has been residing continually in Australia for over 10 years, or a Special Category (Subclass 444) Visa Holder; and

- Are not receiving a JobKeeper Payment from another employer.

The payments are considered taxable income and PAYG income tax must be withheld. It is at the employer's discretion whether to pay superannuation on any wage increases stemming from the JobKeeper Payment.

New Eligibility Restrictions

Businesses seeking eligibility under the new JobKeeper Payment Scheme will be required to demonstrate an actual decline in turnover of 30% in the September 2020 quarter compared to the same period in 2019 (50% for those with an aggregated turnover of more than $1 billion and 15% for charities and not-for-profits). The further revised JobKeeper Payment Scheme that will come into effect on 4 January 2021 requires reassessment for the December 2020 quarter.

Applications for the JobKeeper Payment Scheme are open and businesses can apply directly via the ATO.

For employers and employees alike, JobKeeper and other stimulus measures are helpful and is undoubtedly a lifeline. For many others, the simple concept of recovering financially from the economic knock-on effect of COVID-19 seems unachievable and quite simply unrealistic.

If these measures have not been effective in assisting your business, and you are facing solvency issues, you should seek early advice from a qualified insolvency practitioner.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.