The Federal Government has recently announced various changes to the JobKeeper scheme, including that it will extend JobKeeper payments from 27 September 2020 until 28 March 2021, vary the JobKeeper eligibility requirements and gradually reduce the payment rates. These changes will come into effect from 28 September 2020, with the existing JobKeeper scheme remaining in place until 27 September 2020.

The extension and changes to the JobKeeper scheme are intended to help businesses and not-for-profits that have been most significantly impacted by COVID-19. This includes sectors such as hospitality, tourism and creative arts.

It is up to employers receiving JobKeeper to ensure that they meet the new eligibility criteria and accurately nominate the correct payment rate for employees.

Snapshot

- The JobKeeper scheme, which was due to end on 27 September 2020, is being extended until 28 March 2020.

- The Government has announced changes to eligibility requirements and payment rates, which will come into effect from 28 September 2020.

- Eligibility will be determined by actual, rather than projected, GST turnover loss and two tiers of reduced payment rates will be introduced.

Changes to employer eligibility – new turnover loss test

One of the major changes to the scheme is that eligibility will no longer be assessed according to projected GST turnover loss – instead it will be assessed according to actual GST turnover loss.

To continue to be eligible for JobKeeper from 28 September to 3 January 2020, employers will have to demonstrate an actual loss in the September quarter of 2020, of:

- 50% for businesses and not-for-profits with an aggregated turnover of more than $1 billion;

- 30% for businesses and not-for-profits with an aggregated turnover of less than $1 billion; or

- 15% for charities.

A further reassessment must be done for the period between 4 January 2021 and 28 March 2021, by reference to the actual GST turnover loss in the December quarter of 2020.

These changes do not come into effect until 28 September 2020, so new applicants for the JobKeeper payment who apply before that date will be required to demonstrate a projected (rather than actual) decline in turnover of the relevant amount.

Reduction in payment rate

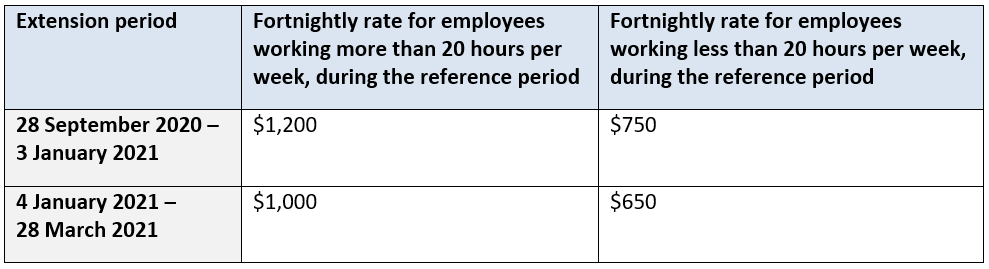

After months of speculation, the Government has confirmed it will reduce the JobKeeper payment rate for employees, starting from 28 September 2020. From that date, two tiers of payments will be introduced in order to better reflect the incomes of employees before the COVID-19 pandemic. These payments will be further reduced on 4 January 2021.

Determining which tier of payment employees fall into will be done according to what is called the 'reference period', which is the four weeks prior to 1 March 2020 and the four weeks prior to 1 July 2020. If employees were eligible for JobKeeper at both 1 March 2020 and 1 July 2020, the four week period with the higher number of hours of work is used. If not, the four week period prior to 1 July 2020 is used.

The new payment rates are summarised in the table below.

Employers are responsible for nominating which payment rate they seek to claim for each eligible employee.

Key takeaways

Employers have a responsibility to ensure their business meets the relevant turnover requirements at various points throughout the year. They must also take care to ensure eligible employees are correctly classified in order to receive the appropriate JobKeeper subsidy – there is no longer a 'one-size-fits-all' approach to the scheme.

As the JobKeeper scheme has been extended, the JobKeeper amendments to the Fair Work Act 2009 will continue to apply. This means that employers are still able to utilise the various JobKeeper enabling directions to manage employees and business decline as a result of COVID-19, such as a JobKeeper enabling stand down direction and a direction to perform different duties and work at different places.

This publication does not deal with every important topic or change in law and is not intended to be relied upon as a substitute for legal or other advice that may be relevant to the reader's specific circumstances. If you have found this publication of interest and would like to know more or wish to obtain legal advice relevant to your circumstances please contact one of the named individuals listed.