The aim of this year's Federal Budget is clear: increase consumer and business confidence, grow the economy, and create jobs. One way the government hopes to achieve this goal is through a boost to research and development (R&D) investment.

"We are providing $2 billion in additional Research and Development incentives – removing the cap on refunds, lifting the rate and rewarding those businesses that invest the most."

Treasurer Josh Frydenberg

The government has abandoned its controversial Treasury Laws Amendment (Research and Development Tax Incentive) Bill 2019 that sought to cut $1.8 billion from the R&D tax incentive. Instead, from 1 July 2021 it will inject $2 billion through a simpler system that rewards companies for investing more in R&D.

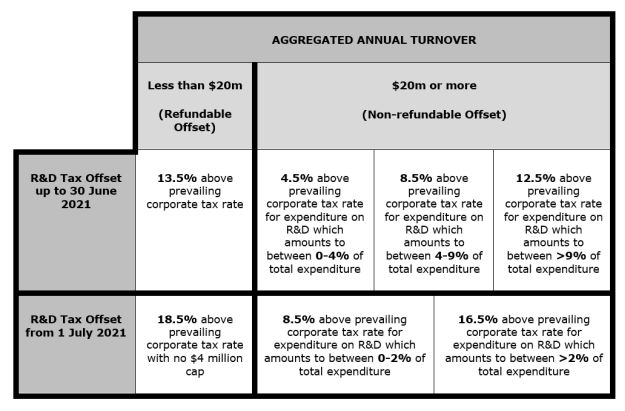

For businesses generating less than $20 million per annum, the refundable R&D tax offset will be raised from 13.5% to 18.5% above the prevailing corporate tax rate. The $4 million refund cap will no longer apply.

Businesses generating more than $20 million per annum will benefit from a simpler two-tiered system that boosts the R&D tax offset rates for those businesses investing more than 2% of their expenditure on R&D. However, base rate entities will lose the existing net tax benefit of the reduced corporate tax rate.

Businesses investing a greater proportion of their expenditure in R&D will benefit most from the changes, with intensity premiums rising to 16.5% for investments in excess of 2% compared with 8.5% for lower levels of investment.

Table: R&D tax incentive changes for businesses

The government will increase the R&D expenditure cap from $100 million to $150 million and has flagged improvements to the administration, integrity and transparency of the R&D tax incentive.

The changes apply from 1 July 2021.

Originally published 8th October 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.