Government principals and their contract management consultants must be extra diligent in assessing and responding to payment claims under the security of payment regime as a result of a recent case in New South Wales that will be equally applicable in Queensland.

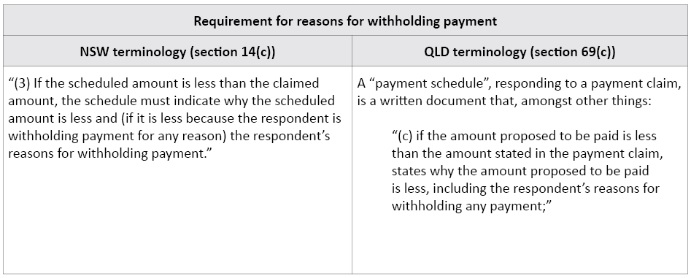

In the case of Turnkey v Witron, the NSW Supreme Court held that the payment schedule was invalid under section 14 of the Building and Construction Industry Security of Payment Act 1999 (NSW) (NSW Act). In relation to its relevance to Queensland, this provision is similar to section 69 of the Building Industry fairness (Security of Payment) Act 2017 (QLD) (Qld Act), with the terminology of each set out below:

The case involved the principal (Witron) and the contractor (Turnkey) entering a contract for electrical installation works at a fixed price of $11.4 million. As a result of delays and an issue with the scope of works, the contractor sought to re-price the contract at $14,141,951.32.

After numerous email exchanges in April 2023, it appeared that both parties had agreed to the new contract price. On 1 May 2023, the contractor served the principal with a payment claim for $499,924.63 for the contract works and $304,230 for 10 identified variations. Two days after, the principal sent an email to the contractor, which they later claimed was the payment schedule. The email appeared to conflict with the emails in April regarding the acceptance of the revised contract price. The case then turned to whether the email constituted a valid payment schedule.

The case determined that a payment schedule must contain reasons that are "clear enough" to indicate why payment is being withheld. Whether a payment schedule is clear will be entirely dependent on the construction of the payment schedule, the words that are used and what can be inferred.

However, what is of particular interest is the Court's response to the partial reasoning provided by the principal in response to the payment claim. In this case, it was established that the principal had provided reasons for withholding payment for 60 per cent of the items for which payment was withheld, but failed to give reasons for the remaining 40 per cent. Although there was adequate reasoning for most of the payment schedule, the failure to provide reasoning for the remaining portion resulted in the entirety of the payment schedule being invalid.

This outcome means that the party responding to a payment claim cannot ignore part of the claim for which money is being withheld and must address every aspect of the payment claim, providing clear reasons for withholding payment. However, whilst the reasons must be clear, the NSW Act does not require "that the reasons given be correct, justified or adequate." The Qld Act also provides no basis under section 69(c) for a reason to be correct, it just must be stated within the payment schedule.

If Queensland courts take the same approach as done in NSW, it will have significant consequences for those issuing payment schedules (including government principals and their consultants) because, if a payment schedule does not adequately address every aspect of the payment claim, the party responding to the claim will be held liable to pay the full amount claimed despite providing reasons for withholding payment on most of the items for which payment was being withheld.

Arguably, a better interpretation of section 14 of the NSW Act would be that the requirement to provide reasons in the payment schedule be viewed as an opportunity to do so. This would ensure that any consequence would be the onus of the respondent rather than invalidating the entire payment schedule. Such a consequence would bring into effect section 20(2B) of the NSW Act, which is akin to section 82(4) of the Qld Act, effectively barring the respondent from raising reasons that had not been identified in the payment schedule.

If government principals on construction projects wish to avoid future disputes, the best approach is to ensure that every part of the payment claim is carefully assessed and that appropriate reasons be given for any withheld payments. This results in both parties having a much better understanding of each other's position on payment.

This publication does not deal with every important topic or change in law and is not intended to be relied upon as a substitute for legal or other advice that may be relevant to the reader's specific circumstances. If you have found this publication of interest and would like to know more or wish to obtain legal advice relevant to your circumstances please contact one of the named individuals listed.