Liechtenstein is a particularly crypto-friendly jurisdiction in Europe: As early as 2020, Liechtenstein implemented the TVTG aka "Blockchain Law", a comprehensive regulation of the token economy, thus creating legal certainty. The country in the heart of Europe is home to a vibrant crypto scene: by now, more than 28 companies have registered for nearly 60 service provider roles, including 4 larger exchanges. MiCAR provides for transitional provisions and facilitations for service providers registered under national laws. Exchanges that are registered in Liechtenstein under the Blockchain Law by the end of 2024 can benefit from this.

The MiCAR regulation is intended to end the existing patchwork and ensure maximum harmonization in the crypto sector: As an EU regulation, MiCAR is binding for all member states and applies directly in all EU member states for all crypto assets that do not fall within the scope of the existing EU financial regulations. The central goal of this regulation is to create legal certainty throughout Europe. The regulation is also intended to control the financial risk posed by crypto assets (e.g., risk to market integrity and financial stability). Innovation and further development should also be promoted. MiCAR will have a significant impact on the European crypto sector as a whole and beyond.

In order to maintain its pioneering role in the crypto sector, the government of Liechtenstein has submitted a proposal for an early amendment to the TVTG in preparation for MiCAR: The goal is to integrate certain MiCAR-CASP service providers into the TVTG even before it applies in the EU, and to create legal certainty during the transition from the Blockchain Law to MiCAR. The introduction of a new service provider role for lending and staking is also planned. Thus, Liechtenstein offers an added value of legal certainty and more than just MiCAR.

When does MiCAR apply in Liechtenstein?

MiCAR entered into force within the EU on 29 June 2023.The MiCAR rules addressed to market participants will gradually take legal effect: From June 2024, the provisions on asset-referenced tokens and e-money tokens will be applied in the EU, all other provisions from December 2024.

Liechtenstein is part of the EEA, not part of the EU, so MiCAR is not directly applicable in Liechtenstein. With the publication of the regulation in the Official Journal of the EU, the process to incorporate it into the EEA Agreement begins. Liechtenstein will push for the adoption of MiCAR into the EEA Agreement and aims for full applicability at the same time as in the EU, 18 months after announcement in the Official Journal. This would have the consequence that all regulations of MiCAR - especially with regard to issuers and CASPs - would be implemented at the same time as in the EU.

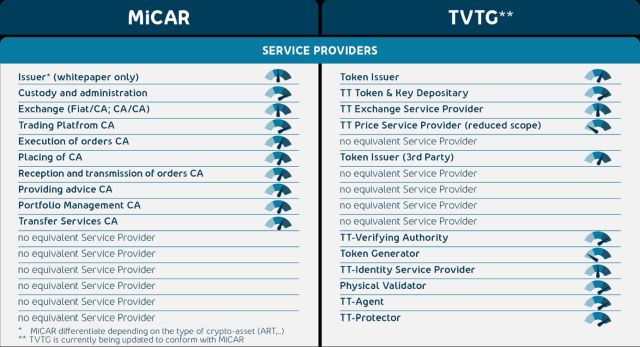

Comparison of TVTG service provider roles with CASP

What do the transitional provisions/simplified procedure according regulate?

MiCAR contains transitional provisions for issuers of crypto-assets and providers of crypto-asset services (CASP).

Transitional provisions for

- Issuers of crypto-assets that are admitted to a trading platform before MiCAR comes into force:

- Marketing communications must comply with MiCAR

- The operator of the trading platform has to ensure within 36 months after the entry into force of MiCAR that a whitepaper is created, notified, and published in accordance with MiCAR

- Those providing TT services under national law may continue to provide their services

- For a maximum of 18 months after MiCAR comes into force, or

- Until they have received a permit under Art. 63 MiCAR, whichever comes first.

- Member states can decide not to offer this option of a transitional arrangement or to reduce the duration if they believe their national legal framework is less strict than the MiCAR regulation.

- Issuers of asset-referenced tokens (ART): May continue to offer these publicly until they have received a permit under Art. 21 MiCAR, provided they have applied within one month after it comes into force.

- Banks that publicly offer asset-referenced tokens (ART) may continue to do so, provided they have applied for a permit no later than 1 month after the entry into force of MiCAR.

- Simplified procedure for CASP: Member states can provide a simplified procedure for a permit as a CASP:

- Only for CASPs that have a national permit to provide CASP services at the time of MiCAR coming into effect

- For applications up to 18 months after MiCAR comes into effect

- The member state must ensure that the requirements of MiCAR are met

What advantages does Liechtenstein offer?

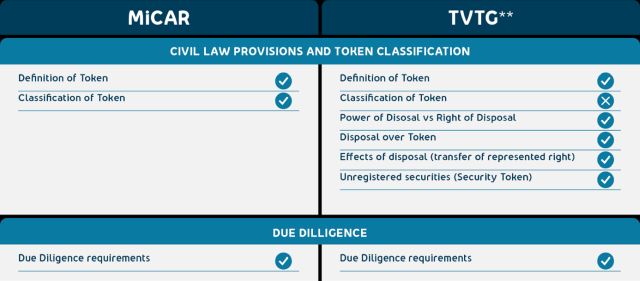

In addition to regulatory provisions, the Blockchain Law also contains civil law provisions, particularly with regard to tokens, the representation of rights by tokens, and their transfer: In Liechtenstein, classic property rights, even on physically indivisible value objects and fungible items, can be made digitally divisible and transferable into any number of token units through tokenization. This creates legal certainty and new opportunities for commercialization and liquidity creation.

In addition to its EEA access, Liechtenstein also has open access to the Swiss market due to its integration into the Swiss Franc currency area and a customs union. Over the past few years, a remarkable blockchain ecosystem has developed in Liechtenstein. The government and authorities of Liechtenstein are open to innovation and new technologies. Together, they are in constant dialogue with market participants. In order to promote the competitiveness and future viability of the financial center, the government of the principality has established the Financial Market Innovation and Digitalization Unit: It supports financial service providers or finance-related companies in their private innovation process. The Liechtenstein Financial Market Authority has also opened itself to the token economy by creating the "Regulatory Laboratory".

Here's how you should act now

We recommend checking now how the MiCAR regulation affects your business model. Do you need a white paper or does it make sense for you to register your company in Liechtenstein now and thus be MiCAR-ready? Are new adjustments required in the area of compliance? We are happy to assist you in analyzing and implementing what makes sense in your case.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.