A. INTRODUCTION

By enacting the Virtual Financial Assets Act (VFAA), the Maltese Government has regulated the Blockchain / ICO / DLT industry. The law appoints the Malta Financial Services Authority (MFSA) as the designated authority to oversee this business.

Since this industry has elements of the Financial Service Regulations (namely MiFID), it is important to clearly distinguish one from the other.

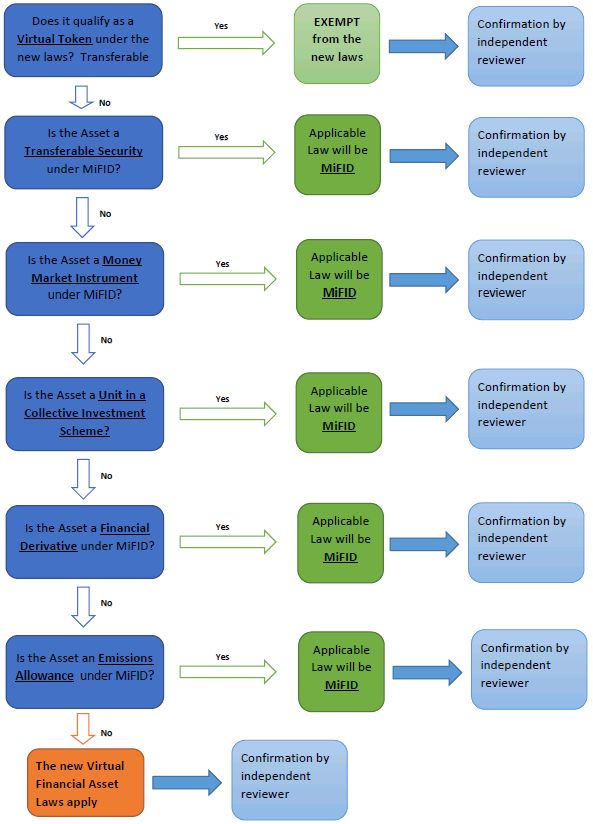

In order to ensure a clear difference, the MFSA has sought to further clarify the instances under which the new legislation applies. It has done this by introducing the Financial Instrument Test, which will be analysed below.

B. PURPOSE OF THE TEST

The objective of the Financial Instrument Test (hereinafter 'the Test') is to determine whether a Distributed Ledger Technology ('DLT') asset falls under:

- the existing Financial Services legislation (e.g. MiFID)

- the proposed Virtual Financial Assets Act ('VFAA') or

- is otherwise exempt.

By undergoing the Test, the DLT asset will be classified accordingly.

C. WHEN TO APPLY THE TEST

The Test will be applied in the following scenarios:

- In an Initial Coin Offering (ICO); and

- During the intermediation of DLT Assets by persons undertaking certain activities in relation to such DLT Assets (VFA Services).

Being the designated authority specifically appointed to oversee this business, the Malta Financial Services Authority (MFSA) is proposing that the Test is mandatory in the above scenarios.

In addition, the MFSA has also proposed that the Test is confirmed by an external reviewer.

D. DEFINITIONS

It is important to take into account the below definitions:

- Distributed Ledger Technology

(DLT) - means a digital or electronic database or ledger

which ordinarily is –

- distributed, shared and replicated;

- public or private or hybrids;

- permissioned or permissionless or hybrids;

- protected with cryptography or equivalent forms of encryption; and

- auditable:

- DLT Asset –

means –

- A Virtual Token; or

- A Virtual Financial Asset; or

- A Financial Instrument

- Virtual Financial

Asset – a VFA is any form of digital medium

recordation that is used as a digital medium of exchange, unit of

account, or store of value and that is not one of the following as

defined below:

- Electronic Money;

- Financial Instrument; and

- Virtual Token.

- Malta – ICOs – The New Legislation

- Malta – Virtual Financial Asset Services – The New Legislation

E. METHODOLOGY OF THE TEST

In a nutshell, the Test shall consist of a number of checklists. The aim of the Test is that the DLT Asset is analysed against a set of instruments in a prescribed order.

If the asset falls to be classified under any of these instruments, then by default it does not qualify as a Virtual Financial Asset under the new laws, and hence the latter shall not apply. It is important to keep in mind that this Test is to be used during both ICOs as well as when offering any of the VFA Services as regulated by law.

In brief, the following instruments will need to be analysed in the following order mentioned below. First there is a focus on Virtual Tokens and then the Test progresses to analyse various financial instruments under MiFID.

The following is the order of analysis of the instruments:

F. ANALYSIS OF THE VARIOUS INSTRUMENTS

It is now important to analyse the details of the Test by analysing the proposals of the MFSA:

1. Does the DLT Asset qualify as a Virtual Token under the VFAA?

The proposed definition of a Virtual Token is a DLT asset that:

- Has no utility, value or application outside of the DLT platform on which it was issued; and

- That cannot be exchanged for funds or legal tender on such platform or with the issuer of such DLT asset.

If the DLT Asset qualifies as such under the proposed regulations, then it should be exempt under the new laws, and hence the VFAA is not applicable.

If it does not qualify under the definition of a Virtual Token, one has to proceed to the next point below.

2. Does the DLT Asset qualify as a Transferable Security under MiFID?

The definition of "transferable security" refers to those classes of securities which are negotiable on the capital market, (except instruments of payment), such as:

- shares in companies or other entities, and depositary receipts in respect of shares;

- bonds or other forms of securitised debt, including depositary receipts;

- any other securities giving the right to acquire or sell any such transferable securities or giving rise to a cash settlement.

The main characteristics in order for a DLT Asset to be classified as a Transferable Security hence are the following:

- The DLT Asset is negotiable on the capital market; And

- The DLT Asset confers rights

analogous to those of shares in company or other entities such

as:

- Participation in the capital of the issuer;

- Right to receive proceeds from liquidation of issuer;

- Entry in the register of shareholders;

- Right to acquire or sell transferable securities -

- Right to voting;

- Right to dividends or other proceeds from company assets.

- Rights to periodical inco/ proceeds derived from

- Principal amount due of fixed sum with fixed / variable maturity; or

- Entry in the register of debenture holder

- Right to sell or acquire

- Is not an instrument of payment.

If the DLT Asset falls under any of the above definitions, the applicable regulatory regime is the MiFID, and not the VFAA. Hence, the new legislation will not apply in this case.

If it does not qualify under the definition of Transferable Security, one has to proceed to the next point below.

3. Does the DLT Asset qualify as a Money Market Instrument under MiFID?

These are defined as instruments which are normally dealt in on the money market, such as treasury bills, certificates of deposits and commercial papers and exclude instrument of payment.

The main features of a Money Market Instruments are the following:

- Have a valued that can be determined at any point in time;

- Are not derivatives; and

- Have a maturity at issuance of 397 days or less; and

- Have features substantively equivalent to treasury bills, certificates of deposits or commercial papers.

If the DLT Asset falls under any of the above definitions, the applicable regulatory regime is the MiFID, and not the VFAA. Hence, the new legislation will not apply in this case.

If it does not qualify under the definition of Money Market Instrument, one has to proceed to the next point below.

4. Does the DLT Asset qualify as a Unit in a Collective Investment Scheme?

A Collective Investment Scheme is defined as a scheme that has the following legally-defined characteristics:

- Objective of the issue is the collective investment of capital

- The scheme operates according to the principle of risk spreading; and either

- The contributions of the participants and the profits or income out of which payments are to be made to them are pooled; or

- At the request of the holders, units are or are to be repurchased or redeemed out of the assets of the scheme or arrangement, continuously or in blocks at short intervals; or

- Units are, or have been, or will be issued continuously or in blocks at short intervals.

If the DLT Asset falls under any of the above definitions, the applicable regulatory regime is the MiFID, and not the VFAA. Hence, the new legislation will not apply in this case.

If it does not qualify under the definition of a Unit in a Collective Investment Scheme, one has to proceed to the next point below.

5. Does the DLT Asset qualify as a Financial Derivative under MiFID?

The MiFID gives a detailed definition of 'derivatives' as follows:

- Options, futures, swaps, forward rate agreements and any other derivative contracts relating to securities, currencies, interest rates or yields, emission allowances or other derivatives instruments, financial indices or financial measures which may be settled physically or in cash;

- Options, futures, swaps, forwards and any other derivative contracts relating to commodities that must be settled in cash or may be settled in cash at the option of one of the parties other than by reason of default or other termination event;

- Options, futures, swaps, and any other derivative contract relating to commodities that can be physically settled provided that they are traded on a regulated market, a MTF, or an OTF, except for wholesale energy products traded on an OTF that must be physically settled;

- Options, futures, swaps, forwards and any other derivative contracts relating to commodities, that can be physically settled not otherwise mentioned in point 6 of this Section and not being for commercial purposes, which have the characteristics of other derivative financial instruments;

- Derivative instruments for transfer of credit risk;

- Financial contracts for differences;

- Options, futures, swaps, forward rate agreements and any other derivative contracts relating to climatic variables, freight rates or inflation rates or other official economic statistics that must be settled in cash or may be settled in cash at the option of one of the parties other than by reason of default or other termination event, as well as any other derivative contracts relating to assets, rights, obligations, indices and measures not otherwise mentioned in this Section, which have the characteristics of other derivative financial instruments, having regard to whether, inter alia, they are traded on a regulated market, OTF, or an MTF.

If the DLT Asset falls under any of the above definitions, the applicable regulatory regime is the MiFID, and not the VFAA. Hence, the new legislation will not apply in this case.

If it does not qualify under the definition of a Financial Derivative Instrument, one has to proceed to the next point below.

6. Does the DLT Asset qualify as an Emissions Allowance?

Emission Allowance Financial Instruments relate to units recognized for compliance with the Emissions Trading Scheme Directive. Emission Allowance is an allowance to emit one tonne of Carbon Dioxide or other greenhouse gases (as defined) during a specified period, which unit shall be transferable in accordance to the Directive.

In order for the DLT asset to qualify as an emissions allowance, it should be issued within the national competent authority in accordance to the directive.

If the DLT Asset falls under any of the above definitions, the applicable regulatory regime is the MiFID, and not the VFAA. Hence, the new legislation will not apply in this case.

If it does not qualify under the definition of an Emissions Allowance, then the new laws will apply.

G. FLOW CHART OF THE FINANCIAL INSTRUMENT TEST

H. CONCLUSIONS

By introducing the Financial Instrument Test, the MFSA has ensured a clear distinction between the current Financial Services Laws (MiFID) and the new Virtual Financial Asset Act.

The Test will be rendered mandatory and will have to be confirmed by an independent verifier. This confirms the importance of the test, as it will have a material bearing on which regulatory regime to apply.

Hence, one has to proceed with great caution before embarking on any ICO / DLT project, as there might be various laws that might need to be taken into consideration. A detailed analysis of the intended project is thus necessary in order to ensure legal compliance and avoid severe legal consequences.

To this effect, it is highly advisable that all ICO / Blockchain intended issuers seek proper legal advice and guidance at all stages of their project.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.