SK Engineering & Construction Co Ltd v Conchubar Aromatics Ltd and another appeal [2017] SGCA 51

In a recent landmark decision, the Singapore Court of Appeal reversed the High Court's Order sanctioning two schemes of arrangement. Shook Lin & Bok LLP's Partner Debby Lim acted as Singapore counsel for the successful appellant, who was the only creditor to object to the schemes. The Court of Appeal laid down guidance on the vexed issue of related creditors. Significantly, the Court of Appeal departed (albeit obiter) from its previous decision in The Royal Bank of Scotland NV (formerly known as ABN Amro Bank NV) and others v TT International Ltd and another appeal [2012] SGCA 9, on the appropriate discount to apply to the votes of related creditors that are not wholly-owned subsidiaries of the scheme company. As a testament to its complexity and the issues of public importance, this case was heard by a five-judge panel instead of the usual three.

Facts

The Scheme Companies, UVM Investment Corporation ("UVM") and Conchubar Aromatics Ltd ("Conchubar") were direct and indirect shareholders respectively in Jurong Aromatics Corporation Pte Ltd ("JAC"). Subsequently, JAC ran into financial difficulties and was placed into receivership in September 2015. As a result, the Scheme Companies themselves were in financial distress as their shares in JAC were their primary assets.

Jurong Energy International Pte Ltd ("JEI") was set up on 13 July 2015 in an attempt to preserve and rehabilitate the JAC project. JEI submitted to the receivers and managers of JAC ("JAC's R&M") a restructuring proposal ("the JEI Proposal").

The Scheme Companies then proposed the Schemes to their respective creditors.

Essentially, the core of the Schemes was contingent on JAC's R&M accepting the JEI Proposal, the effect of which was for JEI to purchase the two Scheme Companies' respective shares in JAC via the issue of JEI shares or JEI convertible bonds (of the same or greater value than that of their respective JAC shares) to the Scheme Companies. The said JEI shares or JEI convertible bonds would then be distributed pari passu to the two Scheme Companies' creditors.

On the other hand, if JAC's R&M were to reject the JEI Proposal or if one year passed from the date of commencement of the Schemes (the "Expiry Date"), whichever being earlier, then the two Scheme Companies would then be liable to make failsafe payments to their creditors.

On 18 March 2016, the Judge granted leave to the two Scheme Companies to convene meetings of their respective creditors to consider the Schemes.

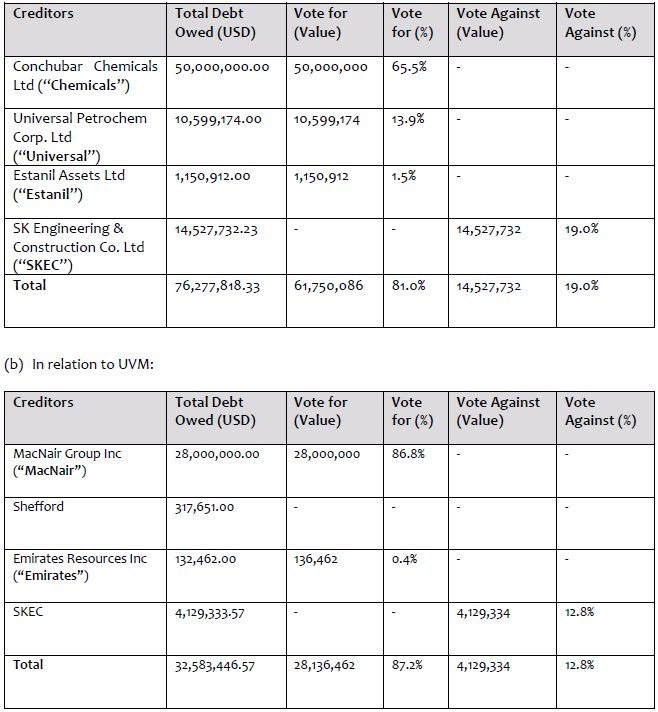

The voting results, which satisfied the requisite statutory majority set out under section 210(3AB) of the Companies Act, were as follows:

(a) In relation to Conchubar:

SKEC, who was a judgment creditor of both Scheme Companies, was the only creditor of the two Scheme Companies that voted against both of the Schemes. On 29 August 2016, the High Court sanctioned the Schemes (see Re Conchubar Aromatics Ltd and another matter [2017] 3 SLR 748). SKEC had objected on the basis that the votes of all the creditors which had voted in favour of the proposed Schemes ought to be wholly discounted, as they were each related to Conchubar or UVM. It further contended that the proposed Scheme was not feasible for lack of certainty as it was contingent upon the JAC's R&M's acceptance of the JEI Proposal.

The Issue of Related-Creditors

The Court of Appeal held that it is not possible to definitively set out what constitutes a related creditor as the objectivity of a creditor can be impaired in a myriad of ways – whether or not a particular creditor is a related creditor ultimately involves a fact-sensitive and fact-intensive analysis. The Court observed that the presence of one or more of the following (non-exhaustive) factors could go towards establishing the existence of a relationship between a creditor and a scheme company:

(a) The scheme company controls the creditor or vice versa. Alternatively, the scheme company and the creditor have a common controlling shareholder, i.e. a shareholder who owns (directly or indirectly) 50% or more of the shares in each of these companies.

(b) The creditor and the scheme company have common shareholder(s) who hold a less than 50% but more than de minimis stake in both companies.

(c) The creditor and the scheme company have common director(s)

(d) The scheme company's and the creditor's controlling shareholders are: (i) related by blood, adoption or marriage; or (ii) (where the controlling shareholders are corporate entities) controlled by individuals who are related by blood, adoption or marriage.

(e) The creditor is related by blood, adoption or marriage to the controlling shareholder(s) or director(s) of the scheme company.

The CA went on to hold that:

(a) Conchubar and Chemicals were not related parties. The Convertible Bond Subscription Agreement("CBSA"), SKECJI Shareholders' Agreement ("SKECJI SHA") and the Deed dated 12 November 2012 between SKEC and Conchubar did not show that they were related parties because:

(i) The SKECJI SHA merely indicated a funding commitment made by both Conchubar and SKEC towards SKECJI;

(ii) There was nothing to warrant the assertion that the CBSA was the means by which Chemicals undertook to assist Conchubar in fulfilling the latter's funding commitment under the SKECJI SHA;

(iii) It was not against commercial sense that SKEC would enter into such an arrangement; and

(iv) Despite Conchubar and Chemicals being wholly-owned by the same company and sharing a common director, they had made statutory declarations that Conchubar and Chemicals were not related and the Court had no reason to go behind the declarations.

(b) Universal and Estanil were not related parties. It did not follow that an assignee-creditor will automatically be found to be related to the scheme company simply because the assignment of debt to it by the assignor-creditor was not conducted at arm's length. Further, the Ultimate Beneficial Owners of Universal and Estanil had also made statutory declarations that those companies were not related to Conchubar and the Court had no reason to go behind them.

(c) UVM and MacNair were not related parties. Clause 4.1.1 of the UVM scheme would extinguish MacNair's share acquisition rights. Thus, MacNair had no special interest in the scheme over and above that of an ordinary creditor.

(d) UVM and Emirates were not related parties. The receivables assigned to Emirates were not connected to MacNair's rights under the Convertible Bond Agreement dated 31 March 2011. Even if they were, any rights would be extinguished by Clause 4.1.1 of the UVM scheme.

Apart from the Court's holding above, it also touched on the following topics during the course of its decision: –

The Debt Assignments

The CA was of the view that "vote-splitting" in order to circumvent the "headcount" test (i.e. majority in number) prescribed by section 210(3) of the Companies Act would mean that those who attended the creditors' meeting might not be "fairly representative of the class or creditors the class of members".

The Court's focus should be on satisfying itself that: (a) the statutory requirements have been satisfied; (b) the statutory majority have voted in a manner that is representative of the interests of the class concerned; and (c) the scheme is one which is reasonable.

Further, where creditors have obtained debts by assignment, there has to be sufficient information to satisfy the Court that the assignments were genuine and made at arm's length, such as through audit confirmations.

In the present case, the CA did not think that Chemicals and MacNair owed genuine debts to Universal, Estanil and Emirates. The High Court Judge should not have sanctioned the schemes without proof of authenticity of those debts. The appeals would therefore be allowed on this issue.

Material Non-Disclosure

The CA held that the rejection of the JEI Proposal should have been disclosed and it was difficult to believe that the Scheme Companies were unaware of the same.

However, as the directors of the Scheme Companies had deposed that their respective companies had been under the impression that the JEI Proposal was still under consideration, the CA had no choice but to accept that the Scheme Companies had not known of the rejection of the JEI Proposal at the time of the creditor's meetings; thus a finding that there was no material non-disclosure.

The Rejection of the JEI Proposal

The CA agreed that the rejection of the JEI Proposal had made the schemes unworkable and essentially meaningless. This was not on the basis of uncertainty, but on the basis that sanctioning the schemes in such circumstances would be "tantamount to the court sanctioning a scheme of arrangement to propose a new scheme, which is absurd".

The CA further agreed that the failsafe payments were not key to the schemes as they were only a miniscule fraction of the debt owed by the Scheme Companies.

Therefore, the schemes at the time of the sanction hearing were not schemes which "a man of business or an intelligent and honest man, being a member of the class concerned and acting in respect of his interest(s), would reasonably approve".

Commentary

No jurisdiction other than Singapore (in TT International (No. 1)) has suggested applying a partial discount to the votes of related creditors which are not wholly-owned subsidiaries of a scheme company. The Court felt that the exercise of determining an appropriate partial discount is inevitably arbitrary and subjective, and not amenable to definitive guidance. It opined that a more principled and certain approach is to wholly discount the votes of creditors once they are found to be related to the scheme company.

As the Court found that there were no related creditors, its views on the appropriate discount to apply to related creditors' votes are, strictly speaking, obiter. Nevertheless, this is still important guidance for future cases as similar issues are likely to arise. Even with the new cram-down provisions, the scheme proponent still has to obtain the support of creditors with at least 75% in value of the total debt.

A scheme is a creditor-centric democratic instrument which is given effect by law. However, the nature of schemes inevitably give rise to issues of minority creditor protection. In order to prevent the tyranny of the majority, the court retains supervisory oversight of the scheme process.

The Court of Appeal had certain misgivings about the debts of some of the creditors. The courts will not simply rubber stamp schemes regardless of the underlying factual matrix and without sufficiently robust evidence in respect of certain creditor debts. This decision is a keen reminder for those promulgating schemes that the Singapore Courts will not allow the integrity of this highly effective restructuring tool to be compromised. The words of Justice Snowden in a recent English judgment are particularly apt when he opined that "the scheme jurisdiction can only work properly and command respect internationally if parties invoking the jurisdiction exhibit the utmost candour with the court".

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.