I. What is Antitrust Law and what does it has to do with merger control rules?

Competition Law sets the rules governing the exchange of goods and services in the free market. It protects market freedom, the balance between supply and demand and encourages economic efficiency. Also, it helps to promote and regulate strong competition between different market players, to guide the action of the different competitors and to protect consumers. Those rules seek to protect the interests of consumers and to promote competition in a specific market by prohibiting individual or collective acts and/ or behaviors that can restrict competition by imposing barriers to entry to the market, by allowing the establishment of monopolies, by discriminating other actors of the market or by the establishment or abuse of a dominant position, among others.

Finally, Competition Law includes the regulation regarding (a) merger control, (b) anti-competitive and restrictive practices, (c) unfair competition and (d) consumer rights.

In the following paragraphs we are going to make a brief description of Merger Control regulation.

II. Colombian Antitrust Authority and applicable legal framework on Merger Control?

- Legal Framework

Law 1340 of 2009 and Resolution 10930 of 2015. - Antitrust Authority

According to Law 1340 of 2009, the Superintendence of Industry and Commerce ("SIC") is the only authority entitled to review a Merger in order to determine if it restraints competition in a relevant market.

Exceptions:

(i) Superintendence of Finance of Colombia ("SFC") reviews mergers which take place between two or more companies or institutions supervised by the SFC.

(ii) Civil Aviation Authority: this entity supervises all business operations taking place in the aviation sector, such as code sharing agreements, joint exploitation, charter agreements, among others.

- Legal Framework:

Law 155 of 1959, Decree 1302 of 1964, Law 1340 of 2009 and Resolution 10930 of 2015.

III. Analysis Criteria: Objective and Subjective Standards and Thresholds

According to the relevant regulations on merger control, specifically the provisions of Article 9 of Law 1340 of 2009 and in accordance with article first of Resolution 10930 of 2015, any transaction that results in the merger, consolidation, integration or acquisition of control has to be informed, as long as the following conditions are met:

(i) When considered individually or collectively, the parties had during the fiscal year previous to the proposed transaction, operating income that exceed 100.000 minimum legal wages; OR;

(ii) At the end of the fiscal year previous to the proposed transaction, the parties had individually or collectively considered assets that exceed 100.000 minimum legal wages; AND,

(iii) The companies are active in the same market or are part of the same value chain.

In consequence, it is mandatory to inform the SIC prior to the closing of a transaction if said transaction meets (i) the assets/ operating income in Colombia exceed the amount set by the SIC in terms of minimum monthly legal wages, (iii) the transaction is a merger, consolidation, integration or acquisition of control, and (iii) the parties are active in the same market as competitors (horizontal overlap), or they are part of the same value chain (vertical overlap) in Colombia.

With respect to the assets or operating income, it is important to clarify the following:

- The operating income or assets that shall be taken into account have to be located in Colombia.

- The threshold includes operating income or assets of companies that develop the same activity or are part of the same value chain and are controlled by the same entity.

- When the parties to the transaction participate in the Colombian market only through exports, the operating income and the assets located abroad must be included, in addition to those that belong to the controlled companies.

IV. Market share threshold

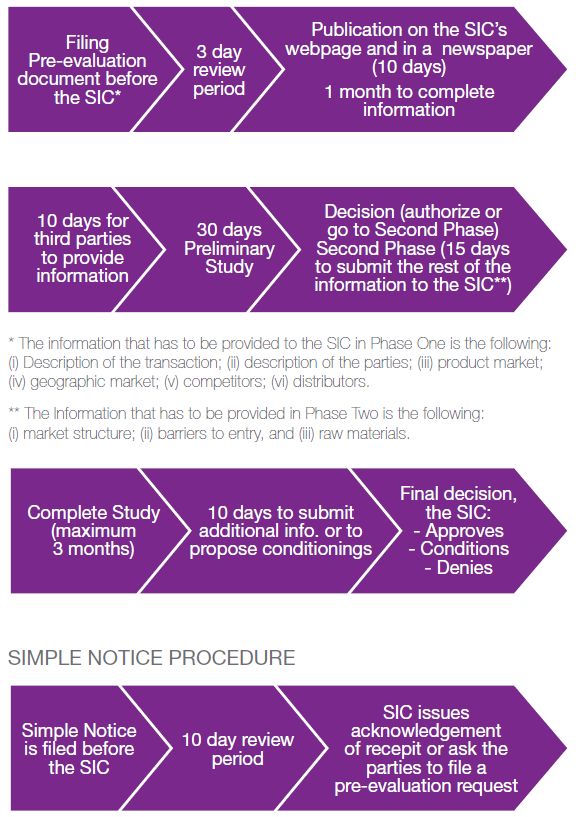

In the event that the parties to the transaction comply with the conditions above because they participate in the same market or value chain and have operative income and/or assets that exceed the amount described above, then the next step, is to determine the market shares of the parties in the relevant market in Colombia. If the joint market shares of the parties exceed 20%, the parties have to file a Pre-evaluation request before the SIC, which means that the transaction may not be closed in Colombia until the SIC approves the transaction. This stand-still obligation, however does not bar the parties from closing the non-Colombian portion of the transaction (if the merger or acquisition is carried in multiple jurisdictions).

In the other hand, if they comply with the conditions above but jointly have less than 20% of the relevant market, the proposed operation is subject to a Simple Notice form which the SIC shall analyze and respond within 10 business days. Please note that after the review of the information, if the SIC finds that the information presents is not reliable, it shall request the parties to file a Pre-evaluation request.

V. Procedure before the SIC

Documents and Information that shall be included in the Simple Notice:

1) Name and Tributary Identification Number ("NIT") of the Companies

2) Financial Statements

3) Description of the proposed transaction including the legal mechanisms used for such purpose and the chronogram.

4) Definition of the relevant market (product market and geographic market)

5) Competitors

6) Market shares of the competitors and of the parties

7) Specific regulations

The parties also have to include the methodology and the sources used to come up with the figures provided.

VI. Operations exempt from merger control

The following transactions are exempt from merger control:

- The transactions that do not meet the thresholds.

- The transactions that take place between companies that are part of the same corporate group.

- The transactions between companies that are subordinate.

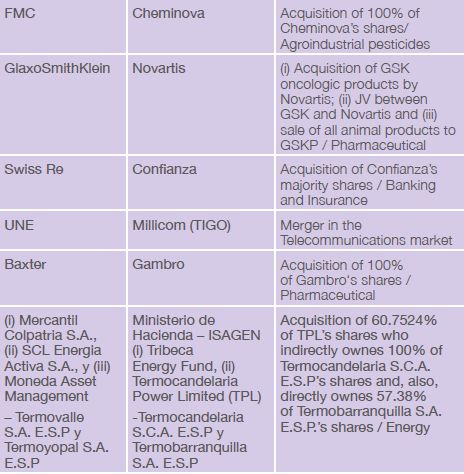

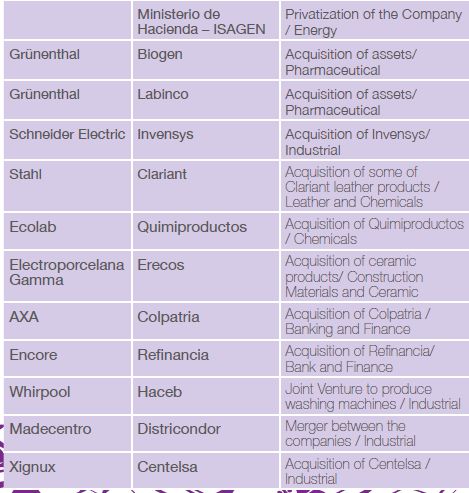

VII. Antitrust Recent Experience

Please find below some of the most relevant transactions in the past three years. You will find in bold the firm's client.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.