On April 5, 2017, the Korea Fair Trade Commission ("KFTC") granted conditional clearance of the proposed merger of the Dow Chemical Company("Dow") and E. I. du Pont de Nemours and Company ("DuPont"), requiring a divestiture of ethylene acrylic acid (EAA) copolymers and ionomers business related assets.

According to the KFTC's press release, the proposed merger does not raise competitive concerns in the seed, pesticide, and other chemical-related industries because both Dow and DuPont have low market shares in these markets and indeed there are no business overlaps. On the other hand, the KFTC examined the market concentration, unilateral effect, and coordination effect in the EAA copolymers and ionomers market and concluded that the transaction will likely practically restrict competition in the market.

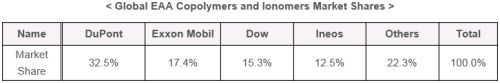

More specifically, the KFTC reached its decision based on the following factors: (i) after the merger, the combined market share of the top three competitors in the EAA copolymers and ionomers market will increase to 77.7%, thus triggering the anticompetitive effect presumption under Article 7 (4) of the Monopoly Regulation and Fair Trade Act; (ii) DuPont, with a 32.5% market share, and Dow, with a 15.3% market share, are respectively the largest and third largest competitors and the combined market share of the merging parties is twice as high as ExxonMobil's, the next largest competitor, market share; and (iii) in this already concentrated and oligopolistic market, the number of major competitors will decrease from four to three.

To resolve the competitive concerns, the KFTC imposed a structural remedy by requiring the merging parties to divest either DuPont or Dow's assets related to the development, production, and sale of EAA copolymers and ionomers within six months of the consummation of the merger. The KFTC also required the merging parties to hold separate each party's EAA copolymers and ionomers assets until completion of the divestiture. The merged company is also required to file a detailed compliance report with the KFTC within thirty days from the required divestiture.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.