Know your homes and loans

Are you aware that any contributions you've made to qualifying home saving and loan schemes are tax-deductible on your 2016 Luxembourg individual income tax return? The deduction goes up to €672 (the same amount extending to any spouse/partner in the taxpayer's household, and the same amount again for each child living in the household as well). We remind you to review your 2016 contributions before year-end so that you can reach the maximum deduction.

A footnote for next year: the amount deductible for home savings plans (€672) will be increased to €1,344 for individuals between 18 and 40 years old in 2017. For everyone else the ceiling will remain €672.

Assure yourself on insurance

More potential tax deductions would come from premiums paid out to qualifying life, death, accident, disability, sickness, or third-party liability insurance. The same specs apply as to the previous tip regarding a ceiling of €672, increasable for spouses/partners and children. Any questions? Give us a click.

Be interested in interest

Debit interest. Perhaps you've gone days, weeks, or months without thinking about these two words.

Debit interest.

But did you know that your debit interest on consumer loans, credit cards, and debit bank accounts are tax-deductible on your 2016 individual income tax return in Luxembourg? Up to the tune of €336, and the same amount again for spouses/children. A further note: this ceiling will be merged with the ceiling for tax deduction on insurance premiums: the combined annual ceiling will be €672 per member of the household from 1 January 2017.

Pay attention to pensions

Your premiums for 3rd-pillar voluntary pension schemes?

Tax deductible.

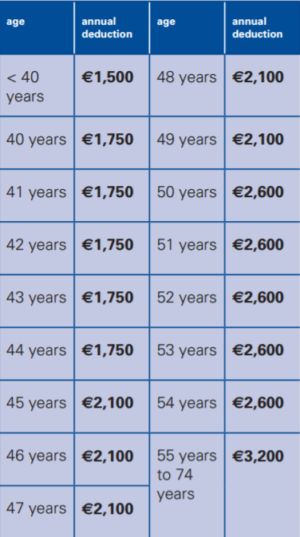

On your 2016 Luxembourg individual income tax return, the following ceilings apply separately to each spouse/partner:

This particular ceiling will rise in 2017: these premiums will become deductible for all taxpayers up to €3,200 from 1 January 2017 onward.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.