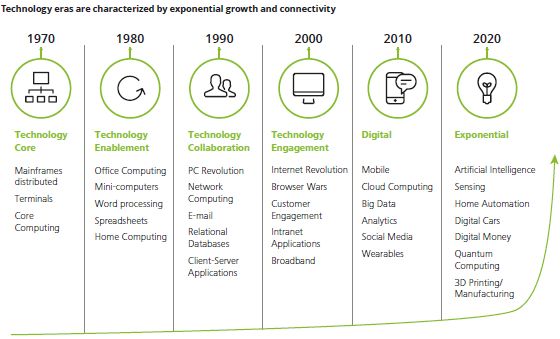

With 1 billion digital natives joining the labor force in the next seven years, 70 billion connected computing devices by 2020 and the amount of data doubling every 18 months, digital is the new era of business across all industries. It is a stepping stone in the evolution of the modern world, made possible by the exponential growth in the use of new technologies. The digital era requires a new way of thinking about how to compete, which influences the way products, services, campaigns and operating models are designed and delivered.

The banking industry is no exception with 35 percent of banking revenue put at risk due to the digital revolution. This article reviews the top 10 digital initiatives that banks have undertaken in recent years with various levels of success, highlighting their related benefits and the lessons learned, based on case studies observed on the market.

Our studies demonstrate that the banking and securities sector will lead digital market spending with relative market size growing from US$5 billion to US$8.8 billion by 2020 at a worldwide level. Like many other industries, the banking sector is facing a changing environment with digital disruptions taking place in several spheres.

- With regards to customers, their expectations of digital experiences have been raised by non-banking players. Personalized, integrated services and holistic solutions for diverse financial needs are now expected. Next-generation customers also expect banking services to be available when and where they want them.

- Regarding the competition landscape, non-traditional players and startups (FinTech) are picking off high-value areas of the value chain where banks have ignored opportunities, or white spaces that are not important enough to current bank operations or not economically relevant with their legacy operating model.

- Operational wise, banks are forced to address front-to-back simplification and transformation due to aging infrastructure and servers, uncompetitive cost structures, and increasing pricing pressure in the transaction space.

As a consequence, huge investments have already been made by the banks as they seek to either become a digital leader, or try to catch up with their peers and competitors. Such efforts have met with varying levels of success. Going digital would allow banks to deliver an end-to- end and tailored customer experience across all channels, focusing on the habits and expectations of new generations. Furthermore, they would be able to retain and even expand their customer base, preventing customers from switching to non-banking competitors. Finally, banks could also lower their operational costs through the digitization of their repetitive and time-consuming processes, i.e., account opening or loan origination, thanks to the increased support of front-end activity by digital channels.

Becoming a successful digital organization requires more than a one-time investment. It requires ongoing evolution based on accurate and timely feedback from internal and external customers, which will only become possible if the organizational model is agile enough to cope with the pace of change and increased client interaction.

Today, digital is the common denominator for both challenges and opportunities faced by banks, creating a sink-or-swim situation for traditional players. Banks that forgo typical bespoke, iterative approaches and invest in integrated and forward- thinking transformation are achieving success in the digital era. In this context, many digital initiatives have been launched in the world of banking over the past few years.

- Digital strategy: adopting a digital strategy in line with your business strategy

- Digital customer segmentation: adapting customer segmentation drivers to new digital habits

- Customer lifecycle journey: removing friction from the customer journey

- Digital operating model: digital strategy driving the adoption of a digital operating model

- Agile transformation: starting with digital as a project and ending with digital as a core value

- Digitization of processes: transitioning from manual and paper-based processes to digital processes

- Mobile and omni-channel: providing a seamless user experience across all digital channels

- Cyber security: transforming the cyber security threats into opportunities

- FinTech: leveraging FinTech via a win-win strategic alliance

- Analytics: shifting from a "data-capturing" to a "data-leveraging" approach

Hereafter, we describe each initiative's connection with current market trends, and provide insight on the benefits and the lessons learned, as well as case studies observed from the market.

1. Adopting a digital strategy in line with your business strategy

Today, mobile devices provide unprecedented access to information, products and services. Businesses need to create a seamless experience and a consistent customer journey, projecting their brand clearly across the many touch points, channels, and devices their customers use. Digital strategy helps banks define a bold vision for their entire digital journey. It is the gateway that leads to all other digital initiatives. They need to reimagine how profits are made, rethink how relationships are created and managed, reshape how they operate, and rewire the competitive fabric of the entire banking industry. Such a digital strategy should be considered alongside a more agile operating model and optimized banking processes to allow banks to become more intuitive enterprises.

By participating in ideation and prioritization workshops, organizations create a backlog of digital initiatives that can be tailored to align with their corporate strategic objectives. An enterprise-wide digital strategy helps companies to become more effective in acquiring new customers and drives greater loyalty to retain their existing customer base. Furthermore, by combining a business-centric lens with a customer-centric viewpoint, a modern digital strategy can increase product penetration and customer satisfaction, while maintaining or improving business performance.

Digital strategy is the foundation that underpins the future state of the organization when it reaches digital maturity. Over time, clear differences have been identified between banks at the early stage of their digital maturity and those that are already mature. There are visible and less visible aspects of this maturity, cutting-edge technology being one of the most visible elements.

When trying to adopt new technology, the main reason for failure usually lies in the fact that organizations have not changed the culture and mindset of their employees. Leading digital banks not only have a clear and coherent digital strategy but they are also excelling at communicating it, often dictated by a single person or a limited number of people who demonstrate digital fluency to their colleagues.

Banks have also different objectives in terms of strategy depending on their level of maturity. Less mature organizations are using digital to improve efficiency and customer experience, while developed banks focus on transforming their business to stay at the cutting edge of the competition landscape, reflecting a vision beyond technologies.

In terms of culture, digitally developed banks have a more risk-taking approach than their less mature peers. They are also in better shape to implement digital initiatives by leveraging the benefits from cross-departmental collaboration. Being comfortable with risk and a collaborative mindset are key factors behind innovation.

For an Australian bank, digital banking was at the center of the transformation agenda. It focused on a long-term digital strategy comprising channels, data, agility and FinTech. They created UBank, which is their digital-only offering aimed at customers who wish to deal exclusively online or via their mobile. In 2014, the bank invested in the development of API, a programming interface layer that exposes some of the bank's functionalities and how certain services operate. The bank also launched an innovation hub created in the vein of start-up methodologies. In 2016, the bank announced a $50 million innovation fund to invest in start-ups.

Banks must understand that the opportunities offered by digital transformation are not embodied by the technology as such, but rather arise from the way banks are integrating new technologies to transform their business, their customer journey and how they map digital capabilities to their organization's roadmap.

2. Adapting customer segmentation drivers to new digital habits

New generations (Y and Z) customers who grew up with the Internet expect an immersive, personalized and frictionless digital experience with banking products and services. According to the millennial disruption index, 53 percent of millenniums think that their bank does not offer anything different from others and 33 percent believe they will not need a bank at all in five years' time. Moreover, 73 percent would be more excited about a new financial service offered by Google, Amazon or Apple, rather than by their bank.

With increasing competitors' brands and online-only offerings, including those offered by players from other industries, customers are looking to new alternatives and are expecting exceptional value-added services that go beyond core service offerings, breaking with previous industry standards. Failure to meet expectations is costly for banks, as some customers leave their traditional bank and look for more innovative players as a result of having lost trust in the big players.

Banks should already be segmenting customers to ensure targeted services and content depending on the client's digital habits, thus providing a customizable online service, which will propel improvements in the customer experience. Improved segmentation of their clients leads banks to create experiences that truly differentiate them in the marketplace, resulting in improved cross-selling. They will be able to better adapt products and services to key customer segments and strengthen their customer retention with improved customer knowledge. Aside from this, operational efficiencies will also be optimized through alignment to the defined segments.

Since digital banking services are not exclusively used by Gen Y and Z customers, the usual segmentation based on behavior should prevail. A leading universal bank in Russia implemented a new customer segmentation strategy based on customer income. The focus was on high and middle income segments (affluent and mass-affluent) with tailor-made products and services with a dedicated financial advisor and personal relationship manager respectively. The bank learned that they should pay attention to customer retention instead of customer attraction and that their segmentation strategy should involve an omni-channel seamless experience with a focus on utilization. Finally, they identified remote access channels as essential tools if banks wish to become leaders within the most profitable customer segments.

To read this Report in full, please click here.

This article contains general information only, and none of the Deloitte entities belonging to the Deloitte Network is, by means of this article rendering accounting, business, financial, investment or other professional advice or services. This article is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect the reader's finances or business. Before making any decision or taking any action that may affect the reader's finances or business, the reader should consult a qualified professional adviser.