I am pleased to present to you issue 1 of Deloitte Malaysia's quarterly Economic Outlook.

This new publication demonstrates our continued support and committed endeavor to deliver valuable insights on the economic landscape in which we all do business; combining both a retrospective angle to see what we can learn from recent activity as well as providing detailed outlooks, projections, trends and market conditions. While the focus is very much on Malaysia, we are mindful of the impact of the ASEAN region and the global economy and so we keep one eye on developments overseas too. We hope that this overview will be of benefit to you as you consider your business strategy in the challenging business environment we find ourselves in.

Looking back, 2015 global growth – currently projected at 3.3 percent – was marginally lower than in 2014, following a setback in activity in the first quarter of 2015 which resulted in a small downward revision across the year.

According to the IMF, the underlying drivers for a gradual acceleration in economic activity in advanced economies – easy financial conditions, more neutral fiscal policy in the Euro area, lower fuel prices, and improving confidence and labor market conditions – remain intact. The continued growth slowdown in emerging market economies reflects several factors, including lower commodity prices and tighter external financial conditions, structural bottlenecks, rebalancing in China, and economic distress related to geopolitical factors. A rebound in activity in a number of distressed economies is expected to result in a pickup in growth in 2016.

Overall, with growth expected to strengthen to 3.8 percent in 2016, the global economy is poised for growth comparable to recent years, but "with a somewhat different texture", as termed by Forbes: European countries will do a little better, Asian countries a little worse, and natural resource-based economies much worse. However, many economists view Asia as a 'wild-card' in the outlook and so the coming year will be an interesting one for us all.

I hope that you will find this first issue of our Economic Outlook interesting – I welcome your feedback on how we can improve for future editions.

Thank you again for partnering with Deloitte in 2015, and we look forward to supporting you in greater depth in 2016.

GLOBAL ECONOMIC OUTLOOK AND TRENDS

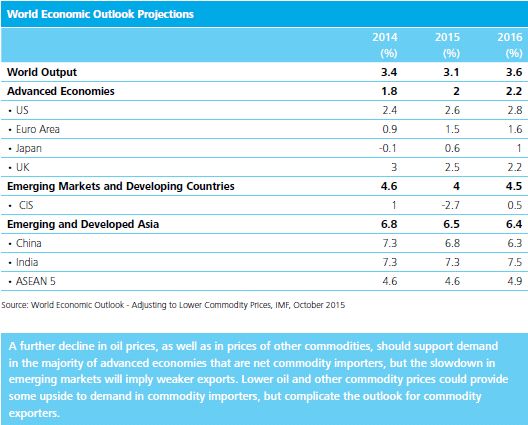

The global economy registered a growth of 2.9 percent in H1 2015, and is projected to grow at 3.1 percent in 2015 (0.3 percentage point lower than in 2014), before picking up to 3.6 percent in 2016.

- The recovery in advanced economies is expected to pick up slightly (particularly in the Euro area, supported by the decline in oil prices and accommodative monetary policy). On the other hand, growth in emerging markets and developing economies is projected to slow, due to declining commodity prices, reduced capital flows to emerging markets, pressure on currencies, a slowdown in China with less reliance on import-intensive investment, and adjustment in the aftermath of credit and investment boom.

Major trends to look out for:

1. Values of major currencies:

Currencies of major emerging economies have depreciated in real effective terms, reflecting weaker fundamentals, i.e., weakening growth prospects and worsening terms of trade. In real effective terms, the euro appreciated by 3.7 percent and the U.S. dollar by 2.3 percent between March and August 2015, while the yen weakened slightly.

Following the depreciation of the Yuan in August 2015, financial markets have become more volatile. This led to an increase in global risk aversion, weakening currencies for many emerging markets, and a sharp correction in equity prices worldwide.

2. Weak commodity prices:

After remaining broadly stable during the second quarter of 2015, a sharp drop in sectoral investments has led to decline in oil prices. This was supported by a strong supply from members of the Organization of the Petroleum Exporting Countries (OPEC), the prospects of higher future output following the nuclear deal with Iran, and weaker global demand. Following excess supply and weaker demand, oil prices are forecast to remain below projected levels through 2020. The IMF suggests average annual prices of $51.62 a barrel in 2015, $50.36 in 2016, and $55.42 in 2017.

- Lower oil prices have supported demand for importers. Income gains from lower oil prices have supported increases in private consumption in advanced economies, (except in the United States (harsh winter) and Japan (low levels of consumption due to delayed pass-through and wage moderation).

3. Slowing Chinese economy:

The slowdown in China is, so far, in line with forecasts (expected to grow 6.8 percent in 2015 and 6.3 percent in 2016), but its cross-border repercussions appear greater than previously envisaged.

- This is reflected in weakening commodity prices (especially for metals) and reduced exports to China (East Asian economies). Investment growth slowed compared with last year and imports contracted, but consumption growth remained steady. While exports were also weaker than expected, they declined less than imports, and net exports contributed positively to growth.

- If China registers further slow growth, the effects would be felt in the rest of the region, especially in countries linked to China through trade, investment, and tourism.

4. Expectations about monetary policy in the United States:

With the first increase in U.S. policy rates (0.25 percent since 2009 and is expected to increase to 0.5% by Q4 2015) approaching and contracting the global outlook, emerging markets will see tightened financial conditions. Dollar bond spreads and long-term local-currency bond yields have increased by 50 to 60 basis points on average, and stock prices are weaker, while exchange rates have depreciated.

- While the increase in U.S. interest has been anticipated and is likely to be orderly, markets could react sharply, causing currencies to depreciate, bond spreads to rise, capital inflows to fall, and liquidity to tighten.

![]()

To read this Report in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.