On 29 December 2014, Bank Indonesia issued a new regulation (No. 16/21/PBI/2014) on the Implementation of Prudential Principles in Managing Offshore Loans by Non- Bank Corporations ("PBI No. 16/21"). In conjunction with PBI No. 16/21, Bank Indonesia also issued Circular Letter of Bank Indonesia No. 16/24/DKEM dated 30 December 2014 on the Implementation of Prudential Principles in Managing Offshore Loans by Non-Bank Corporations ("SE No. 16/24").

PBI No. 16/21 was issued to improve previous Bank Indonesia Regulation No. 16/20/PBI/2014 concerning the same subject matter ("PBI 16/20"). PBI No. 16/21 takes effect and is binding to all Non-Bank Corporations as of 1 January 2015, revoking the previous PBI No. 16/20.

PBI No. 16/21 is applicable to all non-bank corporations in Indonesia ("Non- Bank Corporations") which incur offshore loans in a foreign currency. This includes, but is not limited to, group corporate and shareholder loans to subsidiaries, and not just external bank financings or bonds. Whilst PBI No. 16/21 defined "Offshore Loans" as loans (and/or bonds) incurred by residents (individuals, legal entities or other bodies which are domiciled in Indonesia, or plan to be domiciled in Indonesia for at least 1 year) with respect to non-residents in foreign currency and/or Rupiah, including syariah financing.

"Non-Bank Corporations" are defined as any legal entity other than banks, and other entities receiving offshore loans in a foreign currency. Each and every Non-Bank Corporation which receives offshore loans in a foreign currency must implement certain "prudential principles", including the following 3 (three) main obligations:

1. Hedging Ratio

Hedging Ratio is the ratio of total hedged value and negative margin of Foreign Currency Assets and Foreign Currency Liabilities;

2. Liquidity Ratio

Liquidity Ratio is the ratio between Foreign Currency Assets and Foreign Currency Liabilities; and

3. Credit Rating

Credit Rating is defined as the assessment conducted by a rating agency to assess corporate financial conditions or credit worthiness of a company.

A. HEDGING RATIO

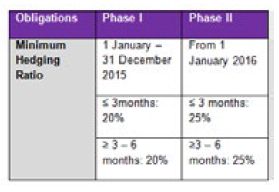

PBI No. 16/21 requires Non-Bank Corporations that have offshore loans in a foreign currency to comply with the minimum currency hedging ratio as set out therein. The hedging would be implemented in the form of derivative transactions of the relevant foreign currency against Rupiah by way of forward, swap and/or option transactions. The minimum requirement of Hedging Ratio phases under PBI No. 16/21 is stipulated as follows:

Formula:

1 January to 31 December 2015

= [Foreign Currency Assets – Foreign Currency Liabilities ≥ 3 - 6 months] x 20%

from 1 January 2016

= [Foreign Currency Assets – Foreign Currency Liabilities] x 25%

B. LIQUIDITY RATIO

Non-Bank Corporations that have offshore loans in a foreign currency must meet the requirements of the minimum liquidity ratio under PBI No. 16/21, by providing adequate Foreign Currency Assets to meet Foreign Currency Liabilities that shall mature within 3 (three) months from the end of the quarter. The minimum Liquidity Ratio is set at a minimum of 70% (seventy percent).

C. CREDIT RATING

Non-Bank Corporations that have offshore loans in a foreign currency are required to fulfill a minimum Credit Rating of Standard & Poor's (S&P) BB- (or equivalent) issued by a Rating Agency that is recognized by Bank Indonesia. The Credit Rating is a valid rating of the corporation (issuer rating) and/or debt security (issue rating) pursuant to the type and maturity period of the loan.

The Credit Rating validity period in relation to a corporation (issuer rating) and/or bonds issued by the corporation (issue rating) is no more than 2 (two) years after the rating has been issued. If Non- Bank Corporations engage in external debt activity through the issuance of longterm debt securities, then the applicable Credit Rating is the long-term Credit Rating. The Credit Rating requirement will be applicable for offshore loans that will be executed on 1 January 2016 onwards.

Non-Bank Corporations which have offshore loans in a foreign currency from its parent company, or are guaranteed by the parent company, are permitted to use the Credit Rating of the parent company. Newly established Non-Bank Corporations are permitted to use the Credit Rating of its parent company for no longer than 3 (three) years after commercial operation.

D. EXEMPTIONS

Non-Bank Corporations that record financial statements in United States Dollars and fulfill specific criteria are exempt from the minimum Hedging Ratio. Consequently, such Non-Bank Corporations must have:

1. a ratio of export revenue to total business revenue greater than 50% in the previous calendar year; and

2. a license issued by the Minister of Finance to maintain bookkeeping denominated in US dollars.

The exemptions to the minimum Credit Rating requirements are given to:

1. refinancing of offshore loans in foreign currency which does not increase the outstanding amount of the previous loans, or if it does increase, such increase must not exceed (a) USD 2,000,000 (two million US Dollars) or (b) if it exceeds USD 20,000 (two million US Dollars), then this amount must not be more than 5% of the outstanding refinanced loans;

2. offshore loans in a foreign currency for infrastructure projects from: (a) international lending agencies, such as the Asian Development Bank and the World Bank, (b) a syndication loan with more than a 50% contribution from an international bilateral or multilateral institution;

3. offshore loans in a foreign currency for the financing of central or regional government infrastructure projects;

4. offshore loans in a foreign currency that is secured by an international bilateral or multilateral institution;

5. offshore loans in a foreign currency in the form of trade credit; or

6. offshore loans in a foreign currency in the form of other types of debt that are not included within the meaning of loan agreements, debt securities, and trade credit, including insurance claim and dividends that have been declared but not paid.

E. REPORTING OBLIGATIONS

A Non-Bank Corporation is required to submit reports to Bank Indonesia in relation to the implementation of prudential principles.

The Non-Bank Corporations will submit the report along with the supporting documents, including audited financial year reports or quarterly financial reports to Bank Indonesia, which outlines: (a) hedging ratio, liquidity ratio, and credit rating; and (b) any applicable exemptions (if any). If deemed necessary, Bank Indonesia may also (i) request additional explanations, records, evidence, or any supporting documents with or without the involvement of the respective company, (ii) directly examine the company, or (iii) appoint a third party to carry investigations on behalf of Bank Indonesia.

F. SANCTIONS

Non-Bank Corporations that fail to meet the reporting requirements will be subject to administrative sanctions in the form of a written warning. The enforcement of this sanction shall become effective after the start of the fourth quarter of 2015 report.