This article was first published in the March 2006 issue of International Tax Review;

www. internationaltaxreview.com

December 2005 saw the ruling coalition here in Japan agree on proposals for tax reform in 2006. This article outlines some of the more significant proposals for corporate taxpayers.

The 2006 annual tax reform proposals are not expected to be approved by the Diet until around the end of March. Full details of the amended tax laws will not be clarified until Diet approval has been obtained. This article has been prepared with reference to the proposals published by the ruling coalition on 15 December 2005 and readers should bear in mind that the proposals could undergo modification before they are enacted into law.

1. Corporate Reorganisations – Share for Share Exchanges and Share for Share Transfers

As background for those readers not familiar with Japanese corporate transactions, a share for share exchange is a legal procedure under which an existing company (i.e. acquiring/parent company) acquires 100% of the shares of another existing company (i.e. acquired/subsidiary company), in exchange for its shares being issued to the shareholders of the acquired/subsidiary company. A share for share transfer is a similar legal procedure, with the only difference being that a new company is set up to acquire 100% of the shares in the acquired/subsidiary company.

Generally speaking, under the current law the tax treatment of share for share exchanges and share for share transfers is different from the tax treatment afforded to other similar forms of corporate reorganisations, such as mergers and de-mergers (also know as corporate splits in Japan). The 2006 tax reform proposals intend to align the tax treatment of share for share exchanges and share for share transfers with that of mergers and de-mergers.

(a) Tax treatment of transferring shareholdersUnder the current law recognition of capital gains or losses made by the transferring shareholders and arising from an exchange or transfer can be deferred, subject to the following conditions being met:

- the acquiring/parent company records the shares in the acquired/subsidiary company at the same or lower tax value as the aggregate of that recorded by the transferring shareholders (alternatively if the number of transferring shareholders were 50 or more records should be made at the tax net asset value of the acquired/subsidiary company or lower); and

- more than 95% of the value received by the transferring shareholders is made up of the acquiring/parent company’s shares.

Under the 2006 tax reform proposals recognition of capital gains or losses made by the transferring shareholders and arising from an exchange or transfer can be deferred, as long as the transferring shareholders receive only shares in the acquiring/parent company. This proposal will come into effect for exchanges and transfers performed on or after 1 October 2006.

(b) Tax treatment of the acquired/subsidiary company

Under the current law there is no taxable event for the acquired/subsidiary company. Under the 2006 tax reform proposals if an exchange or transfer is tax qualified there will also be no tax issues for the acquired/subsidiary company. However under the 2006 tax reform proposals, if an exchange or transfer is not tax qualified the acquired/subsidiary company will have to revalue certain types of assets and any gains or losses the company makes as a result of the revaluation will have to be included in the calculation of its taxable income. The assets that should be revalued include land, securities, fixed assets, monetary receivables and deferred assets. However assets with unrealised gains or losses less than the lower of: (i) 50% of capital and capital surplus; and (ii) JPY 10 million will be exempt.

The conditions for tax qualified exchanges or transfers are expected to be the same as those that currently exist for tax qualified mergers and de-mergers.

This proposal will come into effect for exchanges and transfers performed on or after 1 October 2006.

(c) Issues arising where a group files consolidated tax returns

Under the current law, a revaluation of assets by an acquired/subsidiary company will not be required upon entry into a consolidated tax group if the acquired/subsidiary company satisfies certain onerous conditions.

Under the 2006 tax reform proposals, a revaluation of assets by an acquired/subsidiary company will not be required upon entry into a consolidated tax group if the relevant exchange or transfer is tax qualified.

This proposal will come into effect for exchanges and transfers performed on or after 1 October 2006.

(d) Transfer of assets/liabilities in a non qualified exchange or transfer

Under the current law if a reorganisation is not qualified, assets and liabilities are deemed to be transferred at their fair market value. However liabilities that are not fixed cannot be transferred for tax purposes and their tax treatment is ambiguous.

The 2006 tax reform proposals provide that liabilities that are not fixed can be transferred in a non qualified reorganisation and such liabilities can be recorded on the tax balance sheet. In addition, any difference between the fair market value of the net transferred assets that were stated on the balance sheet of the transferor and the consideration for the transfer, will be recorded as an asset or liability for tax purposes. This difference will be recognised as goodwill and will be deductible over five years for tax purposes.

This proposal will come into effect for non qualified reorganisations performed on or after the date that the new Japanese corporate law is implemented.

2. Adjustments due to the Implementation of the New Corporate Law

The 2006 tax reform proposals include certain proposals which are necessitated by the implementation of the new Japanese corporate law. Below is a list of these proposals:

(a)Under current law when new shares are issued, the aggregate of capital and capital surplus of the issuer increases by the amount of the total issue price. Under the 2006 tax reform proposals, the aggregate of capital and capital surplus will increase by, in the case of a contribution in kind, the fair market value of the contributed assets or otherwise by the amount of any cash contribution.

This proposal will come into effect for distributions from retained surplus on or after the date that the new Japanese corporate law is implemented.

(b) Where companies have issued shares which have a repurchase option attached, under the new Japanese corporate law the issuer may repurchase the shares in exchange for cash or another class of shares. Under the 2006 tax reform proposals if issued shares are repurchased in exchange for a different class of shares, the exchange will be deemed to be made on a no gain, no loss basis.

This proposal will come into effect for share transfers performed under the exercise of a repurchase option on or after the date that the new Japanese corporate law is implemented.

(c) The new Japanese corporate law allows companies to allot new shares or rights to subscribe for new shares to existing shareholders, without receiving additional contributions. The 2006 tax reform proposals state that such allotment will not be a taxable event for the receiving shareholders.

This proposal will come into effect for allotments made on or after the date that the new Japanese corporate law is implemented.

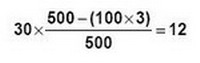

(d) Under the current law if a company repurchases treasury shares and the repurchase price exceeds the capital and capital surplus attributable to the repurchased shares, the excess is deemed to be a dividend. The capital attributable to the repurchased shares is calculated using the following formula:

Under this formula, for a company with different classes of shares in issue the deemed dividend amount would be computed based on the total number of shares in issue. The 2006 tax reform proposals state that the capital and capital surplus attributable to repurchased shares will be calculated individually for each class of shares. In addition under the 2006 tax reform proposals, when treasury shares are repurchased capital and/or capital surplus will be reduced by an amount equal to the repurchase price (less the amount of any deemed dividend); this changes the position under the current law and brings tax treatment in line with accounting treatment.

These proposals will come into effect for treasury share repurchases performed on or after 1 April 2006, subject to certain transitional measures applying.

(e) Any form of repatriation made following the enactment of the new corporate law will be required to be made as a distribution from retained surplus. The fact that such a distribution has to be made in accordance with procedures for declaration of a dividend creates an issue under the current tax law regarding the tax treatment of the repatriation. The issue is whether tax treatment should be determined according to the source of the retained surplus or whether the repatriation should be treated as a dividend. This issue is solved by the 2006 tax reform proposals which state that the tax treatment of the distribution will be determined according to the source of the retained surplus.

This proposal will come into effect for distributions from retained surplus on or after the date that the new Japanese corporate law is implemented.

(f) Under the current law, if a debtor files an application for corporate rehabilitation proceedings or if similar events stated under the current law occur, the deduction of expired tax losses is allowed up to a certain amount. The 2006 tax reform proposals provide that the deduction of expired tax losses will also apply to a debt-equity swap where the debtor has recognised debt forgiveness income.

No implementation date for this proposal is currently available.

3. Prevention of Tax Avoidance

The current law does not restrict the use of tax net operating losses of loss-making companies.

The 2006 tax reform proposals contain a measure to disincentivise the acquisition of loss-making companies. It is proposed that if: (i) a "certain shareholder" acquires more than 50% of the shares in a loss-making company; and (ii) the loss-making company ceases to operate the business it operates at the time of the acquisition within five years of the acquisition and it starts a new business of a materially larger size within five years, or "certain other conditions" are met (the "trigger events"), tax losses that are carried forward in the fiscal years prior to the "trigger events" will be discontinued. Furthermore, any capital losses incurred within three years from the beginning of the year of any trigger event will not be tax deductible.

Since a draft text of the amendment is not yet available, we do not know precisely what a "certain shareholder" or the "certain other conditions" will be.

This proposal will come into effect for loss making companies purchased on or after 1 April 2006.

4. Performance Rewards - Director’s Bonuses and Remuneration

Current Japanese law states that compensation paid on an irregular basis or determined with reference to a company’s profits, such as bonuses paid to directors, officers and statutory auditors, is not deductible for corporate tax purposes. However compensation paid on a regular, monthly basis is deductible.

The 2006 tax reform proposals state that the following types of compensation will now be deductible for corporate tax purposes, even if paid irregularly:

(a) compensation not calculated with reference to the profits of a company provided that the amount and timing of the payment is set out in the company’s policies or by-laws.

(b) Compensation calculated with reference to the profits of a listed company or its consolidated affiliates, provided that the compensation satisfies certain conditions including:

- payment does not flow from a family business to its directors;

- payment is recorded as an expense for accounting purposes in the year that it was made; and

- appropriate procedures, such as obtaining remuneration committee sign off on the material terms of the payment and making public disclosure (for example in a report required under the Securities and Exchange Law), were undertaken.

This proposal will come into effect for business years starting on or after 1 April 2006.

5. Stock Options

Current accounting guidelines do not allow expenses relating to stock options to be recorded as losses. New Japanese accounting guidelines (currently still in draft form) propose that costs relating to stock options should be recognised as expenses over the period from the grant date to the vesting date of the option. The new guidelines will be applicable to issuers of stock options granted following the enactment of the new Japanese corporate law.

Under the 2006 tax reform proposals issuers will be allowed to deduct expenses relating to stock options issued to individuals as consideration for their services. The expenses will be deductible in the year that the options are exercised, unless the options are tax qualified stock options for Japanese income tax purposes.

This proposal will come into effect for stock options which are derived from decisions to issue such stock options made on or after the date that the new Japanese corporate law is implemented.

6. Thin Capitalisation

Under the thin capitalisation rule, if a Japanese company pays interest on debt owed by a Japanese company to a controlling overseas shareholder and the average balance of such debt is more than three times the equity received from such a controlling overseas shareholder, the interest that relates to the excess debt is generally excluded from the Japanese company’s tax deductible expenses.

The 2006 tax reform proposals extend the scope of the type of interest on debt and the debt which is subject to the thin capitalisation rule, to include the following items:

(a) When a taxpayer borrows from a third party and the loan is backed by a guarantee from a controlling overseas shareholder: (i) debt = the loan from the third party; and (ii) the interest on debt = the interest on the loan and guarantee fees paid to the controlling overseas shareholder.

(b) When a taxpayer borrows from a third party using bonds borrowed from a controlling overseas shareholder as collateral: (i) debt = the loan from the third party; and (ii) the interest on debt = the interest on the loan and the borrowing fee paid to the controlling overseas shareholder.

(c) When an arrangement combines (a) and (b) above: (i) debt = the loan from the third party; and (ii) the interest on debt = the interest on the loan, the borrowing fess and the guarantee fees paid to the controlling overseas shareholder.

Here is an example, in diagram form, using the scenario set out in item (a) above, of how the amended thin capitalisation rule will work:

Current Law:

Proposed Law:

![]()

These extensions will come into effect for business years starting on or after 1 April 2006.

In addition, under the 2006 tax reform proposals, liabilities attached to bond repurchase arrangements (saiken gensaki or Japanese repo) where the borrowing is related to the lending will be excluded from the category of debt outlined above. In this instance the relevant debt to equity ratio will be 2:1, not 3:1.

This proposal will come into effect for business years ending on or after 1 April 2006.

7. Information Exchange

Under the 2006 tax reform proposals, if a country having a tax treaty with Japan requests information in relation to a tax evasion investigation being conducted by that country, even if there is no domestic tax implications for Japan, the Japanese tax authorities will have the right to make a voluntary investigation in Japan and provide any information it uncovers to the requesting country.

This proposal is in line with global movements towards greater transparency and information exchange amongst tax authorities, which is a movement promoted by the OECD. No implementation date for this proposal is currently available.

8. Transfer Pricing

When a taxpayer does not submit information that is necessary in order to calculate an arm’s length price in accordance with Japanese transfer price principles, the Japanese tax authority can estimate the arm’s length price using comparable substitute approaches.

Under the current law the resale price method, cost plus method and other similar methods can be used by the tax authority. The 2006 tax reform proposals extend the number of methods of calculation that the tax authority can use to include:

- the transactional net margin method; and

- the profit split method.

This proposal will take effect for determinations regarding fiscal years starting on or after 1 April 2006.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.