At a glance

Many funds and similar entities will be exempted from consolidating controlled investees under amendments to IFRS 10, 'Consolidated financial statements'. This is a result of the IASB issuing amendments to IFRS 10, IFRS 12, 'Disclosure of interests in other entities' and IAS 27, 'Separate financial statements', on 31 October 2012. These amendments will particularly benefit funds, as those that qualify will be able to fair value controlled investments, rather than having to consolidate them.

The guidance applies to an 'investment entity'. The amendment to IFRS 10 defines an investment entity and introduces an exception to consolidation. The amendments to IFRS 12 introduce disclosures that an investment entity needs to make.

The amendments apply for annual periods beginning on or after 1 January 2014; earlier application is permitted.

Key features of the guidance

Definition of an investment entity

First you will need to assess whether your entity meets the investment entity definition. "An investment entity is an entity that:

- obtains funds from one or more investors for the purpose of providing those investor(s) with investment management services;

- commits to its investor(s) that its business purpose is to invest funds solely for returns from capital appreciation, investment income or both; and

- measures and evaluates the performance of substantially all of its investments on a fair value basis."

You will also need to consider a set of typical characteristics. These, combined with the definition, are intended to allow for an appropriate balance between creating a clear scope and allowing judgement in assessing whether your entity is an investment entity. The characteristics are:

- holding more than one investment;

- having more than one investor;

- having investors that are not your entity's related parties; and

- having ownership interests in the form of equity or similar interests.

The absence of one or more of these characteristics does not prevent your entity from qualifying as an investment entity but you will need to determine why it is an investment entity even though it does not meet at least one of the typical characteristics; and you will need to give disclosures.

Your entity will not be disqualified from being an investment entity where it also carries out any of the following activities:

- Providing investment-related services to third parties and to its investors, even when substantial.

- Providing management services and financial support to its investees, but only when these do not represent a separate substantial business activity and are carried out with the objective of maximising the investment return from the entity's investees.

Accounting by an investment entity

Instead of consolidating the entity's subsidiaries, you will account for them at fair value through profit or loss. The only exception is for subsidiaries providing services that are related to the entity's investment activity, which should be consolidated.

Accounting by a non-investment entity parent for investments of an investment entity subsidiary

Your business might be an investment entity but its parent might not be. A non-investment entity parent is required to consolidate line by line all entities it controls including those controlled through an investment entity. For example, an investment entity fund is controlled by an insurance group. The insurance group will have to consolidate line by line the subsidiaries of the fund in the insurance group's financial statements, even though the subsidiaries will be fair valued in the fund's own financial statements. What is known as the fair value 'roll-up' is not allowed to be applied in a non-investment parent entity.

Disclosures

Where your entity qualifies as an investment entity, required disclosures include the following:

- significant judgements and assumptions made in determining that the entity meets the definition of an investment entity;

- reasons for concluding that the entity is an investment entity, even though it doesn't have one or more of the typical characteristics;

- information on each unconsolidated subsidiary (name, country of incorporation, proportion of ownership interest held);

- restrictions on unconsolidated subsidiaries transferring funds to the investment entity;

- financial or other support provided to unconsolidated subsidiaries during the year, where there was no contractual obligation to do so; and

- information about any 'structured entities' that the entity controls (for example, any contractual arrangements to provide financial or other support).

Transition guidance

The amendments are generally applied retrospectively when your entity meets the definition of an investment entity at the date of initial application; this applies irrespective of whether the entity would have met the definition of an investment entity in prior reporting periods. Any difference at the beginning of the comparative period between:

- the previous carrying amount of the assets, liabilities and non-controlling interest of a controlled investee; and

- the recognised amount of the investor's interest in the investee (that is, it fair value), is adjusted to equity at the beginning of the immediately preceding period.

Investment entities: Exception to consolidation

Background

The IASB has amended IFRS 10 so that an 'investment entity' fair values its subsidiaries instead of consolidating them. The Board believes that a class of entity (an investment entity) uses a different business model to most other entities. It manages all of its investments on a fair value basis, whether they are simple investments, associates or controlled. It provides fair value information to its users, and that fair value information is more useful for decisionmaking than consolidated information. The Board further noted that preparing consolidated financial statements for such entities could hinder users' ability to assess their financial position and results; this is because consolidated financial statements emphasise the financial position, operations and cash flow position of their investees, rather than those of the entities themselves. Consolidation also hinders comparability within the financial statements; some of the items consolidated might be measured at historical cost, whilst other non-controlling interests might be carried at fair value.

This makes assessment of the performance of an investment entity difficult; and it does not reflect the way in which the entity's business is managed.

Such entities are investment entities and are usually investment funds. The IASB decided that these entities should fair value their investments (including investments in subsidiaries).

Accounting by an investment entity

IFRS 10 requires an entity that is a parent to present consolidated financial statements. The amendment provides a limited scope exception to parents that are 'investment entities'. If your entity is an investment entity under the standard, it is exempt from consolidating underlying investees that it controls; instead, it is required to account for these subsidiaries at fair value through profit or loss under IFRS 9, 'Financial instruments'. [IFRS 10 para 31].

PwC observation

Many funds and similar entities do not have any subsidiaries. For example, a mutual fund might have many equity investments in other entities that are each a small, non-controlling holding in those entities. The exception in IFRS 10 only applies to a parent that is an investment entity. Similarly, the new disclosure requirements in IFRS 12 apply only to a parent that is an investment entity and has unconsolidated subsidiaries. So, you do not need to make an assessment of whether your entity is an investment entity where it does not control any subsidiaries. Similarly, even if it is an investment entity but does not have subsidiaries, the amendments to IAS 27 a2 have no consequences.

Notwithstanding the exception from consolidation in the amendment, you are required to consolidate any subsidiaries that provide services relating to your entity's investment activities. [IFRS 10 para 32]. This includes investment management services, investment advisory services and administrative support. Such services might form a substantial part of your business and might be provided to third parties as well; this will not disqualify your entity from being an investment entity. [IFRS 10 para B85C].

Accounting by the parent of an investment entity

The exception from consolidation extends to the consolidated financial statements prepared by your investment entity's parent only where the parent qualifies as an investment entity itself. If your parent entity does not qualify as an investment entity, it will be required to consolidate all entities that it controls (including all underlying investees controlled through your investment entity and any other investment entities) under IFRS 10.

Facts

Parent is an insurance company, writing insurance business. Parent does not qualify as an investment entity under IFRS 10 because, amongst other things, its purpose is not to invest funds solely for capital appreciation and/or investment income. It sets up a subsidiary, 'IE', which manages funds that back some of Parent's insurance liabilities. Some of IE's investees are controlled private equity investments. IE qualifies as an investment entity under the criteria set out in the amendment to the standard and explained below.

Accounting treatment

In IE's own separate and/or consolidated financial statements, IE measures its controlled investees at fair value through profit or loss. But Parent's consolidated financial statements will consolidate all of its controlled investees, including IE and IE's investees.

Definition

The standard defines an investment entity as, "an entity that:

- obtains funds from one or more investors for the purpose of providing those investor(s) with investment management services;

- commits to its investor(s) that its business purpose is to invest funds solely for returns from capital appreciation, investment income or both; and

- measures and evaluates the performance of substantially all of its investments on a fair value basis."

[IFRS 10 para 27].

For your entity to qualify as an investment entity you must meet the above definition.You must also consider the following typical characteristics of an investment entity:

- holding more than one investment;

- having more than one investor;

- having investors that are not your entity's related parties; and

- having ownership interests in the form of equity or similar interests.

[IFRS 10 para 28].

The above typical characteristics are indicative and supplement the definition to allow the use of judgement in assessing whether your entity qualifies as an investment entity. You will be required to make appropriate disclosures in your financial statements to explain why your entity meets the definition of an investment entity if (in the absence of one or more of the above typical characteristics) you conclude that your entity is nevertheless an investment entity. It is highly unlikely that your entity will meet the definition of an investment entity where it has none of the typical characteristics; but it might be possible.

[IFRS 10 para BC234].

Determining whether an entity is an investment entity

The above definition and typical characteristics require you to consider all the facts and circumstances when assessing whether your entity is an investment entity including its purpose and design. [IFRS 10 B85A]. The definition has three key elements:

- investment management services;

- business purpose; and

- fair value measurement.

The amendment does not provide detailed guidance on the first element of the definition; but it does note that provision of investment management services differentiates investment entities from other entities.

[IFRS 10 para BC237].

The amendment provides guidance around the second and third elements of the definition: business purpose and fair value measurement.

Business purpose

The purpose of your entity's business should be to obtain funds from its investor or investors, and to invest them solely to obtain returns from capital appreciation and/or investment income. Its business purpose might be evidenced in:

- documents (such as its offering memorandum, publications and other corporate or partnership documents); and

- the way it presents itself to other parties (for example, to potential investors or potential investees).

So, if the entity states to its investors that it is making medium-term investment for capital appreciation, this will be consistent with the business purpose of an investment entity. But, if the entity presents its investment objective as jointly developing, producing or marketing products with its investees, its business purpose would appear to be inconsistent with that of an investment entity; this is because it suggests that its purpose includes earning returns from development, production or marketing activity.

[IFRS 10 para B85B].

Part of your entity's business purpose might be to provide investment-related services (including investment advisory services, investment management, and investment support and administrative services) either directly or through a subsidiary. These services could be provided to investors and/or third parties. Participating in such investment-related services does not disqualify your entity from being an investment entity, even if these services form a substantial part of its business; this is because such services are an extension of its operations. [IFRS 10 paras B85C, BC240].

But , if such services are provided by one of your investment entity's subsidiaries, you will be required to consolidate the subsidiary. [IFRS 10 para 32].

PwC observation

In many cases, entities will provide little or no investment management, consultancy or other services but they will have significant investing activities (for example mutual funds). In other cases, entities might provide significant investment management, consultancy or other services with little or no investing activities of their own (for example asset management companies). In either of these cases, it might be clear that the entity is an investment entity (the mutual fund), or is not an investment entity (the asset manager). But, for business models that include both investing activities and providing investment related services, judgement is likely to be required to determine whether or not the entity is an investment entity. The judgement applied could be so significant that an entity should describe it in its critical estimates and judgements.

For example, a private equity firm that obtains funds from its investors, committing to provide them with investment management services in order to invest for capital appreciation and/ or investment income, might be an investment entity. This would be the case even though a significant portion of its activities includes providing sub-advisory and portfolio management services to third parties. But, the entity should consider all relevant factors, not only the mix of services and investing activity. Factors that are likely to indicate that the entity is not an investment entity are: earning revenue from providing substantial management services or strategic advice to investees; not measuring and evaluating all investments at fair value; or holding investments with no defined exit strategies. Careful consideration of all relevant facts and circumstances will be necessary to determine the appropriate accounting.

Participating in the following investment related activities (either directly or through one of your subsidiaries) does not disqualify your entity from being an investment entity; this is because these activities can be seen as being consistent with the entity's overall purpose of investing for capital and/or income. But, these activities need to be undertaken to maximise investment returns (capital appreciation and/ or investment income) from the entity's investees; and they must not represent a separate substantial business activity or a separate substantial source of income. These permitted activities are:

- providing management services and strategic advice to an investee; and

- providing financial support(such as a loan, capital commitment or guarantee) to an investee.

[IFRS 10 para B85D].

A subsidiary of an investment entity that provides these services should be consolidated by the investment entity. [IFRS 10 para B85E].

PwC observation

It might not always be apparent whether a subsidiary of an investment entity is providing investment related services (and should be consolidated) or is not providing such services (and should be measured at fair value through profit or loss). This assessment could be complicated by some apparent overlap between paragraph 27(a) (definition of an investment entity) and paragraph 32 (definition of entities that should be consolidated by an investment entity) of IFRS 10.

The first element of the investment entity definition is that an entity obtains funds from investor(s) in order to provide them with 'investment management services'. So, it might be argued that for a subsidiary of an investment entity to qualify as an investment entity itself, it must be providing investment management services. This could imply that all investment entity subsidiaries of investment entity parents should be consolidated by those parents.

We do not believe that the IASB intended all investment entity subsidiaries of an investment entity parent to be consolidated. Otherwise, the amendment would have been clear that subsidiaries falling into paragraph 32 of IFRS 10 (providing investment related services) included all investment entity subsidiaries. Paragraph BC272 seems to confirm that investment entity subsidiaries generally should be measured at fair value by investment entity parents.

Our view is that the only investment entity subsidiaries that should be consolidated by an investment entity parent are those which have a separate substantial business activity of providing investment-related services (such as those described in paras 32 and B85C-E).

It might be unusual for an investment entity subsidiary to provide such services as a separate substantial activity. For example, a master fund that is controlled by a feeder fund, where the master fund's substantive activities are investing and managing the feeder's funds, is not providing investment related services. So it should be fair valued in the feeder funds financial statements.

PwC observation

Some funds provide management services and financial support to their investees. Such activities do not form a substantial business activity carried out by the fund and income from such activities does not form a substantial source of their income. The purpose is to maximise investment return from the underlying investees. Where this is the case, such funds will not be disqualified as investment entities.

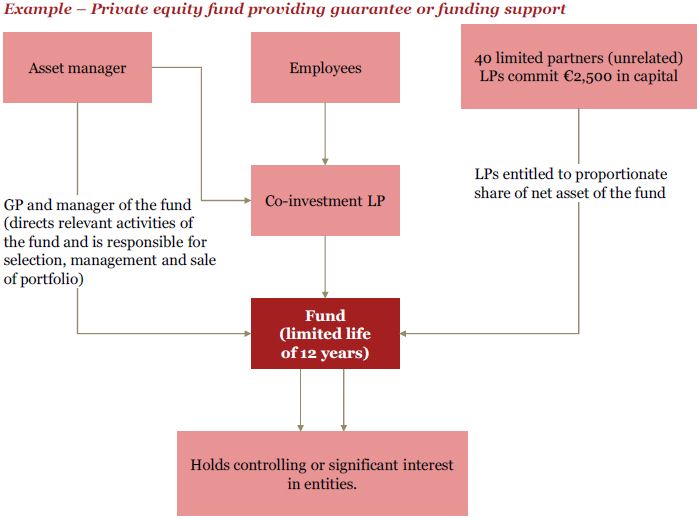

Facts

Two years ago, an asset manager (AM) set up a fund as a limited partnership with 40 limited partners (LPs) and a limited life of 12 years. The LPs are not related; they commit to provide €2,500m. The AM (as a co-investment limited partner) commits an additional €25m, which are its own funds or funds of its employees.

The investment objective of the partnership (as set out in the limited partnership agreement) is as follows: to invest directly in entities in order to acquire a controlling or significant share; and to exit these at a later stage through a trade sale or an IPO process (a 'buy-out fund') between the eighth and twelfth years of the fund's operation, with the aim of generating at least a preferred return rate (the hurdle rate) of 10%.

The AM (who is the general partner of the fund) directs the relevant activities of the partnership; these include:

- The appointment of an AM representative to the board of directors of the underlying investee entities.

- Providing strategic and economic advice to the investees through separate service agreements.

- Providing and arranging financing and (where necessary) financial guarantees in order to assist investees in executing their strategic plans.

- Evaluating and influencing the underlying policies, procedures and key management of the investments.

The AM considers these activities to be necessary to maximise the overall value of the underlying investees. The AM is also responsible for the selection, management and sale of the fund's investment portfolio.

The AM is responsible for providing a quarterly individual capital statement for each LP, detailing the fair value of each investment; and the partnership accounts for all its investees on a fair value basis.

Each LP interest is entitled to a share of disposal proceeds or net asset values on a winding up of the fund. The general partner (that is, the AM) is entitled to management fees and a profit share of capital gains above the 10% hurdle rate. The partnership has no equity.

Is the fund an investment entity, in view of the activities that it performs?

Conclusion

Judgement is required to conclude whether the fund is an investment entity.

The fund meets the first and third parts of the definition of an investment entity:

- It obtains funds from more than one LP to make investments and to provide them with investment management services.

- It measures and evaluates the performance of its investments on a fair value basis.

The second part of the definition is less clearly satisfied. The fund makes each investment with the objective of generating capital return and investment income. It does not intend to hold any of its investments indefinitely; this is because it has a limited life and a defined exit strategy for its investees. But it carries out other activities and its business purpose requires further consideration.

The fund also displays all four typical characteristics:

- it holds more than one investment;

- it has more than one investor;

- investors in the fund are unrelated to the reporting entity; and

- ownership interests in the fund are in the form of partnership interests that entitle partners to a share of net assets.

Regarding business purpose, the fund is involved in providing other investment related activities, these include:

- Providing financial support to the underlying investee, including providing guarantees.

- Providing strategic and economic direction to the underlying investments.

These activities are consistent with the business purpose of an investment entity; and they are permitted so long as they are undertaken to maximise investment returns (capital appreciation and/ or investment income) from the investees. But they should not represent a separate substantial business activity or source of income. Judgement is required to make this assessment.

Exit Strategy

One of the ways your entity's business purpose will be evident is through having an exit strategy for its investments, specifically documenting how it plans to realise capital appreciation on substantially all of its equity and non-financial investments. The exit strategy should clearly document a substantive timeframe for exiting the investments. This does not need to be detailed for each investment: strategies could be identified by types or portfolios of investments held. [IFRS 10 para B85F]. The absence of such a strategy indicates an intention to hold investments indefinitely.

Similarly, if your entity holds any debt investments that are perpetual, it should have identified an exit strategy for such debt investments. [IFRS 10 para B85F].Without an exit plan, the entity's intention could be to hold such debt securities indefinitely.

Holding dated debt instruments to maturity is seen as a valid exit strategy; this is because there is no possibility of holding dated debt investments indefinitely. [IFRS 10 para BC245].

PwC observation

A business purpose of investing for capital appreciation and/or income is not consistent with an objective of holding investments indefinitely. Most non-investment entities do not plan to sell, list or otherwise dispose of most of their subsidiaries within a particular timeframe. A fund, on the other hand, will usually have an exit strategy. An entity should have exit strategies in order to demonstrate a business purpose consistent with being an investment entity.

The amendment gives the following examples of potential exit strategies for different types of investment:

- Exit strategies for private equity securities can include an initial public offering, a private placement, a trade sale of a business, distributions (to investors) of ownership interests in investees and sales of assets (including the sale of an investee's assets followed by a liquidation of the investee, such as when the fund is a limited life fund).

- If your entity has investments in traded equity investments, exit strategies might include selling the investment in a private placement or in a public market.

- An exit strategy for real estate investments might be sale through specialised property dealers or through the open market.

[IFRS 10 para B85G].

Example

A fund holds investments in both equity securities and fixed-maturity debt securities. The stated objective of the fund is to provide investment management services to its investors, and invest funds received from investors solely for returns from capital appreciation and/or investment income. Assume that the fund meets all of the typical characteristics listed in IFRS 10. The fund's strategy for holding debt instruments is to manage its liquidity risk and to mitigate the risk of holding more volatile investments.

The fund has a documented exit strategy for substantially all of its equity investments; but it has no documented exit strategy for its debt investments. The absence of a documented exit strategy for debt investments does not disqualify the fund from being an investment entity, and it does not contradict its business purpose. The debt instruments have a fixed maturity, so they cannot be held indefinitely.

Exit mechanisms that have been put in place only for default events (such as breach of contract or nonperformance) are not considered exit strategies for the purpose of the investment entity assessment.

[IFRS 10 para B85F].

PwC observation

Exit strategies will often be evident from a fund prospectus or an entity's investment management agreement. For example, a limited life fund by definition has exit strategies for its investments. A fund that instructs its manager to turn over its equity investments at least every five years has an exit strategy.

But an entity that is set up for long-term capital growth through manufacturing and selling products in a particular market - and which has no explicit plans to dispose of any of its equity investments - might have more difficulty determining that it has exit strategies for its investments. Such an entity might in fact, be more like a conglomerate and might not have a business purpose of investing for capital appreciation and/or investment income.

Your entity might meet its business objective through holding some investments in another entity for legal, regulatory, tax or similar business reasons. You might not have identified an exit strategy for such investments. But, if the entity that you have invested in has an exit strategy for its investments, your entity will likely qualify as an investment entity. This will often be the case in master-feeder structures. A feeder fund invests in a master fund and does not have a plan to exit the master fund. But, the master fund will make investments and provided there are exit strategies for those investments, the feeder fund will not be disqualified from being an investment entity.

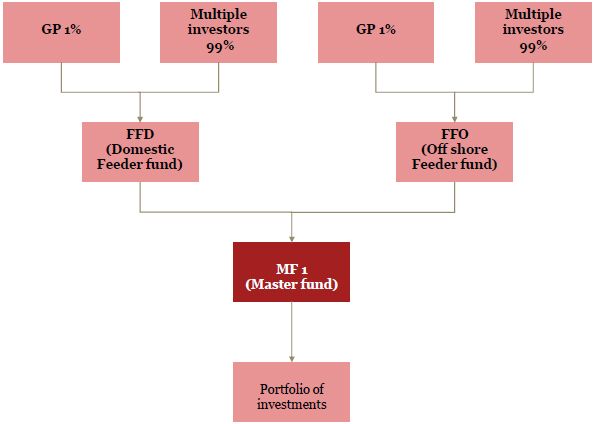

Example – A master-feeder structure (based on IFRS 10 para IE12, example 4)

An entity, master fund 'MF1', is formed in 20X1 with a 10-year life. The equity of MF1 is held by two related feeder funds. The feeder funds are established in connection with each other to meet legal, regulatory, tax or similar requirements.

The feeder funds are capitalised with a 1% investment from the general partner and 99% from equity investors that are unrelated to the general partner (with no party holding a controlling financial interest). The general partner of both FFD (a domestic feeder) and FFO (an offshore feeder) is the manager of MF1, FFD and FFO.

Facts

The purpose of MF1 is to hold a portfolio of investments in order to generate capital appreciation and investment income (such as dividends, interest or rental income). The investment objective communicated to investors is that the sole purpose of the master-feeder structure is to provide investment opportunities for investors to invest in a large pool of assets. MF1 has identified and documented exit strategies for the equity and nonfinancial investments that it holds. MF1 also holds a portfolio of dated debt investments: some of these will be held until maturity and others will be traded. MF1 has not identified which specific investments will be held and which will be traded. MF1 measures and evaluates substantially all of its investments (including its debt investments) on a fair value basis. Also, investors receive periodic financial information, on a fair value basis, from the respective feeder funds, FFD and FFO.

Are MF1, FFD and FFO investment entities?

Conclusion

MF1 and the feeder funds FFD and FFO each meet the definition of an investment entity. The following conditions exist:

- MF1 and the feeder funds FFD and FFO have obtained funds for the purpose of providing investors with investment management services.

- The master-feeder structure's business purpose (which was communicated directly to investors of the feeder funds) is investing solely for capital appreciation and investment income and MF1 has identified and documented potential exit strategies for its equity and non-financial investments.

- Although FFD and FFO do not have an exit strategy for their interests in MF1, they can be considered to have an exit strategy for their investments; this is because MF1 was formed in connection with the feeder funds and holds investments on their behalf.

- The investments held by MF1 are measured and evaluated on a fair value basis and information about the investments made by MF1 is given to investors on a fair value basis through the feeder funds.

MF1 and the feeder funds were formed in connection with each other for legal, regulatory, tax or similar requirements. When considered together, MF1, FFD and FFO display the following typical characteristics of an investment entity:

- Although the feeder funds each hold a single investment in MF1, they could be considered indirectly to hold more than one investment; this is because MF1 holds a portfolio of investments.

- Although MF1 is 100% owned by the two feeder funds, the feeder funds FFD and FFO are funded by many investors who are unrelated to the feeder funds (and also unrelated to the general partner/manager of the funds).

- Ownership in the feeder funds is represented by units of equity interests.

Earnings from investments

If your entity or another member of your group can obtain or is seeking other benefits from your entity's investees that are unavailable to unrelated parties, that investee is not held with the sole objective of obtaining capital appreciation and/ or investment income. Instead, your entity might hold the investment in some operating or strategic capacity. Such an objective means that your entity does not qualify as an investment entity.

Some examples of such benefits, which are inconsistent with an investment entity's business purpose, include:

- The acquisition, use, exchange or exploitation of the processes, assets or technology of an investee. This includes scenarios where you have (or another member of the group that you are a part of has) disproportionate or exclusive rights to acquire assets, technology, products or services of any investee (for example, by holding an option to purchase an asset from an investee if the asset's development is deemed successful).

- Your entity or any other member of your group entering into a joint arrangement (as defined in IFRS 11) or other agreement with an investee to develop, produce, market or provide products or services.

- Financial guarantees or assets provided by your entity's investee serve as collateral for your entity's borrowing arrangements or for those of another member of your group; but an investment entity can use an investment in an investee as collateral for any of its borrowings.

- An option held by your entity's related party to purchase from your entity or any other member of your group an ownership interest in an investee of the entity.

- Any transactions between you (or any other member of your group) and an investee that:

- are on terms that are unavailable to entities that are neither your related parties or related parties of another member of your group or the investee;

- are not at fair value; or

- represent a substantial portion of the investee's or your business activity, including business activities of other entities of your group.

[IFRS 10 para B85I].

It is consistent with an investment entity's business purpose to have a strategy to invest in more than one investment in the same industry, market or geographical area in order to benefit from synergies that the capital appreciation of those investments. This is the case unless your entity is receiving any returns beyond solely capital appreciation and/ or investment income by holding such investments. [IFRS 10 paras B85J and BC243].

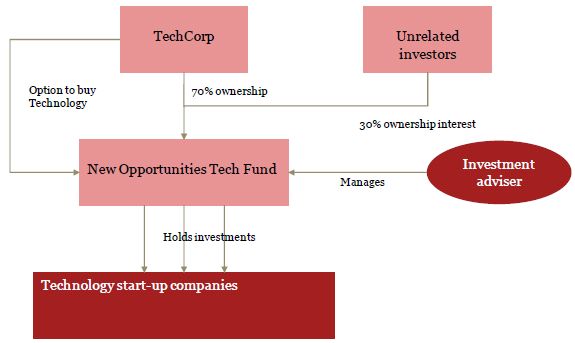

Example – High technology fund (based on IFRS 10 para IE7, example 2)

Facts

A fund is formed by Technology Corp Inc ('TechCorp') to invest in technology start-up companies for capital appreciation. TechCorp holds 70% of the shares in the fund, called 'New Opportunities Tech Fund' and controls the fund. The other 30% of the shares in New Opportunities Tech Fund is owned by a number of unrelated investors. New Opportunities Tech Fund will invest in start-ups; and it will bring together a team of specialists to grow the start-ups.

TechCorp holds options to acquire any of the investments held by New Opportunities Tech Fund, exercisable after 5 years following the purchase of the start-ups by the fund. The exercise price of the options is fair value. TechCorp is likely to exercise the options if the businesses or technology developed by the investees would benefit the operations of TechCorp. No plans for exiting the investments have been identified by the fund. New Opportunities Tech Fund is managed by an investment adviser that acts as agent for the investors in the fund.

Is New Opportunities Tech Fund an investment entity?

Conclusion

New Opportunities Tech Fund's business purpose is to invest for capital appreciation, and it provides investment management services to its investors. But the fund is not an investment entity because of the following arrangements and circumstances:

- TechCorp, the fund's parent, holds options to acquire the investees owned by New Opportunities Tech Fund if the assets developed by the investees would benefit the operations of TechCorp. This provides a benefit to TechCorp in addition to capital appreciation and/or investment income.

- The investment plans of the fund do not include exit strategies for its equity investments. The options held by TechCorp are not controlled by the fund (since they are exercisable by TechCorp) and do not constitute an exit strategy.

Example – Real estate fund

Facts

A real estate fund is set up to invest in real estate assets for the benefit of institutional and retail investors. It is set up and managed by an investment manager experienced in the real estate business. The fund invests in real estate companies and other real estate investment funds which own, manage and lease out real estate assets. The investment manager has a policy of acquiring and disposing of its real estate investments over a five to ten year timeframe, based on market conditions.

The fund earns dividends and share of profits, and it realises capital gains from its real estate investments.

The fund reports (internally and externally) all its investments at fair value and its performance is assessed based on those fair values.

The fund issues redeemable participating units which are redeemable at a share of the fund's net asset value (NAV). The founding documents of the fund confirm its objectives and strategy as stated.

Is the fund an investment entity?

Conclusion

The fund meets the definition of an investment entity because its objective is to generate returns from capital appreciation and investment income through investment management services. It manages its investments on a fair value basis, which is reported to its investors. It displays the typical characteristics of an investment entity which are: it has more than one unrelated investor; it holds multiple investments; and it has ownership interests in the form of fund units which represent a proportionate share of its underlying assets.

Example – Real estate entity (based on IFRS 10 para IE9, example 3)

Facts

Real Estate Investments ('REI') was formed in order to develop, own and operate retail, office and other commercial properties. REI usually holds each of its properties in separate wholly-owned subsidiaries. Those subsidiaries have no other substantial assets or liabilities other than borrowings used to finance the related investment property. REI and each of its subsidiaries report their investment properties at fair value under IAS 40, 'Investment property'. REI does not have a set time frame for disposing of its property investments, but it uses fair value to help identify the optimal time for disposal. REI and its investors also use measures other than fair value (including information about expected cash flows, rental revenues and expenses) to assess performance and to make investment decisions. The directors and managers of REI do not consider fair value information to be the primary measurement attribute to evaluate the performance of REI's investments; instead, they see that information as part of a group of equally relevant key performance indicators.

REI undertakes extensive property and asset management activities (including property maintenance, capital expenditure, redevelopment, marketing and tenant selection) some of which it outsources to third parties. This includes the selection of properties for refurbishment, development and the negotiation with suppliers for the design and construction work to be done to develop such properties. This development activity forms a separate substantial part of REI's business activities.

Is REI an investment entity?

Conclusion

REI is not an investment entity because:

- It has a separate substantial business activity that involves the active management of its property portfolio, including lease negotiations, refurbishments and development activities, and marketing of properties to provide benefits other than capital appreciation and/ or investment income.

- REI's investment plans do not include specified exit strategies for its investments. As a result, it plans to hold those property investments indefinitely.

- Although REI reports its investment properties at fair value under IAS 40, fair value is not the primary measurement attribute used by management to evaluate the performance of its investments. Other performance indicators are used to evaluate performance and make investment decisions.

Fair value measurement

As an investment entity, fair value should be the primary measurement attribute for substantially all investments. For an entity that provides investment management services and invests for capital appreciation and/or investment income, fair value is likely to be more relevant information to evaluate the performance of your entity's investments (both internally and externally) compared to consolidating the entity's subsidiaries or using the equity method for the entity's interests in associates or joint ventures.

Consequently, the amendment requires your entity to measure and evaluate the performance of substantially all of its investments on a fair value basis in order to qualify as an investment entity. [IFRS 10 para 27(c)]. This requirement applies to 'investments'. So, it does not apply to non-investment assets or to financial liabilities. For example head office property and related equipment held under IAS 16, 'Property, plant and equipment' do not need to be measured and evaluated on a fair value basis. [IFRS 10 para B85M].

It is evident that fair value information is your primary measurement attribute if fair value information is:

- used internally by key management personnel to assess performance of substantially all the entity's investments; and

- provided to your entity's investors and the entity measures substantially all its investments at fair value in its financial statements where this is permitted or required by IFRS.

[IFRS 10 para B85K].

Note that 'fair value information' includes using information from financial assets that are fair valued on the statement of financial position with fair value changes recognised in other comprehensive income under IFRS 9 and IAS 39, 'Financial instruments: Recognition and measurement' such as available for sale assets.

An investment entity accounts for:

- investment property using the fair value model in IAS 40, 'Investment property';

- associates and joint ventures on a fair value basis by electing the exception from the equity method in IAS 28, 'Investment in associates'; and

- financial assets on fair value basis under IFRS 9.

[IFRS 10 para B85L].

Typical characteristics of an investment entity

Your entity is expected to display the following characteristics in order to qualify as an investment entity, in addition to meeting the definition. These characteristics are considered typical of investment entities:

- holding more than one investment;

- having more than one investor;

- having investors that are not the entity's related parties; and

- having ownership interests in the form of equity or similar interests.

[IFRS 10 para 28].

The characteristics require you to apply additional judgement. Your entity can be an investment entity in the absence of one or more of these characteristics, provided you have assessed why it is appropriate for it to qualify as an investment entity in the absence of the typical characteristic(s) and make appropriate disclosure in the financial statements (see section on 'Disclosures'). It is considered highly unlikely, but possible, that your entity will qualify as an investment entity where it seems to strictly meet the definition but possesses none of the typical characteristics.

[IFRS 10 para BC234].

More than one investment

An investment entity will typically hold (directly or through another entity) more than one investment, with the objective of diversifying its risks and maximising returns. [IFRS 10 para B85O].

You should look at all the facts and circumstances to determine whether your entity qualifies as an investment entity, considering its business purpose, where you hold only one investment. Some scenarios where it might be appropriate to hold a single investment - and nevertheless qualify as an investment entity - are included in the amendment:

- Your entity has made only one investment because it is in a start up period and has not yet identified suitable multiple investments.

- Your entity has not yet made new investments to replace those that have been disposed of.

- Your entity has been established to pool investors' funds to purchase a single investment that would have been unobtainable by individual investors (for example, when the required minimum investment is too high for an individual investor).

- Your entity is in the process of liquidation.

[IFRS 10 para B85P].

PwC observation

Most of the above single investor situations occur where a single investment is held temporarily or during a period of transition. It would be highly unusual to have only one investment for the life of an investment entity. The intention of investment entities is usually to hold more than one investment.

If the intention is to hold multiple investments (but, for some practical or genuine reasons, your entity could not do so at the reporting date) it will likely continue to qualify as an investment entity.

Example – Limited Partnership (based on IFRS 10 para IE1, example 1)

Facts

An entity (LP) is formed in 20X1 as a limited partnership with a 10-year life. The offering memorandum states that LP's purpose is to invest in entities with rapid growth potential, with the objective of realising capital appreciation over their life. Entity GP (the general partner of LP) provides 1% of the capital to LP and has the responsibility of identifying suitable investments for the partnership. Approximately 75 limited partners (who are unrelated to GP) provide 99% of the capital to the partnership.

LP begins its investment activities in 20X1.But no suitable investments are identified by the end of 20X1. In 20X2, LP acquires a controlling interest in one entity, ABC Corporation. LP is unable to close another investment transaction until 20X3, when it acquires equity interests in five additional operating companies. Other than acquiring these equity interests, LP conducts no other activities. LP measures and evaluates its investments on a fair value basis and this information is provided to GP and the external investors.

LP has plans to dispose of its interests in each of its investees during the 10-year stated life of the partnership. Such disposals include the outright sale for cash, the distribution of marketable equity securities to investors (following the successful public offering of the investees' securities) and the disposal of investments to the public or other unrelated entities.

Is LP an investment entity?

Conclusion

From the information provided, LP meets the definition of an investment entity from formation in 20X1 to 31 December 20X3 because the following conditions exist:

- LP has obtained funds from the limited partners and is providing those limited partners with investment management services.

- LP's only activity is acquiring equity interests in operating companies with the purpose of realising capital appreciation over the life of the investments. LP has identified and documented exit strategies for its investments, all of which are equity investments.

- LP measures and evaluates its investments on a fair value basis and reports this financial information to its investors.

In addition, LP displays the following typical characteristics of an investment entity:

- LP is funded by many investors.

- Its limited partners are unrelated to LP.

- Ownership in LP is represented by units of partnership interests acquired through a capital contribution.

- LP does not hold more than one investment throughout the period. But this is because it was still in its start-up period and had not identified suitable investment opportunities.

Example – Access fund

Facts

An 'access fund' was set up in connection with a 'main fund'. The access fund is the named shareholder on the register of the main fund. The access fund originally invested in the main fund at the initial offering stage of the main fund. Within the governing documents of the main fund, there was an initial subscription of $500 million. Once these capital amounts were raised, the main fund would be closed to new investors. This is referred to as a 'soft-closed' fund. The main fund is closed to monies from new investors but not from existing investors.

The main fund has been set up to make multiple investments, and it has an exit strategy set out in its founding documents.

The objective of the access fund is to invest solely in the main fund. Shareholders who want access to the main fund can only do so through the access fund; this is because the main fund is closed to new shareholders. Shareholders of the access fund are entitled to a proportionate share of net assets of the access fund.

The access fund provides investment management services to its unrelated investors; and it will receive returns from capital appreciation and investment income (that is, distributions from the main fund). The access fund manages its investment in the main fund on a fair value basis.

Is the access fund an investment entity?

Conclusion

The access fund meets the definition of an investment entity:

- The fund obtains funds from investors with the objective of providing investment management services.

- The objective of making investments is generating capital returns and investment income; the fund will receive dividends from the main fund and capital appreciation through increases in the fair value of the main fund. Although the access fund does not have an exit strategy for its investment in the main fund, the main fund has exit strategies for its investments.

- It measures and evaluates the performance of its investment in the main fund on a fair value basis.

The access fund displays three of the four typical characteristics of an investment entity:

- The fund has multiple investors.

- The multiple investors are unrelated.

- The fund has ownership interests in the form of units that entitle the investors to the net assets of the fund.

The access fund does not display the fourth typical characteristic (that is, it has one single investment), but it concludes that it qualifies as an investment entity. It has been set up to provide investment management services to its investors with the objective of earning capital appreciation and investment income from its investment in the main fund. It manages its underlying investment on a fair value basis. The fact that it does not meet the characteristic in these circumstances is not inconsistent with the overall definition and business purpose of being an investment entity. The access fund is required to make appropriate disclosures as to why it has concluded that it is an investment entity despite not displaying all of the typical characteristics.

More than one investor

In order to qualify as an investment entity, your entity would typically obtain funds from several investors, with the objective of providing its investors with investment management services and investment opportunities that they might not have access to individually.

There could be scenarios where your entity has only one investor. In such cases, you should examine the reasons and whether they are consistent with the definition of an investment entity. The amendment identifies some situations where it might be appropriate to conclude that your entity is an investment entity despite having only one investor.

These are situation where:

- Your entity's initial offering period has not expired and it is actively identifying additional suitable investors.

- Your entity has not identified suitable investors to replace ownership interests that have been redeemed.

- Your entity is in the process of liquidation.

[IFRS 10 para B85S]

PwC observation

Most of the above single-investor situations occur where an entity has a single investor temporarily or as part of a winding up process. It would be unusual to have only one investor other than as noted above. Investment entities are usually set up to provide investment management services to a group of investors.

Example – Single investor fund – seed capital

Facts

An investment fund has been set up by its manager; initially the manager is the sole shareholder (that is, the manager has provided 'seed capital'). As at its first period end, the fund has not been successful in receiving funds from other prospective shareholders; but it is actively soliciting new investors. The fund invests in global equities and equity-related derivatives; and it provides its one shareholder with investment management services (as mandated in its prospectus). Its prospectus states that it expects to buy and sell investments regularly, and it expects holding periods of more than one year to be rare.

The fund generates returns from capital appreciations and investment income in the form of dividends. The fund fair values all investments and these valuations are the basis for subscriptions and redemptions into and out of the fund. Subscriptions and redemptions can occur daily.

Is the fund an investment entity?

Conclusion

The fund is an investment entity.

It meets the definition of an investment entity:

- It has been set up to provide investment management services to its investors. For this period, it has only one manager-shareholder and so it is providing investment management services to itself, but this is not its longer-term manager intention.

- It is carrying on its investment activities with the objective of capital appreciation and investment income.

- It measures its underlying investments on a fair value basis and fair value is the basis for subscriptions and redemptions into and out of the fund.

The fund displays the following characteristics:

- It holds multiple investments.

- It does not have multiple investors; but, this is expected to be temporary and the fund manager is actively soliciting new investors.

- It does not have unrelated investors, because it has only a single investor.

- It issues ownership interests in the form of redeemable units that entitle the holders to a share of net assets.

Although the fund has a single investor, this is expected to be temporary. Failing to meet this typical characteristic does not mean that the fund is not an investment entity. In the context of the definition and the fund's overall business purpose, it is an investment entity. The fund is required to make appropriate disclosures in its financial statements on why it qualifies as an investment entity even when it has only one investor.

Your fund or entity might have been set up by a single investor to meet a specific objective or to help support the interest of a wider group of investors. For example, your entity is a fund that has been set up by a corporate entity to make investments on behalf of that corporate entity's employees. So, your entity has a single investor but, in substance, it has been set up to support the interests of a wider group (that is, its parent investor's employees). Other examples of such entities might include a pension fund, a government owned investment fund or a family trust. Each of these is formed by or for a single investor but it represents or supports the interests of a wider group of investors. Failing to meet this characteristic in such circumstances is not inconsistent with the overall business purpose and definition of an investment entity. [IFRS 10 para B85R].

Example – Sovereign wealth fund

Facts

The government of Country X sets up a sovereign wealth fund (SWF) to manage its income from natural resources for the long-term benefit of its citizens. The SWF will, for example, be used to fund future pensions and significant capital projects carried out by the state. The fund is set up as a separate legal entity established under statute, and it is owned by the central bank of country X. It has issued shares to the bank. The fund employs a team of professional investment managers, who work to a mandate that is overseen by the central bank and annually approved by country X's government. The fund makes multiple investments (some of which are controlling stakes) and sets out exit strategies for different classes of investment. The fund produces public reports twice-yearly, which detail the total value of the fund and of its main asset classes. Internal reporting is more detailed and also on a fair value basis.

Is country X's SWF an investment entity?

Conclusion

Country X's SWF is an investment entity because:

- It has been set up to provide investment management services to its investor (which, in this case, is the government of country X).

- It is carrying on its investment activities with the objective of capital appreciation and investment income.

- It measures its underlying investments on a fair value basis, and it reports its funds value on a fair value basis.

It also displays the following typical characteristics of an investment entity:

- It holds more than one investment.

- It has only one investor, which is the central bank of country X. It can nevertheless be seen, in substance, as investing the funds of the citizens of country X on their behalf. This is not inconsistent with the overall definition and business purpose of an investment entity. It has one related party direct beneficiary, due to having one investor; but, again, it could be argued that, in substance, it operates on behalf of many unrelated beneficiary investors.

- The fund has issued units that entitle its investor to a share of its net assets.

Unrelated investors

An investment entity will typically have multiple investors that are not its related parties (as defined by IAS 24, 'Related party disclosures') and are not related to the group to which the investment entity belongs. You need to look at all the facts and circumstances in a situation where your entity has investors that are related to it. This is because having related parties as investors makes it more likely that your entity (or other members of its group) could obtain benefits other than capital appreciation or investment income.

Your entity might qualify as an investment entity even when its investors are related parties. For example, it might be a parallel fund (that is, investing in the same assets as another fund) set up by the manager of that other fund to incentivise and reward a group of the manager's employees. [IFRS 10 para 85U].

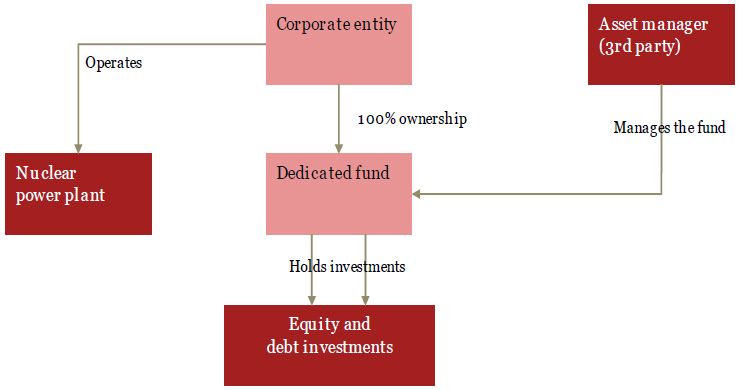

Example –Nuclear power plant

Facts

A dedicated fund is set up by a corporate entity that runs a nuclear power plant. The corporate entity (which owns all of the units in the fund) needs to keep funds available in case of a technical failure of the nuclear power plant. The entity does not have the expertise to manage the fund, so it appoints a third party asset manager. The entity can remove the fund manager on three months' notice.

The fund invests in traded equity and debt instruments (as set out in the investment management agreement and fund founding documents) and its maximum exposure to one investment is not more than 10% of monies invested. The objective of the fund is to generate returns either from dividends and interest or from selling the instruments. The fund does not invest in the nuclear energy industry and the corporate entity has no other relationship with the fund; for example, it does not have options to buy any of the investments made by the fund.

The fund reports fair value information internally and to its corporate parent; and its performance is evaluated against a benchmark stock exchange index.

The fund issues units that are redeemable at any time. The redeemable shares pay the net asset value of the fund when liquidated, and they are accounted for by the fund as equity under IAS 32. The units do not carry voting rights.

Is the fund an investment entity?

How does the corporate entity account for its interest in the fund?

Conclusion

The fund is an investment entity. It meets the definition of an investment entity:

- It provides investment management services to its investor.

- Its business purpose is to invest in debt and equity instruments for capital appreciation and investment income.

- It measures and evaluates the performance of its investments on a fair value basis.

The fund also displays two of the four typical characteristics:

- The fund holds multiple investments.

- The fund only has one investor but in these circumstances that is not inconsistent with its overall business purpose and with the definition of an investment entity.

- The fund does not have unrelated investors, because there is only one investor; but, again, in these circumstances this is not inconsistent with the definition of an investment entity.

- Units issued by the fund entitle the holder to a proportionate share of the net asset value of the fund.

Two of the characteristics are not satisfied because the fund has a single investor. When examining all the facts and circumstances, however, the fund concludes that it is an investment entity and that the failure to meet two of the typical characteristics is not inconsistent with the definition. It gives appropriate disclosure about its judgement under IFRS 12 (see section on Disclosures).

The corporate entity is not an investment entity. It consolidates the fund (including any controlled investments made by the fund).

Ownership interests

Your entity need not be a separate legal entity to qualify as an investment entity. Whatever its legal form, its ownership interest would generally be in the form of equity or similar interests (for example, partnership interest) to which a proportionate share of its net assets is attributable. This is because your entity will generally need a means by which it distributes or attributes value from its capital and income returns. Having different classes of investors does not mean that an entity is not an investment entity. [IFRS 10 para B85V].

Your entity's ownership interests might be accounted for as debt because they do not meet the definition of equity under IAS 32, 'Financial instruments: presentation'. Even though the instruments are not equity, this will usually not indicate that your entity is not an investment entity so long as they provide holders with exposure to variable returns from changes in the fair value of the entity's net assets.

[IFRS 10 para B85W].

PwC observation

Unit trusts and mutual funds often issue units that are accounted for as liabilities under IAS 32 guidance; this is because they do not qualify to be presented as equity under the IAS 32 'puttables' amendment. Where such units (whether or not they are presented as equity) entitle the entity's holders to proportionate shares of net assets, they will not be an indicator that the fund is not an investment entity.

Some funds are financed through debt instruments (particularly in private equity) which participate in the returns of the fund. Such debt instruments would not be a negative indicator of investment entity status under the 'ownership interests' typical characteristic.

Separate financial statements

There are two different situations where separate financial statements are relevant to investment entities.

The first situation is where your entity controls investee subsidiaries but none of these subsidiaries is required to be consolidated; in other words, it does not control any subsidiaries that provide investment related services. [IFRS 10 para 32]. In such a situation, it will measure all of its subsidiaries at fair value through profit or loss, and it will present separate financial statements as its only financial statements. [IAS 27 para 8A].

Alternatively, your entity might be an investment entity that has some investee subsidiaries that are accounted for at fair value through profit or loss, and other subsidiaries that provide investment-related services and which are consolidated. In this case, it will prepare consolidated financial statements under IFRS 10. In these consolidated financial statements, the subsidiaries providing investment-related services are consolidated and other investees are measured at fair value through profit or loss. The entity might also be required to prepare separate financial statements. In those separate financial statements, it must account for the subsidiaries that are measured at fair value through profit or loss in its consolidated financial statements in the same way as in its separate financial statements. [IAS 27 para 11A].

Reassessment of investment entity status

You should reassess investment entity status when facts and circumstances indicate that there is a change to one or more of the three elements making up the definition of an investment entity or to any of the typical characteristics. [IFRS 10 para 29].

Any change in status is accounted for prospectively (that is, from the date when the change in status occurred). [IFRS 10 para 30].

Example – Investors redeem units

Due to a change in market conditions, investors in a fund are redeeming their units. As a result of this redemption, one significant investor remains in the fund. The fund should reassess its investment entity status. In this case, the fund might continue to meet the definition and remain an investment entity, in either of the following situations: if its business continues to be management of investments for capital appreciation and/or income, but now for one investor instead of many; or if it expects that this will be a temporary situation.

Example – Fund nearing end of life

A fund was set up with a limited life of 10 years. The fund is in its final year, and it reaches a stage where it has one single investment remaining. The objective of the fund has not changed; and the fund is realising its final investment with the objective of maximising the return to its investors. The fund should reassess its investment entity status when it has a single investment, because it no longer meets one of the typical characteristics. But it might conclude that it continues to be an investment entity if its single investment is not inconsistent with its overall purpose; in that case, it continues to meet the definition of an investment entity.

Accounting for a change in status – Becoming or ceasing to be an investment Entity

Consolidated financial statements

The amendment contains guidance on how your entity should account in its consolidated financial statements for a change in status - when it either becomes or ceases to be an investment entity. This is done prospectively.

[IFRS 10 para 30, paras B100, B101].

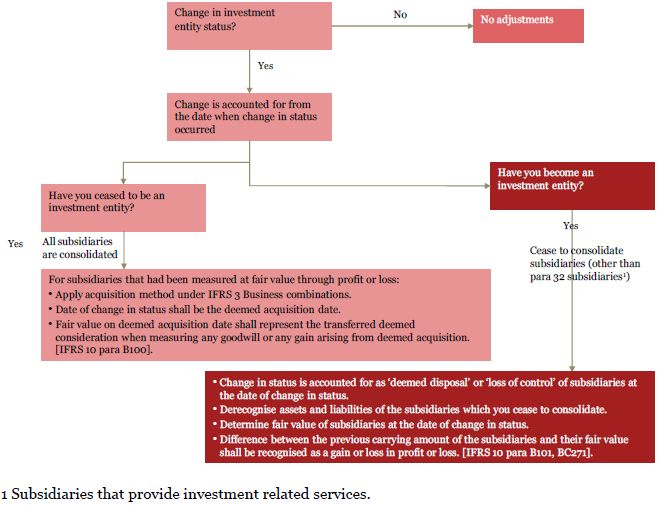

The flowchart below illustrates how the change in status is accounted for in the consolidated financial statements

Separate financial statements

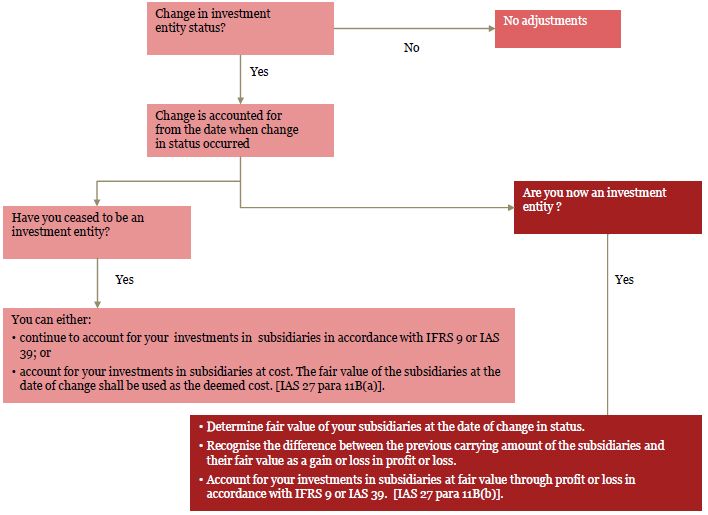

If your entity prepares separate financial statements, the flowchart below illustrate how to account for a change in status (that is, when your entity becomes or ceases to be an investment entity). This is done prospectively from the date of the change in status. [IFRS 27 para 11B].

Disclosure

IFRS 12, 'Disclosure of interests in other entities' has been amended to introduce disclosure requirements for investment entities with controlled subsidiaries. Appendix A to this document sets out the disclosures. These disclosures are also required by an investment entity parent that prepares separate financial statements as its only financial statements (see page 21). [IAS 27 para 16A].

The intention of the IFRS 12 disclosures is to give relevant information to users to help them understand:

- significant judgements and assumptions made in making the investment entity determination;

- reasons for concluding why you consider your entity to be an investment entity, even if it doesn't have one or more of the typical characteristics; and

- information about unconsolidated subsidiaries and unconsolidated structured entities controlled by your entity.

An investment entity is exempt from providing summarised financial information about its associates and joint ventures when they are accounted for on a fair value basis under IAS 28. [IFRS 12 para 21A].

IFRS 7, 'Financial instruments: Disclosures' applies to investments in subsidiaries that are measured at fair value through profit or loss.

Date of application and transition requirements

The amendment is applicable for periods beginning on or after 1 January 2014. Earlier application is permitted. If you apply the amendment early, that fact should be disclosed; and the amendments to other standards should also be applied. [IFRS 10 para C1B].

PwC observation

Early adoption will allow entities that apply IFRS 10 at its application date of 1 January 2013 to apply the investment entity amendment at the same time.

To apply the amendment, you first need to determine whether your entity meets the definition of an investment entity at the date of initial application of the amendments. The date of initial application is the beginning of the annual reporting period for which the amendment is applied for the first time. [IFRS 10 para C2B]. For example, if you apply the amendment for the accounting period beginning on 1 January 2014, the date of initial application will be 1 January 2014. You should make the assessment as at the date of initial application (in this example, 1 January 2014) based on all the facts and circumstances that exist at that date. [IFRS 10 para C3A].

The following paragraphs assume that your entity meets the definition of an investment entity at the date of initial application and is applying the amendment.

The amendment should be applied retrospectively. This is the case irrespective of whether the entity would have met the definition of an investment entity in prior reporting periods. The entity should cease to consolidate its subsidiaries; instead, it should measure them at fair value through profit or loss as if the amendment had always been effective except for any subsidiaries it is required to consolidate because they provide investment-related services (under IFRS 10 para 32). But your entity is not required to make any adjustment for subsidiary investments which it had disposed of or lost control of before the date of initial application. [IFRS10 paraC3E]. The entity should adjust equity at the beginning of the immediately preceding period, for an amount that is the difference between:

- the previous carrying amount of the subsidiary; and

- the fair value of the investment entity's investment in the subsidiary.

The entity should also transfer to retained earnings any fair value adjustments that had been recognised in other comprehensive income at the beginning of the preceding annual period. [IFRS 10 para C3B].

The fair value of your entity's investments at the beginning of the immediately preceding period should be determined under IFRS 13, 'Fair value measurement'. If fair value is to be determined on a date before IFRS 13 is adopted, the fair value of your investments should be the fair value amounts that were previously reported to investors or to management (provided those amounts represent the amount for which the investments could have been exchanged between knowledgeable, willing parties in an arm's length transaction at the date of the valuation). [IFRS10 paraC3C].

If it is impracticable to measure subsidiaries at previous fair values, you should apply the requirements of the amendment at the beginning of the earliest period for which its application is practicable; this might be the current period. Where this is the case, the adjustment to equity noted above should be made at the beginning of the current period. [IFRS 10 para C3D].

PwC observation

We would expect that most investment entities will, be able to apply the amendment retrospectively (if they would also have met the definition of an investment entity in prior periods). This is because fair value measurement, evaluation and information provision are essential features of investment entities.

The IFRS 10 transition requirements are applicable where your entity prepares consolidated financial statements in the previous period and in the current period. Where you prepare separate financial statements (either as your only financial statements or in addition to consolidated financial statements) the amendments to IAS 27 include transition requirements. These are similar to ones in IFRS 10 described above and can be found in paragraphs 18C-18I of IAS 27.

The flowchart below illustrates IAS 27 transition requirements for separate financial statements of an investment entity.

Disclosures

Appropriate disclosures made? (Yes/ No/ N/A)

General disclosures

- The investment entity shall disclose information about significant judgements and assumptions it has made (and changes to those judgements and assumptions) in determining that it has met the definition of an investment entity.

[IFRS 12 para 9A]

- If the investment entity does not have one or more of the typical characteristics of an investment (see para 28 of IFRS 10), it shall disclose its reasons for concluding that it is nevertheless an investment entity.

[IFRS 12 para 9A]

- When an entity becomes, or ceases to be, an investment entity, it shall disclose the change of investment entity status and the reasons for the change. In addition, an entity that becomes an investment entity shall disclose the effect of the change of status on the financial statements for the period presented, including:

- The total fair value, as of the date of change of status, of the subsidiaries that cease to be consolidated;

- The total gain or loss, if any, calculated in accordance with paragraph B101 of IFRS 10; and

- The line item(s) in profit or loss in which the gain or loss is recognised (if not presented separately)

[IFRS 12 para 9B]

Interests in unconsolidated subsidiaries

- An investment entity that, in accordance with IFRS 10, is required to apply the exception to consolidation - and instead account for its investment in a subsidiary at fair value through profit or loss – shall disclose that fact.

[IFRS 12 para 19A]

- For each unconsolidated subsidiary, an investment entity shall disclose:

- the subsidiary's name;

- the principal place of business (and country of incorporation if different from the principal place of business) of the subsidiary; and

- the proportion of ownership interest held by the investment entity and, if different, the proportion of voting rights held.

[IFRS 12 para 19B]

If an investment entity is the parent of another investment entity, the parent shall also provide the disclosures in 19B (a)–(c) for investments that are controlled by its investment entity subsidiary. The disclosure may be provided by including, in the financial statements of the parent, the financial statements of the subsidiary (or subsidiaries) that contain the above information.

[IFRS 12 para 19C]

- An investment entity shall disclose:

- the nature and extent of any significant restrictions (for example resulting from borrowing arrangements, regulatory requirements or contractual arrangements) on the ability of an unconsolidated subsidiary to transfer funds to the investment entity in the form of cash dividends or to repay loans or advances made to the unconsolidated subsidiary by the investment entity; and

- any current commitments or intentions to provide financial or other support to an unconsolidated subsidiary, including commitments or intentions to assist the subsidiary in obtaining financial support.

[IFRS 12 para 19D]

- If, during the reporting period, an investment entity or any of its subsidiaries has, without having a contractual obligation to do so, provided financial or other support to an unconsolidated subsidiary (for example, purchasing assets of, or instruments issued by, the subsidiary or assisting the subsidiary in obtaining financial support), the entity shall disclose:

- the type and amount of support provided to each unconsolidated subsidiary; and

- the reasons for providing the support.

[IFRS 12 para 19E]

- An investment entity shall disclose the terms of any contractual arrangements that could require the entity or its unconsolidated subsidiaries to provide financial support to an unconsolidated, controlled, structured entity, including events or circumstances that could expose the reporting entity to a loss (for example, liquidity arrangements or credit rating triggers associated with obligations to purchase assets of the structured entity or to provide financial support).

[IFRS 12 para 19F]

- If during the reporting period an investment entity or any of its unconsolidated subsidiaries has, without having a contractual obligation to do so, provided financial or other support to an unconsolidated, structured entity that the investment entity did not control, and if that provision of support resulted in the investment entity controlling the structured entity, the investment entity shall disclose an explanation of the relevant factors in reaching the decision to provide that support.

[IFRS 12 para 19G]

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.