10.1. Fees and payments to the Insurance Broker

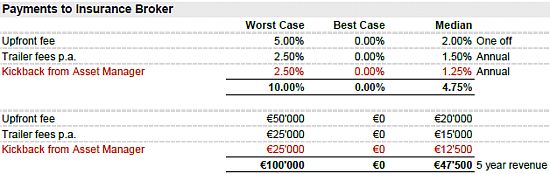

The broker may receive an up-front commission of between 1% and 5% of premium for his services plus a 0.3% annual trailer fee on the NAV of the assets underlying the policy for the term of that policy. In addition, he may negotiate a kickback from the asset manager for bringing the business. This kickback is allegedly normally about 0.3% p.a. taken on the value of the assets in the policy. Though this can be more depending on the assets within the portfolio. If the asset managers profitability is higher through the use of high cost investment funds and structured products, the broker may demand – and get - a larger slice. The table below shows the main payments to the broker, undisclosed payments in red.

Table 10: Fees to insurance broker over 5 years

Many international Clients believe it is necessary to go over a broker. This is not the case. An international Client taking out a Swiss or Liechtenstein insurance policy does not need a broker, the Client can approach the asset manager or insurance company directly. For non-Swiss Clients taking out larger policies, i.e., over €1 Mio. the insurance broker may be superfluous. The broker must bring skills, knowledge or other value to the table, otherwise his value add is all too often negative due to the upfront and trailer fees charged. The difference on using or not using a broker can be considerable – up to 10% of paid in premium over five years - with the 5 – 6% median case being about the minimum a Client can expect to pay. On larger policies, we believe that international Clients should look very carefully at whether the services of an insurance broker are called for. At the upper end, the Client should in any case be advised by a lawyer or other intermediary specialising in these products.

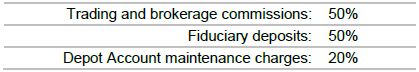

10.2. Fees and payments to the Insurance Company

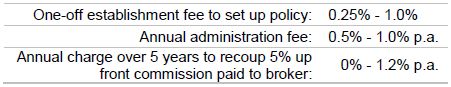

The insurance company is the key service provider. It issues the policy and provides coverage to the policyholder in return for payment of the insurance premium. There are three main fees charged by the insurer for its own services of which two are one-off fees, listed below.

The full range of payments is presented in the table below.

Table 11: Fees to insurance company over 5 years

- The establishment fee covers general administration and set up expenses on the part of the insurance company. On larger policies this is negotiable down to zero.

- The annual ca. 1% administration fee covers the insurers costs to administer the policy over the term and is also used to pay the brokers 0,3% annual trailer fee. For larger policies this is negotiable down to 0.5%.

- Some providers deduct the brokers up-front fee (assuming 5%) as a 1.2% p.a. fee over the first 5 years of the paid in premium (i.e., 6%). This is to cover the cost of the 5% upfront fee to the broker. This can be negotiated, though the broker will fight to protect his commission. To be fair, 5% has become rather uncommon, with 1.5-3% the going rate among the more serious providers for policies in the €500K – €1 Mio. range. This is generally disclosed, though many Clients are not really conscious of it.

With these providers, the recoup of the up-front fee to the broker is partly disguised as the insurance company debits the Client account over 5 years. Psychologically, this is less apparent to the Client than "5% up-front" even though he is actually paying 20% more. Behavioral finance in practice – the Client is more willing to pay 1.2% over 5 years than 5% up front. In substance, this is a financing transaction. The insurance company is charging the client a 20% interest rate to finance the pre-payment to the broker. The Client is charged 20% over 5 years to finance. The effective loan is over 5 years at the beginning balance, not on a diminishing balance basis. On a €1 Mio. policy for example, assuming the brokers commission is €50K, plus €10K going to the insurance company in financing charges, the total cost to the client is €60K. In substance, the insurance company is treating the 5% as a loan to the client and charging the client 20% interest.

The up-front fee is on a sliding scale, with policies between €1 - 5 Mio. generally carrying 1.0 - 3% up front charges.

Should the Client decide to surrender the policy early, the Client is often liable for the remainder of the broker fee as a surrender penalty. I.e., should the Client surrender the policy in year 2, he is liable for years 3,4 and 5 surrender penalty of 1.2% for a total of 3.6%. This equates to a €36,000 surrender penalty on a €1 Mio. policy1.

Note that the insurance company is generally fully transparent with respect to fees charged. Futhermore, there is not a great deal of difference to the insurer between worst and median case.

Effectively the insurance company is charging a small premium to cover its risk in working with the broker. This risk premium is paid by the Client.

The real cost of service provided by the carrier, approximately:

- 0.5% – 1.0% establishment fee to set up policy – one-off

- 0.5% p.a. to cover administration costs for the policy.

The policy itself, the structure, is relatively cheap to set up and maintain from a pure cost of service perspective, it is very good value indeed given the benefits and advantages.

In the classical sense, an insurance company's core competence is insurance; the pooling of actuarial risk and charging a premium to cover that pooled risk to Clients. Put another way, an insurer manufactures and sells insurance products priced to reflect risk plus administration costs plus a profit margin. Investment management may be a competency but is often outsourced – with the investments remaining on the insurers books. The difference with these products is that asset management is outsourced to an asset manager - with the added advantage of taking the risk off the insurers books. The asset manager has a discretionary mandate to manage the account according to guidelines agreed with the Client. Often the guidelines are very flexible indeed with the insurance company only specifying three or four possible strategies with very wide ranges of asset allocation allowing the Client to talk with his asset manager directly about the specifics of the strategy chosen. It is not the insurance companies job to watch over the investments or keep an eye on the investment manager. The insurer does arguably have a fiduciary duty to the policyholder, however this duty is interpreted rather loosely. Properly done, it is an excellent model where Clients with a trusted investment manager can retain him while profiting from the advantages insurance brings. Poorly done, it can be a recipe for disaster.

The cheapest and generally most transparent way is for the Client to approach the insurance company directly. This happens in practice, but it's relatively rare at the high end. Many investors are not comfortable trusting the insurance company with asset management - the insurance company may outsource it anyway. One medium-sized Liechtenstein insurer does work like this. They operate a simple business model in which a broker or other intermediary receives up-front and trailer fees, with asset management outsourced to a single partner bank with standard, pre-defined strategies and a unitary asset management. I.e., the Client can choose investment strategy, but cannot choose the asset manager. This is a more retail business, the policies written by this insurer tend to be smaller, under €1 Mio. For Clients of this insurer, this solution works very well, it is good value, transparent, controllable and low cost to the policyholder2.

10.3. Fees and payments to the Asset Manager

The asset manager manages the assets underlying the policy according to guidelines formally agreed with the policyholder and insurance company. The asset manager receives a limited power of attorney from the insurance company to manage the account on behalf of the policyholder (the ultimate beneficial owner). The asset manager has the most control and the most influence over costs. He is the main recipient of undisclosed payments, hence this is the longest treatment. We assume the asset manager is not charging an "all-in" fee for his services. "All-in" fees do happen, but they are rare in insurance.

The asset manager charges a management fee for his services, generally varying between 0.5% to 1.5% of assets under management (AUM) and is fully disclosed. In addition, completely separate to the management fee, asset managers commonly receive retrocessions and kickbacks on a variety of products and services. These may be kickbacks on trading commissions, brokerage, depot administration fees, investment (Mutual) funds and structured product emissions, fund management fees and others. These payments are generally not disclosed. Prior to the landmark Swiss Supreme court ruling in 2006, most asset managers did not disclose these payments in any way to the Client, even their existence was often denied. Lastly, the asset manager often receives a finders fee from the bank for bringing new money, generally about 0.2% to 0.3%. The Client doesn't pay this one, but we mention it for completeness.

If the asset manager is taking retrocessions on brokerage, he can increase his revenue by trading the account. We believe turnover rates on policies are lower than on direct Client discretionary accounts, around 30% turnover in an average year for a direct Client discretionary actively managed account in Switzerland is relatively common. We "think" the average insurance wrapper account has about 20% turnover in the average year.

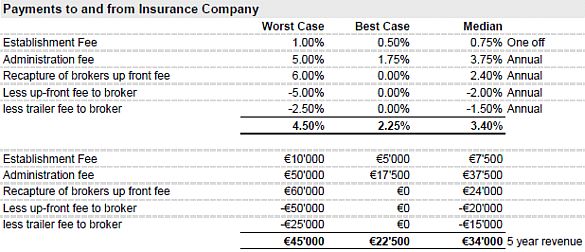

Basic retrocessions on bank services paid to asset managers by one globally active private bank in Zürich are as follows:

For every €1 brokerage paid to the bank by the Client, the asset manager receives €0.50 back from the bank not disclosed to the Client. The conflict of interest is not subtle, the asset manager has an incentive to trade the account. Selection of custodian bank is too often driven not on the basis of best execution, cost and service quality, but on "which bank pays the highest Retrocessions?".

The table below gives an overview of the payments to and from the asset manager over 5 years given as percentage of premium paid in and absolute values. Undisclosed payments in red. The percent fee calculation is simple addition, not compounding.

Table 12: Payments to and from the asset manager over 5 years

An analysis over a 5 year period is necessary for a representative picture, 10 would be better. Annual charges are meaningless because of the asset managers leeway in placing products with varying up-front commissions, loads and management fees, thereby "managing" costs from year to year. For example:

- Changing retrocession arrangements

- High set up costs in the first year

- Varying portfolio turnover from year to year, 10%, 20%, 30%, 40%...

- Varying purchases and turnover of funds and structured products with high up front loads and management fees

The scope for abuse is extraordinary with a cartoonish spread between best and worse case. The variability of and capability to steer the levels of undisclosed payments make it very difficult to estimate the true cost of service for a particular policy. In good years, the asset manager may milk the account more so than in bad years. I.e., the asset manager will restrain himself in bad years where the Client is looking more closely at his costs and will load up the extra-cost products in good years where the

Client is making money and not looking too closely at his account. The asset managers profitability can vary enormously from one year to another, which on a pure fee based model would not and should not be the case.

If the broker has brought the asset manager the business, the asset manager will often pass a kickback to the broker. If the Client came directly or is a pre-existing Client the asset manager retains all revenue accruing from both insurer and Client.

It is true that if dissatisfied with the asset manager the Client can request the insurance company to terminate the asset management agreement and nominate a new manager. In practice, this rarely happens. The Client needs to be feeling real anger before he will take this step. It is also true that the larger insurance players have their compliance departments keeping an eye on the asset managers and do in some cases change the asset manager. Again, this is relatively rare. We do not know how they oversee or monitor asset managers.

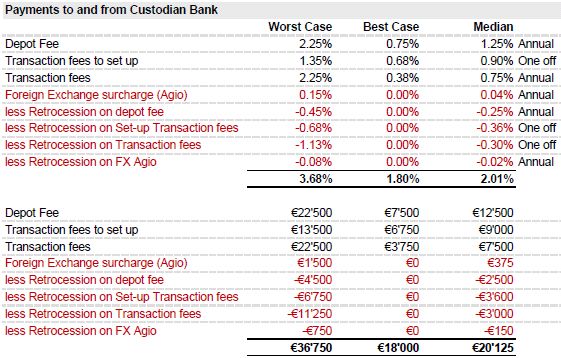

10.1. Fees and payments to and from the custodian bank

The custodian generally charges 0.15% to 0.35% on the NAV of the assets. He is a pure service provider, with a caretaker role in a volume business. Custody is understood as a pure commodity business, there should be very little differentiation between banks. In practice there are material differences between different banks in terms of standards, due diligence, procedures, pricing, service standards, the retrocessions they pay and what they are willing to accommodate. Standards tend to be high at the large Swiss banks, a close eye is kept on their asset managers because their reputations are on the line. When a big mistake happens, the whole world gets to hear about it as recently happened in the case of UBS. The smaller and private banks are a very mixed bag, some are very good indeed with high service standards and quality. Others resemble wild west outfits, where a lot can be arranged.

Given the commodity nature of custody, rather than go into "what can happen", we focus on the normal situation. The banks interest is in catering to the interests of asset manager, fund producer, insurance company and broker, these are his Clients, not the policyholder. The table below sets out the main payments, undisclosed in red.

Table 13: Payments to and from the custodian bank over 5 years

Note that there is not a lot of difference between the best and median case for the custodian. This is because higher margins on custodian bank charges usually get paid out to the asset manager as retrocessions.

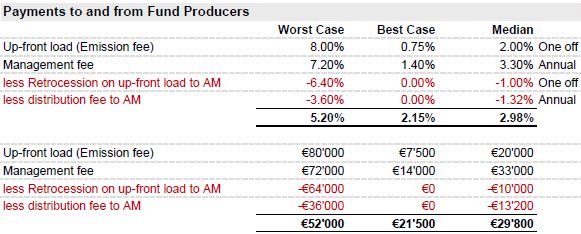

10.2. The fund producer

Investment funds are a huge source of potential abuse. The asset manager has a strong incentive to buy funds for the portfolio that:

- Charge high up front fees to the Client and pass these fees on to the asset manager

- Pay high distribution fees to the asset manager out of the management fee, implying higher management fees than necessary

Many investment funds carry an up front load or charge, a percentage premium to NAV. The up-front load is a commission paid on top of the NAV and varies from 0 to 5%. I.e., the asset manager purchases the fund for the Client at NAV or at a premium to NAV. When the asset manager purchases the fund at a premium, the fund producer passes that premium back to the asset manager as a retrocession giving the asset manager up to 5% of the NAV as an up front payment from the fund producer. The Client of course is pays an additional 5% of the value of the fund. For example, the asset manager buys the fund at €105 for the Client, the fund is valued at €100 in the Clients account and the fund company pays the asset manager 5% for placing its product. 5% is now less frequent, 2-3% however is common.

A distinction needs to be made here as there is often confusion as to who the producer actually is;

The fund producer:

- puts the fund together

- defines strategy

- promotes and places the fund

- usually does the asset management

The fund administrator:

- is generally a pure service provider charging defined set up fees, legal fees and an annual administration fee for its services

- provides the legal construct for the fund, takes care of administration, compliance, regulatory matters audit, etc.

- plays a support role

The fund producer may be an independent specialist fund company whose business it is to put funds together. He may also be an asset manager launching his own funds, usually in cooperation with a small group of co-managers3. All take and place a "tranche" of the issue with their Clients. For simplicity the following treatment takes the usual case of a separate, independent fund producer selling his product to an asset manager.

Generally the fund producer takes a small slice of the up front load, 0 - 0.5% with the rest going to the asset manager. The asset manager chooses which funds to place in Client portfolios giving him enormous bargaining power. The asset manager negotiates from a position of strength, if an independent fund company does not cooperate on kickbacks, there are plenty of others – witness the thousands of private label funds - available.

Up front loads are generally not disclosed specifically to the Client, though the point is often debated as the existence of the load is disclosed in the prospect. The asset manager will hold that the up front fees are disclosed in the prospect. The load however is generally taken at the discretion of the asset manager. The Client does not make the investment decision nor is he informed or asked if he wishes to purchase that particular fund. More instructive is to look at what is disclosed to the Client on the statement.

The asset manager generally receives an ongoing distribution fee from the fund provider, usually around 50% - 60% of the fund producers annual management fee. The asset manager therefore receives 0.5% - 0.85% p.a. distribution fee on the NAV of the fund. The main payments are detailed in the table below.

Table 14: Payments to and from the fund producer over 5 years

There is an extraordinary number of private or white label funds in Switzerland covering the full spectrum of strategies, many with high up front loads and management fees. These funds have to be going into portfolios somewhere. Yes, many funds do not have up-front loads (or are distributed at NAV), have management fees in the 0.8% - 1% range and add value. Again, it comes down to the asset manager to what goes into the portfolio. When presented with two otherwise identical funds, one paying a 3% up front Retrocession and 0.75% ongoing, the other paying nothing, clearly the high kickback fund will get preference.

The real issue is that Retrocession payments are endemic to the system and not disclosed, i.e., there is no potential penalty for taking the kickback. It can be very difficult to place a fund in Switzerland that does not pay some up front load Retrocession plus distribution fee when the asset manager knows this will not seen by his Clients. The fix is easy; mandatory separate disclosure by asset managers of retrocessions received on investment funds and structured products. The Swiss Funds Association (SFA) howled in protest when this idea was tabled a few years ago. It was shelved.

Footnotes

1. Note: a surrender penalty on a policy of over €1 Mio. is an indicator of a poorly set up policy.

2. Other smaller policies (less than €500K), particularly in Germany for example can be ridiculously badly set up with an unintelligible raft of fees and charges. Early redemptions - in the first 5 to 10 years of inception of the policy - have been known to result in the policyholder losing up to half his paid in premium.

3. This is an extraordinarily wide area with all manner of providers launching funds, from well-organised investment specialists to one and two man shows. The range of quality is wide, from very good actively managed funds consistently beating market benchmarks to funds that are so bad one wonders how they can seriously end up in a Client portfolio.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.