Opponents Pursue Referendum

On July 23, 2019, Ohio Governor Mike DeWine (R) signed House Bill 6 (HB 6) into law. As detailed below, HB 6:

- Adds new ratepayer charges for a $150 million per year "Nuclear Generation Fund" and a $20 million per year "Renewable Generation Fund" to provide subsidies for two nuclear and six permitted, utility-scale solar projects in Ohio from 2021 through 2027;

- Significantly reduces Ohio's renewable portfolio standard (RPS) and terminates the RPS at the end of 2026;

- Ends Ohio's annual energy efficiency savings requirements on December 31, 2020 while reducing the total cumulative savings requirement to a collective benchmark of 17.5%, a target that the four Ohio utilities are likely to meet primarily or entirely through existing savings; and

- Allows the Ohio distribution utility owners of the Ohio Valley Electric Corporation (OVEC) – AEP Ohio, Duke Energy Ohio, and Dayton Power & Light – to recover the net costs of OVEC's coal plants in Ohio and Indiana from Ohio utility ratepayers through 2030.

HB 6 is scheduled to take effect after October 21, 2019 – 90 days from Governor DeWine's signature. However, a group called "Ohioans Against Corporate Bailouts" (OACB) has begun the process of placing a referendum on the November 2020 ballot to repeal the law. OACB took the initial required steps of submitting at least 1,000 signatures along with a summary of the proposed referendum to the Attorney General, and after revising and resubmitting the summary it was approved as of August 30, 2019, as "fair and truthful" with the necessary valid signatures as required by law. The petitioners must now submit 265,774 signatures of registered Ohio voters (from at least 44 of the 88 Ohio counties, with at least 3 percent of total voters from each of those counties) by October 21, 2019, to place the referendum on the November 2020 ballot. If OACB meets these requirements, HB 6 is stayed until Election Day 2020.

1. Nuclear and Renewable Generation Funds (R.C. 3706.40-3706.65)

- The Ohio Air Quality Development

Authority (OAQDA) will distribute $150 million per year to approved

owners/ operators of qualifying nuclear resources and $20 million

per year to approved owners/operators of qualifying renewable

resources at a rate of $9/MWh.

- A "qualifying nuclear resource" must be located in Ohio and fueled by nuclear power (R.C. 3706.40(A)).

- A "qualifying renewable resource" must use solar as the primary energy source, have obtained a certificate for construction of a major utility facility from the Ohio Power Siting Board before June 1, 2019, and be interconnected with PJM1 (R.C. 3706.40(B)).

- An application from a "qualifying nuclear resource" or "qualifying renewable resource" must be submitted to the OAQDA by February 1, 2020. An applying nuclear resource must provide specified financial data and projections along with any other information that demonstrates that the resource is projected not to continue being operational (R.C. 3706.41).

- The OAQDA must approve an application by March 31, 2020, if the resource meets the definition of a qualifying nuclear or renewable resource, and for a nuclear resource if its application meets the requirements under R.C. 3706.41 and it maintains a principal place of business and a substantial presence in Ohio (R.C. 3706.43).

- Approved nuclear or renewable resources must report their MWh generation by quarter to OAQDA starting by April 7, 2020. OAQDA will issue a credit for every MWh reported and approved at a rate of $9 per generation credit for each resource (R.C. 3706.45).

- Distribution of funds will occur quarterly from April 2021 through January 2028, for credits approved for the quarter 12 months prior (R.C. 3706.55). The methodology for dealing with shortfalls in the nuclear or renewable funds is addressed by R.C. 3706.59.

- The Public Utilities Commission of

Ohio (PUCO) must conduct a management and financial review of a

qualifying nuclear resource receiving credits under R.C. 3706.55,

and its owner or operator, by May 1 of each year for 2021 through

2027 (R.C. 3706.61). The PUCO shall submit a report summarizing the

findings of each annual audit to the Senate President, House

Speaker, and OAQDA. The report will be public, excluding

confidential or proprietary information. The OAQDA may reduce or

cease payments if:

- The Federal Energy Regulatory Commission or Nuclear Regulatory Commission has established an incentive to continue the resource's commercial operation;

- The resource is no longer a qualifying nuclear resource (i.e., the owner/operator can no longer demonstrate that the resource is projected not to continue being operational) or no longer has a principal place of business and substantial presence in state;

- The resource has applied to decommission before May 1, 2027; or

- The market price for energy is above a "strike price" of $46/MWh.

- The PUCO must determine the amounts

to be collected from each Ohio electric distribution utility for

the nuclear and renewable generation funds, and the charges for

each of their customers to be effective by January 1, 2021, subject

to limits on monthly charges per customer as follows (R.C.

3706.46):

- Residential customers: 85 cents

- Self-assessing industrial customers under R.C. 5727.81 (using at least 45 million kwh annually at a single location): $2400

- Other non-residential customers: a rate "established in a manner that avoids abrupt or excessive total net electric bill impacts for typical customers"

- The OAQDA must adopt rules to implement R.C. 3706.40-3706.65 pursuant to Ohio Revised Code Chapter 119 by January 1, 2020.

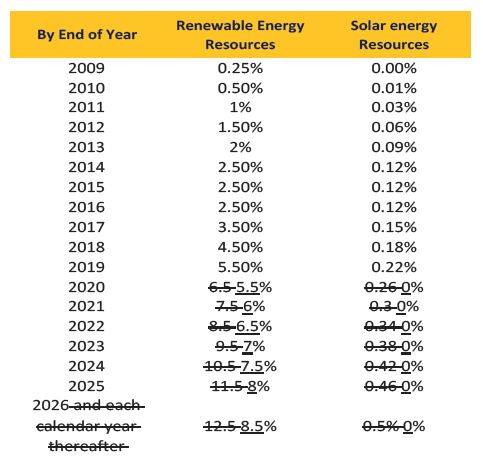

2. Renewable Portfolio Standard (RPS) (R.C. 4928.64): HB 6 reduces the 2026 benchmark for the RPS from 12.5% to 8.5%, while eliminating the RPS's "solar carve-out" in 2020. It also cuts off the RPS as of the end of 2026 by eliminating any maintenance of the standard for "every year thereafter." (This will likely harm project developers' ability to obtain long-term financing). Electric distribution utilities may still continue to recover ongoing costs of renewable contracts through December 31, 2032, if they were executed before April 1, 2014, and the costs were being recovered through a bypassable charge as of September 12, 2014 (R.C. 4928.641).

- R.C. 4928.642 further reduces the RPS compliance requirement for 2020-2026, reducing the annual compliance obligation for all entities by the amount of kilowatt hours produced by qualifying renewable resources certified under R.C. 3706.40. This reduction is applied proportionally to all electric distribution utilities and electric services companies based on their existing compliance baseline. R.C. 4928.645(C) does provide that the qualifying resources receiving credits from the renewable generation fund under R.C. 3706.45 cannot "double dip" and also receive credits for compliance with the Ohio RPS under R.C. 4928.645.

- R.C. 4928.644(B) further reduces the RPS compliance requirement for 2020-2026. It exempts self-assessing purchasers (with annual usage of at least 45 million kwh at a single location) from the compliance baseline calculation under R.C. 4928.643, and also exempts those customers from all RPS charges.

3. Energy Efficiency Resource Standard (EERS) (R.C. 4928.66): HB 6 eliminates the ongoing annual EERS energy savings requirement after 2020, while extending all existing portfolio plans through December 31, 2020 (R.C. 4928.66(A)(1) (a), (F)). After 2020, R.C. 4928.66(G) effectively applies a cumulative savings target of 17.5%. Specifically, by February 1, 2021, the PUCO must determine the cumulative savings achieved by each electric distribution utility under the EERS through December 31, 2020, based on savings banked under R.C. 4928.662(G) compared to the collective usage baseline from 2018-2020. If those savings equal at least 17.5% of the collective baseline, compliance with R.C. 4928.66 is deemed to be achieved.

If collective savings through 2020 are less than 17.5% of the overall baseline, the PUCO must determine how to further implement energy efficiency programs to achieve cumulative energy savings "equal to seventeen and one-half percent, and not more, of the baseline." Once the utilities collectively reach the 17.5% cumulative savings benchmark, any cost recovery for compliance with R.C. 4928.66 "shall terminate." The current utility plans are designed to achieve at least 8.2% cumulative energy savings by the end of 2020, and the four utilities have banked savings ranging from 4-12% of baseline as of the end of 2018 (with the potential to add more banked savings in 2019 and 2020). Accordingly, the utilities are likely to satisfy most or all of the 17.5% cumulative savings requirement by the end of 2020.

- Future Voluntary Energy Efficiency Programs?: Note that R.C. 4905.70, which predates R.C. 4928.66, separately requires the PUCO to "initiate programs that will promote and encourage conservation of energy and a reduction in the growth rate of energy consumption, promote economic efficiencies, and take into account long-run incremental costs." That provision has been the source of authority for PUCO approval of natural gas conservation programs and presumably is the basis for statements by at least some electric distribution utilities that they will continue to run efficiency programs even after achieving compliance with R.C. 4928.66. Additionally, R.C. 4928.143(B)(2)(i) authorizes an electric distribution utility to include energy efficiency programs as part of a future Electric Security Plan.

- Mercantile Opt-Out: Amended R.C. 4928.6610 expands the energy efficiency opt-out to all mercantile customers as of January 1, 2020, with the opt-out applying any "portfolio plan" implemented under R.C. 4928.66 or under the PUCO's energy efficiency rules as currently codified or "hereafter recodified or amended." (That definition of "portfolio plan" is likely intended to apply the opt-out to future efficiency programs implemented under R.C. 4905.70 or other PUCO authority.) HB 6 also repeals R.C. 4928.6616, removing the requirement for opt-out customers to submit reports to the PUCO regarding their independent efficiency efforts.

4. OVEC: HB 6 creates a definition of "legacy generation resource" encompassing OVEC's Clifty Creek coal plant in Madison, IN (1,303 MW) and Kyger Creek coal plant in Cheshire, OH (1,086 MW) (R.C. 4928.01(A)(41)). The PUCO must create new riders to recover OVEC's "prudently incurred costs" from customers of all four Ohio electric distribution utilities (replacing any existing OVEC riders, which have to date been approved for AEP Ohio, Dayton Power & Light, and Duke Energy Ohio), starting on January 1, 2020 and lasting through December 31, 2030 (R.C. 4928.148). The rate design for the OVEC riders subject to monthly customer caps are as follows (R.C. 4928.148(A)(2)):

- Residential customers: $1.50

- Other customer classes: comparable monthly caps for each class, not to exceed $1500 per customer

If the costs exceed the monthly caps, they are to be deferred as a regulatory asset that may be recovered as determined by the PUCO. The PUCO must review claimed costs to make a prudence and reasonableness determination in 2021 (for 2020), 2024 (for 2021-2023), 2027 (for 2024-2026), and 2030 (for 2027-2029) (R.C. 4928.148).

5. Other:

- Mercantile Renewable Agreements (R.C. 4928.47): On a nondiscriminatory basis and subject to PUCO approval, an electric distribution utility may "enter into an agreement having a term of three years or more with a mercantile customer or group of mercantile customers for the purpose of constructing a customer sited renewable energy resource in this state that will provide the mercantile customer or group with a material portion of the customer's or group's electricity requirements." However, any direct or indirect costs of the renewable resource must be paid for by the utility and the mercantile customer(s), and cannot be collected from any other customers. A mercantile customer is "a commercial or industrial customer if the electricity consumed is for nonresidential use and the customer consumes more than seven hundred thousand kilowatt hours per year or is part of a national account involving multiple facilities in one or more states" (R.C. 4928.01(A)(19)).

- Decoupling (R.C. 4928.471): Authorizes electric distribution utilities to file an application for a decoupling mechanism for 2019 and each year thereafter that will decouple "base distribution rates for residential and commercial customers . . . to the base distribution revenue and revenue resulting from implementation of section 4928.66 of the Revised Code excluding program costs and shared savings, and recovered pursuant to an approved electric security plan" for calendar year 2018. The decoupling mechanism is to last until PUCO approval of new base distribution rates for the utility. This provision appears to allow recovery of "lost distribution revenues" in connection with energy efficiency programs as of 2018 regardless of whether a utility continues to implement energy efficiency programs that achieve energy savings in future years, unless the PUCO deems that recovery to constitute "double recovery," which is barred under R.C. 4928.471(C).

- PILOT (R.C. 5727.75): HB 6 amends this provision to allow projects with nameplate capacity under 20 MW to qualify for the PILOT without approval by the relevant board of county commissioners under R.C. 5727.75(E)(1) (b) or (c).

- Local Jurisdiction Over Wind Farms 20MW and Less (R.C. 4906.13): HB 6 eliminates statewide Ohio Power Siting Board (OPSB) jurisdiction over on-site, customer-generating, behind-the-meter wind projects of 20MW or less. The law allows municipalities and other (local) political subdivisions to regulate such projects. The new law maintains OPSB jurisdiction over projects greater than 20MW, or projects of 5-20MW if not behind-the-meter.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.